Reflections of 2024 and Resolutions for 2025

Macro-economic scenario

FY 2024-25 will be the third full fiscal year since India’s economic recovery began after the COVID-19 pandemic. Continuing on strong GDP growth trajectory of FY 22-23 (7% GDP growth1) and FY 23-24 (8.2% GDP growth1), the Reserve Bank of India has forecasted India’s real GDP to grow at 6.5% in FY 24-25 (source: RBI, MPC meeting, 6th December 2024). The fiscal deficit target for FY 24-25 is 4.9%, down from 5.6% in FY23-24 (source: Union Budget 2024-25). As we closed the calendar year, India’s forex reserves stood at USD 640 billion2. Robust economic growth, narrowing fiscal deficit and strong forex reserves put India in a macro sweet spot in her journey to be the 3rd largest economy of the world by the end of this decade.

Source: 1. Ministry of Statistics and Programme Implementation (31st May 2024). 2. RBI weekly statistical supplement (as on 27th December 2024)

Equity market

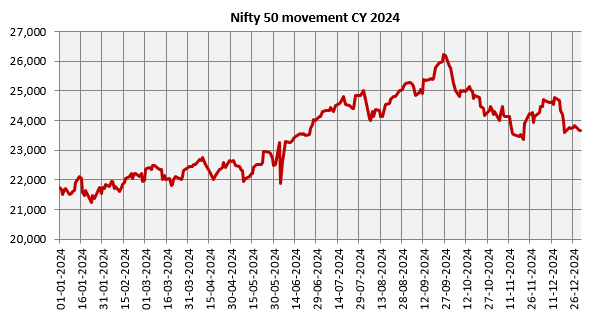

2024 was a year with several important political events like Lok Sabha elections, US Presidential elections etc. We had landmark financial events like US Federal Reserve interest rate cuts after 4 years of restrictive policy, Japanese interest rate hike after 17 years etc. We saw bouts of volatility in equity market (see the chart below). Foreign Portfolio Investor’s (FPI) net investments turned negative in the last quarter (October to December) of CY 2024 (source: NSDL, FPI Monitor, as on 31st December 2024). Various domestic and global factors like concerns about corporate earnings outlook, outperformance of Chinese equities, concerns about interest rate cuts, strengthening US Dollar etc were responsible for increasing volatility in the last few months of the year. Despite the headwinds, the bellwether Nifty 50 ended the year with 10% gain, while the broad market index Nifty 500 ended nearly 16% higher on a YOY basis (source: NSE, as on 31st December 2024).

Source: National Stock Exchange, as on 31st December 2024. Disclaimer: The chart above is purely for investor education purpose to illustrate volatile nature of markets. Past performance may or may not be sustained in the future

Debt market

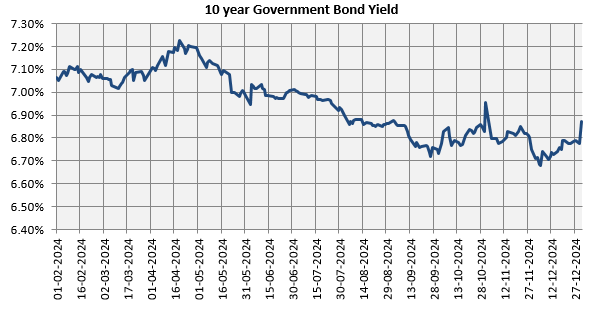

The debt market was expecting rate cuts in 2024. In September 2024, the Fed eased monetary policy for the first time in 4 years with a 50 bps rate cut (Source: FOMC Minutes of Meeting held on September 17th – 18th,, page 12). The Fed followed up with two more rate cuts of 25 bps each in November (Source: FOMC Minutes of Meeting held on November 6th – 7th, page 11) and December (Source: FOMC Minutes of Meeting held on December 17th – 18th, page 13). However in the last Federal Open Market Committee meeting in December, the Fed tempered rate cut expectations by indicating fewer rate cuts in 2025 (that what was previously expected). The RBI remained cautious about inflation and kept interest rates unchanged in 2024. The 10 year Government Bond yield softened in 2024 and ended the year in 6.7 – 6.8% range (source: RBI, CRR and Interest Rates, as on 27th December).

Source: Investing.com, as on 31st December 2024. Disclaimer: The chart above is purely for investor education purpose. Past performance may or may not be sustained in the future

Commodities market

Precious metals continued to shine in 2024 with gold prices rising by 26%. Silver prices increased by 15% in 2024. High inflation, purchases by central banks and expectations of rate cuts drove the precious metals rally in 2024. As an asset class, gold outperformed equity in 2024 (Source: MCX spot prices, NSE, as on 31st December 2024).

Taxation changes

Several important tax changes were announced in 2024 Union Budget. Some of the key tax changes applicable for mutual funds are as follows:-

- Exemption limit for long term capital gains taxation for equity or equity oriented funds (minimum equity allocation of 65%) was raised from Rs 1 lakh to Rs 1.25 lakhs

- Short term capital gains tax for equity or equity oriented funds raised from 15% to 20%

- Long term capital gains tax for equity or equity oriented funds raised from 10% to 12.5%

- Long term capital gains taxation holding period for mutual fund schemes other than equity and debt funds is 2 years

- Indexation was removed from long term capital gains taxation. Long term capital gains tax for mutual fund schemes other than equity and debt funds is 12.5%

Source: Budget Speech 2024-25. Annexure to Part B, Amendments relating to Direct Taxes, Section C.4

Lessons learnt from financial markets in 2024

- We had several negative surprises this year, but the market quickly recovered. You should remain calm in the face of negative surprises and not make decisions in panic

- Markets are volatile. Do not try to time the market. You need to remain disciplined in your investments

- Winners rotate among asset classes. One asset class will not always outperform. Asset allocation (diversification across asset classes) will help you balance risk and return

- In a globally interconnected world, global events will have impact on our markets. Instead of trying to predict global events, you should focus on your financial goals and investment plans

Resolutions for 2025

- The start of a new year is a good time to think about your financial goals. If you do not have well defined, quantifiable financial goals, now is a good time to do your goal planning. Consult with your financial advisor if you need help.

- If you have financial goals, now is the time to review and renew it. Have your goals changed? Is there a major expense or investment on the cards in the new future?

- Are you on track to achieve your financial goals in the desired timeframe? Do your investments need replenishing? If you are falling short, then you need to have a plan in place e.g. increasing your SIP, opting for SIP Top-up etc

- Focus on your short term goals. Is there a major expense or investments on the cards in the near future e.g. house purchase, children going to college, children’s marriage, major home renovation / improvement etc? Try to maximize your savings to minimize your stress when you have to incur the expense or make the investment.

- At the same time, do not lose focus on your long term goals like retirement planning. Remember, retirement planning is a financial goal which cannot be financed through a loan. Remain disciplined in your retirement planning. Over the years, your lifestyle may have changed and your expenses would have increased. Resolve to maintain the same lifestyle even in your retirement years and increase your investments if required.

- Since we are now in the final quarter of FY 24-25, you should ensure that you complete your tax planning well before the deadline of 31st March. Consult with your tax advisor if you need help in tax planning.

- Apply the lessons learnt from your investment journey in 2024. Try to be a more disciplined and informed investor.

Conclusion

Resolutions are meaningless without commitment and discipline. For example, if you have made a resolution to follow a fitness regimen, you should stick to it no matter what challenges you face in your professional and personal lives. At the start of 2025, make or renew your commitment towards your long term financial wellness. At the same time invest in your physical and mental wellness. Also make a commitment towards making yourself a more informed investor. Aditya Birla Sun Life AMC Limited (ABSLAMC) has worked tirelessly in the area of investor education with the objective of creating a community of informed and capable investors. Digital tools like podcasts, videos, gamification etc can make learning easier and fun - You can access the digital learning platform through the website -https://mutualfund.adityabirlacapital.com/Investor-Education

Disclaimer:

The details related to tax benefits are general information only. Investors are advised that before investing, consult their Tax Consultant or Financial Advisor to determine tax benefits applicable to them.

An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY