Understanding volatility and dealing with it

Volatility is inevitable in equity markets

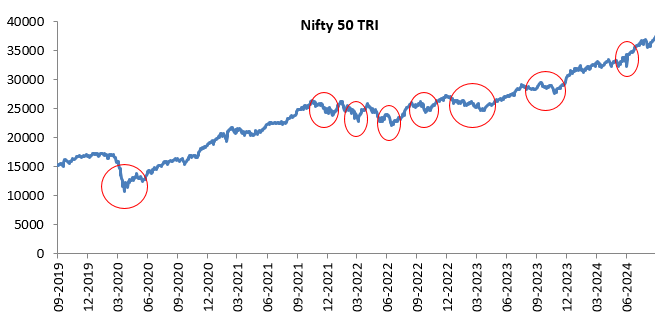

Volatility refers to fluctuation of stock prices and is an intrinsic characteristic of equity as an asset class. Volatility is inevitable and unavoidable if you are investing in equities. The chart below shows the Nifty 50 Total Return Index values over the last 5 years (ending 31st August 2024). You can see that even though the market has seen periods of volatility (circled in red), the index had grown at a CAGR of nearly 19.9% in the last 5 years.

Source: Nifty 50 TRI. Period: 01st September 2019 to 31st August 2024. Disclaimer: The above chart is purely for investor education purposes to illustrate the volatile nature of equity markets. Past performance may or may not be sustained in the future.

Dynamics of stock prices – Demand and Supply

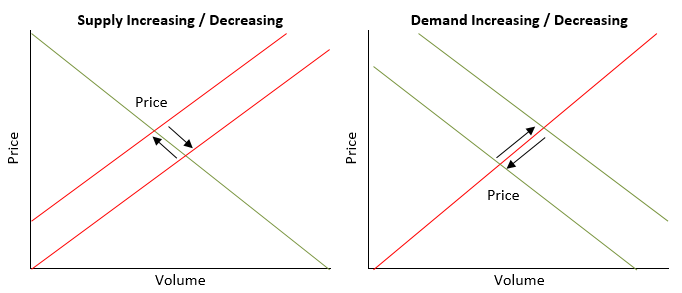

The stock exchange is essentially a marketplace, where buyers and sellers of stocks interact and carry out transactions. The price movement of a stock in the short term depends on the demand from buyers and supply from sellers (see the diagram below, green and red lines denote demand and supply respectively).

You can see that if supply decreases share price will rise and when supply increases share price will fall. Similarly, when demand increases share price will rise and vice versa.

What causes demand and supply to change at a market level?

- Economic Crisis: Stock markets are very sensitive to economic forecasts because economic cycles are major drivers of corporate earnings. In times economic growth, corporate earnings grow faster, and in times of recession corporate earnings decline. Bigger the crisis, bigger is the fall in equity markets. The most recent example of major economic crisis leading to market crash is the fallout of COVID-19 pandemic and announcement of Lockdown in 2020 (source: World Bank, World Development Report 2022).

- Inflation and interest rate outlook: High inflation has an impact on corporate earnings, since it can lead to lower consumer demand. Furthermore, inflation and interest rates are linked, since the controlling inflation is one of the major monetary policy objectives of the Reserve Bank of India. The central bank may hike interest rates to control inflation, which in turn may lead to lower demand in certain industries where demand is based on debt financing e.g. realty, automobiles etc. Higher interest rates can also result in lower capex spending because interest costs of companies will increase if the spending is financed through debt.

- Change in Government policy: Changes in Government policies can have impact on investors and corporates causing volatility in market. Demonetization is an example of volatility in the market caused by uncertainty about the impact on the economy. A more recent example of market volatility caused by policy change is the market reaction to capital gains taxation changes in Union Budget 2024, even though the market recovered soon.

- Political uncertainty: Political instability and policy uncertainties have an impact on economic growth and investments (both foreign and domestic investments). There are several examples of adverse market reaction to the spectre of political instability.

- Global events: With increasing globalization of capital markets (equity, debt, commodity markets etc) global events also have a major effect on stock market. For example, conflict in the Middle East, central bank interest rate actions etc resulted in volatility of varying degrees in our equity market.

Adverse events, economic, monetary or fiscal policy related, political, global etc, has an impact on investor risk sentiments. Negative risk sentiments can cause supply to increase and demand to go down, causing volatility in market.

Volatility and risk

Even though the terms volatility and risk are often used interchangeably, they are not the same. Risk refers to possibility of making a loss, whereas volatility is fluctuation in prices (upwards or downwards). Investors should understand this difference clearly, so that they are able to make informed investment decisions. In the world of investments, volatility is used as a proxy for risk.

Different asset classes / sub-classes have different risk profiles

Different classes like equity, fixed income (debt), commodities etc, have different risk profiles. Within an asset class, different sub-classes have different risk profiles. For example, within equity asset class, large caps have lower risks compared to midcap / small cap. With debt as asset class, shorter duration funds have lower risks compared to longer duration funds. Within commodities, silver may be more volatile than gold etc. You should know the risk profile of your investments and make suitable investment decisions based on your risk appetite and investment needs. You should consult with your financial advisor or mutual fund distributor if you need help in understanding the risk profile of your investment.

Understanding risk at a scheme level

While some asset classes / sub-classes may be more or less volatile compared to other, you should understand risk at a scheme level to make informed investment decisions. Two most commonly used measures of risk are:-

- Standard Deviation: Standard deviation is a measure of dispersion of a fund’s returns over the measurement period from its average return in that period. Standard deviation is usually calculated taking monthly returns of a scheme for the last 3 years. Standard deviation is a measure of volatility or risk of a mutual fund scheme. Higher the standard deviation, higher is the volatility or risk.

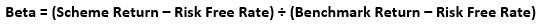

- Beta: Beta is the risk of a stock or mutual fund scheme relative to the relevant benchmark market index. In simple terms, Beta tells us, how much percentage the Net Asset Value of a scheme will change if the market benchmark moves up or down by a certain percentage. The formula of Beta is as follows:-

Higher the beta, higher is the volatility or risk. An important difference between standard deviation and beta is that while standard deviation is an absolute measure of risk, while beta is a relative measure of risk. Standard deviation is a measure of total risk, while beta is a measure of systematic risk.

Understanding Systematic and Unsystematic Risks

There are two types of risks in equity investments, Systematic risk or Market risk and Unsystematic risks. Systematic or market risk refers to the risk of the overall equity market. It is undiversifiable risk. All mutual funds are subject to market risks. Unsystematic risks, on the other hand, are stock specific risks e.g. a stock underperforming versus its peers for any reason. Diversified equity funds aim to reduce unsystematic risks by investing in a large number of stocks across industry sectors.

Though unsystematic risks can be reduced substantially through diversification, actively managed funds may have still have some unsystematic risks because they are overweight / underweight on certain stocks relative to the benchmark index. Passive funds like ETFs or index funds, on the other hand, have no unsystematic risks because they are not overweight / underweight on any stock; passive funds simply track the benchmark index.

As discussed earlier, market risk is undiversifiable and hence all mutual funds are subject to market risk. Apart from market risk, there can be other types of risks in mutual funds:-

- Concentration risk: Concentration is the opposite of diversification. If your scheme has high allocations to certain stocks or bonds, then underperformance of high concentration stocks can have a substantial impact on the performance of your mutual fund scheme. You should check Top 5 / 10 holdings of the scheme to determine whether the scheme portfolio is too concentrated.

- Liquidity risk: Liquidity risk refers to ease / difficulty with which assets of a scheme can be converted to cash, to meet redemption needs. Certain securities are more liquid than others. Examples of highly liquid securities are Government Bonds, Tri-Party Repos, highly rated corporate bonds and money market instruments, large cap stocks etc. The cash-holdings of a scheme can also be an indicator of the liquidity risk.

- Credit risk: This is specific for fixed income or debt funds. Credit risk refers to risk of non-payment of interest (coupon) or principal (face value) or both by the bond issuer. Unlike interest rate risk, which is a systematic risk, credit risk can result in permanent loss if the issuer defaults. You should consider credit risk carefully before investing. You should look at the credit quality of a fund i.e. percentage of assets invested in Sovereign or highly rated papers (e.g. AAA, AA etc) to understand the credit risk of a fund.

SEBI Riskometer

The market regulator, SEBI, has mandated all mutual funds to show the risk profile (from low to very high) of every scheme in a scheme Riskometer (see below).

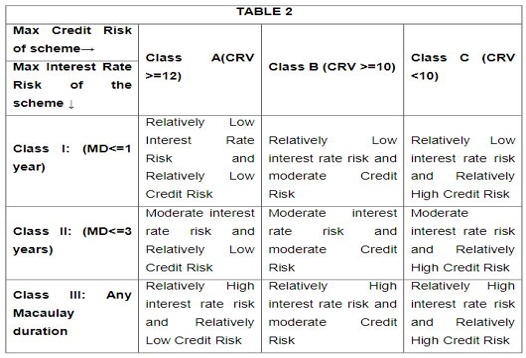

In addition, SEBI has asked debt mutual funds to indicate the interest rate risk class (I to III) and credit risk (A to C) in a potential risk class (PRC) matrix (see below).

These tools will empower investors to get an understanding of risks through pictorial representation and help them to make informed investment decisions.

How to deal with volatility?

- Understand volatility: Lack of understanding often causes confusion and wrong investment decisions. In this article, we have explained what volatility is, what the causes of volatility, what are measures of volatility and different types of risk. If you have a good understanding of risks, you can make the right investment decisions. You should also understand that market volatility is unavoidable and what you should do in volatile markets.

- Do not panic: Market corrections are temporary; market eventually recovers – it is the nature of equity markets. But if you panic and sell, you will make a permanent loss. Being patient is of utmost importance.

- Do not try to time the market: Many investors sell in falling markets in the hope of buying at lower prices when market bottoms. It is very difficult to predict market bottom. Remain disciplined in your investments.

- Do not act on rumours: There are always rumours in the market about something in the future. In the age of social media, these rumours may get amplified. Making investment decisions based on some rumour, even from a so called trusted source can harm your financial interests. Always verify the information you receive before acting. Consult with your financial advisor or mutual fund distributor if you need information or help.

- Stick to your financial plan: In our article, Steps to achieve financial independence at a desired age, we discussed about the importance of financial planning in achieving your financial goals. Sticking to your financial will help you remain disciplined and not be affected by short term volatility.

- Focus on asset allocation: Asset allocation helps to balance risk and return to provide stability to your portfolio. With focus on asset allocation, you should take a portfolio view and not get distracted by performance of individual schemes in your portfolio. Asset rebalancing is an important part of asset allocation. You should rebalance your asset allocation from time to time to ensure that the risk profile of your portfolio is aligned with your risk appetite and investment needs.

- Take advantage of volatility through SIP: Investing through the Systematic Investment Plan (SIP) route for your long term goals is one of the best approaches that can help you remain disciplined in your long term financial goals. In fact, SIP will help you take advantage of volatility through Rupee Cost Averaging of acquisition cost of investments.

Conclusion

In this article, we discussed about volatility and how to deal with it. Discipline and knowledge are your best friends in navigating through the uncertainties in your investment journey. We recently celebrated World Investor Week. Awareness of the importance of investor education and protection was the main theme of World Investor Week. Awareness of risks of markets and mutual funds will make you a smarter investor. If you want learn more about volatility, explore the Advanced Section in Aditya Birla Sun Life AMC’s Investor Education Portal.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY