Relevance of gold in financial planning

Since time immemorial, investors have been drawn to the glitter of gold as an asset. Gold has long been regarded as a stable and dependable investment option that has weathered economic cycles. This precious metal is more than just an ornament or a cultural symbol. It serves as a safe haven during economic slowdown, a hedge against inflation, and an important asset allocation vehicle that offers diversification in investments. This article delves into the importance of adding gold in your portfolio, and the most efficient ways in which you can invest in gold.

The Cultural Significance of Gold in India

Gold is considered as more than just an economic asset in India. It is tremendous cultural significance. This precious metal is customarily gifted or bought at festivals and auspicious occasions such as Diwali, Akshaya Tritiya, Dhanteras, weddings etc. Due to the strong demand for gold regardless of market cycles, it’s worth and stability as an asset is reinforced by this deep cultural tie.

Why should Gold belong in your portfolio?

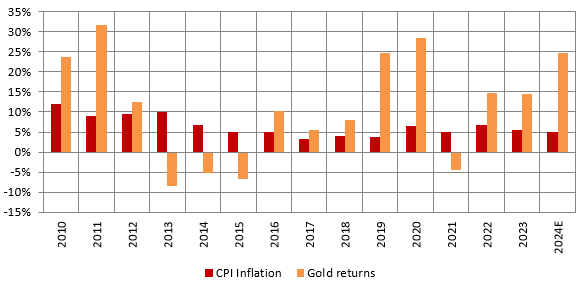

- Hedge against inflation: Historically, gold has retained its purchasing power in the long term, while the purchasing power of currency declines due to inflation. The chart below shows return of gold versus CPI inflation. You can see that in most years, gold returns were higher than the inflation rate. Higher the inflation, higher were the gold returns in most years.

Source: CPI Inflation from World Bank from 2010 to 2023. 2024 Estimate based on average YOY inflation of all months from Jan to Oct 2024 (Ministry of Statistics and Programme Implementation, Government of India) Gold returns refers to percentage increase / decrease in INR price of Gold based to MCX spot prices, as on 31st December 2023. Disclaimer: The chart above is purely for investor education purposes to illustrate relationship between inflation and gold. Past performance may or may not be sustained in the future. Please consult with your financial advisor before investing.

- Safe haven asset: Gold is considered to be safe haven asset because its value is not impacted by wars, geo-political or economic turmoil. If we look at long term price history of gold, we can see that price of gold usually rises in times of economic slowdown or recession since the demand for gold goes up during such periods.

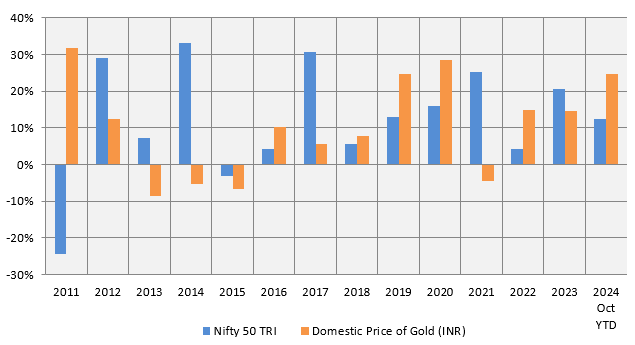

- Diversification in portfolio: Gold has a low of negative correlation with equities. Gold usually outperforms when equity is underperforming and vice versa. By adding gold into your asset allocation plan, you can lower your overall portfolio's volatility and across different investment cycles and bring stability to your portfolio.

Source: National Stock Exchange, Multi Commodity Index, Advisorkhoj Research, as on 31st October 2024. Nifty 50 TRI represents equity as an asset class and MCX Gold Spot price represents gold. Disclaimer: The chart above is purely for investor education purposes to illustrate relationship between equity and gold. Past performance may or may not be sustained in the future. Please consult with your financial advisor before investing.

- Diversifying currency depreciation risk: The relationship between gold and currency is complex involving many factors like trade deficit, monetary policy and US Dollar. Since India is an importer of gold, gold prices usually go up when the Rupee depreciates.

How can you invest in gold?

You can buy gold either in physical form e.g. jewellery, coins, and bars etc, or as financial asset e.g. gold ETFs, gold fund of funds, Sovereign Gold Bonds etc. Some digital platforms / mobile wallets also offer digital gold. However, buying / selling digital gold is not regulated by SEBI. In this article, we will only focus on physical gold investment versus gold as financial asset e.g. ETF, FOF, SGB etc. Each option has its own distinct benefits and drawbacks in terms of safety, cost efficiency, and liquidity, so it is critical to understand which one best fits your financial objectives.

Physical gold

Traditionally, jewellery is the most popular type of gold investment in India. It functions as a long-term asset that may also be worn and enjoyed. However, purchasing jewellery often comes with additional expenditures in the form of making charges, as well as logistical charges involved in the storage of the physical gold e.g. bank locker charges. Furthermore, gold jewellery usually has impurities which are deducted from the value of gold if you sell your gold jewellery. Gold coins and bars are a simpler and more direct type of actual gold investing. These do not have impurities and have much lower ‘making charges’ than jewellery depending on the form. However, you have to incur cost of storage for gold coins and bars, since they are in physical form.

Gold ETFs

Gold ETFs are exchange-traded funds that track the domestic price of gold. Gold ETFs are highly liquid since they are traded in the stock exchange, just like shares of listed companies. ETFs provide a way to invest in Gold without the need for physical storage of the precious metal. They are backed by physical Gold of 99.5% purity (as specified by SEBI regulations). There is no risk of impurities because the ETFs track the market price of Gold of highest purity. You need to have a Demat and trading account to invest in Gold ETF. Gold ETF is a highly cost effective and safe way of investing in gold.

Gold fund of funds

If you do not have Demat account, you can invest in Gold fund of funds. Gold fund of funds are mutual fund schemes which invest in Gold ETFs. Though the Total Expense Ratios (TERs) of Gold fund of funds are higher than Gold ETFs, they offer the convenience of mutual funds viz. no need of Demat accounts, redemption with the Asset Management Company at applicable Net Asset Values, investments from your regular savings through Systematic Investment Plans etc. Through SIPs, you can invest small amounts in gold from your regular savings for your long term financial goals like children’s marriage, estate planning etc.

Sovereign Gold Bonds (SGB)

Sovereign gold bonds are government securities denominated in grams of gold. Minimum investment in SGB is 1 gram and the maximum permissible limit for individual and Hindu Undivided Family (HUF) investors is 4 kilograms of Gold. SGBs are issued by the RBI on behalf of the Government. SGBs are attractive investment option for investors who want to earn an interest along with the appreciation of the gold value. SGBs pay interest at the rate of 2.5% per annum (payable twice a year) and have an eight-year term. Upon maturity you will get the market price of gold that you purchased through SGB. However, SGBs have limited liquidity before its full tenure and also incurs a penalty for early exit. The last tranche of SGB was issued by RBI in February 2024 but you can invest in SGB in the secondary market at prevailing market prices.

What are advantages of Gold ETFs / FOFs compared to physical gold?

- Investing in physical gold requires considerably higher outlay. You can invest small amounts (e.g. Rs 500, 1000 etc) from your regular savings in gold funds (through SIP) for your important life-stage goals like children’s marriage, estate planning etc.

- Unlike physical gold e.g. gold jewellery gold ETFs and FOFs does not have risk of impurities. As mentioned before, you will get the market price of gold when you sell your gold ETF or FOFs.

- Unlike physical gold, which is usually stored in bank lockers, there are no storage costs in gold ETFs and FOFs because it is a financial asset.

- Gold ETFs and FOFs are more cost efficient and liquid investment options than physical gold.

Recent tax changes

The holding period for long term capital gains taxation in gold has been reduced to 2 years. Short term capital gains are taxed as per the income tax rate of the investor, while long term capital gains are taxed at a flat rate of 12.5% (no indexation).

Source: Budget Speech 2024. Annexure to Part B, Section C.4

Conclusion

The significance of Gold in Indian culture and society cannot be overstated. In this article, we have the discussed the role of gold as an asset class and its role in your asset allocation / financial plan. Though many Indian households still purchase gold in the physical form (e.g. jewellery), Gold ETFs and Gold FOFs are more cost efficient ways of investing in gold. Consult your financial advisor or mutual fund distributor about how you can invest in gold for your financial planning needs.

Disclaimer:

The details related to tax benefits are general information only. Investors are advised that before investing, consult their Tax Consultant or Financial Advisor to determine tax benefits applicable to them.

An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

- How can Multi Asset Allocation Funds provide stability in your portfolio

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY