Retirement Planning: Accumulation Phase

Retirement is inevitable phase of life especially for salaried investors. After your retirement, you may not have any income from your profession but you will still have expenses that have to be met from your accumulated savings. Therefore in your working years, you need to save and accumulate a sufficiently large corpus which can meet the income needs in your retired life. It is human nature to focus on immediate priorities and ignore the ones that are long term in nature. However, you should understand the challenges of retirement planning and make it a priority early in your working years.

Challenges of retirement planning

- Increasing longevity means retired lives can span 25 – 30 years. A longer retired life implied that you need to have a large enough corpus to ensure that you do not run out of funds.

- Your expenses will keep increasing over time due to inflation. Assuming 4% inflation, your monthly expenses will double in about 20 years.

- Health risks are much higher when you advance in age. Over the years, the quality of healthcare has improved significantly, but cost of healthcare has also increased.

- Many young people want to marry / start a family at a later age compared to previous generations. These people will have to achieve multiple life-stage goals like children’s higher education, children’s weddings and retirement planning within relatively shorter time-frame.

- Lifestyle is a factor that you must factor in your retirement planning. As your income grows, your lifestyle changes and costs associated with it. Your retirement corpus should be sufficiently large, so that you do not have to compromise on lifestyle after retirement.

Phases of retirement Planning

There are three phases in retirement planning:-

- Accumulation: The accumulation phase essentially begins when you start saving for retirement. Savings is not enough. You should invest your savings in the right asset class to generate sufficient returns to meet your retirement needs. The focus in the accumulation phase is to build wealth.

- Transition: This is the phase between accumulation and distribution. In this period you continue to save for retirement and at the same ensure that the risks in your portfolio are balanced. The transition phase typically begins about 10 years prior to retirement. Asset allocation is important in this phase.

- Distribution: This begins when you retire. In this phase you will start generating income or cash-flows from your investments to meet your expenses. Your risk appetite is low in this stage of life and you should align your portfolio with your risk profile. However, you should also ensure that a portion of your portfolio continues to grow to fight inflation.

We will focus on accumulation phase in this article. We will discuss the other phases in the subsequent articles on this topic.

Importance of early start in accumulation phase

Time is one of the most important factors in wealth creation due to the power of compounding. The power of compounding can be understood through the concept of compound interest. When you invest in an interest bearing product (e.g. fixed deposit) where interest is accrued but not paid out, the interest accrued gets added to principal – you will not only get interest on the principal, you will also get interest on interest. Interest on interest means your interest is compounding every year. The same principle applies to equity also. In an equity mutual funds (growth option), the profits made by the scheme are re-invested in the scheme and value of your investment will increase, so returns will compound. The longer you remain invested higher is the power of compounding. Therefore if you start early, you may be able to accumulate more wealth.

Mistakes you should avoid in the accumulation phase

The focus in the accumulation phase should be on saving and investing in a disciplined way. You should avoid these mistakes to enjoy a stress free retirement:-

- Not saving enough: In terms of modern lifestyle, there are many expenses like eating out, socializing with friends, going on vacations, keeping up with fashion trends, electronic gadgets etc. At the same time, you should build a discipline of investing for which you need to inculcate the habit of saving. Carefully evaluate which expenses can be reduced or eliminated so that you are able to save more. Starting a SIP at the beginning of the month can be a good tactic to get into a disciplined savings habit.

- Spending triggers / compulsive spending: Spending triggers can lead you to spend much more than what you would usually spend. For example, you are strolling through a shopping mall and suddenly a certain item on display like a fancy shoe or dress or an electronic item catches your eye. This can trigger, in some people, a great desire to buy the item even though they had no plans to buy the item before they saw it. Product launches can be another spending trigger. Is there a compulsive need to buy the latest smartphone model, even though the features of your current phone are fulfilling all your needs? People with compulsive spending habits end up spending much more and saving less. This can harm their financial interests in the long run.

- Credit card debt: Credit card is a very useful payment mechanism; you can also earn reward points on your credit card spending. But many young investors build up debt using credit cards. You should understand that credit card debt has a cost because you need to pay interest on your outstanding balances. When you are paying interest on your credit card or personal loan debt, you will have lesser investible surplus. This will harm your financial interest in the long term.

- Over-extension: Over-extension refers to the situation where the investor has to spend a substantial part of his / her income e.g. 40% or more on debt servicing (e.g. EMI payments). Over-extension can have several repercussions like penalties for ECS / NACH bounces, downgrading your credit scores, severe financial and mental stress if you do not have income for an extended period, insufficient savings and investments etc. You should plan carefully before you make a big ticket purchase for which you have a take a loan. A common thumb-rule is that your EMI payments should not exceed one third of your income. You should decide how much loan you should take based on your financial situation and take the help of your financial advisor if required.

- Wrong investment choices: Many investors are able save enough but are still not able to meet their financial goals. This is due to wrong investment choices. For example, you cannot expect equity returns from fixed income investments. Different asset classes have different risk / return profiles. You should invest in the right asset class based on your risk appetite and financial goals. You should consult with a financial advisor if you need help in selecting the right product for your investment needs.

- Lack of clarity on investment objectives: You should have a clear financial goal or investment objective when you are making an investment e.g. life insurance, savings plan, income generation, capital appreciation etc. You should have separate investments for each financial objective.

- Speculative investments: With proliferation of digital investments and trading platforms, the investment process has become much simpler. However, this also has had the unintended consequence of investors making uninformed investment decisions or getting lured into speculative investments which may not be suitable for them. There are many stories of investors losing large sums of their hard earned money in F&O trading, crypto investments etc. You should understand the risks of different types of investments and avoid get rich quickly schemes. Consult with your financial advisor if you need help.

SIPs for retirement planning

The first step of retirement planning is to determine your financial goal – how much retirement corpus you need after factoring inflation. The next step is to determine how much you need to save and invest at regular intervals to achieve your retirement planning goal. Mutual fund systematic investment plans (SIPs) are great investment options for retirement planning for the following reasons:-

- You can start with small investments from your regular savings and accumulate wealth over long investment tenures through the power of compounding.

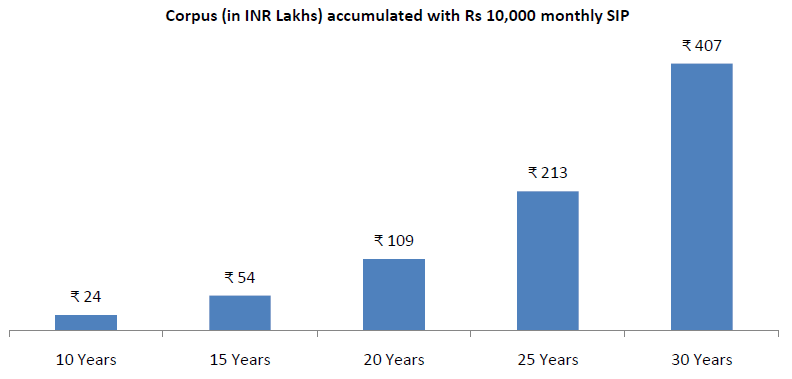

- With SIPs you can start savings and investments from an early stage of your working life and get the benefit of an early start. The chart below shows the corpus accumulated with Rs 10,000 monthly SIP in an equity fund. You can see that over long investment tenures the power of compounding in wealth creation is substantial. The earlier you start, higher is your wealth creation potential.

Source: Advisorkhoj, AMFI, Mean CAGR returns considered for illustration is 12.64% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of Sensex. SIP investments on first day of every month for the stated periods have been considered for this illustration. SIP Returns are calculated on CAGR basis. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023 and as amended from time to time to define the concept of power of compounding. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

- SIPs will force a savings habit which will stand you in good stead in the long run. Savings habit will help you curb spending triggers and help you save more, which in turn can lead to more wealth creation for your long term financial goals. Financial advisors ask investors to setup the SIP auto-debit date at the beginning of the month. That way, you can prioritize savings / investments over spending and rationalize unnecessary spending.

- SIP Top-up or SIP Step-up is a mutual fund facility using which you start with small amounts and increase your SIP investments at specified intervals (e.g. annual, half-yearly etc). As your income grows over time, your savings should also grow. SIP Top-up facility enables you to invest incremental amounts through SIP. SIP Top-up can help you reach your financial goals faster and / or create additional wealth for your retirement or other financial goals.

Regular monitoring of progress of investments till retirement

Once you have started saving and investing for retirement, you need to regularly the monitor the progress of your investments for the following reasons:-

- Is your current savings and investment plan sufficient to meet your financial goal? If not, then you need to recalibrate your plans.

- Have you shifted your goal post? Life is dynamic and there may be times when we have to re-adjust our plans based on situations. Shifting goal post is undesirable from a planning perspective, but if it is unavoidable, then you need to have a plan for meeting your financial goal.

- The market value of each asset class changes over time due to different returns. This can make your asset allocation drift away from your target or desired asset allocation, resulting in your portfolio risk not being aligned to your risk appetite. You should review your asset allocation and rebalance your portfolio to align it with your risk profile.

- What is the performance of the funds in your portfolio? How are they performing versus their benchmark indices? When evaluating fund performance, it is important to look at performance over sufficiently long investment periods. For equity funds you should look at minimum 3 year returns versus the benchmark index of the scheme. If your funds are underperforming versus their benchmark indices over sufficiently long investment tenures, you may consider replacing your funds.

Conclusion

Retirement phase is sometimes described as the golden years of your life. During this phase, you reap the rewards of the hard work you put in your career. Retirement does not have to be boring or sitting idle. You can spend time with your loved ones, travel to destinations that you want to, pursue interests that you were unable to in your busy working years etc. But for that you need financial security. The efforts that you put in the accumulation phase of your retirement planning, the small sacrifices you make and disciplined savings / investing habit, will go a long way in ensuring financial security for your retirement years.

Disclaimer:

An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY