Financial security for women investors

The percentage of older population (65 years and above) in India’s total population will rise to 13.8% by 2050, according to the UN World Population Ageing 2019 Report (page 46). These figures point out the importance of planning for the post-retirement years well before its onset, which typically happens at age 60 for most salaried individuals. Unfortunately, retirement planning is not high priority among substantial number of Indian households. This may be due to lack of investor awareness or education. Unfortunately, investor awareness deficit is even higher among the female section of our population. Lot more work needs to be done to promote awareness about financial planning in general, and retirement planning in particular among women investors in India.

We celebrate 8th March as International Women’s Day. The theme of Women’s Day is, “For ALL women and girls: Rights. Equality. Empowerment.” Empowered women investors are in control of their financial destiny, in which financial independence is of crucial importance. In this article, we will discuss how women should approach retirement planning.

Difference between men and women as investors

- Saving behaviour: There is a perception that since women earn lesser compared to men, they save. However, this is changing with societal shifts from joint to nuclear families, women embracing singledom and availability of greater career opportunities. Now more women are seeking financial independence.

- Risk Aversion: Research indicates that women tend to be more risk averse compared to men. (Croson, R., & Gneezy, U, 2009). Unlike men, women prefer conservative investment strategies that focus on stability and long term returns rather than high-risk investment options. This balanced outlook to investing keeps women averse to high-risk trading in comparison to men. According to another study, males can be overly optimistic in their ability to make investments, which causes them to engage in more trading activities and speculative investments, which can harm their financial interests in the long term. (Barber, B. M., & Odean, T, 2001)

- Investment Preference: Women in India are increasingly engaging with mutual funds and other investment vehicles but still show a significant preference for traditional investments. As per an AMFI report (Mutual Growth, March 2024) salaried women allocate 57% of their savings to Fixed Deposits versus only 13% exposure to mutual funds. they continue to allocate a larger portion of their portfolios to stable investments compared to men, who favour equities. Women may also prioritize long-term goals and focus on investments that align with their values, such as sustainable or impact investing.

- Decision-Making Processes: Despite being more methodical and disciplined in their approach towards savings and investments, women have less confidence regarding their decisions related to financial issues than their male counterpartsand they often seek advice from their spouses or financial consultants for their investment decisions.

Why is retirement planning important for women?

Women often face unique financial challenges compared to men, making retirement planning crucial. Retirement planning is important for women because: -

- Longer life expectancy: Women tend to outlive men, requiring a larger retirement corpus. The life expectancy is 66.5 years for men and 70.1 years for women as per a 2024 data. (Source: World Factbook CIA.org).

- Career breaks: Women may have to take career breaks for family responsibilities like maternity, caregiving for the sick or elderly in the family, relocating with spouse to his new work location or other reasons. This can impact their savings and investment contributions.

- Lower earnings: Despite women making great advancements in their career, there is still considerable disparity in income between men and women. However, the expenses are usually the same for both men and women in their respective income and age levels. Therefore, it is more so important for women to start planning for their retirement earlier to save up enough from their income and build a large enough corpus to lead a financially independent post- retirement life.

- Financial Independence: Planning for retirement ensures women retain their financial independence and not have to depend on their spouse or children or other relatives in their later years.

Challenges Women Face in Retirement Planning

- Limited financial literacy: Many women, especially in rural and semi-urban areas, lack knowledge about financial products or even access to it. Most women depend on their male family members to take investment decisions. Lack of knowledge leads to lack of empowerment in financial decisions of the family,

- Prioritizing family over self: Women often prioritize children's education and household expenses over their retirement savings. This is usually related to cultural and social expectations regarding gender roles.

- Lack of opportunities to participate in financial decisions: In patriarchal societies the men of the family usually make financial decisions. This bias is stronger in rural or semi-urban areas. There are also regional disparities within India with regards to participation of women in financial and investment decision making.

- Engagement in unpaid household activities: According to a study conducted by the Ministry of Labour (April 2023), labour force participation among women in India is only 32.8%. In other words, 67% of women are financially dependent on their spouses or other family members. Since they do not have an independent source of income, the chances of such women to be able to save is lower.

- Income disparity: Women's retirement savings differ significantly across income groups due to income disparities, career trajectories, family obligations and other reasons. High and middle-income cohorts are the ones who have access to education and investment options while, for those belonging to the lower income groups, saving for retirement may not even occur as an idea worth exploring.

- Health reasons: Women often are forced into career breaks due to biological reasons (e.g., pregnancy, childbirth, childcare etc). Certain health issues e.g. osteoarthritis, psychological conditions due to hormonal changes etc, are more prevalent in women than men.

Retirement planning mistakes which women should avoid

- Not taking enough risks: Since women are risk averse, they shy away from investing in high return instruments like equity which also come with the associated risk. This makes them lose out on the growth potential of such instruments. Investment in the equity mutual funds mitigate the risks associated with direct equity investments. Women should look at this option while keeping their risk profile balanced with other debt and gold investments as well.

- Compromising on investments for other priorities: In the effort of juggling responsibilities towards the home, children, in-laws and parents, women try to get other things done first before starting to invest. A structured financial plan investments for the different goals can help women investors to achieve multiple goals various goals including her own long term retirement planning.

- Starting their investment journey late: Women tend to start investing quite later in life, often after the kids start going to school which makes them lose out on the opportunity cost. Starting to invest earlier has its benefits as we will see in the next section.

- Afraid of making mistakes:A sense of insecurity prevents women from diving into investing and prevents them from the benefits of long-term investments. It is important to remember that starting to invest does not require one to be an expert.

Importance of Starting Early

Starting retirement investments early provides multiple benefits:

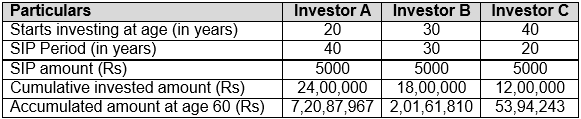

- Power of compounding: Starting Systematic Investment Plans (SIPs) earlier can help build a huge retirement corpus, due to the power of compounding. The chart below represents the difference in the corpus created when different investors (A, B, and C) start with a Rs 5000/- SIP in the Sensex from the age of twenty, thirty, and forty till the retirement age of sixty.

Source: Advisorkhoj, AMFI, Mean CAGR returns considered for illustration is 12.64% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of Sensex. SIP investments on first day of every month for the stated periods have been considered for this illustration. SIP Returns are calculated on XIRR basis. The above illustration has been provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023, and as amended from time to time to define the concept of power of compounding. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing./p>

- Lower financial burden: A longer investment horizon reduces the monthly SIP requirement.

- Better risk appetite: Younger women can afford to invest in high-return instruments like equities.

- More flexibility: Early planning allows room to adjust investments based on life changes like marriage or career shifts. Aditya Birla Sun Life Mutual Fund’s Retirement Calculator will help you determine, whether you are on track of your retirement and how much additional monthly savings you need to have if you are falling short.

Financial planning for different female cohorts

- Young working women: This is the stage, ideally towards the beginning of the woman’s career, where she should start saving, and more importantly investing in the right asset class to grow an appropriate inflation adjusted corpus. Aggressive investments like equity mutual funds or equity-oriented hybrid funds through SIPs (Systematic Investment Plans) can be suitable investment options. The focus during this stage is to build wealth, through the power of compounding over long investment tenures.

- Middle aged women: Some women start investing at a later age, like in their 40’s or even 50’s. At this stage of life, the income would be higher, but they may have to balance important life-stage goals e.g., children going to college, children's wedding etc. This is a time to prepare for adjusting to the empty nest and reviewing expenses and most importantly, since retirement is drawing nearer, allocating a larger percentage of the investments to their retirement corpus. The focus should be on a balanced approach, diversifying into debt and hybrid funds while still maintaining equity exposure.

- Low-income group women: The Government’s initiative, PM Jan Dhan Yojana bank accounts has expanded financial inclusion in India. Nearly 56% of PM Jan Dhan Yojana bank account holders are women (source: Press Information Bureau, Government of India, as on 28th August 2024). Along with access to banking, lower income group women can avail investment options provided by mutual funds for small investments. Mutual funds provide option of starting SIP with small investments e.g., Rs 100 monthly SIP. Through the power of compounding, even small investments made from regular savings can grow into a substantial corpus. Get into the habit of investing for your financial security.

- Women in semi-urban / rural areas: Lower income and lack of easy access to financial products have been the key issues in the past for this cohort. However, with improved mobile connectivity, lower cost devices, low-cost data and digitization of financial services, women in semi-urban / rural areas now have easy and highly convenient access to mutual fund products. Women investors can do their e-KYC and get onboarded to mutual funds. All types of mutual fund transactions (e.g., lump sum, SIP, switches, Systematic Transfer Plan, Systematic Withdrawal Plan etc) can be done from the comfort of one’s home through mobile app. You can completely avoid the hassle of going to the office of a fund house or Registrar and Transfer Agents through online or mobile app transactions. You can also view and manage your portfolio, download account statements, change bank details etc using your mobile app.

- Homemakers: Homemakers can also participate in ensuring their family’s financial well-being and security. By reducing day to day expenses, they can take the first step towards having a retirement corpus for themselves and their families. Instead of keeping the savings in cash, homemakers can get higher returns on their regular savings by investing them in mutual funds. ABSL's campaign "Har Ghar SIP" (https://www.advisorkhoj.com/bslmf/ghar-ghar-mutual-fund:-har-ghar-sip) is an initiative to ensure that each member of the family can start a SIP for their life goals. In fact, homemakers can create different kitties for vacation planning, children's education etc, along with retirement planning needs of the family.

- Single mothers: Challenge faced by single mothers is to ensure their children’s bright future as well as their own financial independence after retirement with single income. Careful expense management, financial planning and discipline is required to meet the challenges of balancing current expenses and different life-stage goals. Single mothers may have to make sacrifices in their lifestyle aspirations and focus on savings to ensure financial security for their families. You can use Aditya Birla Sun Life Mutual Fund’s retirement planning calculator to calculate the corpus and SIP / SIP Top-up amount to live your dream retirement.

- Small business owners: As more young women are embarking on successful entrepreneurial ventures; India is building a vibrant entrepreneurial culture that will serve as inspiration for future generations of women entrepreneurs. Challenge faced by small business owners is dual – they have to invest in their business and also their own financial security. Through careful financial planning and discipline, small business owners can successfully meet the dual challenge. Mutual funds provide investment solutions both for small businesses and the business owners.

Conclusion

In conclusion, improved financial literacy, right guidance, and making financial independence a priority can go a long way towards making women more inclined towards planning for their retirement years. Aditya Birla Sun Life AMC has online learning resources in form of podcasts and blogs, specifically designed for women investors. The right time to start investing towards your retirement corpus and financial security is as soon as you can. Contact your financial advisor or mutual fund distributor to plan and start investing towards a financially secure post-retirement life.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY