Lump Sum or Systematic Investing: Which is better in the long term

This is not an article on lump sum versus SIP investing. I am sure that you have read several financial blogs discussing advantages and disadvantages of lump sum investment versus Systematic Investment Plan (SIP). Some bloggers are of the opinion that, lump sum was a better mode of investing, while others extol the many virtues of SIP. Some expert bloggers say that, lump sum investments work better in bull markets, whereas SIPs give more bang for the buck in volatile markets through rupee cost averaging. I agree with these bloggers that lump sum in bull markets and SIP in bear markets works well, but how is this information useful for average retail investors?

How will the retail investor, or for that anyone, know whether we will have a bull market or a bear market in the coming years? We had our take on lump sum versus SIP in our Advisorkhoj blog and said that, lump sum investment and SIP simply cannot be compared. Lump sum investment is contingent upon having lump sum funds to invest; if the investor relies on monthly savings for investments, then SIP is the best mode of investment. Anyway, this post is not about lump sum versus SIP.

A knowledgeable friend asked me last year, if systematic investing was the best approach over a long investment horizon, even if he had the lump sum funds to invest. He argued that, unlike the US, our (Indian) market is much more volatile and therefore, can systematic investing give better results than lump sum investing? My intuitive answer to him would have been “no” because lump sum investment gives longer exposure to equity, the best performing asset class in the long term, compared to systematic investments. But I refrained from giving an answer to my friend because I wanted to test his hypothesis with historical data analysis. My schedule did not give me enough time for most of the last year to test my friend’s hypothesis, but over the Christmas / New Year holiday period, I did find some time to do some number crunching, the results of which, we share with our readers later in the post.

Before we jump into the analysis, let us discuss about Systematic Transfer Plans. If an investor has lump sum funds to invest in equities but, at the same time, is also worried about volatility, then Systematic Transfer Plan (STP) is a mechanism by which the investor can invest the lump sum amount in a low risk no load fund (e.g. liquid funds) and transfer a fixed amount to an equity scheme(s) at a regular frequency. However, STP is mostly used as short term strategy against volatility; can we use STP as a very long term strategy to create wealth?

The easiest thing to do for testing my friend’s hypothesis was to use the Mutual Fund STP Calculator, but I did not want to use it for several reasons. Firstly, over a very long investment horizon, a simple STP, where you invest in a liquid fund and transfer to equity systematically, is not the most efficient because a large portion of the investor’s funds will remain invested in liquid funds for a very long time. It is better to invest most of the funds in a higher yield accrual income fund (debt fund) and a smaller portion in liquid funds from where the STP to equity will take place. From time to time the investor should top up the liquid fund from the income fund, so that the STP can continue.

The second problem with using our Mutual Fund STP Calculator was that any analysis of mutual fund scheme performance will most likely be biased by the impact of fund manager’s alpha. If a fund manager delivers high alphas even in bear markets, it should be fairly obvious that lump sum returns will beat SIP because price decline in market corrections will be limited. Therefore, it is more appropriate to use market data for this analysis. For market data, I did not want to use the more popular Sensex or Nifty because these two indices have a limited number of large cap stocks and not reflective of the broader market; a broad based index like BSE-500 or NSE-500 is more suitable. I decided to use the BSE-500 index.

As for the time-frame of analysis, I decided to go for a 10 year investment horizon. I could have gone for a longer time-frame but data availability limitation was one factor and I also thought that, the Indian equity market has matured a lot in the past 20 years or so. Very often commentators, bloggers and other media influencers, including us in Advisorkhoj, talk about 20 year returns of a fund, but is it really relevant? The level of FII participation was much lower 20 years back, retail participation was also much lower, there was no F&O trading and market regulations were not as matured. As capital markets mature, they also become more efficient. From 1996 to 2006 the Sensex grew at a compounded annual growth rate (CAGR) of almost 12%, whereas from 2006 to 2016 the Sensex grew at a CAGR of around 10%. The slightly lower CAGR is, among other things, also reflective of the natural course of evolution in our market’s maturity. In my view, a 10 year investment horizon for this analysis is more reflective of our market’s maturity.

I am sure many readers are eager to know the results of the analysis. The actual analysis is the easiest part of the exercise. I follow a number of personal finance, stock and bond market blogs. While I enjoy these blogs very much, I have observed that, a number of bloggers perform very complex analyses and share the results in form of fancy graphs and charts, but they do not, perhaps for the sake of brevity, care to explain the parameters / conditions of the analysis or even the objective of the analysis.

From a reader’s perspective, he or she gets bullet points from these blogs, but not a comprehensive understanding of the subject. In Advisorkhoj, we want our readers to be educated about investments so that they can make better personal finance decisions. In this post, I want to take our readers through my thought process, so that you can have an understanding of the objectives of the analysis; hence, the slightly long preface.

Let us now get into the analysis. Let us assume that you had Rs 10 Lakhs on January 1, 2006 which you wanted to invest in BSE-500, which, as discussed earlier, is our benchmark for equities. You had two options, investing in lump sum or investing it systematically. Let us first talk about lump sum investment.

Lump Sum Investment

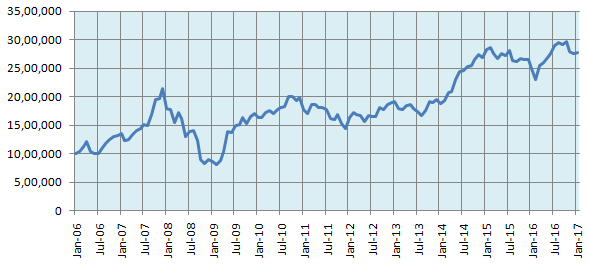

The chart below shows the growth of Rs 10 Lakhs lump sum investment.

Source: Bombay Stock Exchange, Advisorkhoj Analysis

You can see in the chart above that, in late 2008 / early 2009, your investment value would have dipped below your invested amount (Rs 10 Lakhs), but for most periods the investment value was over Rs 15 Lakhs. Rs 10 Lakhs invested in lump sum on January 2006 in BSE-500 would have grown to Rs 27.64 Lakhs by January 1, 2017.

Systematic Investment

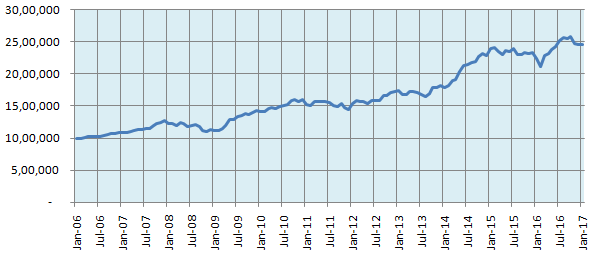

As discussed earlier, the most efficient way of investing systematically, would be to invest a large portion of your funds in a higher yield accrual income fund and a small portion in liquid funds, from which you will initiate your monthly STP to BSE-500. Your income fund should have low interest rate and credit risk, so that you can earn stable returns from your income fund. From time to time, you will top up your liquid fund from the income fund, so that you continue your STP. We assumed that you get 8% annualized returns from your fixed income (income fund and liquid fund) investments. Why did we assume 8%? The average 10 year Government Bond yield over the past 10 years has been around 8%. The 10 year bond yield is usually taken as a benchmark for fixed income yield. If you take credit risk you can get higher yields, but since we did not want to take credit risks, we have assumed average 8% returns from fixed income (debt / money market mutual funds). The chart below shows the growth of your Rs 10 Lakhs investment using this strategy.

Source: Bombay Stock Exchange, Advisorkhoj Analysis

Rs 10 Lakhs invested through this strategy from January 2006 in BSE-500 would have grown to Rs 24.62 Lakhs by January 1, 2017. Compare this chart with the previous (lump sum) chart; if you invested in lump sum your investment would have grown to Rs 27.64 Lakhs. I was not at all surprised that, lump sum investment gave higher returns (recall my intuitive answer to my friend’s question regarding lump sum versus systematic investing over a long period). However, I must admit to our readers that I was surprised with the results.

As I was doing the analysis, before I got the results, I thought that the difference between the investment values through lump sum and systematic investments will be quite large. I was surprised that, the difference between was not as large as I had expected. Whether Rs 3 Lakhs difference between the two investment strategies is large or small, is a matter of subjectivity which I leave it to our readers to decide. There are other interesting observations that, we can make by comparing the systematic investment chart with the lump sum chart. The investment value never dipped below your invested amount (Rs 10 lakhs). You will also observe that, the growth in the investment value was steadier in systematic investing compared to lump sum.

Conclusion

Let us discuss what we learnt in this post. The first learning is obvious. Over a long period of time, lump sum investment is likely to give higher returns than systematic investments, because your capital is exposed to the superior asset class (in terms of returns) for a longer period of time.

The second learning is that, you can create wealth even through systematic investing over a long period of time. The third and the most important learning is that, your strategy should be determined by your own needs e.g. your investment objective, your risk appetite etc. Lump sum investments require higher risk appetites. If you do not have high risk appetites, then systematic investment is a better approach. Before writing this post, I shared my findings with my friend who asked me to compare lump sum and systematic investing. He asked me that, if our markets become less volatile like markets in the US, does lump sum make more sense in the future. The great advantage of mutual funds compared to other investment products lies in its flexibility. If you think one investment strategy gives better results than another, you can easily switch to the better strategy. All you need to determine is what works best for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY