Make big vacations come real with mutual funds

It is summer vacation season. Many families are using this opportunity to take a break from the heat and their daily grind to enjoy their vacation in some exotic holiday destinations. A vacation is great opportunity to spend quality time with your family and recharge your batteries, but it can burn a hole in your pocket if you are not careful enough with spending. In this article we will discuss how proper planning and investing with mutual funds can make your dream vacations come true without compromising on other important financial priorities.

Importance of advance planning for holiday goals to save costs

Unless you enjoy the thrill of impulsive travel, you can save a lot of costs and last minute hassles if you plan well in advance. If you book early, you can get good deals on your flight and hotel bookings. If you are a solo traveller or a couple, you can plan offseason travel. You can not only get cost savings but also more privacy in offseason travel. Most importantly, with careful planning you can save sufficient funds for your vacation travel without taking recourse to debt.

Save and invest so that you go on vacation not through credit cards but your investment amount

An Indialends (a Fintech company) study reveals that there was five-fold surge in surge in travel specific credit cards in 2022 – 23 (source: Livemint, 27th September 2023). As per the study 50% of the credit card applications during that period were for travel specific credit cards. While some travel specific credit cards offers several benefits like rewards program, airport lounge access etc, large number travellers are funding their travel expenses with credit cards. This trend is not just seen in travel but in many other areas of consumer spending. But since travel expenses can be quite large you should understand the financial implications of funding your vacation through credit cards.

Most credit cards charge a monthly interest rate of 2.5 – 3.5% (source: Bank Bazaar, 30th April 2024). Let us examine two scenarios. In the first scenario, let us assume you spent Rs 1 lakh on your vacation which you funded through credit card. You plan to pay this back over four months. Your total outgo will be Rs 1,08,900/- (assuming 3.5% monthly interest rate). Let us now go through a second scenario, where you planned and accumulated the required corpus of Rs 1 lakh through SIP in a mutual fund scheme. Assuming a rate of return of 7.2*%, your required monthly SIP would have been Rs 8,062 and your total outgo would have been Rs 96,743. You can see that you could have saved around Rs 12,150 with better planning and disciplined savings / investments.

* Mean CAGR returns considered for illustration is 7.2% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of 10 year G-Sec. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023. Disclaimer: Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations.

Budgeting for vacation goals

You need to decide how many vacations you want to take in a year. Usually, most families take two vacations, one in summer and one in winter. Many families also take vacations during the festive season and occasions like birthdays, anniversaries etc. Next step is to work out the costs for each vacation. It will depend on where you plan to visit. You should budget for air or train fares, hotels / resorts, local transportation, meals, shopping etc. If you are planning a foreign vacation you should also consider exchange rates and how it may change in your vacation planning.

SIP - Invest with small amounts to make every big vacation become real

With rising cost of airfare, hotels, etc., vacations can involve considerable amount of expenses. So you need to plan well in advance to ensure that your budget and savings are not disturbed or misaligned. With regular savings and investments you can fulfil the vacation goals for your family.

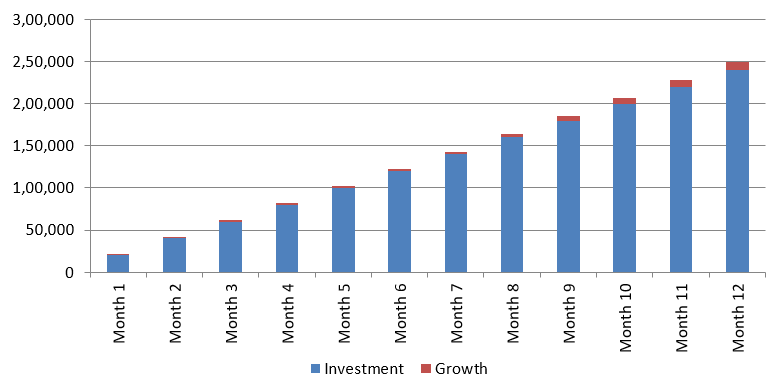

Why is regular savings important? Regular savings keeps you disciplined in your expenses. Money not saved can get spent in some discretionary expenditure. Further when you invest your savings you can get returns – the chart below shows the growth of Rs 20,000 monthly SIP for your vacation goals for the year assuming returns of 7.2%*.

* Mean CAGR returns considered for illustration is 7.2% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of 10 year G-Sec. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023. Disclaimer: Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations.

Mutual funds as a solution to all your future vacation plans

Vacation planning is usually short to medium term financial goal within 12 months to 3 years. Mutual funds can be better solution for vacation planning because they have the potential of giving higher returns than traditional savings. For short to medium term financial goals, debt or debt oriented mutual fund schemes are good investment options because they are less volatile than equity or equity oriented mutual fund schemes.

If you plan to take a vacation within 12 months then shorter duration debt funds like money market funds, low duration funds, short duration funds etc can be suitable investment options. If you have a longer time-frame then corporate bond funds, banking and PSU funds, dynamic bond funds and even conservative hybrid funds can be suitable investment options.

If you are planning a foreign vacation then you have to factor in exchange rates and currency depreciation. The cost of a 2 week or 15 day trip to the United States for 4 people can range from US $17,000 to $23,000, including airfare, visa, lodging, food, local transportation etc (source: makemytrip.com as on 1st May 2024). Three years back, the USD to INR exchange rate was around INR 74 / USD. Today it is around INR 83 / USD. If you planned your trip 3 years back, your budget estimate would have been around Rs 17 lakhs for a family of four. But your actual expense in INR would have been more Rs 19 lakhs purely due to currency depreciation. In other words, you had to spend Rs 2 lakhs more than estimated because you did not factor in fluctuations in foreign exchange rates. If you are planning a foreign vacation with 3 year investment horizon, hybrid funds like multi asset allocation funds can be suitable investment options. Multi asset allocation funds have exposures to multiple asset classes, some of which like gold, silver, international equities etc can serve as a safeguard against currency depreciation.

Vacation goal versus other life goals - getting your priorities right

While you and your family deserve a great vacation, you should never lose sight of your long term life stage goals like children’s higher education, retirement planning etc. One of the most common financial planning mistakes is to prioritize short term goals over long term goals. You may think that you will have time to catch up on your long term goals, but in reality that does not happen and you end up making compromises which can result in you falling short of your financial goals.

Suggested reading Revisiting goals in the new financial year

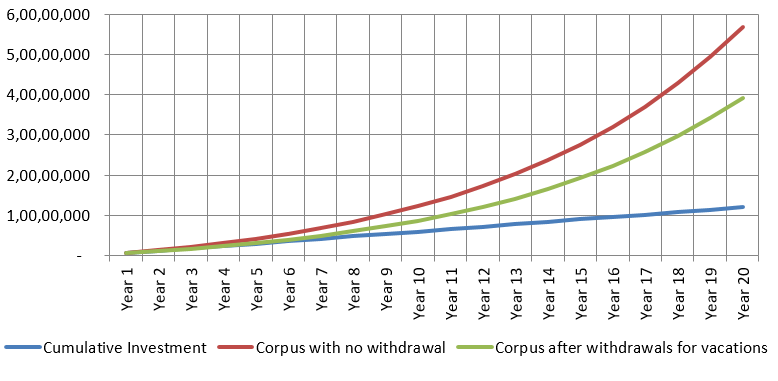

Let us take the example of two investors, both of whom are saving for retirement through SIPs in equity funds. Investor A is disciplined in his retirement planning. Investor B also saves and invests for his retirement, but he withdraws some funds every year from his retirement corpus for vacation travel. Let us assume both Investor A and Investor B are investing Rs 50,000 every month for retirement over a period of 20 years. Investor B withdraws Rs 2 lakhs every year for vacation travel. Let us assume their return on investment is 12.93%*. The chart below shows the growth of the retirement corpus till both of them get to retirement age (after 20 years). You can see that Investor B (illustrated by the green line) is considerably behind Investor A (illustrated by the red line) by the time they retire.

* Mean CAGR returns considered for illustration is 12.93% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of Nifty 50. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023 to illustrate the concept of power of compounding. Disclaimer: Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations.

This does not mean you deny yourself and your family the pleasures of a vacation but look for ways to cut down travel expenses, so that you don't have to dip into your children's higher education kitty or your retirement nest egg. It is all about prioritization.

Conclusion

You and your family deserve a great vacation – it works as medicine for your body and mind. So start planning for your next vacation and involve your family in it. Planning for a vacation can be as enjoyable as vacation, but you must not compromise on your long term financial security. Start saving and investing to make your travel and vacation goals come real.

Some vacations require less planning while some need more planning. For example, for your semi-annual / annual trip to your hometown, you can save / invest in relatively low risk debt funds. But there are vacations which you plan over longer duration e.g. a vacation in Europe or US, vacation to celebrate your 10th or 20th wedding anniversary, your parent’s 50th wedding anniversary, your child turning 18, your child’s pre or post wedding celebration etc in your dream vacation destination. Plan a SIP for these big vacations to make your dream vacations come real - a SIP for each of your dream vacations.

Book your tickets and hotel at the right time. Enjoy your vacation but do not over-indulge. With careful planning and disciplined savings you can have a wonderful vacation with your family and at the same time, stay on course of your long term life-stage financial goals.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY