Steps to achieve financial independence at a desired age

What is financial independence?

We need income or cash-flows to pay for our expenses, regular or unplanned. Our regular expenses include food, rent / EMI, utilities, school fees, transportation etc. Unplanned expenses can be those related to medical emergencies, repairs, replacing assets etc. How do we pay for these expenses? Salaried people pay for these expenses from their regular monthly salaries, while business owners meet these expenses from their business incomes. However, there may be situations when we do not have regular income from our professions e.g. post retirement. When we do not have income from our professions, we have to pay for our expenses from the income or cash-flows from our investments.

Financial independence means that the cash-flows from your assets should be sufficient to pay for all your planned and unplanned expenses. It is important for you understand, what we mean by assets in this context. Cash-flow generating assets are physical or financial resources that can generate cash-flows for you. The cash-flows can be in the form of interest, dividends, mutual fund systematic withdrawal plans (SWP), annuities, rental income etc.

Vehicle for personal use, gold jewellery, expensive watch, electronic gadgets etc are not cash-flow generating assets. Bank fixed deposits, mutual funds, Post Office small savings schemes, shares, bonds, real estate property rented out a tenant etc are cash-flow generating assets. If the cash-flows generated by these assets is sufficient to meet all your current and future expenses (factoring in inflation), you can achieve financial independence. In other words, you would not have to depend on income from your profession, either salary or business income, to sustain yourself / your family and maintain your / your family’s lifestyle.

You may like to read the article we published last year Financial Independence: Mutual Fund Sahi hain

Why is financial independence an important financial goal?

Financial independence should be one of the most important financial goals for all salaried investors. A day will come when your salary credit will stop – after your retirement. How well are you prepared for it? As per a study done by Max Life Insurance Company, in partnership with Karvy Insights in 2021, 9 out of 10 urban Indians are worried that their savings will not last for the entirety of their retired lives (source: Mint, 7th December 2021). Unfortunately in India, unlike the developed Western economies, there is no national level retirement plan (e.g. Social Security Retirement benefits in the US) which meets the income needs of the entire retired population base. In order to achieve financial independence, you need to start saving and investing, to create your own corpus that provides you sufficient cash-flows when you do not have an income from your profession.

Suggested reading: Revisiting Goals in the new financial year

Achieve financial independence at a desired age

While the COVID-19 pandemic was a terrible tragedy globally and here in India, it also caused many investors and families to re-evaluate their personal and professional goals. With growing uncertainty in many industry verticals as well as professional domains, there was increased focus and commitment towards personal financial planning, savings and investments. People also realized the importance of personal lives, work life balance and pursuing personal aspirations beyond the boundaries of their professional careers, be it in terms of vocation or entrepreneurship. Due to growing uncertainty about job security due to technology and other changes, investors may want to achieving financial independence early i.e. before the official retirement age. Over the years, there has also been a significant increase in investment awareness among retail investors thanks to the investor education initiatives of AMFI, mutual fund industry (please refer to Aditya Birla Sun Life Mutual Fund’s online investor awareness resources), as well efforts of individual mutual fund distributors and financial advisors.

Steps to achieve financial independence

There are many success stories of achieving early financial independence in the social media. There are stories of investors taking early retirement and starting YouTube channels, organic farming, opening small businesses, turning into full time investors, travelling round the world etc. In most cases, they were able to pursue their personal aspirations because they had financial security from their investments. These stories are not just inspiring but have important lessons which you can use in your journey towards financial independence.

- Budgeting: The first and one of the most important steps in planning for financial independence is making your monthly expense budget. Budgeting should not be just an accounting exercise; you should use this to evaluate your expenses and lifestyle. Carefully evaluate which expenses are essential (e.g. food, utilities, rent / EMI, school fees etc), which expenses are really important for your family (e.g. health / fitness, extra-curricular activities for your children, travelling etc) and which expenses can be reduced / eliminated. Involve your family including your children in this exercise. If you are able to reduce your monthly budget, you will not only be able to save and invest more, you can permanently reduce your costs, which will make your / your family’s lifestyle more sustainable.

- Factor in Inflation: Once you have a monthly budget, you have to estimate what your future monthly expenses will be after factoring inflation. For example if your current monthly expense is Rs 1 lakh, your monthly expense after 20 years at an assumed inflation rate of 5% will be Rs 2.65 lakhs. Remember your costs will keep going up all through your life. So your corpus should be sufficiently large to pay for increasing expenses through your whole life.

- Estimate corpus required: The next step is to estimate how much corpus you need to achieve financial independence by a certain age. There will be a number of factors in this estimation,

- Your current expenses

- Inflation rate

- Your current age

- The age by which you want to achieve financial independence

- Your current retirement savings (if any)

- Assumed return on investment

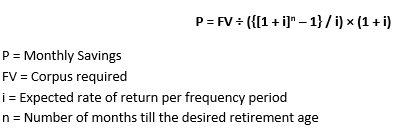

- Monthly savings target: Once you know your financial goal, you can calculate how much you need to save every month. The formula for calculating the monthly savings amount is as follows:-

Do not worry if the formula looks too complicated. Aditya Birla Sun Life Mutual Fund’s Retirement Calculator will calculate the monthly savings amount for you. A word of caution when you are using a retirement calculator; different investors have different risk appetites, depending on age, assets, liabilities etc. The risk / return profiles of different types of investments / mutual funds are different. You need to use the right returns assumptions for investments suitable for your risk appetites. You should consult with your financial planner, if you need any help. - Savings is not enough, you have to invest: Many investors complain that they do not have expensive lifestyles and are able to save a good percentage of their incomes, yet their corpus is not large enough. If you put all your savings in risk free investments (e.g. traditional fixed income investments), then your post tax inflation adjusted returns may leave you short of your financial goal. In order to achieve your financial goals, you need to invest your savings in the right asset class. You need to invest in an asset class that generates sufficient returns that will enable you to achieve your goal of financial independence. For young investors, equity is a suitable asset class for wealth creation.

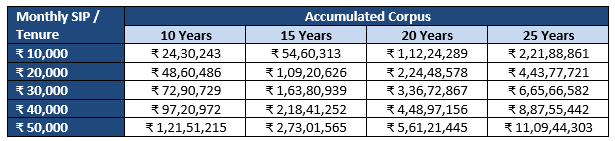

- Start mutual fund SIP early in your career: Mutual fund systematic investment plans (SIPs) are ideal investment options for long term investing. Through SIPs you can start investing for your financial independence with relatively small amounts. If you start early, you can invest over longer investment horizon and benefit from the power of compounding (see the table below). You can see that if you have longer investment tenures you can achieve your desired corpus with less monthly investments – power of compounding.

Disclaimer: Mean CAGR returns considered for illustration is 12.93% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of Nifty. SIP investments on first day of every month for the stated periods have been considered for this illustration. SIP Returns are calculated on CAGR basis. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023 and as amended from time to time to define the concept of power of compounding. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing

- Consider SIP Top-Ups: As you progress through your career and your income increases, you can increase your SIP investments using the SIP top-up facility. SIP top-up is a mutual fund facility, whereby you can increase your SIPs every year (or any other interval) by a certain amount or percentage. SIP top-up can help you achieve financial independence quicker.

- Remain disciplined: The importance of discipline in investments cannot be overstated. You need to remain disciplined in your investments, irrespective of whether the market is moving up or down. Though a lot has been said on the importance of discipline, it is easier said than done. This is because investors have behavioural biases and can make irrational investment decisions in times of high volatility in the market. We have discussed this in our article, What is Behavioural finance and its impact on investment decisions. You should educate yourself on investments and above all, remain laser-sharp focused on your goal of financial independence. You can have a better appreciation of discipline in investments, if you play an investor education game by Aditya Birla Sun Life Mutual Fund, FingoMF.

Markets will go up or down, but your goal should not change. Investors who have achieved financial independence, had to go through the same market phases which the rest of us went through and yet they achieved success, while others could not. If you follow their stories, you will understand that a large part of their success was due to remaining disciplined even when their investments were down in value. Mutual fund SIP is a great investment option in volatile markets because it enables you to lower the average cost of acquisition of your mutual units through Rupee Cost Averaging. - Have plans for different financial goals: At different life-stages, you may have multiple financial goals. These may include paying off your loans, children’s higher education, children’s wedding, home improvements etc. It has often been seen that investors use their retirement savings for these goals e.g. use retirement corpus to pay for children’s higher education or wedding. You do not have to make that compromise, if you have separate financial plans to achieve each of these goals.

Final word

In this article we discussed, why achieving financial independence should be one of the most important goals in our life. It is, without a doubt, one of the most challenging life goals, but our effort will be considerably reduced if we plan early and benefit from the power of compounding over a long investment period. Though many investors understand the importance of financial security, it is often neglected as a financial goal because we tend to give more importance to short term goals and neglect long term ones. Financial planning helps us stay focused on both short term and long term goals. Start saving and investing, as early as possible, to achieve financial independence at your desired age.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY