Importance of budgeting as the foundation of sound financial planning

What is financial planning?

Financial planning is the process of defining your goals e.g. home purchase, children’s higher education, children’s marriage, retirement planning, estate planning etc and developing an investment plan to meet your goals. Financial plans help you prepare for big events in your life and ensure financial security.

Suggested reading financial independence: Mutual Fund Sahi Hain

Importance of savings in financial planning

In order to create wealth and achieve your life-stage goals, you need to invest in the right assets which can get your commensurate returns needed to achieve your financial goals. In order to invest, you need to save a portion of your disposable income. Without adequate regular savings it will not be possible to achieve your financial goals.

Savings is a part of ancient Indian cultural traditions. The ancient Indian philosopher Chanakya’s Arthashastra, alludes to importance of savings. Chanakya writes in Arthashastra, “Save your wealth against future calamity... when riches begin to forsake one, even the accumulated stock dwindles away”. The legendary American investor, Warren Buffet has this advice for investors, “Do not save what is left after spending, but spend what is left after saving”.

You may also like to read importance of goal setting in financial planning

Lifestyle and savings

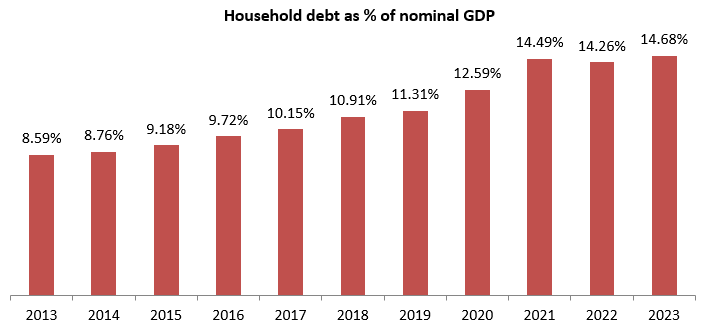

Saving habits are very personal. It depends on our lifestyle, relative to our income levels. Some of us, irrespective of our income levels, are very careful about expenses. Others are more extravagant as far as spending is concerned. Indians are traditional savers, but in recent years with rising consumerism, there is a propensity to spend more on lifestyle related consumption. One of the consequences of rising discretionary consumption spending in India is the growing household debt in India (see the chart below).

Source: CIEC data, as on 31st December 2023

The fundamental mathematical equation for your financial well being is as follows:-

If you have a deficit it implies that either you are meeting your expenses through debt (e.g. credit card loan) or by drawing on your accumulated savings. Expenses financed though credit card loans has costs associated with it i.e. interest cost. This further reduces your savings. If you have a deficit, you should urgently try to reduce your expenses. If you have a surplus every month it implies that you are able to save every month. You should then evaluate whether your current savings are adequate to achieve your financial goals and take appropriate measures. You may have to cut down on your expenses, if required.

Is there a compromise between better standard of living / lifestyle and savings? One of the reasons, why you work hard is to give yourself and your families a better standard of living or lifestyle. While lifestyle is an important consideration, you should not lose sight of your future life-stage goals. A happy compromise can be achieved between your lifestyle and savings. This is where budgeting becomes an important part of your financial planning.

Personal finance budget is the foundation of your financial plan

Your budget allows you to plan how to spend your money. It makes it easier to find ways to save money. Your savings invested in the right asset class will generate returns to achieve your stage of life financial goals like children’s higher education, children’s marriage, retirement planning, estate planning etc. You should link your savings / investments to different financial goals. Ideally you should have separate investment plans for different financial goals. Alternatively, you can set your financial goals and do your budgeting accordingly.

Aditya Birla Sun Life Mutual Fund has developed a very effective application – Smart Selfie (click on the hyperlink to explore further), which can help you set different personal finance goals.

You can reduce your expenses without compromising lifestyle

Through a careful budgeting exercise, you may be able to identify expenses which you can easily reduce, with any noticeable impact on your lifestyle. For example, you may have subscribed to many TV channels or OTT platforms, but through a thoughtful exercise you may find that there are channels or subscriptions that you almost never watch. Similarly in your mobile plan, you may have opted for services that you do not need. You may be able to reduce wasteful expenditures by making our personal finance budget and sticking to it.

Sometimes, it is not just about reducing consumption, but also getting lower prices for the goods and services you consume e.g. shift to online purchase, moving to lower cost vendor without compromising on quality etc. Some costs may seem too small to bother about. But even small additional savings can make a big difference to your long term wealth, with the help of power of compounding.

Case Study – How budgeting can help you achiever your goals?

Ramesh and Suresh are 30 years old. They have the same salaries. Both have similar expenses and savings. Suresh works with a financial advisor to make a financial plan. As a part of budgeting exercise Suresh is able to reduce his monthly expenses by Rs 5,000 by making small sacrifices like car pool for daily commute, availing school bus services for kids instead pickup / drop by car, cutting down on restaurant visits, cancelling a few OTT subscriptions, etc. Suresh invests the additional monthly savings in a diversified equity mutual fund through monthly systematic investment plan (SIP). Ramesh on the other hand, carries on with his / his family’s normal lifestyle. How much additional wealth Suresh can create through this incremental Rs 5,000 monthly savings? By the time both Ramesh and Suresh retire at the age of 60, Suresh will be able to accumulate additional corpus of Rs 1.75 crores. With budgeting, you can achieve better results towards achievement of your financial goals, in this case, retirement planning.

How to make your personal finance budget?

- What are your non-discretionary expenses? These are the essential expenses e.g. food, accommodation (rent / home loan EMI), children’s education expenses, utility bills (e.g. electricity, LPG, broadband, mobile etc), regular transportation expenses etc.

- Review your payment plans. Can you reduce expenses / save more by changing your payment plans e.g. shift from monthly to annual payments for your broadband, annual insurance premium instead of monthly / quarterly?

- What are your discretionary expenses e.g. restaurant / takeout food bills, movies, clothes, electronic gadgets etc? You may not even know how much you spend on this unless you analyze your bank statements or your credit card statements. How much can you reduce these expenses?

- What are the big one-time expenses that you incur every year e.g. festival shopping, vacations etc? Make a budget for these expenses. These are entirely discretionary expenses. You simply need to decide how much you want to spend.

- Make a list of your expenses – both discretionary and non-discretionary. Assign costs and make your monthly expense budget. Never lose sight of your financial goals. The less you spend, more you can save and invest for your financial goals. Unless you make saving for your financial goals your main priority, the purpose of your personal finance budget will get defeated.

Budgeting is a critical exercise both in pre-retirement and post retirement life

An important step in financial planning as you approach retirement is to estimate your expenses and create a budget. Since you will be living off of income from your savings in your retirement, you should manage your expenses carefully. Many investors think that their expenses will go down considerably after retirement. While some expenses like work commute expenses, home loan EMIs, children’s education etc, may not have to be incurred, you will continue to incur your regular day to day living expenses and other lifestyle related expenses, while medical expenses and certain other expenses may go up over time. You should know that lifestyle is hard to change. It is therefore important that you estimate your expenses and plan accordingly well before you retire.

You may also like to read how ELSS mutual funds can be helpful for cash flows during retirement

Conclusion

Your personal finance budget is a useful guideline that will help you track and manage your expenses. Budgeting requires regular monitoring and discipline. Your personal finance budget is critical in your journey toward financial freedom. There are many online resources that can help your make your personal budget. You should consult with your financial advisor if you need help in your personal finance budget planning.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY