Reflections of 2023 and Resolutions for 2024

Reflections and Resolutions are the two sides of the same coin - your financial goals! Reflecting on a range of events from economic trends and market insights you can learn how to manage risks and the importance of goal focussed approach. Reflection is critical not only on the external events, but it is equally essential to reflect on your cash-flows in 2023 - any changes in income, expenses, or personal situations. Embracing this panoramic introspection of the events of 2023 serves as our compass, ensuring we stay the course on the vibrant expedition of financial goal planning.

Resolutions for the New Year form a proactive step toward financial well-being, security, and long-term success. It empowers individuals to take control of their financial future and make decisions that align with their aspirations and values. Financial resolutions give clarity, purpose and insights in what needs to be done this year to stay on the track of financial goal planning. Let's reflect on the broader set of events that occurred in 2023.

You may also like to read Reflection of 2022 and resolutions for 2023

Reflections of 2023

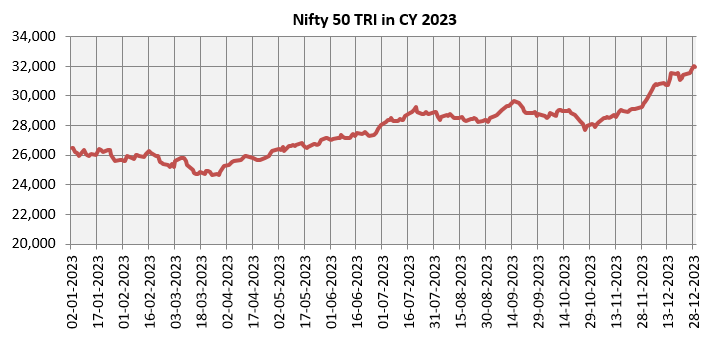

2023 was a good year for equity markets. The Nifty gained nearly 20%, closing the year at its all-time high. The broader market outperformed the Nifty, with Nifty Midcap and Small Cap indices giving 44% - 48% returns. However, the journey to record highs was not smooth for the market. There were many bumps on the road. In this article, we will reflect on key events in 2023 and draw lessons for 2024 and beyond.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

Hindenburg report on Adani

In late January 2023, Hindenburg Research, an US based short seller, brought a report on Adani group alleging share price manipulation through offshore entities and accounting malpractices. Hindenburg launched a bear attack on Adani stocks, whose ramifications were felt in the broad market. The Nifty fell by 6% but recovered soon after (source: Economic Times, National Stock Exchange March 2023).

Uncertainty about interest rates and bond yields

The markets turned volatile again in mid-September due to comments coming from US Federal Reserve about the inflation and future trajectory of interest rates. The market was concerned that interest rates may remain high for a long period of time and strong labour market data from the US only served to heighten these concerns. US Treasury bond yields reached 16-year highs. High Treasury bond yield caused risk aversion and is negative for equity markets (source: Bloomberg, September 2023).

Israel Hamas War

The terrorist attack on Israel on 7th October 2023 by Hamas and retaliatory air strike (and later ground attack) by Israel on Gaza, sparked off a new war in the Middle East. Though the war has largely been confined to Gaza, there were concerns that the war may spread to other parts of the region and cause crude oil prices to rise, raising inflationary concerns all over again. Nifty fell by nearly 7% in September – October, but recovered within a month or so (source: National Stock Exchange, October 2023).

India’s inclusion in JP Morgan EM debt Index

In September 2023, JP Morgan announced that Indian Government Bonds (G-Secs) in its emerging market debt index from June 2024 onwards (source: Reuters, September 2023). According to Finance Ministry sources, this can result in $23 billion investment flows to India. Following JP Morgan’s announcement, Bloomberg proposed inclusion of G-Secs in Bloomberg EM Local Currency Index (source: Economic Times January 2024). This will further bolster foreign investment flows to India.

Fed FOMC meeting in December

In the December FOMC meeting the US Federal Reserve indicated that there will be multiple rate cuts in 2024, which has lowered US Treasury Bond yields and provided tailwinds to the rally in equities.

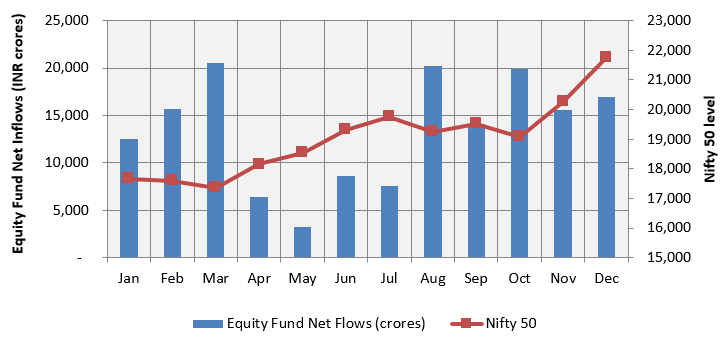

Growing maturity of retail Investors

The chart below shows that retail investments increased in the months when Nifty fell. This shows the growing maturity of Indian investors.

Source: AMFI, NSE, as on 31st December 2023. Disclaimer: The chart is purely for investment education purposes. It should not be construed as recommendation of any investment strategy

Important milestones in the year

- The Indian mutual fund industry reached an important landmark with industry assets under management crossing Rs 50 lakh crores (source: AMFI).

- The total number of mutual fund folios crossed 15 crores in 2023 (approximately 90% of which were accounted for by retail investors, as per AMFI data). As on 31st December total number of folios stood at 16.5 crores (source: AMFI).

- The monthly SIP book has consistently grown from Rs 13,573 crores in December 2022 to Rs 17,610 crores in December 2023. The total number of SIP accounts stood at 7.64 crores, showing that SIP is increasingly being preferred by retail investors for savings and investments (source: AMFI).

- The consistent growth in SIP book despite volatility in the market shows the growing discipline of retail investors as far as savings and investments are concerned.

- The number of demat accounts reached nearly 14 crores (CDSL 10.5 crores + NSDL 3.5 crores) showing gradual shift from traditional fixed income savings mindset towards investments in equities and other asset classes (source: CDSL, NSDL, January 2024).

India’s weight in EM Index is at all time high

FII have been sellers for the past 3 years i.e. CY 2021, 2022 and 2023. This might change soon. India was the best performing G-20 economy in CY 2023 and is projected to be the best performing G-20 economy in CY 2024 also. The weight of India in MSCI Emerging Market Index is at an all-time high of 16.7%, higher than Taiwan, South Korea and Brazil (source: MSCI EM Index factsheet, as on 29th December 2023), closer to China than in the past. Accordingly, India is expected to receive a larger share of FII Emerging Market allocations in 2024. This will provide a further boost to Indian equities.

Resolutions for 2024

Lessons of 2023 set stage for staying focused in 2024 in spite of any events in order to stay goal-focused. Equities will be volatile but if you curb your behavioural biases and remain disciplined you will stand to gain in the long term. Here are some lessons and resolutions for 2024 – these are the eternal tenets of investing:-

- Do not over-react to news and short-term market movements - it can harm your financial interest.

- Do not let global trends deter your investment planning. In the long-term equity returns correlates to earnings growth. Remain disciplined in your investment planning with a focus on quality.

- Stay disciplined in your financial plans. Market may go up or down, but your children's education goal or your retirement goal does not change. Suggested reading – Financial Independence: Mutual Fund Sahi Hain

- Invest through SIP. You can take advantage of market volatility through Rupee Cost Averaging.

- As per the Government’s vision of India becoming a developed economy by 2047, we are in the Amrit Kaal of economic growth. Historical data shows strong correlation between economic growth and equity returns over long investment horizons. Investors should use the economic growth of India to create wealth for themselves by investing in the right mutual funds. This may be the Amrit Kaal for investors also.

Conclusion

The start of a year is a good time to review your financial goals. Your financial goals may change with increasing income, lifestyles, life-stage etc. You should revise your financial goal based on changed circumstances. You should also review your asset allocation and make sure that it is aligned with your risk appetite and financial goals. You should also make sure that your tax planning is in order at the start of the year. There is popular saying that New Year resolutions are meant to be broken. However, as an informed and disciplined investor, you should resolutely stick to these resolutions for your long-term financial well-being. You should take the help of a financial advisor if you need help in goal planning, asset allocation and making investment decisions.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY