How can multi asset allocation work for you?

What is multi asset allocation?

Asset allocation refers to diversification of investments over two or more asset classes. When we talk about asset allocation, investors usually think of a mix of equity and fixed income. Multi asset allocation is spreading your investments over at least 3 asset classes. These asset classes are equity, fixed income or debt, gold, real estate etc.

What are multi asset allocation funds?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI, multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, equity and fixed income or debt, multi asset allocation funds must invest in other asset classes like gold, real estate investment trusts (REITs), infrastructure investment trusts (InvITs) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

Why multi asset allocation achieves better risk diversification?

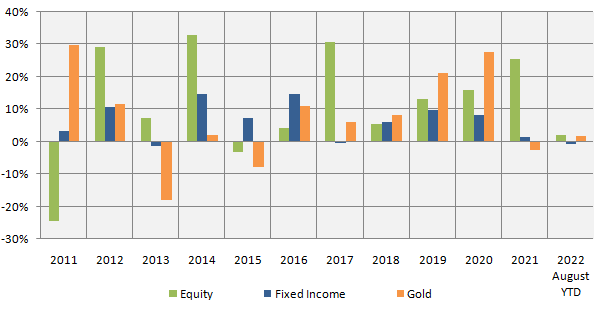

Since Multi Asset Allocation funds invest in 3 or more asset classes they provide stability to your portfolio returns across investment cycles. There is low correlation between returns of different asset classes in different market conditions; equity and gold are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Note the years where gold gave very high returns, these were the years when equity underperformed and vice versa. Adding gold to your investment portfolio provides much better risk diversification compared to a portfolio comprising of just equity and fixed income.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2022. Equity as an asset class is represented by Nifty 50 TRI, fixed income as an asset class has been represented by Nifty 10 year benchmark G-Sec and gold returns refer to appreciation in domestic (INR) price of gold. Disclaimer: Past performance may or may not be sustained in the future.

Suggested reading: Role and importance of multi asset allocation fund in the investors’ portfolio

How different asset allocation models work?

Different asset allocation models have different risk return characteristics. Aggressive Hybrid Funds, for example, invest 65 – 80% in equity and 20 – 35% in fixed income (debt). Conservative hybrid funds invest 75 – 90% in fixed income (debt) and 10 – 25% in equities. Dynamic asset allocation funds or balanced advantage funds have the flexibility dynamically managing their asset allocation depending on market conditions. Equity savings funds invest minimum 65% in equity but can reduce their net equity exposure by using derivatives (e.g. arbitrage). Multi asset allocation funds must invest minimum 10% each in at least three asset classes e.g. equity, fixed income (debt) and gold. Investors should know that risk and return are related. Multi asset allocation fund managers have the flexibility to have different multi asset allocation models (with different asset allocation bands) with the objective of generating risk adjusted returns for investors.

Source: SEBI circular on Categorization and Rationalization of mutual fund schemes (Oct 06, 2017)

Suitable for different risk profiles

You can see that, different multi asset allocation models have different risk / return characteristics. Different investors have different risk appetites and investment needs. Multi asset allocation models can be suitable for different risk appetites from moderate to moderately high depending on the multi asset allocation model. Your asset allocation should be according to your risk appetite. You should consult with your financial advisor, if you need help in understanding your risk appetite and decide your asset allocation accordingly.

Suitable for multiple investment objectives

The primary investment objective of equity as an asset class is capital appreciation. On the other hand, the primary investment objective of fixed income or debt as an asset class is income generation. Gold as an asset class is primarily seen as a hedge against inflation and also has an important role to play in asset allocation, especially in bear market cycles (as discussed earlier in this blog post).

While some investment objectives are more important than others in different life-stages e.g. capital appreciation for young investors, income for senior citizens etc, in certain life-stages investor can have multiple investment objectives. Most investors in India fall in the latter category and therefore, multi asset allocation is relevant for a large number of investors.

You may also like to read overcoming obstacles through asset allocation for diverse life stages

In this blog post, we have discussed how multi asset allocation may work for you. You should consult with your financial advisor if multi asset allocation is suitable for you.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY