Role and importance of multi-asset allocation fund in the investor's portfolio

Importance of risk diversification

The old proverb, “do not put all your eggs in one basket”, is one of the most important tenets of investing. This old proverb can be applied to investments and mitigated through diversification. Risk is an intrinsic aspect of investing; if you are not willing to take risks, you should expect only the lowest possible returns. You can reduce your risks through diversification. Asset allocation is the most important mechanisms of risk diversification.

What is asset allocation?

Asset allocation is spreading your investments over different asset classes e.g. equity, fixed income, gold, real estate etc. The main purpose of asset allocation is balance risk and returns. If you are over-invested in one particular asset class, you may end up either taking too much risk or accept too little returns. Through asset allocation you take optimal risks to get the right returns needed for your financial goals.

What are asset classes?

Before we discuss asset classes, you should understand a fundamental concept in investments – risk and return. Risk and return are interrelated; higher the risk, higher the potential returns. Asset classes are broad categories of investments which have similar risk / return characteristics. The most common asset classes are equity, fixed income, gold and real estate. While equity and fixed income are financial assets, gold and real estate can be in both, physical or financial forms.

Many investors would be familiar with and may have invested in physical gold and real estate e.g. gold jewellery, gold bars, gold coins, residential property, commercial real estate etc. You should know that you can also invest in gold and real estate in financial form i.e. without owning the physical asset. Gold ETFs, gold funds / fund of fund etc, are financial assets related to the gold asset class. Real Estate Investment Trusts (REITs) are financial assets related to real estate asset class.

Each asset class has an important and unique role to play in your investment portfolio. In this article, we will discuss about role of multi asset allocation funds, which invests in multiple asset classes in your investment portfolio.

You must read this overcoming obstacles through asset allocation for diverse life stages

What are multi asset allocation funds?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, fixed income and equity, these schemes invest in asset classes like gold, real estate investment trusts (REIT) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns. Before we delve further in multi asset allocation funds, let us understand the role of different asset classes in your portfolio. As far as asset classes are concerned, we will be focused on three asset classes namely, equity, fixed income and gold.

Equity as an asset class

Equity as an asset class refers to shares of publicly traded companies or related securities. This is one of the most important asset classes from an investment perspective. The primary investment objective in this asset class is capital appreciation and wealth creation. Historical data shows that equity as an asset class has the potential to give superior returns over long investment horizons. Over the last 10 years, Rs 10,000 invested in Nifty 50 TRI would have grown to Rs 38,250 at a CAGR of 14.4% (as on 31st August 2022, source: Advisorkhoj Research). However you should also know that equity as an asset class can be extremely volatile in the short term. You should have moderately high to high risk appetite and long investment horizons, for equity as an asset class.

Fixed income as an asset class

Fixed income as an asset class refers to investments in fixed income securities. The asset class is also known as debt investments. Fixed income securities generate income (as interest or coupon) and return the principal amount on maturity. There are a large variety of fixed income investments e.g. bank fixed deposits, Government small savings schemes, debt and money market instruments etc. The primary investment objective in this asset class is income. Fixed income as an asset class has lower risks (less volatile) compared to equity. Fixed income provides stability to your investment portfolio and can serve a wide variety of investment needs ranging from investment tenures of a few days to many years. They are suitable for investors with low to moderate risk appetites, depending on the nature of investments.

Gold as an asset class

Gold, as an asset class, has huge cultural significance in India. It is considered auspicious and is bought or gifted on auspicious occasions like Akshay Tritiya, Dhanteras, Deepawali, weddings etc. The auspicious significance of gold aside, it is also an important asset class from an investment standpoint because gold is considered to be a store of value. Gold is seen as a hedge against inflation and as historical data shows, has beaten inflation over long investment horizons. Over the last 20 years, Rs 10,000 invested in gold would have grown to over Rs 80,000 at a CAGR of 11.6% (as on 31st August 2022, source: Advisorkhoj Research). Gold also provides stability to your investment portfolio (we will discuss this shortly) during economic recessions; it can also create wealth for you over long investment horizons spanning life-stages. They are suitable for investors with moderate risk appetites and very long investment horizons.

Benefits of Multi Asset Allocation Funds in your portfolio

We have discussed the risk / return characteristics of different classes. By now, you should have some appreciation of the benefit the three asset classes will bring to your investment portfolio. Multi Asset Allocation Fund can provide you these benefits in a single product. Let us now discuss the benefits of Multi Asset Allocation funds in more details.

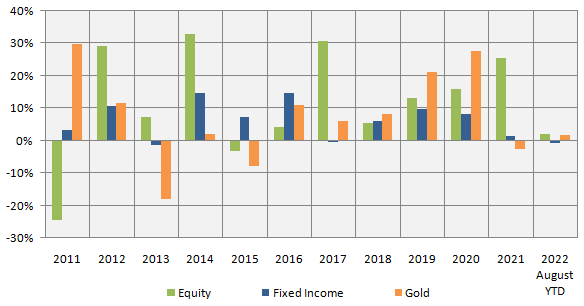

- There is low correlation between returns of different asset classes in different market conditions; equity and gold are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Since Multi Asset Allocation funds invest in all the three asset classes they provide stability to your portfolio returns across investment cycles.

![Gold outperforms when equity underperforms and vice versa Gold outperforms when equity underperforms and vice versa]()

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2022. Equity as an asset class is represented by Nifty 50 TRI, fixed income as an asset class has been represented by Nifty 10 year benchmark G-Sec and gold returns refer to appreciation in domestic (INR) price of gold. Disclaimer: Past performance may or may not be sustained in the future.

- One asset class cannot outperform in all market conditions; this is the essence of investment cycles. However, investors often seem to forget this and make investment decisions based on emotions. Multi Asset Allocation funds will keep you disciplined in your investments and provide you a more stable and disciplined investment experience.

- Automatic portfolio rebalancing will reduce over-exposure to a particular asset class and provide stability of returns through profit booking at higher levels and re-investing in underperforming assets.

- You can benefit from the fund manager’s expertise of rebalancing asset allocation based on market and economic outlook. The fund manager’s objective in Multi Asset Allocation is to balance risk and returns in different market conditions.

- Advantage of equity taxation if average equity allocation during the year is more than 65%. For tax consequences of your investment in these schemes please consult with your financial and tax advisors in order to make informed investment decisions

Why invest in Multi Asset Allocation Funds now?

- There is considerable uncertainty about the global economic outlook with concerns of economic recession in the US.

- Though global commodity prices are showing signs of cooling off, inflation is still very high globally and in India.

- Asset allocation plays a very important role in uncertain economic and financial market conditions since it reduces portfolio volatility.

- You can consider allocating a portion of your portfolio to Multi Asset Allocation funds to provide stability in the short term and also plan for your medium to long term investment goals.

- You should have moderately high risk appetites and long investment horizons (minimum 3 to 5 years) for Multi Asset Allocation funds.

You should consult with their financial advisors if Multi Asset Allocation Funds are suitable for your investment needs.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link : https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY