Motilal Oswal Balanced Advantage Fund: One of the best performing BAFs in 2023

The stock market has rallied strongly in 2023. The Nifty 50 index has rallied from 18,000 levels at the beginning of the year to over 20,000 (as on 13th September 2023). Since the market is at all time high, many investors are turning their attention to asset allocation. Hybrid mutual funds provide a variety of asset allocation solutions for investors with different risk profiles. Balanced advantage funds, which manage asset allocation dynamically based on market movements / valuations can be good investment options in these market conditions. In this article, we will review Motilal Oswal Balanced Advantage Fund. Motilal Oswal Balanced Advantage Fund has been one of the best performing balanced advantage funds in the last 1 year.

What are Balanced Advantage Funds?

Balanced Advantage Funds, also known as Dynamic Asset Allocation Funds, are hybrid mutual funds which manage their asset allocation dynamically between equity and debt. The asset allocation will change depending on market conditions using quantitative asset allocation models.

How Balanced Advantage Funds work?

- Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by a quantitative dynamic asset allocation model based on market conditions.

- Fixed Income: Fixed income allocation is determined by the asset allocation model but is usually capped at 35%.

- Hedging: This is the fully hedged equity component which is not exposed to market risks. Hedging reduces the net equity exposure and at the same time enables equity taxation.

About Motilal Oswal Balanced Advantage Fund

Motilal Oswal Balanced Advantage Fund has recently completed 7 years. The fund was launched in September 2016 and has given 9.1% CAGR returns since inception (as on 31st August 2023). The scheme has Rs 735 crores of assets under management (AUM) as 31st August 2023. The expense ratio of the scheme is 2.35%. Motilal Oswal Balanced Advantage Fund follows counter-cyclical dynamic asset allocation model which decreases equity allocations when markets are expensive and increases it when markets are cheap. Santosh Singh, Rakesh Shetty and Ankush Sood are fund managers of this scheme. While Mr Sood and Mr Singh manage the equity portion, Mr Shetty manages the debt portion of Motilal Oswal Balanced Advantage Fund. The fund managers have combined experience of more than 30 years.

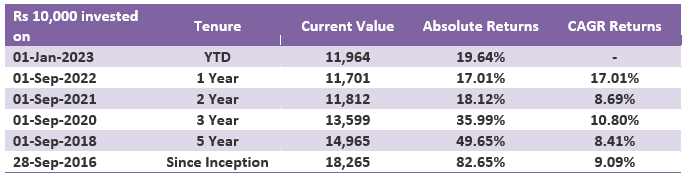

Performance Motilal Oswal Balanced Advantage Fund

The chart below shows the growth of Rs 10,000 lump sum investment and CAGR returns Motilal Oswal Balanced Advantage Fund over various periods.

Source: Advisorkhoj Research Point to Point Returns, as on 31st August 2023.

Rolling Returns

The chart below shows the 3 year rolling returns (3 year investment tenures rolled daily) of Motilal Oswal Balanced Advantage Fund versus the Balanced Advantage category since the scheme’s inception. The category rolling returns is the simple average of 3 year rolling returns of all the schemes in the balanced advantage funds category over the said performance period i.e. since the inception of the scheme. You can see that the Motilal Oswal Balanced Advantage Fund outperformed the balanced advantage (see average rolling returns of the scheme versus category average) over most periods across different market conditions.The scheme underperformed from 2020onwards but has made a strong comeback this year. Motilal Oswal Balanced Advantage Fund is the best performing balanced advantage fund in 2023.

Source: Advisorkhoj Rolling Returns, as on 31st August 2023.

Lower Downside Risk

One of the benefits of investment in balanced advantage funds is lower downside risks in market corrections. The table below shows some of the biggest corrections in the equity market since the launch of Motilal Oswal Balanced Advantage Fund. You can see that the scheme had much smaller drawdowns compared to the market index Nifty 50 TRI. This is due to the dynamic asset allocation strategy of having lower equity allocations at high valuations.

Source: mutualfundtools.com

Steady growth potential through SIP

The chart below shows the growth of Rs 10,000 monthly SIP investment in Motilal Oswal Balanced Advantage Fund over various periods. You can see that fund was able to create wealth over longer investment tenures.

Source: mutualfundtools.com

Dynamic Asset Allocation Model of Motilal Oswal Balanced Advantage Fund

The fund managers use MOVI – Motilal Oswal Value Index, to gauge net equity investments vis-a-vis market level. MOVI is the proprietary index of MOAMC calculated using P/E, P/B and D/Y of Nifty 50. Rule-based rebalancing is executed without any fund manager intervention. MOVI levels dictate what amount of equity and debt is to be maintained. Equity levels are increased with lower MOVI and decreased at higher MOVI.

Where does Motilal Oswal Balanced Advantage Fund invest?

Why invest in Motilal Oswal Balanced Advantage Fund?

- Discipline with Discretion: Discipline of a time-tested & transparent asset allocation framework combined with Discretion of the Fund Manager to tap market volatility / opportunities.

- Unique Positioning in Balanced Advantage Fund Category - Active market cap allocation and Active Sector allocation.

- High quality growth oriented fund with focus on identifying under researched companies where Motilal Oswal AMC has edge of insights on growth pathway.

- Due to asset allocation strategy and contrarian stock calls, fund best suited for long term investment.

- Asset allocation is very important in sideways and volatile markets. Motilal Oswal Balanced Advantage Fund can reduce downside risks in volatile markets and provide relative stability to your portfolio.

Who should invest in Motilal Oswal Balanced Advantage Fund?

- Investors who want capital appreciation and income over long investment tenures

- Investors who do not want high volatility in their portfolios

- Investors with minimum 3 to 5 years investment horizon

- New investors or investors who do not have experience of volatile markets can invest in this scheme

- You should consult with your financial advisor or mutual fund distributor if Motilal Oswal Balanced Advantage Fund is suitable for your investment needs.

Riskometer:

Feedback:

- 3.56- kindly remove the portion small cap fund index is a losers index, keep losing money

- Minimum 5 secs MF standard disclaimer. (Audio)

- Add: BAF and Multi asset product labelling

Disclaimer:

Motilal Oswal Value Index [MOVI] has been developed by MOAMC as an in-house index, the index is calculated taking into account Price/ Earnings, Price/ Book and Dividend Yield of the CNN Nifty Index. It helps gauge the equity markets and helps in understanding if the markets are cheap or expensive.

This has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained herein is for general purposes only and not a complete disclosure of every material fact. The stocks/sectors mentioned herein are used for explaining the concept and is for illustration purpose only and shall not be construed as an investment advice to any party. The stocks/sectors mentioned may or may not be part of our portfolio/strategy/ schemes. Past performance may or may not be sustained in future. The information/data/charts herein alone is not sufficient and should not be used for development or implementation of any investment strategy. All opinions, figures, estimates and data are as on date.

The content does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article.

Investors are requested to note that as a manager to the products of various business segments offered by Motilal Oswal Asset Management Company (MOAMC) or its associates may have financial interest in the stocks/schemes mentioned herein. MOAMC or its associates did not receive any compensation from or other benefits from the subject company/ies whose stocks are mentioned herein or from a third party in connection with the same. Viewers/ readers are advised to consult their financial advisors before making any investments.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

- Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY