A Fund That Invests in 94% Of the Listed Companies

When it comes to index funds, most investors usually think about Nifty 50 Index funds or Nifty Index Funds. There are several reasons why Nifty Index Funds are popular. The Nifty 50 Index is also known as the barometer of the stock market in India. The index comprises the largest 50 companies by market capitalisation; these companies are market leaders and household names. However, there are many other index fund products that provide exposure to a wider universe of sectors and stocks beyond the top 50 companies. For example, the Nifty 500 index will expose you to 3 different market capitalization segments, large-cap, mid-cap and small-cap. In this article, we will review Motilal Oswal Nifty 500 Index Fund.

What are index funds?

For the benefit of new investors, index funds are passive mutual fund schemes that track a particular market index like Nifty 50 (aka Nifty), Nifty Next 50, and Nifty 500 etc. Index funds do not aim to beat the benchmark market index; instead, they simply aim to replicate the index performance subject to tracking errors. There are several advantages of investing in index funds. The Total Expense Ratios (TERs) of index funds are much lower than active funds; TER has a direct bearing on a fund’s performance. Active funds have unsystematic and market risks, while index funds are subject to only market risks. There is no human bias in index funds because these funds simply track the market index.

About Nifty 500 Index

Nifty 500 Index represents the Top 500 listed companies by full market capitalisation. The combined market capitalisation of Nifty 500 stocks is 94% of all companies listed in the National Stock Exchange (Source: AMFI, 30th June 2023). The weights of the constituents in the Nifty 500 index is based on the free float market capitalisation methodology, just like the Nifty 50 Index. The index is rebalanced semi-annually.

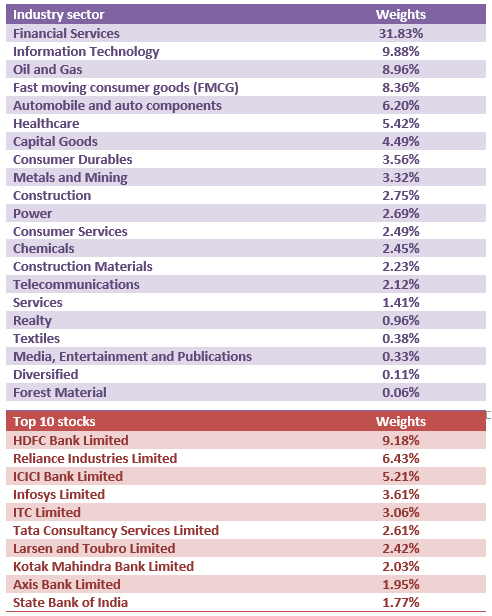

Sector Composition of Nifty 500

Source: National Stock Exchange, as on 31st July 2023

Why invest in Nifty 500?

- The India Growth Story is not just limited to large caps. Midcap and small caps stocks will play an important role in the India Growth Story and tend to outperform large caps in the long term.

- Nifty 500 exposes you to many more sectors when compared to Nifty 50, e.g. capital goods, chemicals, realty, textiles, media, entertainment etc. These sectors have huge growth potential due to rising per capita income, demographic factors, shift towards organised sectors, digitisation etc.

Source: National Stock Exchange, as on 31st July 2023

- The chart below shows the growth in Rs 10,000 investment in Nifty 500 TRI versus Nifty 50 TRI over the last 10 years ending 31st July 2023. In the last 10 years, Nifty 500 TRI gave 15.92% CAGR return, while Nifty 50 TRI gave 14.55% CAGR return.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st July 2023

- Large caps (top 100 stocks by market cap) account for 73% of Nifty 500 index (source: AMFI, 30th June 2023). Large caps will provide stability to your investment portfolio while midcaps and small caps will help you get higher wealth creation over long investment horizons.

Motilal Oswal Nifty 500 Index Fund

Motilal Oswal is one of the most trusted names in the financial services industry. As an organisation, Motilal Oswal has extensive and intensive expertise in equity research (250+ companies, 20 sectors). The fund house has a long track record of performance across many equity product categories. Motilal Oswal has 30 products that include Index Funds, ETF and FoFs. It is spread across 19 domestic equity, 3 debt, 1 commodity, 5 international and 2 asset allocation solutions.

Motilal Oswal Nifty 500 Index Fund has completed nearly 4 years since the launch of the fund. The total expense ratio (TER) of the regular plan is only 1.04%, and that of the direct plan is 0.37%. The tracking difference of the fund over the last year (as on 31st July 2023) is only -0.44%, and since inception (September 2019) is only -0.6%. You can invest in Motilal Oswal Nifty 500 Index Fund, either lump sum or SIP. The minimum investment amount for both lump sum and SIP is Rs 500.

You May also find it interesting to check all Funds from: Motilal Oswal Funds

Why invest in Motilal Oswal Nifty 500 Index Fund?

- Nifty 500 Index covers 94% of India’s listed universe in terms of total market capitalisation making it an ideal proxy for Indian equities.

- Nifty 500 Index is one of the most benchmarked Index. It offers pure beta exposure to Large, Mid and Small caps and 21 out of 21 sectors defined by NSE.

- Performance of the Nifty 500 Index is a combination of Large, Mid and Small Cap.

- Motilal Oswal Nifty 500 Index Fund is the only index fund tracking the Nifty 500 index

- The TER and tracking errors are both low.

Who should invest in Motilal Oswal Nifty 500 Index Fund?

- Investors looking for capital appreciation over long investment horizons

- Investors looking to invest in a passive fund (no unsystematic risks or human biases)

- You should have a high to very high-risk appetite for this scheme

- You should have a minimum 5-year investment horizon for this scheme

- You can invest in a lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisor or mutual fund distributor if Motilal Oswal Nifty 500 index fund is suitable for their investment needs.

You may also want to see the annual returns of all the index funds: Click here

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

- Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY