LIC MF Manufacturing Fund NFO: Wealth creation from India’s manufacturing evolution

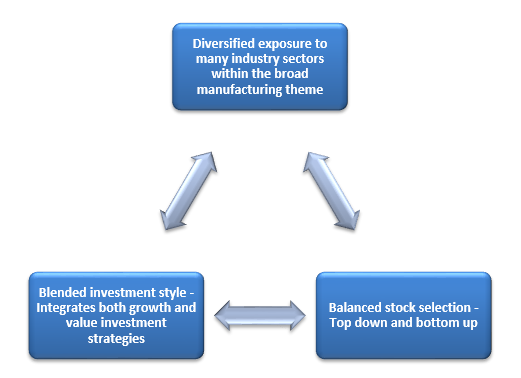

LIC MF has launched a New Fund Offer (NFO), LIC MF Manufacturing Fund. The fund will invest in companies that are engaged in manufacturing and allied activities through top-down and bottom-up approach to stock-picking. Manufacturing is expected to play a major role in the “India Growth Story” and investment in the manufacturing theme has the potential to generate superior returns over long investment horizon. The NFO has opened for subscription on 20th September 2024 and will close on 4th October 2024.

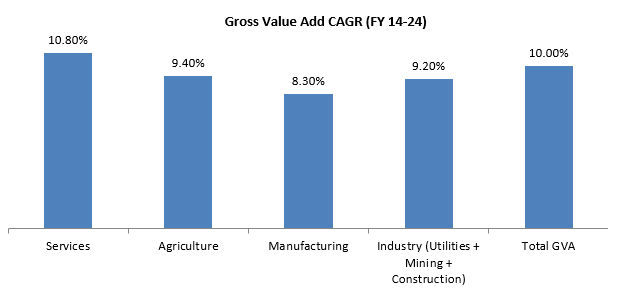

Growth of manufacturing has lagged other economic sectors

Source: LIC MF

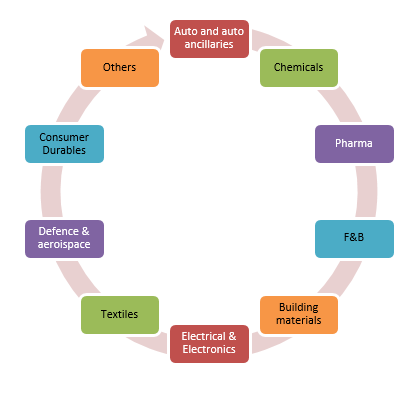

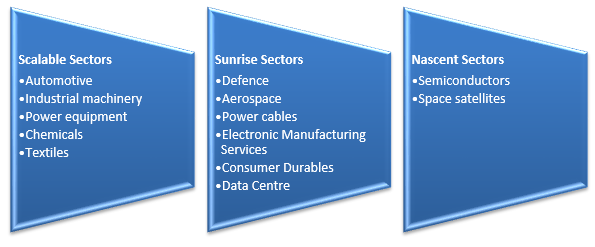

What comes under manufacturing?

Manufacturing is a broad investment theme covering a gamut of sectors like traditional sectors like automotive, consumer durables, pharma, building materials and chemicals. Manufacturing also includes sunrise sectors like defence, aerospace, electronics etc. The benchmark index of the LIC MF Manufacturing Fund, Nifty India Manufacturing index covers 10 industry sectors.

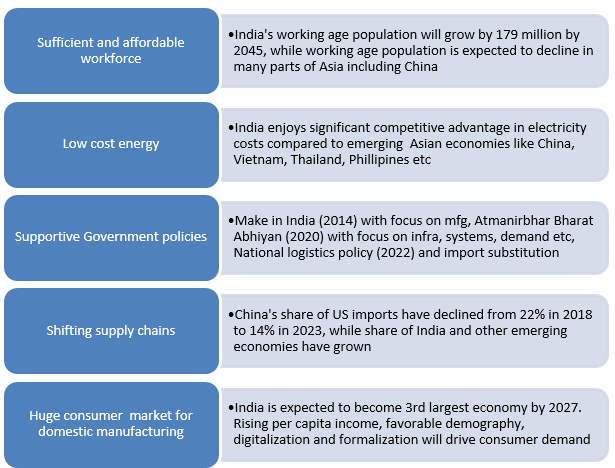

Drivers of India’s manufacturing growth

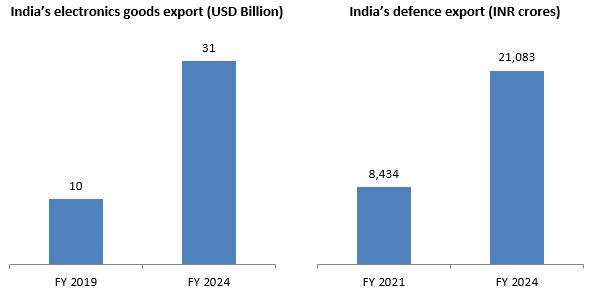

Green shoots of manufacturing growth potential are already visible

Source: LIC MF

Huge growth opportunity in manufacturing for India

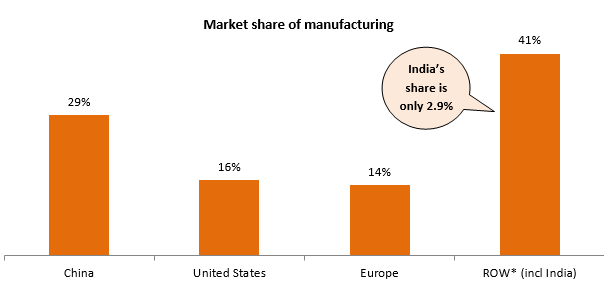

Though India progressed from the 10th largest economy in 2014 to the 5th largest economy in 2019 and expected to become the 3rd largest economy by 2027, its market share in global manufacturing is a paltry 2.9% in CY 2023. The growth potential of India’s manufacturing industries is huge, with potential to grab market share from China and Europe.

Source: LIC MF, CY 2023. *Rest of the world

China exports stood at USD 3.3 Trillion Vs India’s USD 306 Billion in CY23. India can gain market share from China in sectors like Electrical Machinery & Equipment, Nuclear Reactors / Boilers, Vehicles other than Railway, Iron and Steel, Apparel-Knitted Articles, Organic / Speciality Chemicals, Footwear etc, taking advantage of global supply chain realignment (e.g. China + 1). India can also benefit from global supply chain realignment in Europe, where manufacturing is becoming increasingly unviable due to high labour and energy costs. The disruptive impact of the ongoing Russia – Ukraine was on energy costs and logistics in European manufacturing supply chain can accelerate the trend towards alternative manufacturing bases e.g. Europe + 1, with India being an attractive option for European manufacturing companies.

Manufacturing sectors that may grow in India

Where will LIC MF Manufacturing Fund invest?

- Companies that are engaged in manufacturing activities.

- Companies that are well placed to substitute India's imports by manufacturing locally.

- Companies that may benefit from government's “Make in India” initiatives and production linked incentive (PLI) scheme.

- Companies that export goods manufactured in India.

- Companies that enable manufacturing of new age technology solutions in India and abroad.

Why invest in LIC MF Manufacturing Fund?

Who should invest in LIC MF Manufacturing Fund?

- Investors looking for capital appreciation over long investment tenures from India’s manufacturing growth theme

- Investors looking for satellite allocations to their core portfolios

- Investors with high to very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs

Investors should consult their financial advisors or mutual fund distributors if LIC MF Manufacturing Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multi Cap Fund: Good choice for long term investors in current market

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Balanced Advantage Funds: Good risk return trade off with relatively lower volatility

- LIC MF Value Fund: Good fund in volatile market

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY