What are Arbitrage Mutual Funds and its relevance

Arbitrage refers to the opportunity of making risk free profits due to price mismatch between two different markets for the same product. A simple example of arbitrage opportunity is the price difference of the same security in two different stock exchanges e.g. NSE and BSE. The most popular arbitrage strategy is the price difference of a security in cash (or spot) market and F&O (or derivatives) market.

What are arbitrage funds?

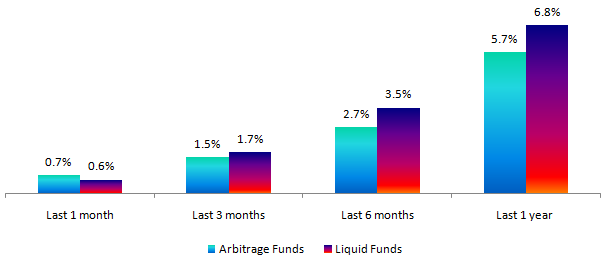

Arbitrage funds are hybrid mutual fund schemes, whose investment objective is to generate income through arbitrage opportunities. These funds have a low risk profile and their returns generally reflect short term money market yields, i.e. return profiles of overnight funds, liquid funds, ultra short term funds etc. The chart below shows the average returns of arbitrage funds category compared to liquid funds over various time-scales (trailing periods ending April 29, 2019).

Source: Advisorkhoj Research

You can see that, arbitrage funds outperformed liquid funds in the last one month, but over longer periods liquid funds have outperformed. Investors should however, take taxation into consideration when making investment decisions.

Taxation Advantage in Arbitrage Funds

A major advantage in arbitrage funds is the taxation. Since these funds are treated as equity funds from a taxation perspective, they enjoy favorable tax treatments compared to fixed income products. Income from debt funds held for less than 3 years are taxed as per the income tax rate of the investor. Profits or capital gains in arbitrage funds held for less than a year are taxed at 15%. If investment holding period is more than a year, then capital gains of up to Rs 1 Lakh is tax exempt. Capital gains in excess of Rs 1 Lakh, if investments are held for more than a year, are taxed at 10%. Arbitrage funds are therefore, much more tax efficient for investors in the higher tax brackets.

How do Arbitrage Funds work?

We will explain with the help of a simple example –

Let us assume that a stock is trading at Rs 100 in the cash market and for Rs 102 in the F&O (derivatives) market. You can lock in risk free profits by simultaneously buying shares of the stock in cash market and selling same number of futures in the F&O market. On expiry of futures, last Thursday of the month(depending on the F&O series), the cash (spot) price and futures price will converge. Therefore, on expiry of the futures your long (buy) and short (sell) position will be equal in value irrespective of which direction (up or down) the price moves.

Let us assume on expiry of your futures, the settlement price is Rs 105. You will make a profit of Rs 5/- share in the cash market and a loss of Rs 3/- share in the F&O market – your profit will be Rs 2/- share. If the settlement price is Rs 98, then you will make a loss of Rs 2/- share in cash market and a profit of Rs 4/- share in F&O market – your profit will again be Rs 2/- share. So on expiry, you will simply square off both the long and short positions and keep the profit. Technically this is risk free profit, but you have to factor in transaction costs like brokerage, Securities Transaction Tax (STT etc.). This will lower your profit. Arbitrage fund managers consider costs and various other factors, to generate the best returns for investors at minimal risk.

Comparing Arbitrage and Liquid Funds

- Futures positions are marked by market on a daily basis. This may cause very near term volatility in arbitrage funds till expiry of futures contract. Liquid fund yields till maturity are generally much more stable because duration risk (interest rate sensitivity) is quite low due to short maturities (usually less than 90 days) for the underlying papers of the fund. You should be prepared to hold arbitrage funds for a longer period compared to liquid funds.

- Historical arbitrage fund returns show that, these funds give higher returns in buoyant market conditions. Usually, arbitrage fund managers use 1 month futures because they are the most liquid derivative contracts. In buoyant markets, fund managers can churn their portfolios more often before F&O expiry generating higher profits for investors. In range-bound markets or corrections, opportunities to churn and generate higher profits are less. You can see in the chart above that arbitrage funds outperformed liquid funds in the last one month, when the stock market saw a pre-election rally. However, in more difficult equity market conditions like corrections or range bound markets, liquid funds tend to outperform.

- SEBI has recently introduced a regulation whereby debt funds will have to mark to market, all underlying papers in their portfolio whose maturities are longer than 30 days. This will impact liquid fund NAVs and returns. This may work to the advantage of arbitrage funds relative to liquid funds.

- Investors should always take taxation into consideration when making investment decisions. From a taxation standpoint, the biggest advantage for arbitrage funds come into effect for holding periods of more than a year because long term capital gains in arbitrage funds of up to Rs 1 Lakh is tax free.

Conclusion

Most house-holds keep their short term savings in their bank accounts. Savings bank accounts pay much lower interest rates (usually 4% p.a.) than liquid fund or arbitrage fund returns. You can see in the returns chart that both liquid funds and arbitrage funds gave much higher returns. Further savings bank interest in excess of Rs 10,000 is fully taxable as per the income tax slab of the investor. Arbitrage funds are much more tax efficient than savings bank. You can put your idle money to much more productive use by investing in Arbitrage funds. You can also invest your idle money in liquid funds. In this blog post, we have discussed how Arbitrage funds work and their pros / cons vis-a-vis liquid funds. You should consult with your financial advisor, if arbitrage funds are suitable for parking your short term funds.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY