Understanding Credit Risk

Over the last 6 to 9 months, several high profile bond and other debt paper defaults and downgrades have wracked fixed income mutual funds. Starting with ILFS default in September 2018 to defaults / downgrades in Dewan Housing, Essel Group, Reliance ADAG companies, Yes Bank etc. the flow of bad news from the debt market seems to be non-stop. This has undoubtedly damaged retail investor sentiments in debt funds. Since SEBI regulations require mutual funds to mark to market, debt securities with maturities of over 30 days, there is an impact on debt fund NAVs and investor returns with every downgrade / default. As per AMFI data in April, two debt mutual fund categories, medium duration funds and credit risk funds, recorded net outflows in the month of April 2019, i.e. redemptions in these two fund categories were more than purchases.

Risk in Debt Funds

Regular Advisorkhoj blog readers know that, there are two main risk factors in debt mutual funds – Interest Rate Risk and Credit Risk. Interest Rate Risk refers to price (NAV) volatility of debt funds – up (if interest rate falls) or down (if interest rate rises) with change in interest rates. Credit Risk refers to price (NAV) downside if the debtor (issuer) fails to meet its debt obligations or if there is a risk (as assessed by the credit rating agencies) in the debtor’s ability to meet its debt obligations. In the past, debt fund investors were mostly worried about interest rate risk because interest rates changed with varying economic conditions and impacted investor’s returns.

Investors did not pay much attention to credit risk because corporate bonds and commercial papers yielded more (higher yield to maturity) than G-Secs and had limited sensitivity to interest rate changes compared to G-Secs. But with the NPA crisis in our banking system over the last few years, as well as the liquidity crunch in NBFCs, credit risk is now an issue which debt fund investors are confronted with. In our view, mutual fund investments are subject to risks, about which investors must be informed, so that they can make the right investment decisions. As far as debt funds are concerned, both interest rate and credit risk are of equal importance. Investors should make informed decisions, according to their risk appetite. Let us deep dive into credit risk.

Credit Risk in Mutual Funds

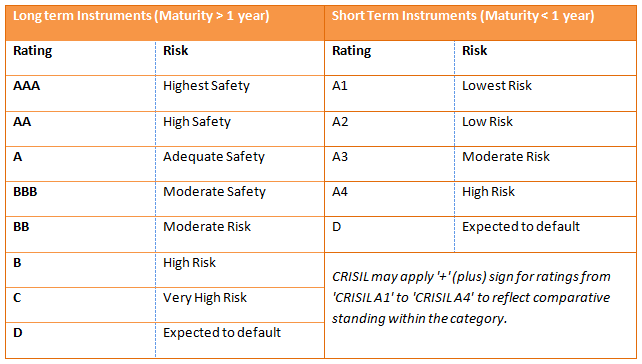

Debt mutual funds invest in a variety of debt and money market securities, like Government Securities (G-Secs), corporate bonds (non convertible debentures), commercial papers (CPs), certificates of deposits etc. G-Secs are backed by sovereign guarantee and therefore, there is no credit risk. Debentures, CPs and CDs are subject to credit risk. Credit risk of these papers is assessed by credit rating agencies, which assign credit ratings to non Government debt instruments. The table below describes the credit rating scale used by CRISIL to rate debt securities.

AMCs disclose the credit ratings of the debt instruments in debt fund portfolios in their monthly factsheets. If you want to reduce your credit risk, invest in debt funds which have large proportion of their assets in G-Secs, AAA, AA and A1 rated securities. While G-Secs have no credit risk, highly rated debentures and CPs have lower chances of getting downgraded compared to lower rated papers.

Yield versus Risk

Interest rate remaining the same, you should know that debentures and CPs give higher yields (returns) compared to G-Secs of similar maturities. Yield spread between AAA and AA rated debentures and G-Secs of similar residual maturities in the yield curve is usually around 100 basis points. Lower rated papers give higher yields (YTM) compared to higher rated papers. The flip side is that, higher yields come with higher credit risk. Investors should make informed decisions based on their risk appetites.

Impact on credit risk on investor returns

If you take credit risk, you will potentially get higher returns, but if there are rating downgrades or defaults in the fund portfolio then fund NAV will get impacted. As discussed earlier, SEBI regulations require mutual funds to mark to market debt instruments with maturities of 30 days or more, irrespective of whether they are making interest payments or not. The extent to which NAVs get impacted in the event of a downgrade or default will depend on the fund’s exposure to affected security. Investors should understand that a debt fund’s portfolio is diversified across many securities, of which one or two can be affected by downgrades or defaults.

Higher the concentration of these securities in the fund portfolio more is the impact on NAV and investor returns. One of diversification thumb rules is that exposure to a single security should not exceed 5%, but this is not a hard and fast rule. As informed investors you should look at exposure to single securities and if it is too high, 10% or higher, then you should be concerned about credit risk. This applies also to highly rated (non G-Sec) papers; there have been multiple instances of AAA / AA securities getting downgraded even to default in the past. When investing in debt funds, in addition to looking at the overall credit quality (percentage allocation to G-Secs, AAA, AA, and A1 etc rated papers) of the fund portfolio, also look at concentration of individual securities in the bond portfolio.

Duration profile and credit risk

Some financial advisors and investment bloggers think that lower duration funds like liquid funds, ultra-short duration funds, money market funds, low duration funds, short duration funds etc. are less impacted by credit risk than longer duration funds. They present some anecdotal evidence to back their claim, but if we go by credit spreads along the yield curve, we do not find any robust evidence that impact of credit risk reduces with lower durations. Except for Gilt funds and Overnight Funds, all other debt funds can have credit risks.

What to do if your debt fund is impacted by adverse credit risk?

If your fund is impacted by an adverse credit risk event, you will come to know of it only after the fact. Since mutual funds will mark to market all securities with maturities of over 30 days, the price damage to NAV would have already happened by the time you come to know about the credit risk event. In such an event, unless you have invested in a liquid fund, where your investment tenor is very short, you should not act in haste.Just because a paper has been downgraded to default, it does not necessarily mean that the investor will not be able to recover the money from the issuer. There are several avenues for AMCs to recover your money (principal or principal and interest) from the issuer.

In the situation of a default,AMCs usually meet with the management in order to get a sense whether the management will be able to meet the debt obligations in the near term, if given some time. AMCs will seek assurance from management on debt repayment, including concrete action steps for meeting the debt obligation like asset sales, asset securitization capital restructuring (promoter’s stake sale, rights issue etc). If the securities are backed by shares pledged by the promoters, then the lender has the right to sell the shares. Finally, there is always the legal recourse through the Insolvency and Bankruptcy Code, but it may never reach that point if all parties involved act sincerely in the best interest of the investors.

Conclusion

In this blog post, we discussed an important risk factor in debt funds, credit risk. Apart from credit quality of your debt mutual fund portfolio, you should also look at concentration risks in order to reduce the credit risk in your investment. In its mutual fund re-classification circular, SEBI has defined debt fund categories, including one for credit risk funds. However, other debt funds may also be subject to credit risk – you should go through the fund factsheet or discuss with your financial advisor. Finally, if you are confronted with a credit risk event in your mutual fund portfolio, you should not act in haste and wait to get more clarity from the concerned fund house or your financial advisor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY