Is it better to invest in tax saving mutual funds through lump sum or SIP

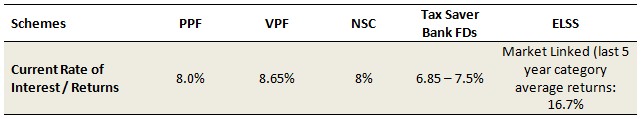

Section 80C of the Income Tax Act 1961 allows tax payers to claim deductions of up to Rs 1.5 Lakhs in a financial year from their taxable income by investing in certain eligible schemes specified under the Section. Eligible schemes under Section 80C include Employee Provident Fund (EPF), Public Provident Fund (PPF), National Savings Certificates (NSC), Tax Saver Bank Fixed Deposits, Life Insurance Policies and Mutual Fund Equity Linked Savings Schemes (ELSS). Of the various 80C schemes, Mutual Fund ELSS schemes and Unit Linked Insurance Plans (ULIPs) are market linked, while others specify a rate of interest. Historical data shows that, ELSS or tax saving mutual funds gives the highest returns over a sufficiently long investment tenor compared to other 80C investment options.

ELSS or tax saving mutual fund is also one of the most tax friendly investment options. Capital gains of up to Rs 1 Lakhs in ELSS are tax exempt. Capital gains in excess of Rs 1 Lakh are taxed at 10%. ELSS has been gaining a lot of interest among investors based on the traffic statistics and queries in Advisorkhoj.com. One of the questions, which investors have with regards to ELSS is, whether they should invest in ELSS in lump sum (up to Rs 1.5 Lakhs per annum) or through monthly Systematic Investment Plan (SIP). We will discuss this topic in this blog post.

Lump Sum versus SIP

There is a lot of online content on Lump Sum versus SIP debate. We also have a number of articles in our blog discussing this topic. Our take on this topic in general for mutual funds is that, the lump sum versus SIP debate is irrelevant because comparing lump sum and SIP is like comparing apples and oranges. You will invest in when you have lump sum funds available with you; on the other hand, you want to invest from your regular monthly savings, then you should invest through SIP. If you have lump sum funds available but you keep them lying in your bank account and invest through SIP for a long period of time, then in a rising market you will get lower returns because you will generally be purchasing units at higher and higher NAVs. The decision to invest in lump sum versus SIP therefore should be driven by your financial situation. Does this lump sum versus SIP decision logic extent to ELSS also? We will discuss this in the next section.

Lump Sum versus SIP investing in ELSS mutual funds

To certain extent, the argument made in the previous paragraph extends to ELSS mutual funds also; you can invest in lump sum only if you have funds available, otherwise SIP is the route for you. However, there is a nuance in the case of tax saving investments. ELSS investment in the strictest sense is not one-time because you need to invest every year to claim deductions from your taxable income and save taxes. Your tax saving in that sense is not strictly one time, but more in the nature of regular investments. Therefore, even you are investing in ELSS in lump sum, when if we look over period of time then your investment pattern is in the nature of an annual SIP. In this context, lump sum investment and monthly SIP in ELSS mutual funds can be compared.

As mentioned earlier, you can invest in lump sum only when you have sufficient funds available with you. For example, if you want to invest Rs 1 Lakh in ELSS, assuming you can claim Rs 50,000 deductions from other 80C sources like EPF, life insurance premiums etc, you need to have Rs 1 Lakh in your bank account.

Through SIP on the other hand, you can spread your Rs 1 Lakh annual investment over 12 monthly installments (approximately Rs 8,300 per month) and invest from your regular monthly savings. Is it better to wait till you have accumulated Rs 1 Lakh in your bank account to invest in ELSS mutual funds or invest through SIPs? We will do some scenario analysis to examine this.

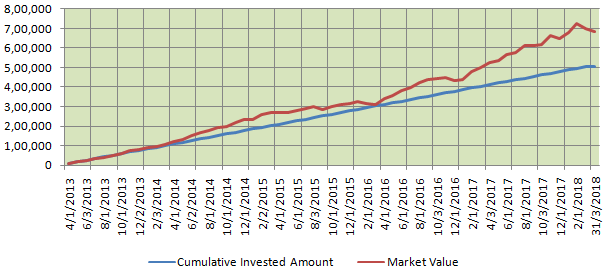

Different investors have different savings and expense patterns. Therefore, we will examine three scenarios of lump sum investments made every year, over a period of 5 years. The period of this analysis will be April 1, 2013 to March 31, 2018.

- Rs 1 Lakh invested in lump sum in ELSS on April 1 of every financial year (April 1 – March 31)

- Rs 1 Lakh invested in lump sum in ELSS on March 1 of every financial year

- The above two scenarios are two extremes, one where you are investing at the beginning of the financial year and the other, where you are investment almost towards the fag end of the financial year. So we will also analyze a third scenario, where you invest Rs 1 Lakh in the lump sum somewhere in the middle of the financial, on October 1. This is also the time, when many Indian companies pay Diwali Bonus to their employees.

In all the above 3 scenarios, you will be saving the same amount of tax. We will compare all the three scenarios with a fourth scenario, which is investing Rs 8,300 per month through SIP. Equity Linked Savings Schemes are essentially diversified equity mutual fund schemes, which invest in equity and equity related securities, across different sectors and market cap segments. Different ELSS funds may have different market cap biases; for purposes of this analysis, we will take the market benchmark Nifty 50 as the proxy for ELSS. Let us examine the different scenarios.

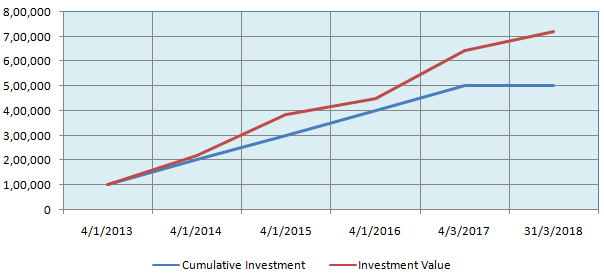

Investing in lump sum in ELSS Mutual Funds on April 1, every financial year

In this scenario we are assuming that you have sufficient funds available in your bank account to invest in ELSS tax savings funds at the beginning of the financial year. This scenario may or may not be applicable to you, depending on your financial situation, but let us see the results.

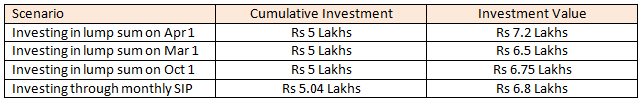

By March 31, 2018 you would have made cumulative tax savings investments of Rs 5 Lakhs, saving around Rs 1.5 Lakhs in taxes over the last 5 years (if you are in the highest tax bracket). The total value of your ELSS investment will be Rs 7.2 Lakhs.

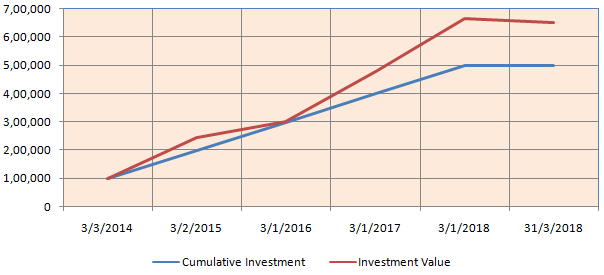

Investing in lump sum in ELSS mutual funds on March 1, every financial year

This is the other extreme scenario but not a very uncommon one. Many tax payers, even if they have investible funds available delay their tax savings to the last 1 or 2 months of the financial year, and scramble to make their tax savings investments towards the end of the financial year. Let us see the results.

By March 31, 2018 you would have made cumulative tax savings investments of Rs 5 Lakhs, The total value of your ELSS investment will be Rs 6.5 Lakhs.

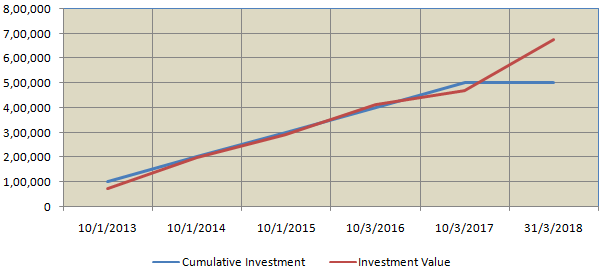

Investing in lump sum in ELSS mutual funds on October 1, every financial year

Let us examine in the intermediate scenario, where you make your tax savings investments on October 1 of every year.

By March 31, 2018 you would have made cumulative tax savings investments of Rs 5 Lakhs, The total value of your ELSS investment will be Rs 6.75 Lakhs. You can see that, in this scenario your returns are higher than in the second scenario, but lower than first scenario.

Investing through monthly SIP in ELSS mutual funds

Let us now see, how much you would have accumulated if you invested through SIP (Rs 8,400 every month)

By March 31, 2018 you would have made cumulative tax savings investments of Rs 5.04 Lakhs, The total value of your ELSS investment will be Rs 6.8 Lakhs.

Summary and our take

Let us present the summary results of the four scenarios.

Our take on this is that, if you expect to have sufficient funds available early in the financial year, it is best to make your tax saving investments early in the year. Your money will remain invested for a longer period of time and therefore, you will get higher returns. You should avoid delay your tax planning till the end of the year because this not only causes last minute hassles but also results in lower returns. We have seen many tax payers missing out on tax savings because they do not have sufficient tax savings funds at the end of the year.

In general, given that different investors have different financial situations, in our view monthly SIP is best method of making tax savings investments through ELSS. SIP not only keeps you disciplined in tax savings but saves you a lot of work. Once you initiate SIP in ELSS through one time ECS mandate, you can keep your tax planning on track for many years, without going through the hassle of making fresh investments every year. As seen in this blog post, you also get superior returns through SIP.

Disclaimer: The views expressed herein are based on internal data, publicly available information and other sources believed to be reliable. Any calculations made are approximations, meant as guidelines only, which you must confirm before relying on them. The information contained in this document is for general purposes only. The document is given in summary form and does not purport to be complete. The document does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information / data herein alone are not sufficient and should not be used for the development or implementation of an investment strategy. The statements contained herein are based on our current views and involve known and unknown risk and uncertainties that could cause actual results, performance or event to differ materially from those expressed or implied in such statements. Past performance may or may not be sustained in the future. LIC Mutual Fund Asset Management Ltd. / LIC Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investment made in the scheme(s). Neither LIC Mutual Fund Asset Management Ltd. and LIC Mutual Fund (the Fund) nor any person connected with them, accepts any liability arising from the use of this document. The recipients(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY