LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

LIC Mutual Fund has introduced a promising investment opportunity, the LIC MF Multi Asset Allocation Fund. This new fund offer (NFO) opens from 24th January 2025 & closes on 7th February 2025. This investment opportunity aims to address the evolving needs of Indian investors seeking balanced growth, reduced volatility and diversification. In this article we will cover the LIC MF Multi Asset Allocation Fund.

Market Context

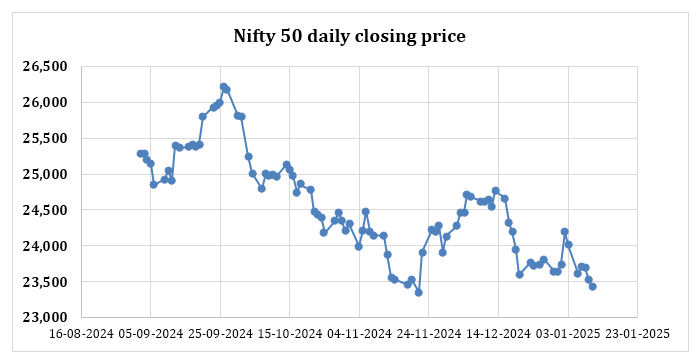

The market has been very volatile for the past few months (see chart below). The Nifty crossed 26,000 levels, hitting its record high in September 2024. Volatility gripped the market in the last 3 months and Nifty closed the year below the 24,000 level, down nearly 2,500 points from its record high. There are several headwinds for the Indian equities, namely cut in FY 2025 GDP growth forecast by the RBI, concerns about corporate earnings outlook, uncertainty about rate cuts, strong US Dollar and FII selling. In this situation, a multi asset allocation strategy can provide stability for your portfolio. From a long-term perspective, a multi asset allocation strategy can provide richer asset class diversification to your portfolio and balance risk / returns across investment cycles.

Source: NSE. Period: 1st Sept 2024 to 10th Jan 2025

What is a Multi Asset Allocation Fund?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations, multi-asset allocation funds must invest a minimum of 10% each in at least 3 asset classes. Apart from the two most popular asset classes, debt and equity, these schemes invest in asset classes like commodities (e.g. gold, silver), international equities, real estate investment trusts (REIT), infrastructure investment trusts (InvITs) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

Why is Multi Asset Allocation important?

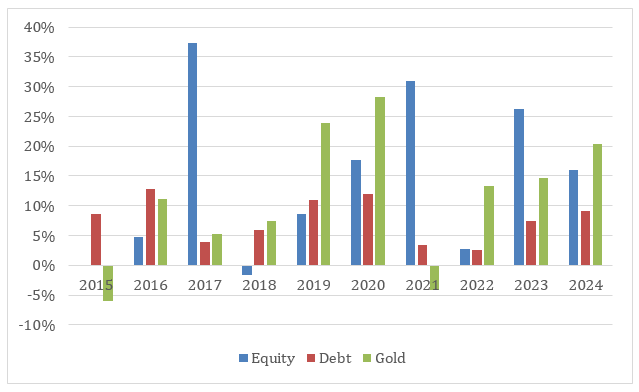

- Winners keep changing among asset classes depending on investment cycles (see the chart below). In the last 10 years, equity was the top performer in 3 years, debt in 2 years, and gold in 5 years. A mix of asset classes will provide stability in different market conditions.

Source: LIC MF, NSE, Crisil, MCX. The above data has been taken from the following indices: Equity: Nifty 500 TRI, Debt: Crisil Composite Bond Index, Gold: MCX Spot Price (data as on 31st December 2024)

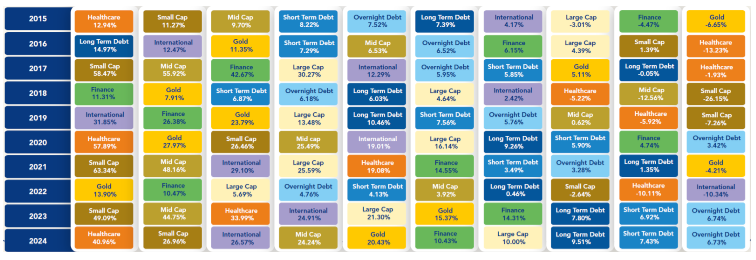

- Winners keep rotating even within asset classes. In equity winners kept rotating among market capitalization and industry sectors (see the chart below which ranks 10 asset sub-categories in order of their return performance- from highest to lowest- for each calendar year from 2015-2024). Diversifying across market cap segments and industry sectors can reduce unsystematic risks and improve portfolio performance across different market cycles.

(Source: LIC MF. The above data has been taken from the following indices: For Overnight Debt: Nifty 1D Rate Index. For Short Term Debt: Crisil 1 Year T Bill Index, For Long Term Debt: Crisil 10 Year Gilt Index, For Large Cap: Nifty 50 TRI, For Mid cap: Nifty Midcap 100 TRI, For Small-cap: Nifty Small cap 250 TRI, For International: S&P 500 PRI (Converted to Rupee Returns), For Finance: Nifty Financial Services TRI, For Gold: MCX Spot Price of Gold, For Healthcare: Nifty Healthcare TRI. NSE, Crisil, MCX; as on 31st December 2024)

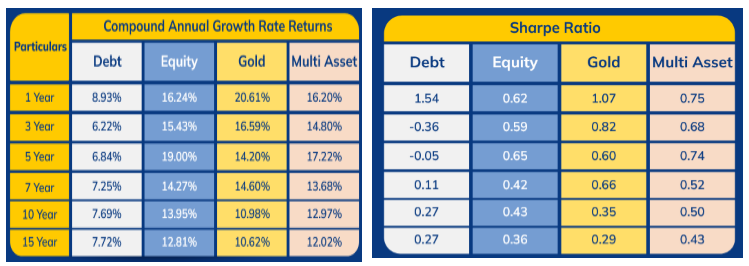

- Combining asset classes with weak or negative correlation helps to build a resilient portfolio. The Multi Asset Strategy delivers better risk adjusted returns (lower volatility) across time periods. You can see that Multi Asset strategy produced higher Sharpe ratios compared to other asset classes over long investment tenures.

Source: LIC MF, NSE, Crisil, MCX; Data from 1st July 2009 till 31st December 2024

Note: Intended Multi Asset Composition - Nifty 500 TRI: 70%, Crisil Composite Bond Index: 15%, Gold: 15% and rebalanced on a daily basis. - Smaller drawdowns

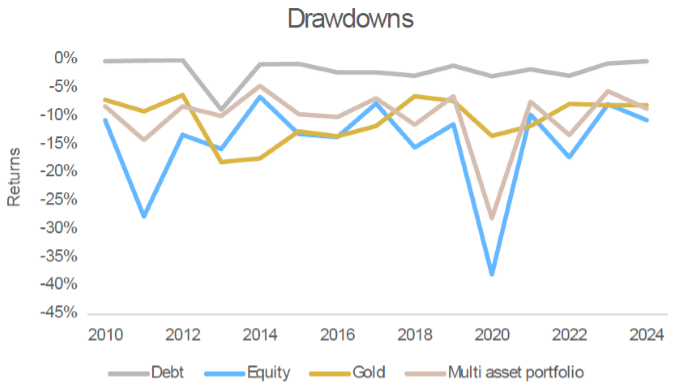

Historical trends emphasize the power of diversification in reducing risk and improving returns. Multi-asset portfolios, through diversification, provide a more stable investment experience with better drawdown protection, making them a preferred choice for investors seeking balanced growth and resilience in their portfolios in volatile markets. The chart below represents the drawdowns in various asset classes during major economic events from CY 2010 to 2024.

Source: LIC MF, NSE, Crisil, MCX (data as on 31st December 2024)

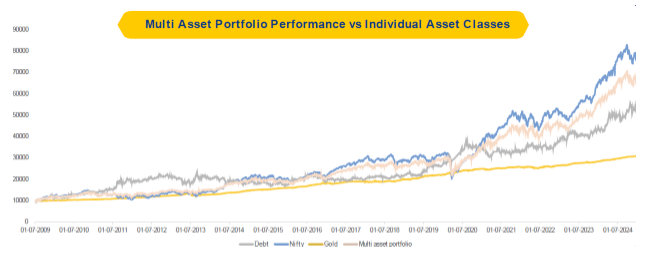

Wealth Creation with Multi Asset Allocation Fund

Historically, Multi Asset Allocation has helped to generate risk adjusted returns over the long term. The chart below shows the performance of a Multi Asset Portfolio when compared to other individual asset classes.

Source: LIC MF, NSE, CRISIL, MCX (data as of 31st December 2024)

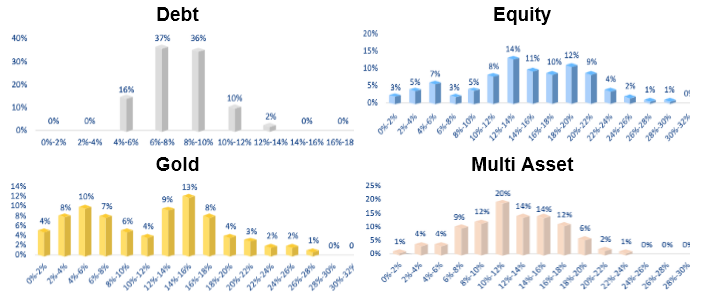

Stable Returns

The comparative returns of different Asset classes from 1st July 2009 till 31st December 2024, rolled on a 3-year basis, are illustrated in the graphic below. The Multi Asset Allocation returns were more than 10% in 70% of the instances (observations).

Source: LIC MF, NSE, CRISIL, MCX (data as of 31st December 2024)

LIC MF Multi Asset Allocation Fund - Fund Overview

The LIC MF Multi Asset Allocation Fund is an open-ended scheme that strategically invests across three core asset classes: Equity, Debt, and Gold. By combining these components, the fund endeavors to deliver long-term capital appreciation while mitigating risks. The fund managers for the LIC Multi Asset Allocation Fund are Mr. Nikhil Rungta for the Equity component, Mr. Sumit Bhatnagar for Equity and Commodity component and Mr. Pratik Harish Shroff for the Debt Component.

Investment Strategy

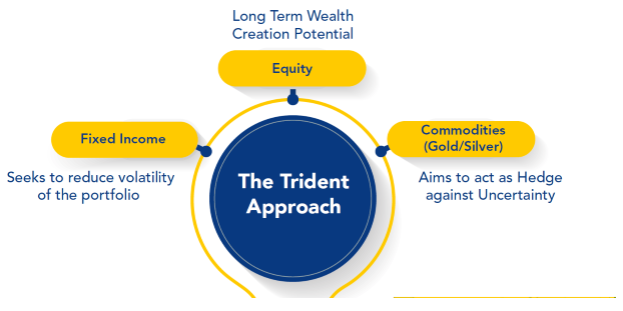

The fund follows a Trident Approach while allocating funds between various asset classes. (See illustration)

Source: LIC MF

The allocation across asset classes is as follows:

- Equity Allocation (65–80%): Targets growth through investments across market caps using both top-down and bottom-up strategies.

- Debt Allocation (10–25%): Focuses on high-quality instruments to optimize returns under varying interest rate conditions.

- Gold Allocation (10–15%): Adds stability and acts as a hedge during uncertain market conditions.

- Silver ETFs and REITs/InvITs: The fund may also invest in Silver ETFs, REITs/InvITs which enhance diversification, following SEBI guidelines.

Why Choose LIC MF Multi Asset Allocation Fund?

- Risk-Adjusted Returns: The multi-asset approach balances the performance of asset classes with weak or negative correlations, providing a smoother investment journey.

- Dynamic Asset Allocation: The fund’s tactical adjustments across asset classes aim to optimize returns in different market environments.

- Convenience: A single scheme offering exposure to multiple asset classes simplifies the investment process.

- Equity Taxation: Offers equity taxation benefits.

Who Should Invest?

This fund is ideal for:

- Investors seeking long-term wealth creation with an investment horizon of more than 3 years.

- Those seeking diversification across equity, debt, and commodities.

- Individuals looking to achieve risk-adjusted returns with reduced portfolio volatility.

- Investors who have a high-risk appetite.

The LIC MF Multi Asset Allocation Fund offers a unique combination of growth, stability, and resilience. Whether you’re a seasoned investor or just starting on your investment journey, this fund provides a diversified approach tailored for long-term wealth creation in the current Indian dynamic market. Speak to your financial advisor or an AMFI registered mutual fund distributor to find out if the fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY