LIC MF Balanced Advantage Funds: Good risk return trade-off with relatively lower volatility

Current market situation

The market is now in a consolidation phase after going through a period of high volatility. The market is currently trading in a relatively narrow range. Though the correction has brought down valuations but there are concerns about corporate earnings outlook. The Reserve Bank of India has revised India’s GDP growth outlook for fiscal year 2025 down to 6.6% (source: RBI MPC 6th December 2024). From the long term perspective, India is in a macro sweet spot due to moderating inflation, narrowing fiscal deficit, strong forex reserves, improving asset quality of banks and healthy corporate balance sheets (improving debt equity ratios). However, headwinds from strong dollar and short term growth outlook concerns may cap the gains. In these conditions asset allocation will play an important role in providing stability to your portfolio. From a long term perspective as well, asset allocation can balance risk / returns in achieving your financial goals.

What are Balanced Advantage Funds?

Balanced Advantage Funds are a type of hybrid mutual funds which follow dynamic asset allocation strategy. The equity and fixed income allocations of the fund change dynamically based on the asset allocation model of the fund. The dynamic asset allocation models are usually back-tested to see how the model performed in different market conditions and across investment cycles. As per SEBI’s mandate Balanced Advantage Funds can invest from 0 to 100% in equity and from 0 to 100% in debt as per their asset allocation model. Balanced Advantage Funds usually use derivatives to hedge equity exposure (i.e. reduce net equity exposure), while maintaining gross equity exposure about 65% to enjoy equity taxation benefits.

LIC MF BAF Dynamic Asset Allocation Model

LIC MF Balanced Advantage Fund uses a two factor dynamic asset allocation model:-

- Forward P/E (80% weightage in the model): Forward P/E ratio is the current share price divided by the forecasted / estimated earnings per share (EPS) over next 12 months. To determine forward P/E, LIC MF focuses on the actual earnings of the companies and not the reported earnings. Nifty 100 P/E is also taken into account.

- Earnings Yield Spread (20% weightage in the model): Earnings yield is the reciprocal of P/E ratio i.e. E/P. Earnings yield spread refers to difference between earnings yield and yield of 10 year G-Sec. If yield spread is high, it means valuation is attractive and if yield spread low, then it means that valuation is expensive.

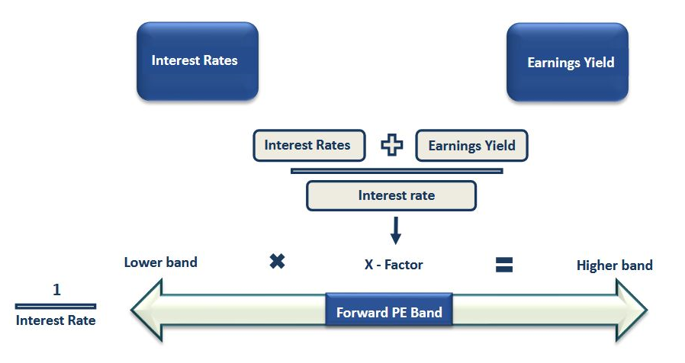

How are PE bands determined?

How is earning spread determined?

LIC MF Balanced Advantage Fund – Lower downside risk and smaller drawdowns

The chart below shows the drawdowns of LIC MF Balanced Advantage Fund versus Nifty 50 TRI since the inception of the scheme. You can see that the fund experienced considerably smaller drawdowns relative to the market. For example, examine the recent drawdown in October – November (circled) in dark blue. While Nifty fell more than 10% from its peak, the drawdown of the fund was less than 5%.

Source: Advisorkhoj Research, as on 30th November 2024

LIC MF Balanced Advantage Fund – Lower volatility compared to peers

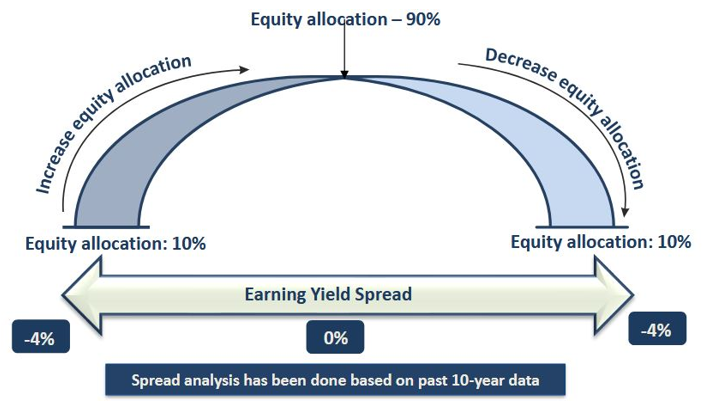

We looked at the standard deviation (a measure of volatility) of all the balanced advantage funds which have completed 3 years (see the chart below). You can see that LIC MF Balanced Equity Fund (marked in blue) had lower volatility compared to most of its peers.

Source: Advisorkhoj Research, as on 30th November 2024

LIC MF Balanced Advantage Fund versus fixed income

The chart below shows the growth of Rs 10,000 investment in LIC MF Balanced Advantage Fund versus PPF (we have used PPF as a proxy for traditional fixed income) since the inception of the scheme. You can see that the LIC MF Balanced Advantage gave significantly higher returns than PPF over 3 years plus investment horizons. With interest rates on a long term secular decline, investors who can take moderate level of risks can consider LIC MF Balanced Advantage Fund to get significantly higher returns than traditional fixed income over long investment horizons.

Source: Advisorkhoj Research, as on 16th December 2024

LIC MF Balanced Advantage Fund – Good risk return trade-off

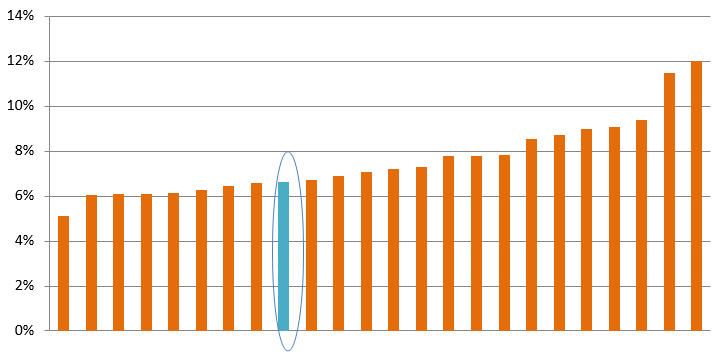

The chart below shows the 1 year rolling returns distribution of LIC MF Balanced Advantage Fund, since inception of the scheme. The fund never gave negative returns over 1 year investment horizon. You can also see that the fund gave 12%+ returns in 55% of the instances. This shows attractive risk return trade off for the fund. The fund can be suitable for new investors or investors who do not have high risk appetites.

Source: Advisorkhoj Research, as on 16th December 2024

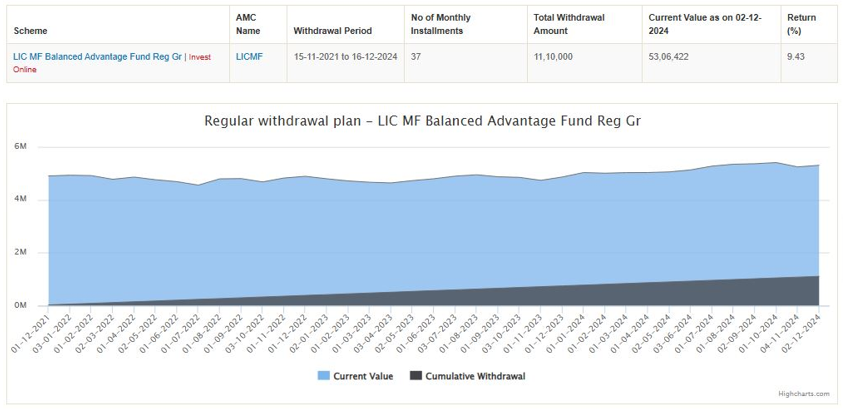

LIC MF Balanced Advantage Fund - Suitable for SWP

A fund which gives relatively stable returns can be suitable for Systematic Withdrawal Plan. The chart below shows the results of Rs 30,000 monthly SWP from Rs 50 lakhs lump sum investment in LIC MF Balanced Advantage Fund since the inception of the scheme. For the sake of simplicity, we have ignored exit loads. You can see that despite withdrawing more than Rs 11 lakhs from the fund through the SWP, the value of the balance units has grown to Rs 53 lakhs.

Source: Advisorkhoj Research, as on 16th December 2024

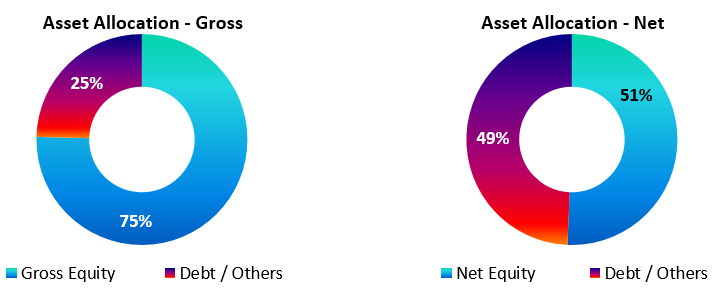

Current asset allocation (gross and net equity)

Source: LIC MF, as on 30th November 2024

Why invest in LIC MF Balanced Advantage Fund?

- Diversification of portfolio

- Dynamic asset allocation

- Margin of Safety

- Protect downside by reducing the drawdown and participate in the upside by asset allocation

- Aims to generate near equity return with relatively lower volatility

- Equity tax benefit

Who should invest in LIC MF Balanced Advantage Fund?

- Investors looking for capital appreciation and income over long investment tenures

- Investors with moderately high risk appetites

- Investors with minimum 3 year investment tenures

- You can invest either in lump sum or SIP

- Suitable investment option for first time investors

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Balanced Advantage Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multi Cap Fund: Good choice for long term investors in current market

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Value Fund: Good fund in volatile market

- LIC MF Flexicap Fund: A suitable long term investment in current market scenario

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY