LIC MF Multi Cap Fund: Good choice for long term investors in current market

Current market context

The equity market has been roiled by volatility over the past few months. The Nifty 50 has plunged more than 15% (as on 28th February 2025) from its all-time high on heavy FII selling caused by INR Depreciation versus the USD and concerns about corporate earnings growth outlook. Selling has intensified in recent weeks due to the concerns about the impact of trade policies of the Trump Administration on India’s economy. February will mark the 5th consecutive monthly loss for the Nifty. Due to the selling pressure from FIIs, large caps saw sharper declines compared to mid and small caps in the initial stages of the correction. However, in the last 2 months, the midcaps (14.4% correction) and small caps (20.7% correction) experienced deeper cuts than large caps (6.5% correction).

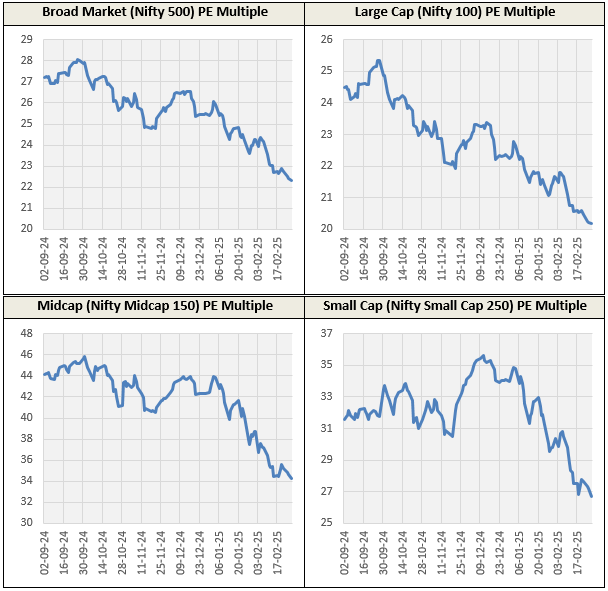

Valuations have moderated

The sharp correction has brough down valuations across all market cap segments (especially large caps), though there are certain pockets of valuation concerns in face of earnings growth outlook.

Source: National Stock Exchange as on 28th February 2025

In current market conditions and valuation scenario Multicap funds may provide attractive investment opportunities for long term investors across the broad market segments. Though there are near term concerns about the fallout of Trump Administration’s trade policies on the global economy, India will continue to be one of the biggest growth markets in the long term. The long-term structural India Growth Story is not about any one market cap segment. It spans across all three market cap segments and several industry sectors. Multicap funds are well positioned to capture the long-term growth opportunities in India’s journey to Viksit Bharat. In this article, we will review LIC MF Multi Cap Fund, which is among the Top 3 multicap funds in the last one year.

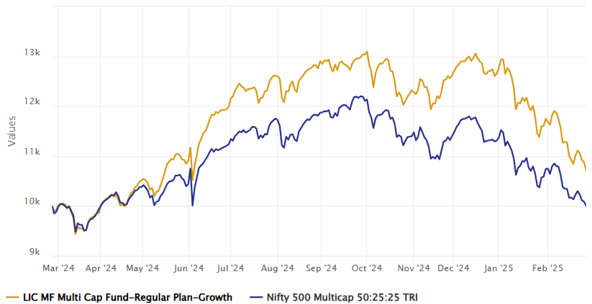

LIC MF Multi Cap Fund outperformed its benchmark

The chart below shows the growth of Rs 10,000 investment in LIC MF Multi Cap Fund versus it’s benchmark index Nifty 500 Multicap 50:25:25 TRI. You can see that the fund outperformed it’s benchmark by a big margin.

Source: Advisorkhoj Research, as on 28th February 2025

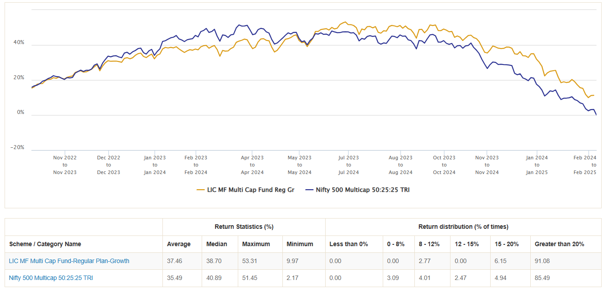

Rolling returns of LIC MF Multi Cap Fund versus benchmark

The chart below shows the 1 year rolling returns of LIC MF Multicap Funds versus its benchmark index Nifty 500 Multicap 50:25:25 TRI since the inception of the fund. You can see that, even though the fund was underperforming in the initial months after launch, it is now outperforming the benchmark index consistently. The average 1 year rolling return of LIC MF Multi Cap Fund is higher than the benchmark index. You can also see the percentage instances of 15%+ CAGR given by LIC MF Multi Cap Fund was significantly higher compared to the benchmark index.

Source: Advisorkhoj Rolling Returns Calculator, as on 28th February 2025

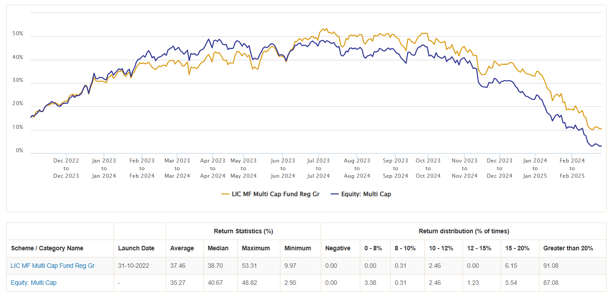

Rolling returns of LIC MF Multi Cap Fund versus peers

The comparison 1 year rolling returns of LIC MF Multi Cap Funds versus the Multicap Funds category average since the inception of the fund tells a similar story. After an initial period of few months, the fund has consistently outperformed the category average. The average 1 year rolling return of LIC MF Multi Cap Fund is higher than the benchmark index. You can also see the percentage instances of 15%+ CAGR given by LIC MF Multi Cap Fund was significantly higher compared to the category average.

Source: Advisorkhoj Rolling Returns Calculator,as on 28th February 2025

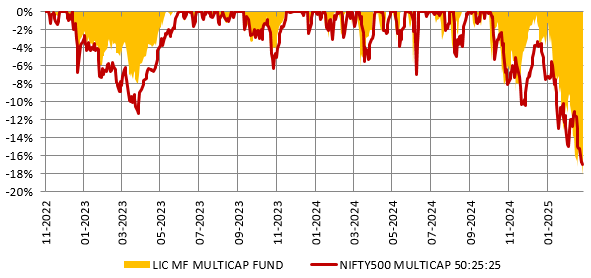

Performance of LIC MF Multi Cap Fund in down markets

The chart below shows the drawdowns of LIC MF Multi Cap Fund versus its benchmark index, Nifty 500 Multicap 50:25:25 TRI since the inception of the fund. You can see that the fund was able to limit downside risks for investors in most market corrections. Historical performance data suggests that funds which can limit downside risks for investors have the potential of giving superior risk adjusted returns over long investment horizons covering multiple market cycles.

Source: Advisorkhoj Research, as on 28th February 2025

Market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of LIC MF Multi Cap Fund over the last 1 year.

The Up Market Capture Ratio of LIC MF Multi Cap Fund over last 1 year was 149% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 1.49%. The Down Market Capture Ratio of the fund was 109% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 1.09%. The market capture ratios of LIC MF Multi Cap Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

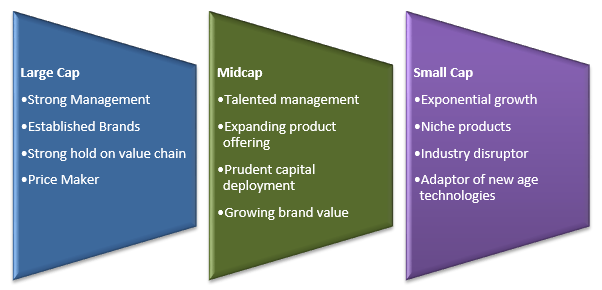

Multicap Strategy of LIC MF Multi Cap Fund

Stock selection

The fund manager follows a blended approach using qualitative and quantitative analysis :-

- Qualitative: Emphasis is put on the company’s products, services, management, competitors, etc. The fund manager evaluates impact of prevailing and evolving macro on above factors on the sector and company

- Quantitative: The fund manager concentrates on the income statements, balance sheets, and cash flows, and analyzes the relationship between price and intrinsic value

The qualitative approach helps in understanding the business dynamics and assigning the better multiple and quantitative approach helps in forecasting financials. Combination of these two approaches helps in determining optimal valuations.

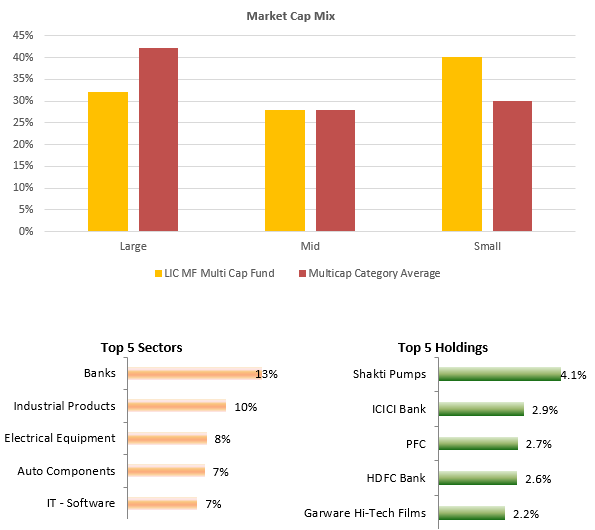

Current portfolio positioning

LIC MF Multi Cap Fund has higher allocations to small cap compared to multicap category average. The higher small cap allocations of the fund create the potential of higher capital appreciation or alpha creation.

Source: LIC MF Factsheet, Advisorkhoj Research as on 31st January 2025

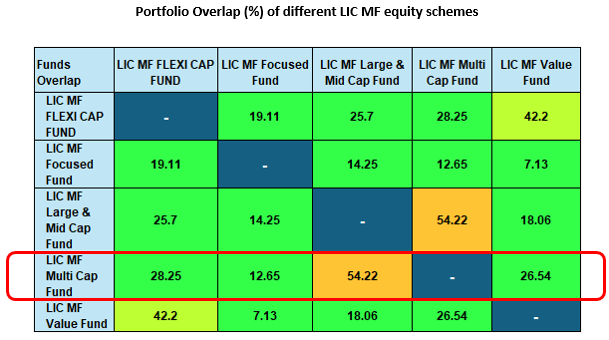

Low overlap with other LIC MF diversified equity funds

LIC MF Multi Cap Fund (marked in red) has relatively low overlap with other diversified equity funds from LIC MF stable (see the table below). You can also see that other diversified equity schemes also have relatively low overlap with each other. You can build your core equity portfolio with LIC MF Multi Cap Fund and other diversified funds from LIC MF as per your risk appetite.

Source: Advisorkhoj Research, as on 31st January 2025

Who should invest LIC MF Multi Cap Fund?

- Investors with long term investment horizon i.e. 5 years or more

- Investors with a high-risk appetite who can tolerate the short-term volatility associated with equity investments

- They are suitable for investors who want to invest from their monthly savings through SIP for their long-term financial goals

- You can invest either in lump sum or SIP depending on your financial situation and investment needs

- If you have lump sum funds but are worried about volatility, then you can invest your lump sum funds in LIC MF Liquid Fund and transfer systematically to LIC MF Multicap Fund through 3 – 6 month STP

You should consult with your financial advisor or mutual fund distributor, if LIC MF Multi Cap Fund is suitable for your investment needs.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Balanced Advantage Funds: Good risk return trade off with relatively lower volatility

- LIC MF Value Fund: Good fund in volatile market

- LIC MF Flexicap Fund: A suitable long term investment in current market scenario

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY