LIC MF Flexicap Fund: A suitable long term investment in current market scenario

About Flexicap Funds

Flexicap funds are diversified equity mutual fund schemes which can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment viz. large cap, midcap and small cap. As per SEBI, large cap stocksare the top 100 stocks by market capitalization, midcap stocks are the 101st to 250th stocks by market cap and small cap stocks are 251st and smaller stocks by market cap.

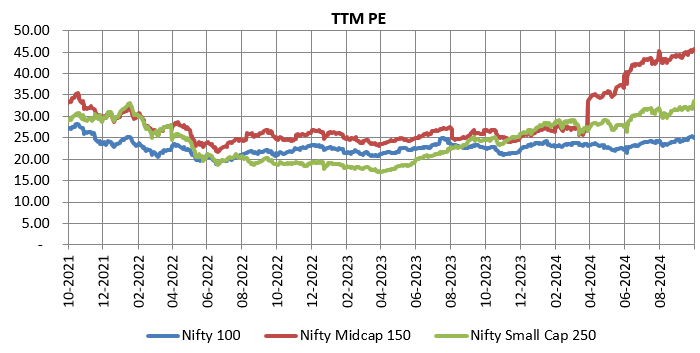

Different market cap segments have different risk / return characteristics. Midcap and small cap stocks can be more volatile than large caps, but they can give superior returns over long investment horizons. Different market cap segments underperform / outperform each in different market conditions (see the chart below). The fund managers of these schemes can invest any percentage of their assets in any market cap segment according to their market outlook. These schemes have wealth creation potential in the long term while balancing downside risks in the short term.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

Why invest in Flexicap now?

Indianequity marketis going through a volatile phase owing to the China’s outperformance and medium term outlook on S&P 500. Escalating Middle East Conflict,coupled with the approaching US elections causing concerns about the dollar devaluations are also affecting global investor sentiments. Valuations are high in certain pockets of the market (see the chart below). Midcaps were trading at significant to both small and large caps. When valuations are at elevated levels, Flexi-cap funds, with their inherent flexibility, are better positioned to handle by adjusting the mix of large, mid, and small caps. Flexicap funds don not have segment wise limits and can dynamically allocate across all three market cap segments.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

In the month of September, Flexicap funds attracted the highest gross inflows (Rs 7,705 crores of funds mobilized) among all actively managed diversified equity fund categories. Dynamic market cap allocation based on market conditions and fund manager’s outlook make flexicap strategy, one of the most prudent one in current market conditions, where there is high volatility and uncertainty about the short term outlook. Flexicap funds have the flexibility of quickly shedding risks in volatile markets by shifting allocations to large caps. At the same time, these funds can take advantage of growth opportunities in the mid and small cap space, as and when these opportunities emerge.

Flexicap funds are also tax efficient. If an individual investor rebalanced between different investments (large, mid or small cap) then such rebalancing would attract tax liabilities for the investor. Flexicap funds are tax efficient in the sense that any rebalancing or change in market cap allocations of the fund does not attract any tax liabilities in the hands of the investor.

LIC MF Flexicap Fund

The LIC Flexicap fund managers Mr Nikhil Rungta and Mr. Jaiprakash Toshniwal apply a mix of investment strategies in order to earn consistent returns. Let us look at these in detail.

- Investment Style: Blend of Growth, Value, Turnaround, Tactical opportunities.

- Market Cap allocation: Dynamic driven by pricing anomalies and macros across the market cap spectrum. The fund managers have maintained relatively lower exposure to large cap as compared to the benchmark. The portfolio consists of 50-55 stocks and is biased towards sector rotation.

- Portfolio turnover / churn: The portfolio has high churn due to tactical changes as per the changing environment.

- Business Quality: Medium to High Quality business due to Value/ Turnaround / Tactical plays.

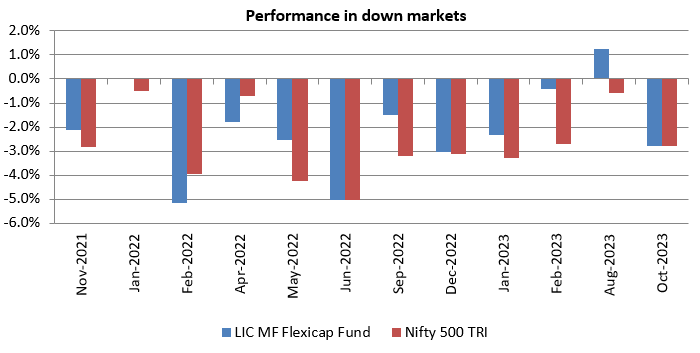

Limited downside risks in market corrections

The chart below shows the returns of LIC MF Flexicap Fund versus Nifty 500 TRI in all the months in which the market (represented by the broad market index Nifty 500) was down in the past 3 years (ending 30th September 2024). You can see that the fund was able to limit downside risks for investors.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

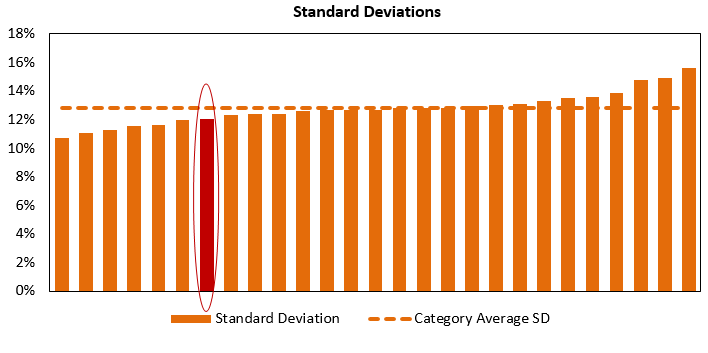

Lower volatility relative to peers

We plotted the standard deviations of all the flexicap funds that have minimum 3 years of track record and AUM of more than Rs 500 crores. You can see that LIC MF Flexicap Fund marked in red has significantly lower standard deviation compared to the category average standard deviation and most of its peers.

Source: Advisorkhoj Research, as on 30th September 2024

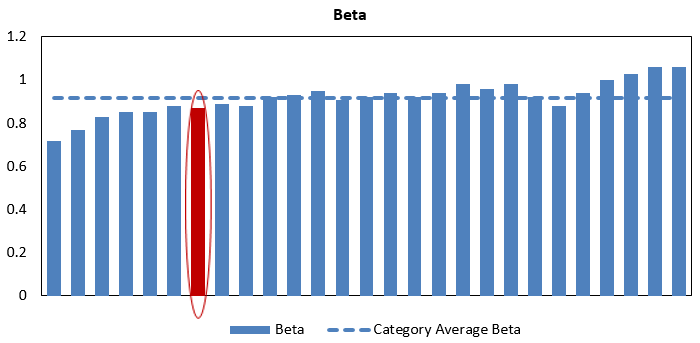

Lower Beta relative to peers

We plotted the Betas of all the flexicap funds that have minimum 3 years of track record and AUM of more than Rs 500 crores. Beta of a fund is a measure of its systematic risks. You can see that LIC MF Flexicap Fund marked in red has significantly lower beta compared to the category average beta and most of its peers.

Source: Advisorkhoj Research, as on 30th September 2024

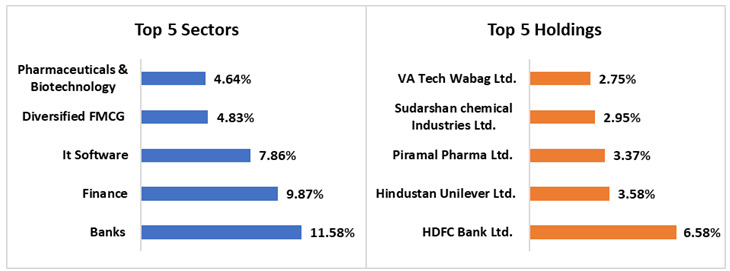

Portfolio Allocation

The fund had a small cap allocation of 41.82% followed by 40.26% in Large Cap and 15.61% in mid cap funds as on 30th September 2024. Below are the top sector allocation and top 5 holdings of the fund as on September 30th 2024.

Source: Fund Factsheet as on 30th September 2024

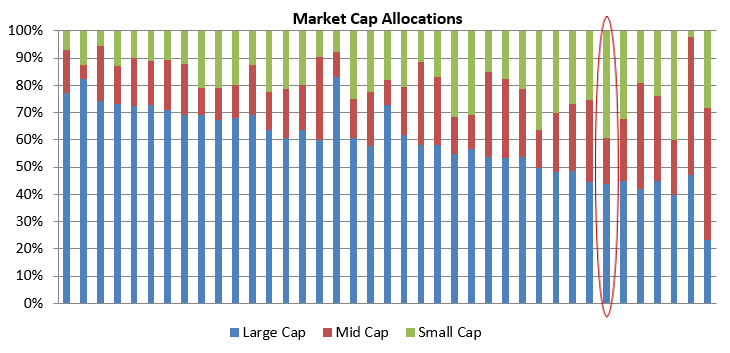

How market cap allocations differ from peers?

The chart below shows the market cap allocations of all the flexicap funds that have minimum 3 year track records and have minimum Rs 500 crores of AUM. You can see that LIC MF Flexicap Fund has significantly higher small cap allocations and lower large / midcap allocations relative to peers. The asset allocation of the fund manager is prudent in the market scenario where midcaps are trading at significant valuation premiums compared to small and large caps.

Source: Advisorkhoj Research, as on 30th September 2024

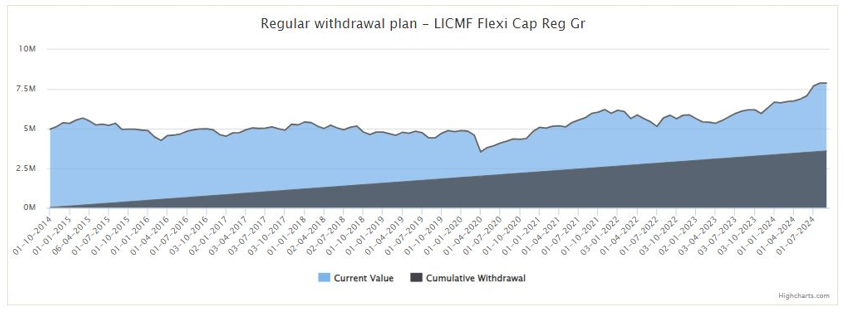

SWP from LIC MF Flexicap Fund

The chart below shows the result of Rs 30,000 monthly SWP from a lump sum investment of Rs 50 Lakhs over the last 10 years (ending 30th September 2024). You can see that despite withdrawing Rs 36 lakhs on a cumulative basis, the market value of the balance units (as on 30th September 2024) increased from Rs 50 lakhs to more than Rs 78 lakhs.

Source: Advisorkhoj Research, as on 30th September 2024

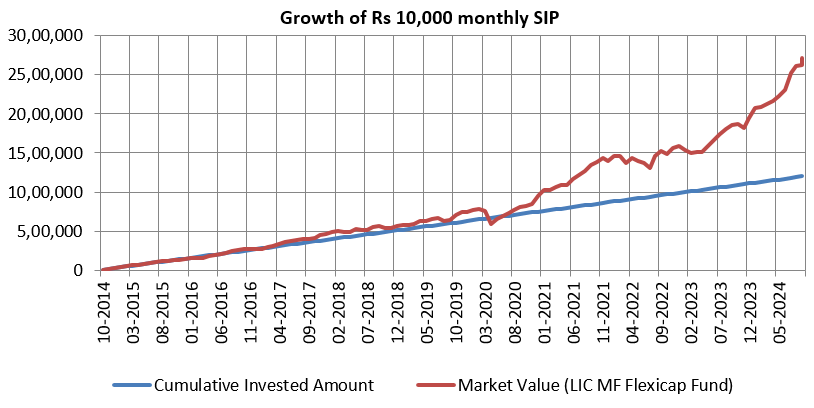

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in LIC MF Flexicap Fund over the last 10 years. You can see that with a cumulative investment of Rs 12 lakhs you could have accumulated a corpus of Rs 27 lakhs over the last 10 years (as on 30th September 2024.

Source: Advisorkhoj Research, as on 30th September 2024

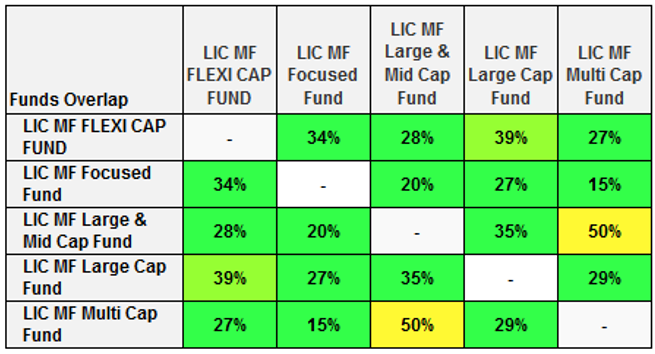

Low overlap with other LIC MF equity funds

The table below shows the portfolio overlap of LIC MF Flexicap Fund with other LIC MF diversified equity funds. You can see that the flexicap fund has low overlap with other funds. You can build a well diversified portfolio of the equity funds using LIC MF schemes.

Source: Advisorkhoj Research, as on 30th September 2024

Why invest in LIC MF Flexicap Fund?

- The fund manager follows a prudent and pragmatic investment strategy to take advantage of opportunities across market cap segments and industry sectors.

- The fund managers have a judicious approach towards stock selection based on near term risk factors especially high interest rates, slowdown in consumption expenditure and global economic slowdown. The fund manager avoids sectors that may be more vulnerable to the near-term risk factors in the present geopolitical scenario.

- The fund manager has maintained relatively lower exposure to large cap as compared to the benchmark index and peers. The portfolio consists of 50-55 stocks and is biased towards sector rotation.

- The portfolio has high churn due to tactical changes as per the changing environment. The fund manager focusses on Medium to High Quality business.

- The investment strategy of the scheme and turnaround in performance gives us the confidence that the scheme can create alphas for investors over sufficiently long investment horizons.

Whoshould invest in LIC MF Flexi Cap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5-year investment tenures.

- Depending on your investment needs, you can invest either in lumpsum or SIP.

Speak to a mutual fund distributor or your financial advisor to understand how LIC MF Flexicap fund may help you achieve your financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY