LIC MF Value Fund: Good fund in volatile market

Current Market Context

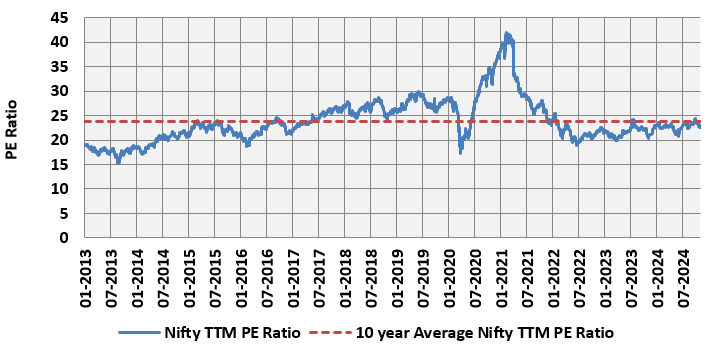

Equity market has been volatile for past one month or so. Concerns about weak Q2 corporate earnings, FII outflows (more than Rs 90,000 crores net sales in October, source: NSE, as on 31st October 2024) and uncertainty about interest rate cuts have dampened market sentiments. The Nifty has fallen more than 2,000 points from its all time high. The sharp correction has brought Nifty valuations back to the 10 year average PE ratio level (as on 31st October 2024). However, there are concerns about valuations in some pockets of the market, especially with downgrades in earnings outlook. In these market conditions value funds can be good investment options for long term investors.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.10.2024

What is Value Investing?

Fund managers who follow the value investing style try to identify stocks which are trading at significant discounts to their intrinsic value. The intrinsic value of a stock is based on fundamental analysis based on various factors like the company’s competitive strengths, market share, industry growth potential, company’s revenue growth prospects, margins, leverage etc. The stock may trade at a price higher or lower than the intrinsic value. Stocks which are trading at significant discounts to intrinsic value provide margin of safety because the downside risk is somewhat limited.

Value funds can add diversification to your portfolio

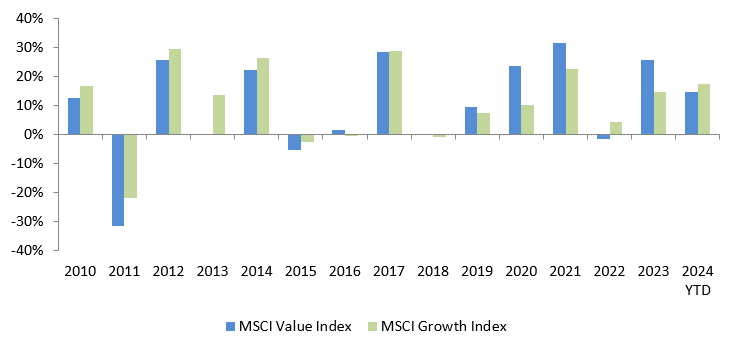

In a momentum driven market like India, investors often prefer growth stocks or growth style of investing. However, historical data shows that growth and value styles outperform each other in different market conditions and valuation scenarios. Adding value funds to your portfolio can provide richer diversification to your equity portfolio.

Source: MSCI, as on 31st October 2024

About LIC MF Value Fund

LIC MF Value Fund was launched in August 2018. Nikhil Rungta and Mahesh Bendre are managing this scheme from 1st July 2024. The fund managers follow value investing strategy for this fund.

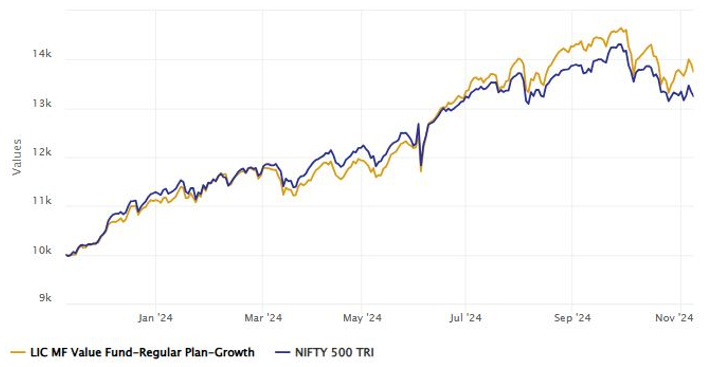

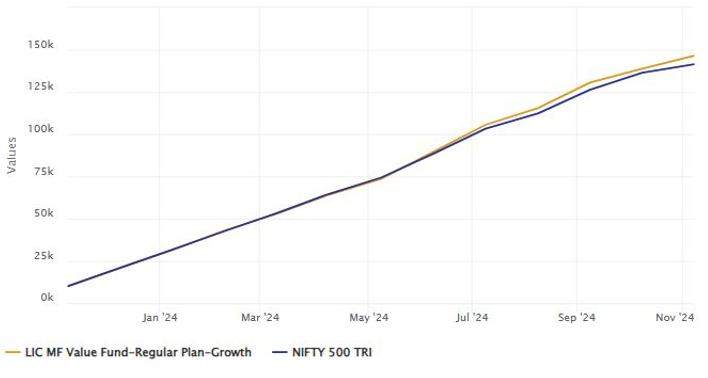

Outperforming the benchmark

The chart below shows the growth of LIC MF Value Fund versus its benchmark index Nifty 500 TRI in the last 1 year (as on 8th November 2024). You can see that the fund has outperformed the benchmark index in the last 1 year.

Source: Advisorkhoj Research, as on 8th November 2024

SIP Returns outperforming the benchmark index

The chart below shows the growth of Rs 10,000 monthly SIP in LIC MF Value Fund versus its benchmark index, Nifty 500 TRI in the last 1 year (as on 8th November 2024). You can see that the SIP returns of the fund have also outperformed the benchmark.

Source: Advisorkhoj Research, as on 8th November 2024

Consistent outperformance across different market conditions

Rolling return is the most unbiased measure a fund’s performance because it is not biased by prevailing market conditions. Rolling returns considers returns across different market conditions, rising markets, falling markets, range bound markets etc, for specific investment tenures. You can see that the fund has outperformed consistently over the last year or so.

Source: Advisorkhoj Rolling Returns, as on 8th November 2024

Market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of LIC MF Value Fund over the last 1 year.

The Up Market Capture Ratio of LIC MF Value Fund over last 1 year was 109% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 1.09%. The Down Market Capture Ratio of the fund was 84% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.84%. The market capture ratios of LIC MF Value Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Investment Strategy

- LIC MF Value Fund predominantly invests in well-diversified portfolio of companies after taking into consideration various factors such as Earning Potential, Asset Value, Cash Flow, Dividend Yield, Company’s competitive advantage etc.

- The fund managers study various parameters like the price-to-book (P/B) ratio, price-to-earning (P/E) ratio, dividend yields (D/Y) of companies within the researched fund house universe in order to arrive at potential investment strategies.

- The fund managers also look into other quantitative parameters like Return on Equity (ROE) and Return on Capital Employed (ROCE) to identify stocks which may be available at more favourable valuations when compared with peer group and stocks in applicable benchmark.

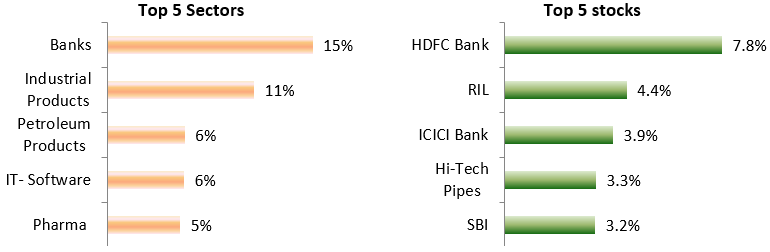

Current Portfolio Positioning

Source: LIC MF scheme portfolios, as on 31st October 2024

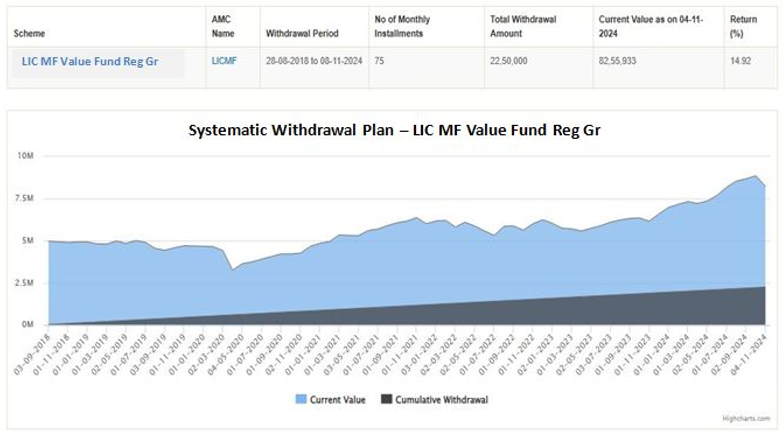

SWP from LIC MF Value Fund

The chart below shows the result of Rs 30,000 monthly SWP from a lump sum investment of Rs 50 Lakhs in LIC MF Value Fund since the inception of the fund. You can see that despite withdrawing Rs 22.5 lakhs on a cumulative basis (nearly 50% of your capital), the market value of the balance units (as on 8th November 2024) increased from Rs 50 lakhs to nearly Rs 83 lakhs.

Source: Advisorkhoj SWP Calculator, as on 8th November 2024

Why invest in LIC MF Value Fund?

- Focus on Fundamentals - Focuses on fundamentally strong companies whose shares appear under-priced by fundamental analysis.

- Long Term wealth creation - Scheme helps investors to benefit from the long term growth potential of undervalued companies.

- Ideal for Value Conscious Long Term Investors - as the Portfolio will comprise of well researched value stocks.

- Allows style diversification - Scheme invests across sectors and market capitalisation with a strong value bias.

Who should invest in LIC MF Value Fund?

- Investors looking for capital appreciation over long investment horizons

- Investors looking for value-based investing approach for long term financial goals

- Investors willing to invest in undervalued business

- Investor looking for diversified investment in fundamentally strong companies across market cap and sectors

- Investors with high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum or SIP depending on your financial situation

Investors should consult their financial advisors or mutual fund distributors if LIC MF Value Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY