A good large and midcap fund for long term investors

Large and Midcap equity fund is a relatively new equity fund category. As per SEBI’s mandate, these schemes should invest at least 35% of their assets in large cap stocks and 35% of their assets in midcap stocks. The top 100 stocks by market capitalization are classified by SEBI as large cap stocks, while the next 150 stocks by market capitalization are classified as midcap. The minimum allocations to large and midcap stocks respectively notwithstanding, the mandate for these schemes is quite flexible allowing fund managers to react to changing market conditions and position their portfolios to take advantage of opportunities.

LIC MF Large and Midcap fund, which recently completed 4 years, has a good performance track record since inception. Rs 100,000 invested in the scheme at the time of launch (NFO) would have grown to Rs 147,457 as on March 30th 2019. The assets under management (AUM) of the scheme, as on 28th February stood at Rs 408.9 Crores. The expense ratio of the regular plan of the scheme is 2.64%, while that of the direct plan is 1.42% (as on 28th February).

The minimum investment in the scheme is Rs 5,000. 12% of the units allotted can be redeemed or switched out without any exit load, on or before completion of 12 months from the date of allotment of units. Exit load of 1% is charged on remaining units if redeemed or switched out on or before completion of 12 months from the date of allotment of units. There is no exit load on redemptions or switches after 12 months from the date of allotment.

The market benchmark of the LIC MF Large and Midcap Fund is Nifty Large and Midcap 250 Index. The annual portfolio turnover ratio of the scheme is 0.91 (as on 28th February 2019). The portfolio beta is 0.98 and the Sharpe ratio is 0.15 (source: LIC MF monthly factsheet). The risk profile of the scheme is moderately high risk.

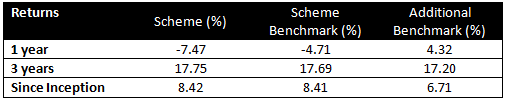

Scheme Performance

Sachin Relekar is the fund manager of this scheme. Mr Relekar has more than 13 years of experience and has been managing this scheme since inception. The scheme has delivered good returns over the last 3 to 4 years. The table below shows the 1 year, 3 years and since inception annualized returns of the scheme versus its benchmark and Nifty 50 (additional benchmark) for periods ending February 28th 2019.

Source: LIC MF Monthly Factsheet

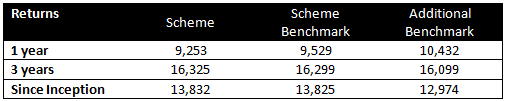

The table below shows the growth of Rs 10,000 lumpsum investment in the scheme (regular plan, growth option), the scheme benchmark (Nifty Large and Midcap 250 Index) and the additional benchmark (Nifty 50 Index) over various time periods, ending February 28th 2019.

Source: LIC MF Monthly Factsheet

You can see from the tables above that LIC MF Large and Midcap fund outperformed the benchmarks over the last 3 and 4 years (since inception) respectively.

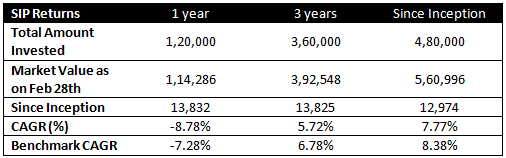

The table below shows the returns of Rs 10,000 monthly SIP in the scheme (regular plan, growth option) over the last 1 year, 3 year and since inception, till February 28th 2019.

Source: LIC MF Monthly Factsheet

Portfolio

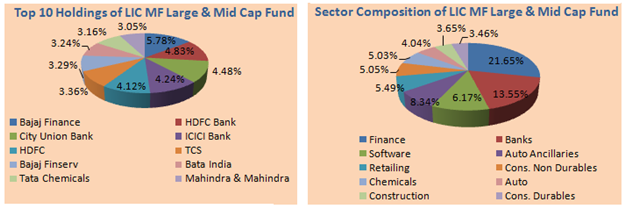

The investment objective of the scheme is to generate long term capital appreciation by investing substantially in a portfolio of equity and equity linked instruments of large cap and midcap companies. The top 10 sectors are Finance, Banks, software, auto ancillaries, retailing, FMCG, chemicals, automobiles, construction and consumer durables. The scheme portfolio is fairly well diversified from a company concentration perspective with the top 5 stocks Bajaj Finance, HDFC Bank, City Union Bank, ICICI Bank and HDFC accounting for around 23% of the portfolio value. The charts below show the top sector and stock holdings of the scheme.

Source: LIC MF Monthly Factsheet

Conclusion

Though LIC MF Large and Midcap Fund underperformed versus its benchmark in the last 1 year, it has delivered good performance over 3 to 4 years. This scheme is suitable for investors with moderately high to high risk appetites. Investors can invest in this scheme for their long term financial goals like children’s education and marriage planning, retirement planning and long term wealth creation. Since this is an equity fund with substantial exposure to midcap stocks, the scheme performance can be volatile from time to time. Hence it is important that, you should have a long investment horizon for investing in this scheme. Investors should consult with their financial advisors if LIC MF Large and Midcap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY