LIC MF Large Cap Fund: A promising large cap fund in current market conditions

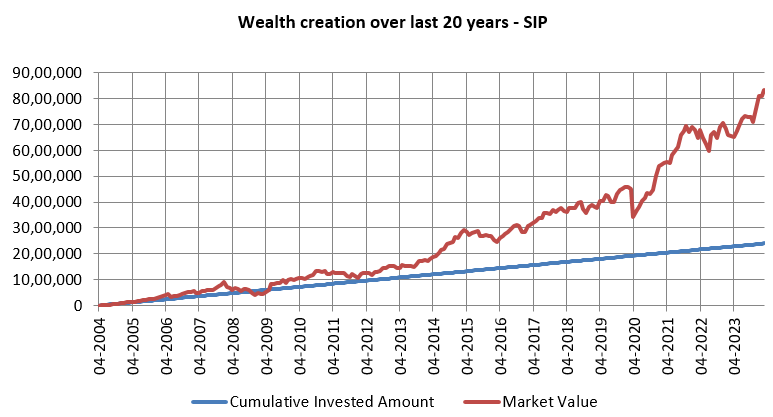

LIC MF Large Cap Fund is one of the oldest mutual fund schemes with track record of nearly 30 years. It is also a proven wealth creator. If you started a monthly SIP of Rs 10,000 in the fund 20 years back, the market value of your investment would have grown to Rs 83.55 lakhs (as on 31st March 2024) with a cumulative investment of just Rs 24 lakhs.

Source: Advisorkhoj Research, as on 31st March 2024. Disclaimer: Past performance may or may not be sustained in the future

Why invest in large cap funds?

- As per SEBI’s market capitalization segment classification, top 100 listed companies by market capitalization as classified as large cap companies.

- These companies are the largest and most reputed companies in India. These companies are leaders in their respective industry sectors.

- Since large cap companies have market share leadership, they are better positioned to withstand economic downturns compared to smaller companies.

- Institutional ownership of large cap companies is significantly higher than midcap and small cap companies. As a result, large cap companies are well researched and visibility of their earnings growth is more than small and midcap companies.

- Since large cap stocks have high institutional ownership (higher percentage of free-floating shares) and are well researched, their price discovery is much more efficient than midcaps and small caps. Their valuations are likely to get less over-stretched compared to midcaps. As a result downside risks in these stocks are lower at / near market tops.

- Large cap stocks tend to be less volatile than midcap and small cap stocks. They usually outperform mid and small cap stocks in market downturns.

- Since large cap stocks have high percentage of free-floating shares, they are much more liquid than midcap and small cap stocks. Liquidity should be an important consideration for your core equity investment portfolio.

Why invest in large cap funds now?

The stock market has been trading at its all time high (as on 31st March 2024). In late February and March, SEBI issued an advisory about froth building up in midcap and small cap companies. Midcaps and small cap stocks turned volatile and we saw a bit of correction in both the market cap segments (small caps saw deeper cuts compared to midcaps). Despite the correction in midcaps and small caps, there are concerns about valuations of these stocks. While the growth outlook for Indian economy is strong (IMF is forecasting 6.8% GDP growth in FY 2024-25), there global risk factors in the near term.

The US economy is expected to avoid recession when the US Federal Reserve reverses the interest rate cycle, but their economy may slow down considerably in the coming months and quarters as mean reversion takes place. Signs of downturn / recession are clearly visible in Eurozone area. Geo-political risks in the Middle East due to tension between Israel and Iran is another global risk factor because it may impact crude oil prices. These risk factors may have an effect on global equities and investment flows. Large cap funds are better placed from the perspective of risk reward trade-off in the near to medium term.

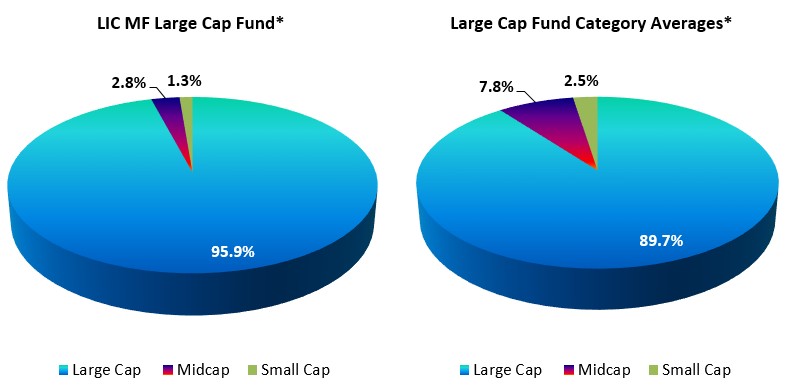

How is LIC MF Large Cap Fund placed relative to peers from a risk standpoint?

LIC MF Large Cap Fund has higher large cap allocations compared to peers. From a risk standpoint, one can expect LIC MF Large Cap Fund to relatively less volatile compared to peers in market corrections.

Source: LIC MF Factsheet, Advisorkhoj Research, as on 31st March 2024. *Only equity portion of the scheme portfolios are considered. Disclaimer: Past performance may or may not be sustained in the future

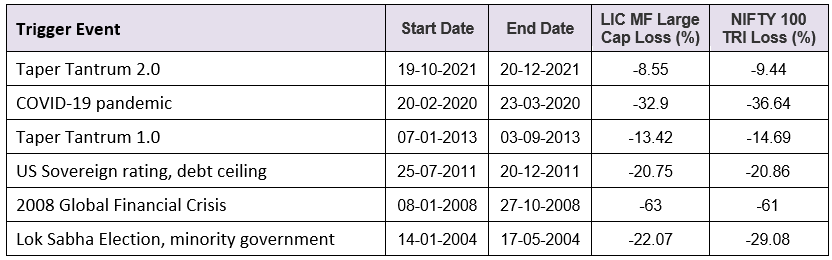

Downside risk limitation

The table below shows some of the biggest market corrections in the last 20 years. You can see that LIC MF Large Cap Fund had lesser drawdowns compared to the benchmark index Nifty 100. We also looked at the months in which the market was down and compared the performance of LIC MF Large Cap Fund versus the benchmark index Nifty 100 in the down months over the past 5 years. For every 1% correction in Nifty 100 TRI in the down months (over last 5 years), LIC MF Large Cap Fund was down by only 0.92% (down market capture ratio). The down market capture ratio is another analytical measure which shows that LIC MF Large Cap Fund was able to provide relative downside risk limitation to investors. In our opinion, volatility should be an important consideration for large cap funds, since you are looking for stability when you are investing in large cap funds.

Source: Advisorkhoj Research, as on 31st March 2024. Disclaimer: Past performance may or may not be sustained in the future

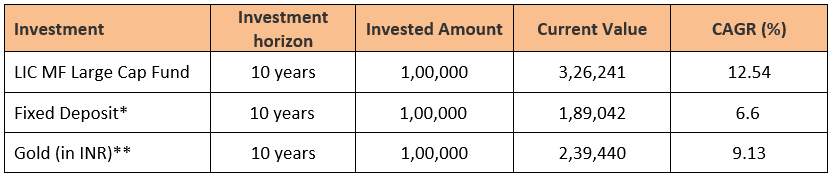

LIC MF Large Cap Fund performance versus other asset classes

Source: Advisorkhoj Research, as on 31st March 2024. *1 year SBI FD interest rates for general citizen have been used as proxy for FD rates. ** MCX spot rates were considered to calculate Gold returns in INR. Disclaimer: Past performance may or may not be sustained in the future

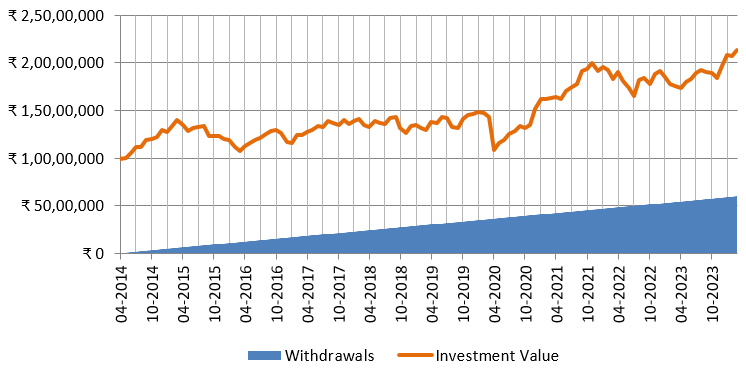

LIC MF Large Cap Fund – SWP for regular cash flows

Since large cap funds are relatively more stable / less volatile, they are suitable investment options for Systematic Withdrawal Plan (SWP). The chart below shows the cumulative withdrawals and current value of Rs 50,000 monthly SWP from Rs 1 crore invested in LIC MF Large Cap over the last 10 years. Despite withdrawing Rs 60 lakhs over the last 10 years, your investment would have grown in value to nearly Rs 2.2 crores. Your XIRR returns over this period would have been 12.7%. For moderate rates of withdrawal LIC MF Large Cap has the potential of generating long term cash-flows for investors along with potential capital appreciation.

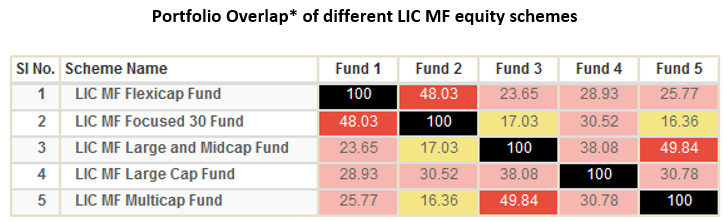

Low overlap with other LIC MF diversified equity funds

It is often seen that different equity schemes from the same fund house have high portfolio overlaps e.g. a large cap and a flexicap fund belonging to the same fund house may have 50 – 60% overlap. Having schemes with high overlaps in your portfolio does not necessarily create more diversification; on the contrary, it may create inefficiencies in your portfolio. LIC MF Large Cap Fund has relatively low overlap with other diversified equity funds from LIC MF stable (see the table below). You can also see that other diversified equity schemes also have relatively low overlap with each other. You can build your core equity portfolio with LIC MF Large Cap Fund and other diversified funds from LIC MF as per your risk appetite.

Source: Advisorkhoj Research, as on 31st March 2024. *Only equity portion of the scheme portfolios are considered.

Investment strategy and portfolio construction

- Investing pre-dominantly in large cap stock. The strategy is to invest in value companies which are transparent and generally carry lower risk profile.

- Identify companies from the universe with strong competitive position in a good business and having quality management.

- Focus on fundamental driven investment.

- Following bottom up approach to stock selection and looking at intrinsic value.

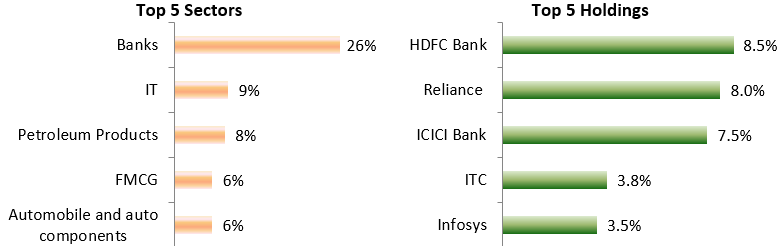

Current portfolio positioning

Source: LIC MF Factsheet, as on 31st March 2024. Disclaimer: Past performance may or may not be sustained in the future

Who should invest in LIC MF Large Cap Fund?

- Investors who are looking for capital appreciation with a long-term investment horizon.

- Those who are looking to build their core portfolio with large-cap stocks.

- Those who have an investment horizon of more than 3 years.

- The fund is suitable for first time or new investors

- You can invest in this fund either in lump sum or SIP depending on your financial situation or investment needs

- If you have lump sum funds but are worried about volatility, then you can invest your lump sum funds in LIC MF Liquid Funds and transfer systematically to LIC MF Large Cap Fund through 3 – 6 month STP.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multi Cap Fund: Good choice for long term investors in current market

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Balanced Advantage Funds: Good risk return trade off with relatively lower volatility

- LIC MF Value Fund: Good fund in volatile market

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY