LIC MF Multicap Fund: Good performance in difficult market conditions

LIC MF launched their multicap fund in October 2022. The fund has 26.37% CAGR return since inception (as on 30th April 2024). Though one and half year track record is too short a performance period to do comprehensive review of an equity mutual fund scheme’s performance, the performance of LIC MF Multicap Fund in difficult market conditions is noteworthy.

Current market context

Indian equities enjoyed a strong rally in 2023 with Nifty 50 TRI giving 19.42% return. Midcaps and small caps outperformed in 2023, with Nifty Midcap TRI giving 44.61% return and Nifty Small Cap TRI giving 49.09% return in 2023 (source: NSE). In February 2023, SEBI issued an advisory on froth building up in valuations of midcap and small cap stocks. We saw a healthy correction in midcaps and small caps in late February and March. Strong job market and high inflation data from the United States raised concerns about timing of interest rate cuts. We are seeing continuing volatility in the market. In these difficult market conditions LIC MF Multicap Fund has been among the Top 5 multicap funds in the last one month.

Consistent track record of LIC MF Multicap Fund

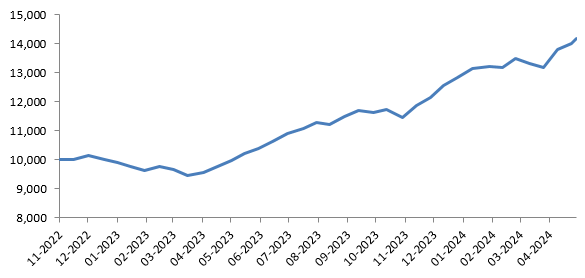

The chart below shows the growth of Rs 10,000 investment in LIC MF Multicap Fund.

Source: Advisorkhoj Research, as on 30th April 2024. Disclaimer: Past Performance may or may not be sustained in the future

Performance of LIC MF Multicap Fund in down markets

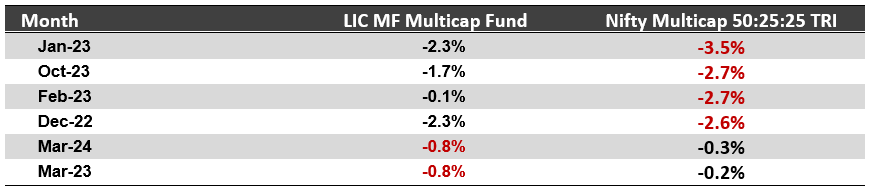

In the table below we have show how LIC MF Multicap Fund performed versus its benchmark market index Nifty Multicap 50:25:25 TRI in months during which the broader market was down since the inception of the fund. You can see that the fund was able to limit downside risks for investors in bigger corrections. Funds which can limit downside risks for investors have the potential of giving superior risk adjusted returns over long investment horizons.

Source: Advisorkhoj Research, as on 30th April 2024. Disclaimer: Past Performance may or may not be sustained in the future

Market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of LIC MF Multicap Fund over the last 1 year.

The Up Market Capture Ratio of LIC MF Multicap Fund over last 10 years was 84% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 0.89%. The Down Market Capture Ratio of the fund was 82% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.82%. The market capture ratios of LIC MF Multicap Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Rolling returns of LIC MF Multicap Fund versus benchmark – Performance consistency

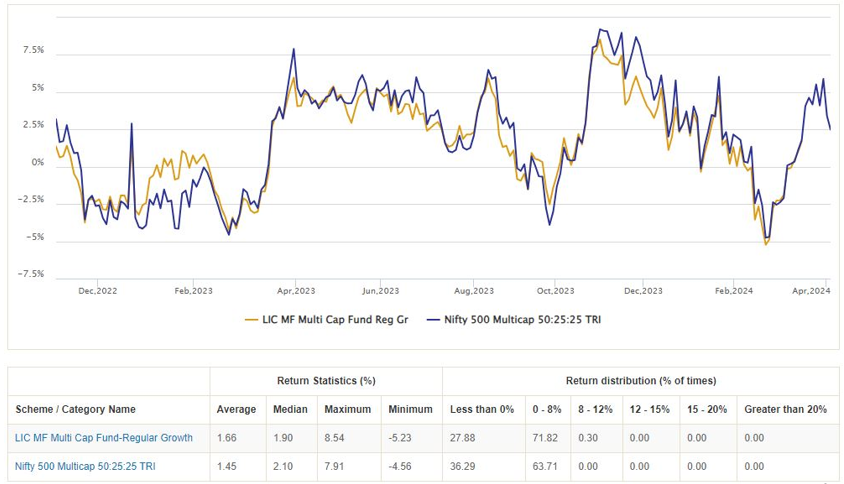

The chart below shows the monthly rolling returns of LIC MF Multicap Funds versus its benchmark index Nifty Multicap 50:25:25 TRI since the inception of the fund.

Source: Advisorkhoj Rolling Returns Calculator, as on 30th April 2024. Disclaimer: Past Performance may or may not be sustained in the future

You can see that the average monthly return of LIC MF Multicap Fund is higher than the benchmark index. You can also see the percentage instances of negative returns given by LIC MF Multicap Fund was less than instances of negative returns of the benchmark market index.

Rolling returns of LIC MF Multicap Fund versus peers – Performance consistency

The chart below shows the monthly rolling returns of LIC MF Multicap Funds versus the Multicap Funds category average since the inception of the fund.

Source: Advisorkhoj Rolling Returns Calculator, as on 30th April 2024. Disclaimer: Past Performance may or may not be sustained in the future

You can see that while some peers gave higher returns, the percentage instances of negative returns given by LIC MF Multicap Fund was significantly less than instances of negative returns of the multicap category average. Higher returns should not be the only consideration in fund selection. You should also look at performance consistency, especially performance of the fund in difficult market conditions. While returns are important, investment experience is also important because negative experiences can result in investors making wrong investment decisions due to behavioural factors.

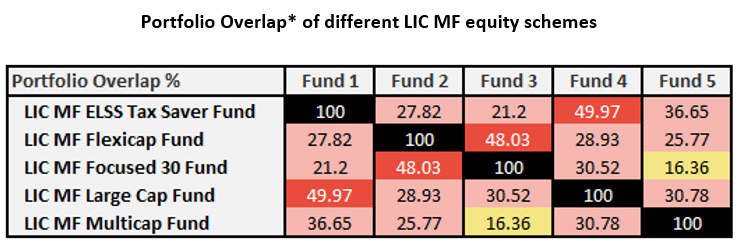

Low overlap with other LIC MF diversified equity funds

It is often seen that different equity schemes from the same fund house have high portfolio overlaps e.g. a multicap and a flexicap or large and midcap fund belonging to the same fund house may have 50 – 60% overlap. Having schemes with high overlaps in your portfolio does not necessarily create more diversification; on the contrary, it may create inefficiencies in your portfolio. LIC MF Multicap Fund has relatively low overlap with other diversified equity funds from LIC MF stable (see the table below). You can also see that other diversified equity schemes also have relatively low overlap with each other. You can build your core equity portfolio with LIC MF Multicap Fund and other diversified funds from LIC MF as per your risk appetite.

Source: Advisorkhoj Research, as on 31st March 2024.

Multicap Strategy of LIC MF Multicap Fund

Stock selection

The fund manager follows a blended approach using qualitative and quantitative analysis:-

- Qualitative: Emphasis is put on the company’s products, services, management, competitors, etc. The fund manager evaluates impact of prevailing and evolving macro on above factors on the sector and company

- Quantitative: The fund manager concentrates on the income statements, balance sheets, and cash flows, and analyzes the relationship between price and intrinsic value

The qualitative approach helps in understanding the business dynamics and assigning the better multiple and quantitative approach helps in forecasting financials. Combination of these two approaches helps in determining optimal valuations.

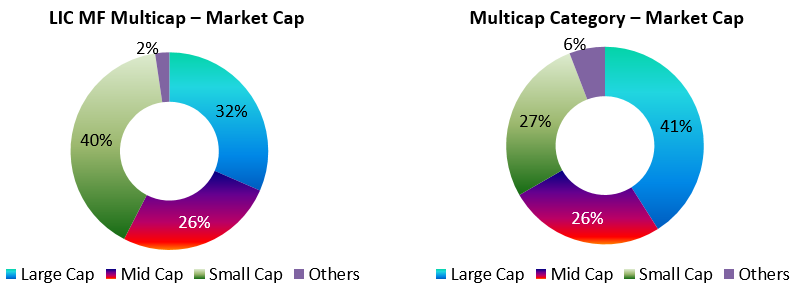

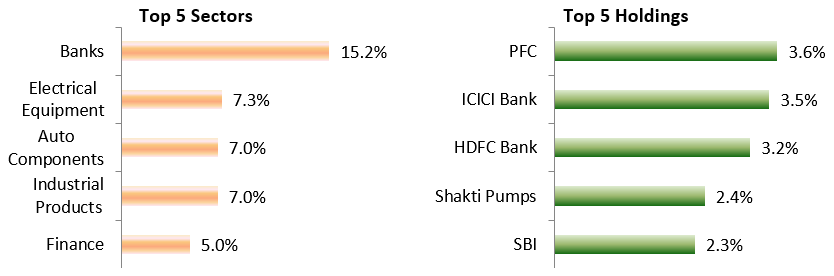

Current portfolio positioning

LIC MF Multicap has higher allocations to small cap compared to multicap category average. The fund also has less cash holdings compared to the category average. The higher small cap allocations of the fund create the potential of higher capital appreciation or alpha creation.

Source: LIC MF Factsheet, as on 30th April 2024.

Source: LIC MF Factsheet, as on 30th April 2024.

Why invest in Multicap Funds?

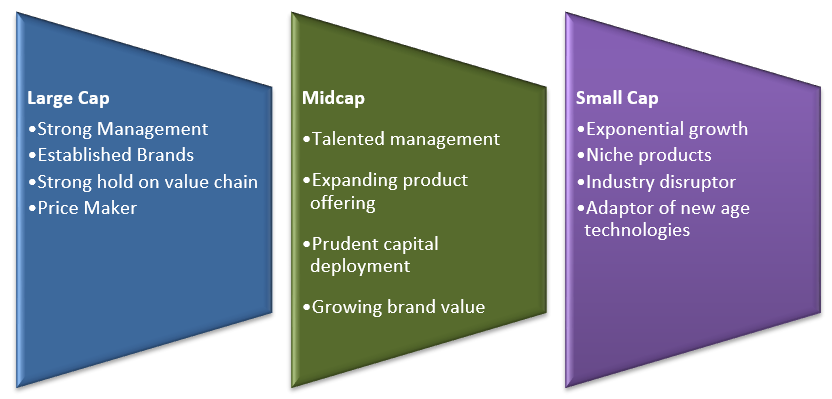

- Different segments of the market outperform each other in different market cycles. For example large cap stocks usually outperform midcap and small cap stocks in bear market conditions. Midcap and small cap stocks have the potential to outperform large cap stocks in bull markets.

- Multicap funds provide exposure to a much larger universe of stocks compared to large cap or even midcap funds. While the large cap segment is restricted to 100 stocks and mid cap to 150 stocks), multicap funds can invest in a universe of 500 or more stocks.

- Multicap funds provide exposure to a larger number of industry sectors compared to large cap funds. There are several sectors where large caps do not have any presence. Some of these sectors may have high growth potential in domestic consumption driven economy like India.

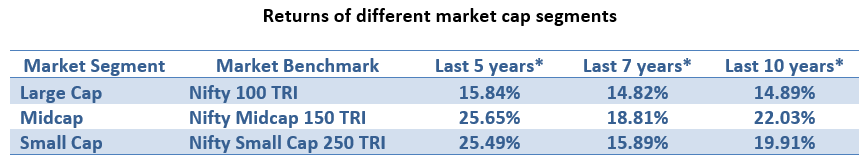

- Multicap funds have 50 – 75% of their portfolio invested in midcap and small cap stocks. Midcap and small cap stocks have the potential and tend to outperform large cap funds in the long term (see the table below).

Source: National Stock Exchange, Advisorkhoj Research. *Trailing Compound Annual Growth Rate (CAGR) returns as on 30th April 2024. Disclaimer: Past performance may or may not be sustained in the future.

- The long term structural India Growth Story is not about any one market cap segment. It spans across all three market cap segments and several industry sectors. Multicap funds are well positioned to capture the long term growth opportunities in India’s journey to Viksit Bharat.

Who should invest LIC MF Multicap Fund?

- Investors with long term investment horizon i.e. 5 years or more.

- Investors with a high-risk appetite who can tolerate the short term volatility associated with equity investments.

- They are suitable for investors who want to invest from their monthly savings through SIP for their long term financial goals like children’s higher education, marriage, retirement planning, wealth creation etc

- You can invest either in lump sum or SIP depending on your financial situation and investment needs

- If you have lump sum funds but are worried about volatility, then you can invest your lump sum funds in LIC MF Liquid Fund and transfer systematically to LIC MF Multicap Fund through 3 – 6 month STP.

You should consult with your financial advisor or mutual fund distributor, if LIC MF Multicap Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY