LIC MF Dividend Yield Fund: The best performing dividend yield fund

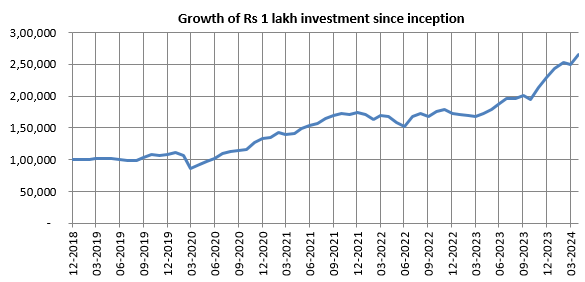

After the spectacular rally in global equity markets over the last 1 year or so, the stock market is trading near record high levels. At market peaks, there are always concerns about valuations; high dividend yield stocks or dividend yield funds can provide stability to your investment portfolio. In this article, we will review the best performing dividend yield fund in the last 1 year, LIC MF Dividend Yield Fund. The fund has completed 5 years and has given 19.96% CAGR (as on 30th April 2024) returns inception – see the chart below.

Source: Advisorkhoj Research, as on 30th April 2024

What is dividend yield?

Dividend yield is the annual dividend paid by the stock divided by the share price. Dividend yield is an important ratio in selecting stocks. Dividend yield = (Annual dividends ÷ Current share price). Suppose the share price of a company is Rs 100. The company declares a dividend of Rs 10. The dividend yield will be Rs 10 ÷ 100 = 10%. Dividend yield funds are equity mutual fund schemes that invest in relatively high dividend yield stocks.

Why is dividend yield important?

Key attributes of high dividend yield stocks are:-

- Tried and tested business model with an ability to generate healthy free cash-flows

- Relatively less prone to downside risk in falling market coupled with capital appreciation prospects in a reviving market

- Reflects optimum usage of free cash-flows, good operational health & sustainability of future earnings

- Consistent dividend payouts (income for investors) & growth ora possibility of likely growth in dividend payouts

How high dividend yield stocks performed in volatile markets?

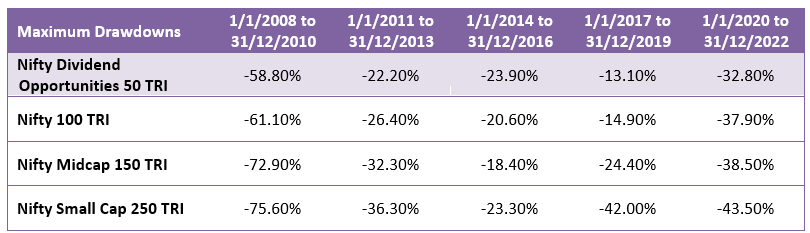

High dividend yield stocks provide margin of safety to investors when the market turns volatile, since investors receive cash-flows in form of dividends even when the share price corrects (falls). This not only reduces your downside risks; you can re-invest in the dividends when share prices are falling and have the potential of getting higher returns when market recovers. The chart below shows how high dividend yield stocks were able to limit downside risks in large market drawdowns.

Source: National Stock Exchange, Advisorkhoj Research

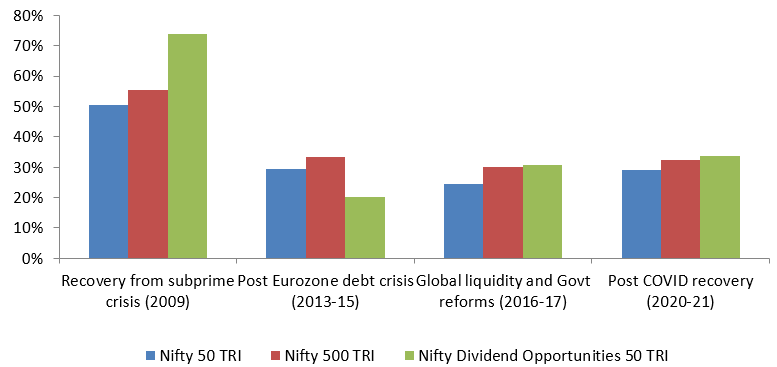

High dividend yield stocks outperformed in early stages of market recovery

Source: National Stock Exchange, Advisorkhoj Research

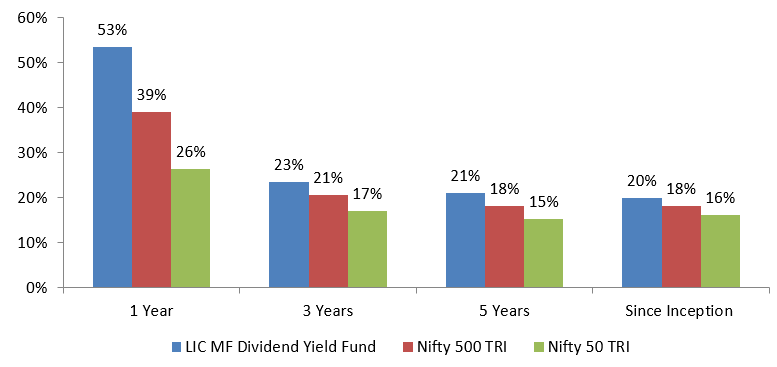

LIC MF Dividend Yield Fund created Alphas for investors

You can see in the chart below that LIC MF Dividend Yield Fund was able to outperform the market benchmark index over different investment tenures since the fund’s inception and create alphas for investors.

Source: LIC MF Factsheet, Advisorkhoj Research, as on 30th April 2024

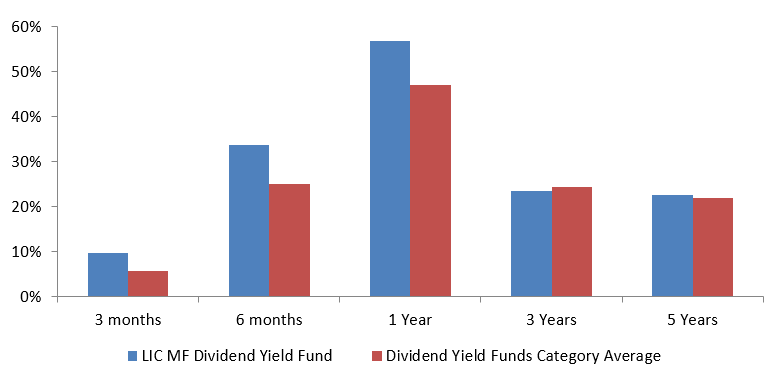

LIC MF Dividend Yield Fund outperformed peer average

You can see in the chart below that LIC MF Dividend Yield Fund was able to outperform the category average over different investment tenures (both short term and long term).

Source: LIC MF Factsheet, Advisorkhoj Research, as on 22nd May 2024

Superior Risk Adjusted Returns – Market capture ratios

Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of LIC MF Dividend Yield Fund over the last 1 year. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratiotells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of LIC MF Dividend Yield over last 3 years was 105% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 1.05%; in other words, the fund was able to beat the market in up markets. The Down Market Capture Ratio of the fund was 90% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by only 0.9%; in other words, the fund was able to limit the downside risk of investors in falling markets. The market capture ratios of LIC MF Dividend Yield Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Superior performance consistency

The chart below shows the 3 year rolling returns of LIC MF Dividend Yield Funds versus its benchmark index Nifty 500 TRI since the inception of the fund. You can see that the average CAGR return of LIC MF Dividend Yield Fund over the last 3 year investment tenures is higher than that of benchmark index. Further observe that the fund never gave return of less than 8% over 3 year investment tenures since inception. You can also see the percentage instances of 15%+ CAGR given by LIC MF Dividend Yield Fund was 95%, significantly higher than that of the benchmark market index. This is the hallmark of great performance consistency.

Source: Advisorkhoj Rolling Returns Calculator, as on 30th April 2024. Disclaimer: Past Performance may or may not be sustained in the future

Investment Strategy

- The Investment strategy of the Scheme would be to invest predominantly in the stocks of dividend yielding companies as identified at the time of investment.

- Primarily companies are selected that have paid dividend in at least 1 of the 3 preceding financial years.

- In addition to dividend yield, other parameters like earning growth prospect, business fundamentals, expansion plans, competitive position, strong balance sheet, quality management, growth prospect etc. are considered for stock selection

- Investment across Sectors and Market Cap with a bias for a quality stocks

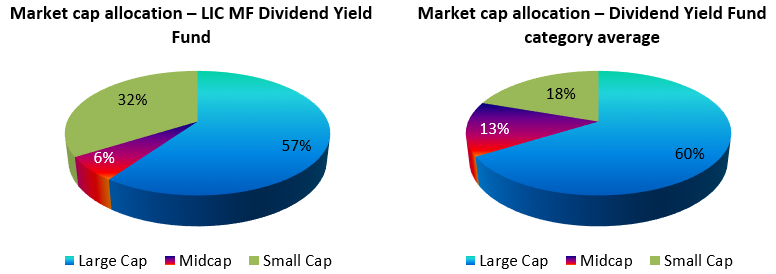

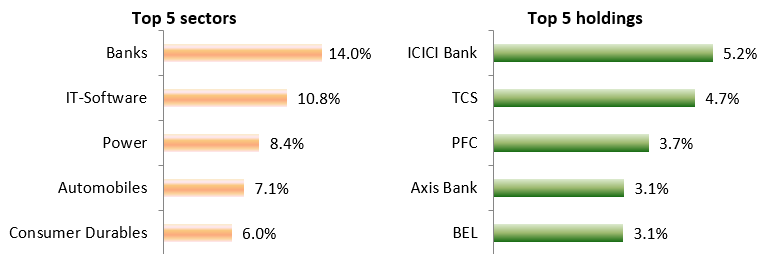

Portfolio positioning

The fund maintains higher exposures to small caps compared to peers. The performance of LIC MF Dividend Yield Funds busts the misconception held by many investors that only bluechip companies can generate high dividend yields and still enjoy capital appreciation. The higher small cap allocations can generate potential alphas for investors.

Source: LIC MF Factsheet, Advisorkhoj Research, as on 30th April 2024

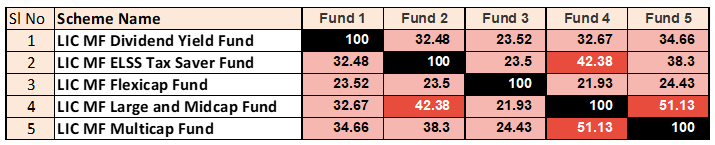

Low overlap with other LIC MF diversified equity funds

LIC MF Dividend Yield Fund has relatively low overlap with other LIC MF diversified equity funds (see the table below). You can also see that other diversified equity schemes have relatively low overlap with each other. You can build your core equity portfolio with LIC MF Dividend Yield Fund and other diversified funds from LIC MF as per your risk appetite.

Who should invest in LIC MF Dividend Yield Fund?

- The scheme is suitable for new or existing investors looking forpotential long term wealth creation wanting to have exposure torelatively strong businesses. The scheme is suited for new investors because volatility will be relatively low.

- The scheme is also suitable for long term investors aiming to build wealth to meet their long term financial goals with a potentially better risk return trade off.

- Since the volatility of the fund can be expected to be on the lower side, the fund may also be suitable for investors who want regular tax efficient cash-flows from their investments through Systematic Withdrawal Plan (SWP) over long investment horizons.

- Investors should have minimum 3 - 5 years plus investment tenure for this scheme.

- Investors should consult with their financial advisors or mutual fund distributors, if LIC MF Dividend Yield Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY