LIC MF Small Cap Fund: A small cap fund with strong potential for long term investors

Why invest in Small Cap?

- India is in a macro sweet spot. IMF is forecasting India’s GDP to grow by 6.8% in FY 2025, making it the fastest growing G-20 economy. India is expected to become the 3rd largest economy by 2027 (as per IMF’s forecasts). Our fiscal deficit in FY 2024 is estimated to be 5.8%, which will be pared down to 5.1% in FY 2025 and back to the long term 4.5% of GDP target in FY 2026.

- Interest rates have peaked and the 10 year G-sec yield has been softening over the past year or so. Lower interests may spur credit growth, demand and capex spending. This will result in higher revenue and earnings growth for companies, especially small cap companies. The cost of debt for these companies will reduce if interest rates come down, resulting in higher PAT / EPS growth.

- Since small cap stocks are under-owned (relative to large and midcaps) by the institutional investors, the price discovery in this market cap segment is not as efficient as large caps or midcaps. As a result, fund managers of small cap schemes have far greater opportunities of indentifying small cap stocks which are currently undervalued in the market. These stocks can generate considerable alpha for investors.

- The universe of small cap stocks is much larger than large cap (total 100 stocks) and midcap stocks (total 150 stocks). Large cap stocks are concentrated in relatively few industry sectors. Sectors like chemicals, packaging, sugar and tea, ceramics and sanitary ware, hotels, logistics and construction can be played better through small cap stocks.

- Stocks that are small cap today have the potential of becoming midcap or large cap stocks in the future. When a stock moves from one market cap segment to the higher market cap segment, valuation rerating takes place. This can result in small cap stocks giving multi-bagger returns.

LIC MF Small Cap Fund – On an upwards trajectory

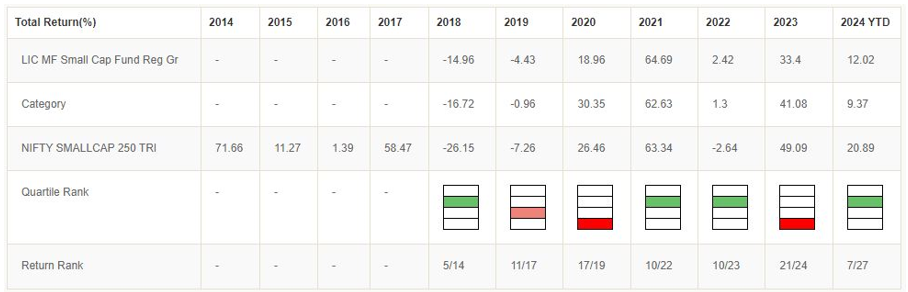

LIC MF Small Cap Fund was launched in June 2017. The fund, managed by Yogesh Patil and Dikshit Mittal, has given 17.5% CAGR returns since inception (as on 19th June 2024). Like many new funds, it struggled in the initial years, but from 2021 onwards, the fund has managed to be in the top 2 quartiles in 3 out of the last 4 years (see the chart below).

Source: Advisorkhoj Quartile ranking, as on 31st May 2024

Outperformer in the small cap funds category over the last 3 years

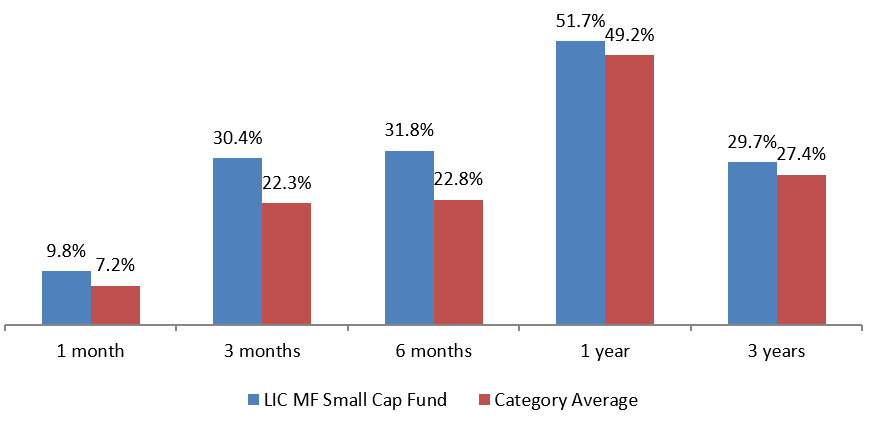

The chart below shows the trailing returns of LIC MF Small Cap Fund versus the category average returns over various time-scales in the last 3 years. You can see that the fund outperformed the category average and the outperformance margin has grown in the more recent periods.

Source: Advisorkhoj Research, as on 19th June 2024

Protected downside risks for investors

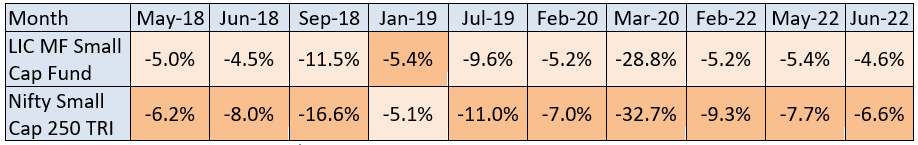

While the primary investment objective of equity funds is capital appreciation, we must not forget that equity as an asset class is volatile. Small caps are more volatile than large caps and midcaps. Investors should have very high risk appetites for small cap funds. That said, investors are human and have behavioural biases. Behavioural biases can lead to wrong investment decisions. Therefore, investor experience should also be an important factor. Behavioural biases get tested in highly volatile markets. We looked at the months with lowest returns since the inception of the fund and compared how LIC MF Small Cap Fund performed versus the market benchmark index. You can see that LIC MF Small Cap Fund was able to limit downside risk for investors – superior investor experience.

Source: Advisorkhoj Research, as on 19th June 2024

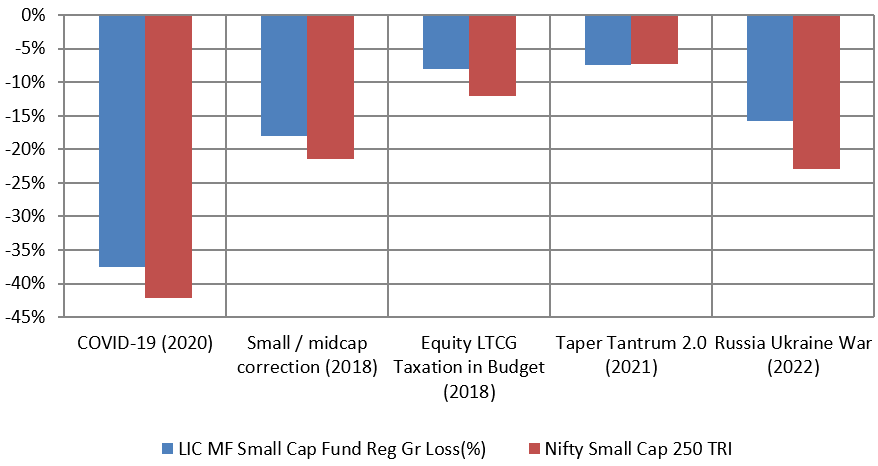

Smaller drawdowns in deep market corrections

The chart below shows some of the largest market drawdowns since the inception of the fund. You can see that the LIC MF Small Cap Fund was able to limit the downside risk for its investors.

Source: Advisorkhoj Research, as on 19th June 2024

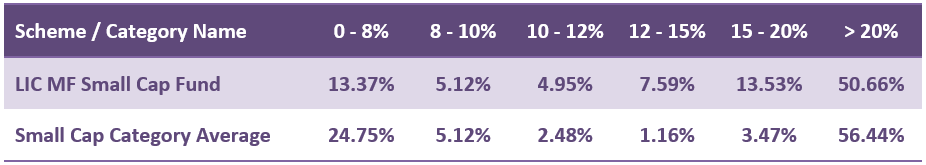

Superior risk adjusted returns relative to peer average

Investors and financial advisors, who follow our blog regularly, know that rolling returns is more unbiased measure of a mutual fund scheme’s performance compared to point to point returns, which many investors usually rely on to select funds for their investment portfolios. We looked at the 1 year rolling returns distribution of LIC MF Small Cap Fund versus category average (see the chart below) since 2021. We took 2021 as the starting point because it usually takes a few years for a young fund to find its feet. You can see that, LIC MF Small Cap Fund was able to produce superior risk adjusted returns for investors. While the percentage instances of negative or sub 8% returns was significantly low for LIC MF, the percentage instances of 15%+ returns of the fund was significantly higher than the category average.

Source: Advisorkhoj Rolling Returns Calculator, as on 19th June 2024

Superior risk adjusted returns relative to market benchmark

Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of LIC MF Small Cap Fund over the last 3 years. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of LIC MF Small Cap Fund over last 3 years was 75% which implies that if the benchmark index went up by 1% in a month, then the fund’s Net Asset Value (NAV) went up by 0.75%. The Down Market Capture Ratio of the fund was only 45% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.45%; in other words, the fund was able to limit the downside risk of investors in falling markets. An up market capture ratio which is higher than the down market capture ratio, is a strong indication of the potential of the fund to give superior risk adjusted returns of the fund.

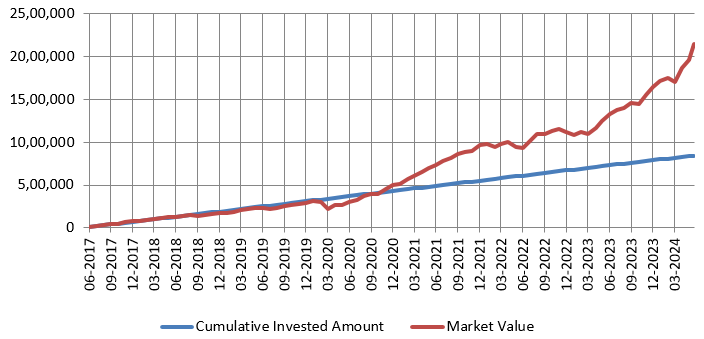

Wealth creation through SIP

So far we have discussed the risk return characteristics of LIC MF Small Cap Fund. The chart below shows the growth of Rs 10,000 monthly SIP in LIC MF Small Cap fund since the inception of the fund. With a cumulative investment of Rs 8.4 lakhs, you could have accumulated a corpus of nearly Rs 22 lakhs in the last 7 years or so.

Source: Advisorkhoj Research, as on 19th June 2024

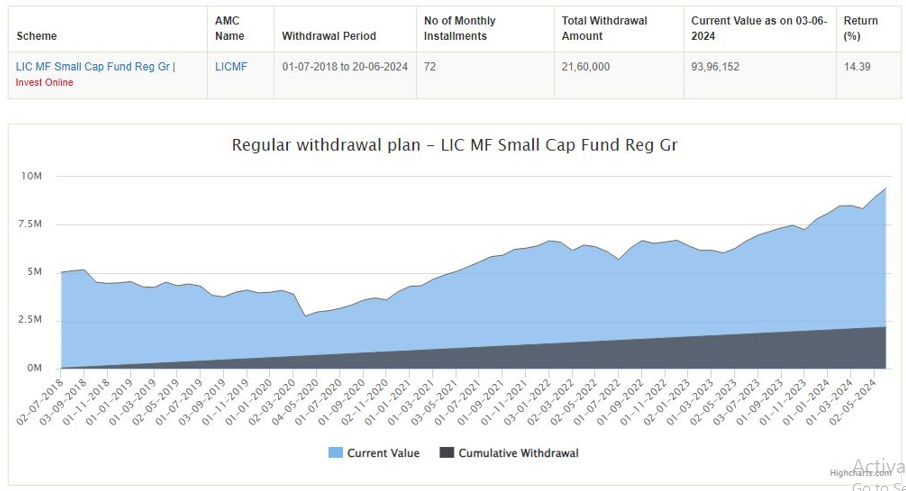

Regular cash-flows through SWP

Let us assume you invested Rs 50 lakhs in LIC MF Small Cap NFO, and began withdrawing Rs 30,000 every month through SWP from 1st July 2018 (you delayed the withdrawals by a year to avoid exit load and short term capital gains taxation). Despite withdrawing Rs 21.6 lakhs over the last 6 years, your investment would have grown in value to nearly Rs 94 lakhs (see the chart below, as on 19th June 2024). Your XIRR returns over this period would have been 14.4%. For moderate rates of withdrawal LIC MF Small Cap Fund has the potential of generating long term cash-flows for investors along with potential capital appreciation.

Source: Advisorkhoj SWP calculator, as on 19th June 2024

Who should invest in LIC MF Small Cap Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high risk appetites

- Investors with minimum 5 year investment tenures

- We think that SIP is the best mode of investment for small cap funds over long investment horizons.

- However, investors can also take advantage of deep corrections to tactically invest in lump sum.

- You can also invest in this fund through 3 – 6 months STP from LIC MF Liquid or Ultra Short Duration Fund.

Investors should consult with their financial advisors if LIC MF Small Cap Fund is suitable for their investment needs.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. The change in Risk-o-meter will be evaluated on a monthly basis. For Scheme related details, including updation in Riskometer (if any) may please be referred on our website: www.licmf.com

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY