LIC MF Large and Midcap Fund: On an upward trajectory

Current market context

The market has recovered after the Lok Sabha election results and is now trading at record highs. The broader market has outperformed Nifty 50 on an YTD basis – Nifty 500 TRI has given 8.8% absolute returns on an YTD basis versus Nifty 50 TRI YTD return of 4.17% (as on 31st May 2024). Over the past 1 year, midcap and small cap funds attracted a lot of investor interest. However, with market at record highs, a more balanced approach towards asset allocation with long horizons may be prudent investment strategy.

Why invest in large and midcap funds now?

- As per SEBI’s mandate for large and midcap funds, the scheme will invest in minimum 35% in large cap stocks (top 100 stocks by market capitalization) and minimum 35% in midcap stocks (101st to 250th stocks by market capitalization). The funds can provide a balance of risk and returns.

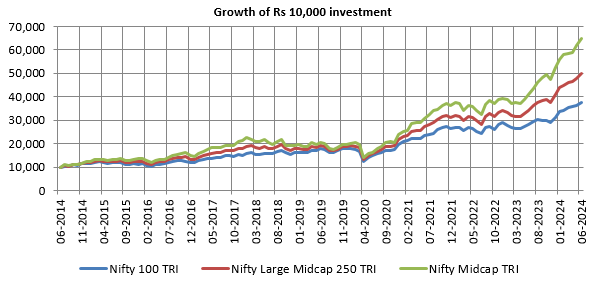

- A diversified portfolio of large cap and midcap stocks can produce superior long-term returns, while reducing downside risks in volatile markets. The chart below shows the growth of Rs 10,000 investment in Nifty 100 TRI (large cap), Nifty Large Midcap 250 TRI (large and midcap) and Nifty Midcap 150 TRI (midcap) over the last 10 years.

Source: National Stock Exchange, Advisorkhoj Research; Period: 01.06.2014 to 31.05.2024.

- Large caps have a heavier tilt towards certain sectors like BFSI, IT, Oil and Gas, FMCG. Large and midcaps provide more balanced exposure to sectors like Capital goods, Consumer services and Realty, where large cap has low or no exposure. These sectors can benefit from India’s consumption driven economic growth, rising per capita income, changing global supply chain landscape (e.g. China+1), Government’s policies e.g. import substitution (Make in India), digitization, infrastructure spending, shift from unorganized to organized sectors etc.

- Over the last 1 year or so, we have seen huge inflows in midcaps especially from retail investors through mutual funds. In May 2024, AUM of midcap funds crossed AUM large cap funds for the first time in history. High demand for midcap stocks may have raised prices of these stocks, making investors nervous. At the same time, India is in a macro sweet spot both in terms of GDP growth and fiscal consolidation pathway. IMF is forecasting India’s GDP to grow by 6.8% in FY 2025, making it the fastest growing G-20 economy. India’s fiscal deficit in FY 2023-24 is estimated to be 5.8% and will be pared down to 5.1% in FY 2024 -25. Interest rates have peaked and the 10 year G-sec yield has been softening over the past year or so. In the current market context, a well balanced exposure to different market cap segments through large and midcap funds can be suitable for long term investors.

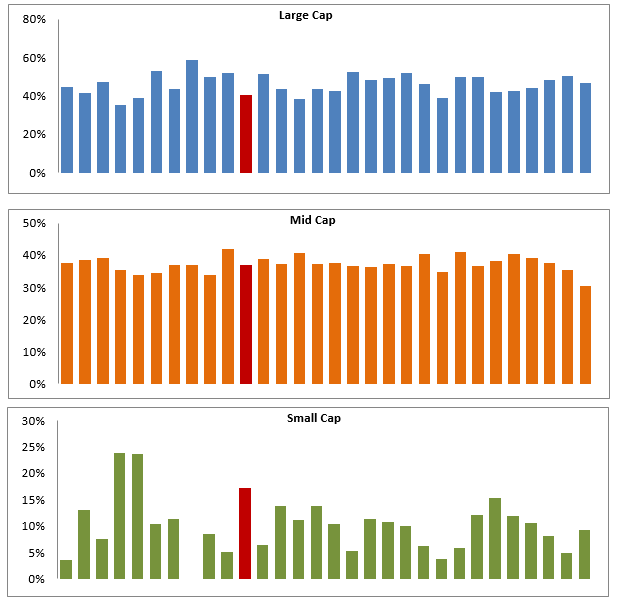

LIC MF Large and Midcap Fund–=Balanced market cap allocations relative to peers

The scheme (red) is currently reasonably balanced between market caps relative to peers. The small cap allocation of the fund is higher than the peer average – alpha creation potential in the long term.

Source: Advisorkhoj Research, as on 31st May 2024

Strong performance in last 1 year

LIC MF Large and midcap had underperformed in the past, but it is making a strong recovery in performance. Nifty 50 is the bell weather of Indian stock market. If we want to evaluate the performance of any equity fund, then it is very natural that we will see how the fund performed versus Nifty. LIC MF Large and Midcap Fund has outperformed the Nifty by a big margin in the last 1 year, as on 17th June 2024 (see the chart below).

Source: Advisorkhoj Research

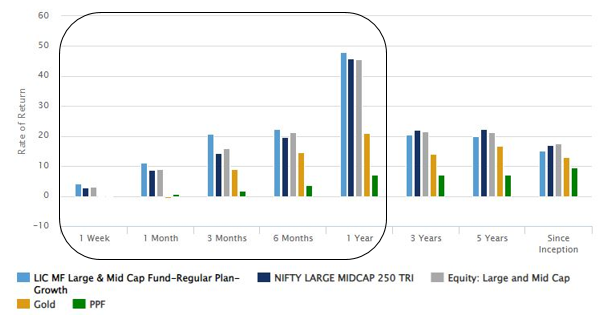

Outperformed both benchmark and category average in recent time periods

You can see in the chart below that while the fund underperformed in the past, it is on an upward trajectory outperforming the benchmark index Nifty Large Midcap 250 TRI and the Large and Midcap Funds category over more recent time periods e.g. 1 month to 1 year. Though 1 year is short time period to evaluate performance, the fund is on the right track in terms of performance recovery.

Source: Advisorkhoj Research

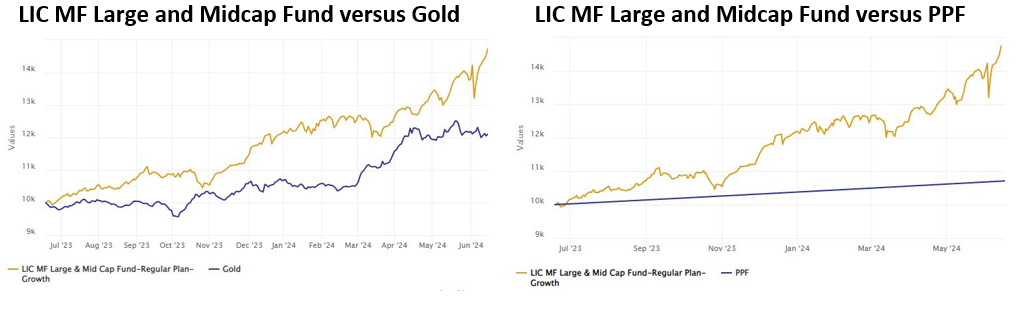

Outperformed other asset classes

Source: Advisorkhoj Research

Superior risk adjusted returns in last 1 year

Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of LIC MF Large and Midcap Fund over the last 1 year. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of LIC MF Large and Midcap Fund over last 3 years was 99% which implies that if the benchmark index went up by 1% in a month, then the fund’s Net Asset Value (NAV) went up by 0.99%; in other words, the fund was able to capture almost the entire market upside. The Down Market Capture Ratio of the fund was only 80% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.8%; in other words, the fund was able to limit the downside risk of investors in falling markets. An up market capture ratio, which is higher than the down market capture ratios e.g. market capture ratios of LIC MF Large and Midcap Fund is clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

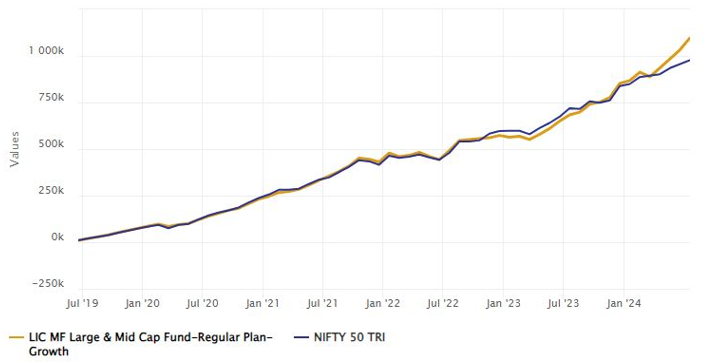

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in LIC MF Large and Midcap fund versus Nifty 50 TRI over the last 5 years (as on 17th June 2024). With a cumulative investment of Rs 6 lakhs, you could have accumulated a corpus of nearly Rs 11 lakhs in the last 5 years.

Source: Advisorkhoj Research

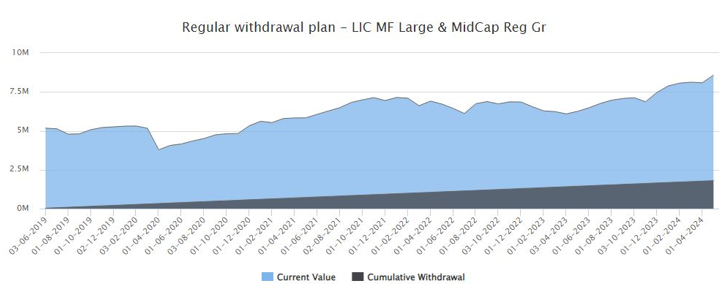

Regular cash-flows through SWP

The chart below shows the cumulative withdrawals and current value of Rs 30,000 monthly SWP from Rs 50 lakhs invested in LIC MF Large and Midcap Cap over the last 5 years. Let us assume you invested in Rs 50 lakhs in LIC MF Large and Midcap Cap on 1st June 2018, and began withdrawing Rs 30,000 every month through SWP from 1st June 2019 (you delayed the withdrawals by a year to avoid exit load and short term capital gains taxation). Despite withdrawing Rs 18 lakhs over the last 5 years, your investment would have grown in value to nearly Rs 88 lakhs (as on 31st May 2024). Your XIRR returns over this period would have been 14.5%. For moderate rates of withdrawal LIC MF Large and Midcap Cap has the potential of generating long term cash-flows for investors along with potential capital appreciation.

Source: Advisorkhoj SWP Calculator

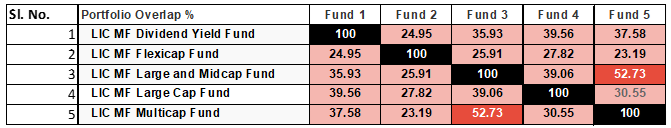

Low overlap with other LIC MF diversified equity funds

LIC MF Large and Midcap Fund has relatively low overlap with other LIC MF diversified equity funds (see the table below). You can also see that other diversified equity schemes have relatively low overlap with each other. You can build your core equity portfolio with Large and Midcap Fund and other diversified funds from LIC MF as per your risk appetite.

Source: Advisorkhoj Research, as on 31st May 2024

Who should invest in LIC MF Large and Midcap Fund?

- The fund is suitable for the investors who are looking for capital appreciation with a long-term investment horizon.

- Those who have moderately high risk appetite and may want to invest in both large-cap and mid-cap stocks.

- Those who would like to invest in stocks of large cap & midcap category.

- You can invest either in lump sum or SIP depending on your financial situation and investment needs.

- If you are worried about volatility, you can also invest in the scheme through 3 to 6 months Systematic Transfer Plan (STP) from LIC MF Liquid Fund.

- Those who have an investment horizon of more than 3 years.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Large and Midcap Fund is suitable for their investment needs.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. The change in Risk-o-meter will be evaluated on a monthly basis. For Scheme related details, including updation in Riskometer (if any) may please be referred on our website: www.licmf.com

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY