LIC MF Infrastructure Fund: Consistently outperformed benchmark

Current economic and market context

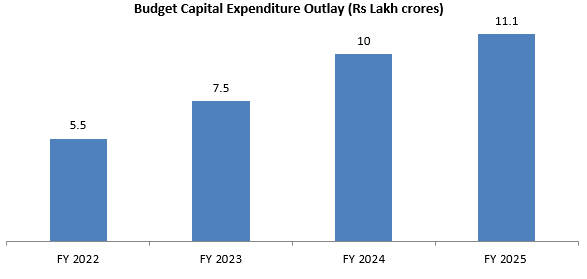

India was the fastest growing G-20 economy in FY 2024. IMF has forecasted India’s FY 2025 GDP growth to 7%, which will again the highest growth rate among G-20 economies. The fiscal deficit has been narrowing – from 6.4% in FY 2023 to 5.6% in FY 2024. In 2024 Union Budget, the fiscal deficit target for FY 2025 is 4.9%. Government borrowing for FY 2025 will be Rs 1.4 lakh crores less than what was estimated in the interim Budget. This may lead to softening of bond yields. The capex outlay for FY 2025 is Rs 11.11 lakh crores, which is Rs 1.1 lakh crore higher than the previous fiscal year.

MSCI India Index in dollar terms (17.17% YTD returns as on 30th June 2024) has outperformed MSCI EM Index (7.49% YTD returns as on 30th June 2024). Higher foreign institutional investors (FII) flows can be expected in the near to medium term since India is the bright spot in emerging markets basket. FIIs net flows in equity was nearly Rs 26,000 crores in June and Rs 31,000 crores in July MTD (as on 23rd July 2024). DII flows have continued to provide strength to the equities market, which is trading near its all time high.

Infrastructure is crucial for India Growth Story

India's nominal GDP is expected to grow from $3.6 trillion in 2023 to $5.8 trillion in 2028 (source: IMF). IMF is forecasting that India will become the third largest economy of the world by 2028-29. The Government wants to promote economic growth by focusing on the manufacturing sectors. It has been proactive in developing policy frameworks aimed at creating a business environment that is conducive for creating high growth manufacturing ecosystem in our country. Improving infrastructure network is crucial step in creating a high growth manufacturing ecosystem. In the last 3 years, the Government spend Rs 23 lakh crores on infrastructure development in areas of roads, highways, ports, power transmission etc. Government spending is likely to have a multiplier effect on private capex investments and industrial growth in India.

Some of the major polices and schemes announced by the Government to boost infrastructure and manufacturing are Make in India, the National Infrastructure Pipeline, PM GatiShakti Master Plan, National Logistics Policy, RCS-UDAN, Sagarmala, Bharatmala, Digital India scheme, Telecom Technology Development Fund, and PLI.

Capital expenditure is crucial in driving infrastructure development. GCF is the most important factor of production particularly in a developing economy. Gross Capital Formation (GCF) has been lagging GDP growth in the past decade. This is largely due to private sector under-investment in capex relative to Government spending. India is witnessing a gradual recovery in private capital expenditure (capex). The Economic Survey 2024 has highlights that non-financial private sector GCF measured in current prices, expanded vigorously in FY 2022 and FY 2023. In the current and coming years, we can see a further surge in private sector capex. Overall the outlook for infrastructure sector is very bright.

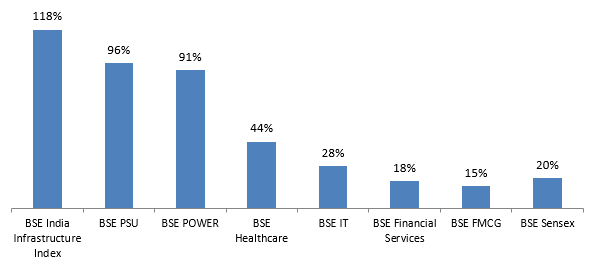

Infrastructure – One of the best performing sectors in the last 1 year

Source: Bombay Stock Exchange, Advisorkhoj Research, as on 22nd July 2024

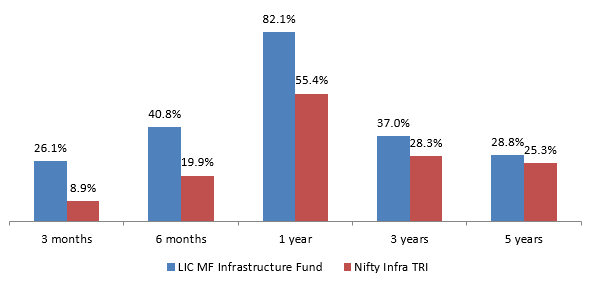

LIC MF Infrastructure Fund – Outperformed the benchmark

LIC MF Infrastructure Fund was launched in 2008. The fund has given 82.1% return in the last 1 year, outperforming the benchmark index Nifty Infrastructure TRI by a large margin. The chart below shows the 1, 3 and 5 year returns of the fund versus the benchmark Index. You can see that the fund has generated alphas for investors.

Source: NSE, Advisorkhoj Research, as on 22nd July 2024

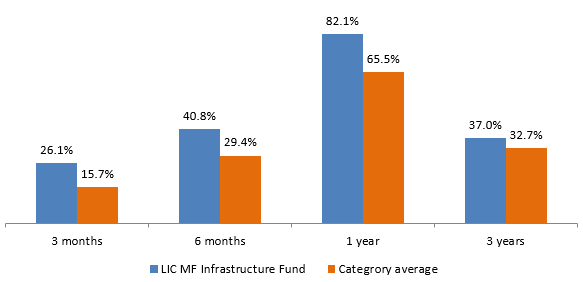

LIC MF Infrastructure Fund – Outperformed the category

Source: Advisorkhoj Research, as on 22nd July 2024

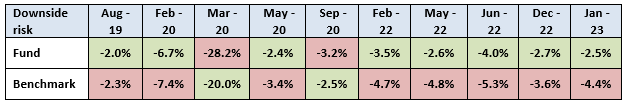

LIC MF Infrastructure Fund – Limited downside risks relative to benchmark

The table below shows the months in which the fund and the benchmark gave negative returns in the last 5 years. You can see that the fund was less volatile than the benchmark in most months when the benchmark index corrected.

Source: Advisorkhoj Research, as on 22nd July 2024

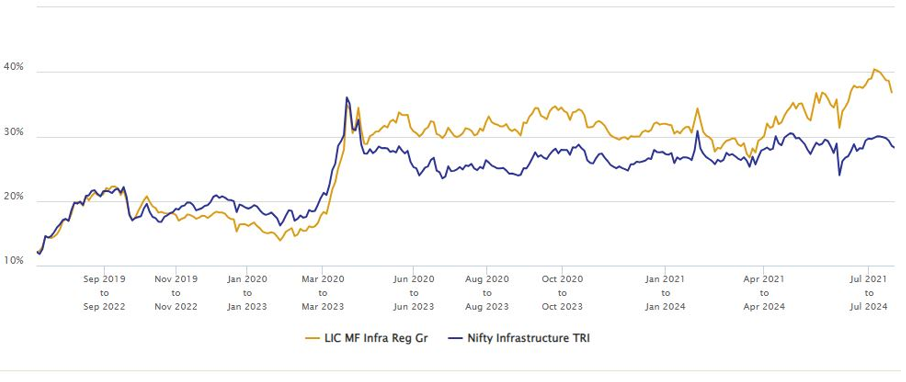

LIC MF Infrastructure Fund – Consistently generated alphas over long investment horizon

The chart below shows the 3 year rolling returns (returns over 3 year investment tenure) of LIC MF Infrastructure Fund versus its benchmark index over the last 5 years. You can see that after a period of underperformance the fund has made a strong recovery and has been consistently outperforming the benchmark index across different market conditions.

Source: Advisorkhoj Rolling Returns, as on 22nd July 2024

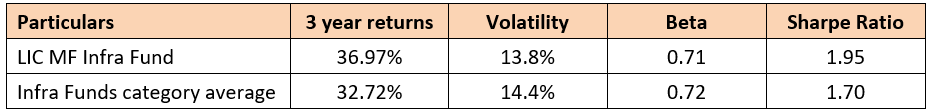

LIC MF Infrastructure Fund – Superior risk adjusted returns relative to peers

To compare performance on the basis of risk adjusted returns of LIC MF Infrastructure Fund versus peers, we compared the 3 years CAGR returns of fund versus benchmark, along with Volatility and Beta of the fund versus benchmark. You can see that despite giving higher returns than the category average, the volatility and beta (both measures of risk) of the fund was lower the category average. This is further validated by superior Sharpe Ratio (a measure of risk adjusted returns) of the fund versus the category average. The fund is in the Top Quartile in terms of risk adjusted returns.

Source: Advisorkhoj Research, as on 22nd July 2024

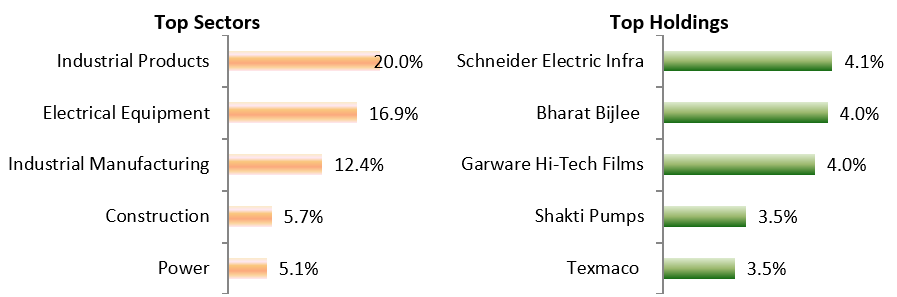

Current portfolio positioning

Source: LIC MF, as on 30th June 2024

Why invest in LIC MF Infrastructure Fund?

- Indian infrastructure sector is now on a structural uptrend driven by Government expenditure and private enterprises capex cycle.

- Indian manufacturing sector is also likely to be key driver for infrastructure driven by capex cycle supported by domestic demand, exports, PLI schemes and China+1 policy.

- LIC MF Infrastructure Fund encompasses entire theme of Traditional and Modern Infrastructure covering sectors like Roads, Ports, Power, Railway, Engineering and Capital Goods, Defence, Logistics etc.

- LIC MF Infrastructure Fund has a track record of alpha creation.

- Our take: Like several other equity schemes of LIC Mutual Fund, LIC MF infrastructure Fund has shown a significant improvement in performance over the past year or so. The fund is now a top quartile fund in the infrastructure sector category. The fund has the potential of creating alphas for investors over sufficiently long investment horizons.

Who should invest in LIC MF Infrastructure Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio

- Investors looking for capital appreciation over long investment tenures from manufacturing theme

- Investors with very high risk appetites

- Investors with minimum 3 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Infrastructure Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY