LIC MF Infrastructure Fund: Benefit from infrastructure growth in India

Role of sectoral / thematic funds

When you are planning to build an equity portfolio, you can think two components in your portfolio – a core portfolio and a satellite portfolio. The core portfolio should be built based on your long term financial goals (e.g. children’s higher education, children’s marriage, retirement planning etc) and your risk appetite. Diversified equity funds are best suited to be part of your core portfolio. In addition to the core portfolio, you can also have a satellite portfolio where you can take relatively higher risks to get higher returns. Sectoral and thematic funds can be part of your satellite. Different sectors or investment themes perform varyingly across market/economic phases. Sectoral or thematic funds provide the opportunity of getting higher returns than the broad market and boost your overall portfolio returns.

Infrastructure Sector has outperformed the broad market

The infrastructure sector has outperformed the broad market since the economy was opened up after the COVID-19 pandemic in 2020-21 (see the chart below). Government spending on the infrastructure sector since the 2021 Union Budget has benefitted the stocks in this sector and this has in turn helped them in outperforming the market.

Source: National Stock Exchange, mutualfundtools.com, as on 30th November 2023

Market and economic context

Equity markets have rallied since the US Federal Reserve indicated that it will not hike interest rates and signalled possible rate cuts in 2024. India is the best performing major economy (7.2% GDP growth in FY 2022-23). Although, the IMF has projected the global growth to fall from 3.5% in 2022 to 3% in 2023, it has raised India's GDP projection from 6.1% to 6.3% for 2023 reflecting stronger-than-expected consumption during April-June quarter. MSCI India Index (USD) in dollar terms (12.19% returns as on 30th November 2023 YTD)has outperformed MSCI EM Index (6.08% returns as on 30th November YTD). India will be key investment destination for foreign institutional investors in the coming months and quarters.

Infrastructure is crucial for India Growth Story

India's nominal GDP is expected to grow from $3.5 trillion in 2022 to $7.3 trillion by 2030. Government wants to promote growth by focusing on the manufacturing sector and increase its contribution to the economy. It has been proactive in developing policy frameworks aimed at creating a business environment that is conducive for creating high growth manufacturing ecosystem in our country, for which improving infrastructure network is crucial requirement. Some of the major polices and schemes announced by the Government to boost infrastructure and manufacturingare Make in India, the National Infrastructure Pipeline, PM Gati Shakti Master Plan, National Logistics Policy, RCS-UDAN, Sagarmala, Bharatmala, Digital India scheme, Telecom Technology DevelopmentFund, and PLI.

Private Sector Capex spending will drive infrastructure growth

Capital expenditure is crucial in driving infrastructure development. Gross capital formation (GCF) refers to the aggregate of gross additions to fixed assets (i.e., fixedcapital formation). GCF is the most important factor of production particularly in a developingeconomy. Gross Capital Formation (GCF) has been lagging GDP growth in the past decade. For instance, gross capital formation has fallen from 36.7% to 29.6% of GDP over last ten years. This is largely due to private sector under-investment in capex relative to Government spending. However, the time is ripe for private sector capex spending as corporate balance sheets have improved significantly. You can see in the chart below that, debt equity ratios of companies have fallen. Lower debt to equity ratio in balance sheets, along with lower cost of financing in declining interest rate regime can boost capex spending and infrastructure growth.

Source: MOSL Institutional Equity

Opportunities for the infrastructure sector

- Improving capacity utilization in factories is likely to result into huge investments across Road, Ports, Power, Railways, Logistics, Manufacturing plants etc.

- The Defence indigenization program has positively grown the order books of Indian companies catering to the defence sector. Growth in exports are also likely to boost defence manufacturing

- Realignment in global supply chains e.g. China +1 strategy will benefit India

- The railway ministry is targeting 100% electrification of its network and laying of at least 2,000 km of new tracks, as well as rolling out more Vande Bharat trains in the upcoming years. Railway capex will boost demand

- The Government is prioritizing highway building. EPC companies with proven track record are likely to benefit immensely from higher allocations to Railways in the Budget

- National logistics policy will be a significant step in fulfilling India’s aspiration of being a developed country

About LIC MF Infrastructure Fund

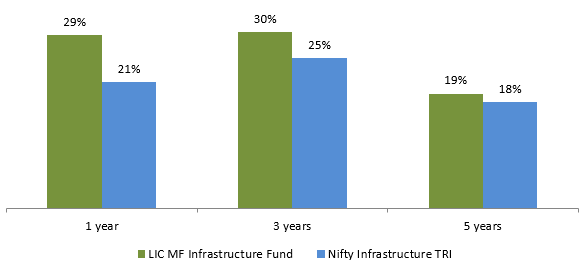

LIC MF Infrastructure Fund was launched in 2008. The fund has given 29.2% return in the last 1 year, outperforming the benchmark index Nifty Infrastructure TRI. The chart below shows the 1, 3 and 5 year returns of the fund versus the benchmark Index. You can see that the fund has generated alphas for investors.

Source: NSE, Advisorkhoj Research, as on 30th November 2023

The table below shows the growth of Rs 10,000 monthly SIP in LIC MF Infrastructure Fund

Source: Advisorkhoj Research, as on 30th November 2023

Portfolio Construction

Source: Advisorkhoj Research, as on 30th November 2023

Why invest in LIC MF Infrastructure Fund?

- Indian infrastructure sector is now on a structural uptrend driven by Government expenditure and private enterprises capex cycle.

- Indian manufacturing sector is also likely to be key driver for infrastructure driven by capex cycle supported by domestic demand, exports, PLI schemes and China+1 policy.

- LIC MF Infrastructure Fund encompasses entire theme of 'Traditional and Modern Infrastructure covering sectors like Roads, Ports, Power, Railway, Engineering and Capital Goods, Defence, Logistics etc.

- LIC MF Infrastructure Fund has a track record of alpha creation.

Who should invest in LIC MF Infrastructure Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from manufacturing theme.

- Investors with very high-risk appetites.

- Investors with minimum 5-year investment tenures.

- You can invest either in lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Infrastructure Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multi Cap Fund: Good choice for long term investors in current market

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Balanced Advantage Funds: Good risk return trade off with relatively lower volatility

- LIC MF Value Fund: Good fund in volatile market

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY