LIC Large and Mid-cap fund: A good performing equity fund

The LIC MF Large and Midcap fund was launched on Feb 2015, and since its inception about 9 years ago, it has given a CAGR return of 13. 51% till date (6th January 2024). Large and Midcap funds are good investment options for investors looking at exposure to the Top performing 250 funds listed at the Indian stock exchanges. SEBI classifies the top 100 stocks by market capitalization as large cap stocks and the next 150 stocks by market capitalization as midcap stocks.

According to directives issued by SEBI, large and midcap schemes must invest at least 35% of their assets in large cap stocks and at least 35% of their assets in midcap stocks. SEBI’s mandate for large and mid-cap schemes is quite flexible, allowing considerable freedom to fund managers in terms of market cap mix according to their outlook.

About LIC MF Large and Mid Cap Fund -

The LIC MF Large and Midcap fund is managed by Mr. Yogesh Patil and Dikshit Mittal. The scheme completed almost 9 years since its inception in Feb 2015, and the NAV has grown steadily over this period (See chart below). The NAV of the Regular growth option of the scheme stands at Rs 30.80 as on 5th January 2024.

With an AUM of Rs 2,360.57 Cr, (as on 30th Nov 2023) the fund has an expense ratio of 1.98% (for the regular plan) and the direct plan has a lower expense ratio of 0.77%. The scheme tracks the benchmark NIFTY Large Midcap 250 TRI.

If you had invested a lump sum of Rs 10,000/- in the LIC MF Large and Midcap Fund (Regular, growth) at its inception, your investment would be worth Rs 30,753 as on 5th Jan 2024. The fund gave over 13.50 CAGR returns.

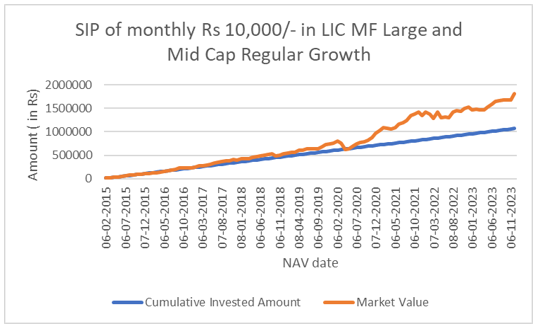

A monthly SIP of Rs 10,000/- started on its inception would have grown to Rs 22,17,023 against an investment of Rs 10,70,000/- giving an impressive XIRR of around 16% (as on 5th January 2024) - See the chart below -

Source: Advisorkhoj Research, as on 5th January 2024. Disclaimer: Past performance may not be repeated in future.

The portfolio of LIC MF Large and Midcap fund Regular Growth -

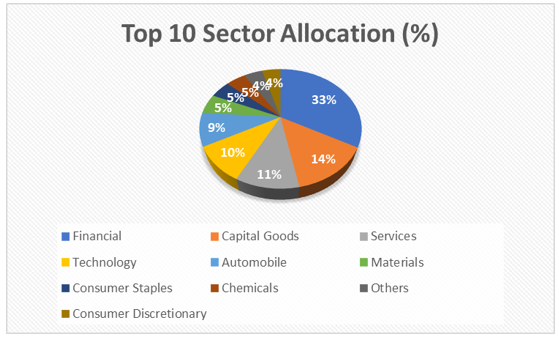

The fund allocates the highest percentage of its investment to the financial sector i.e. 29%, followed by capital goods and services. The pie chart below shows the top 10 sector allocation of the fund.

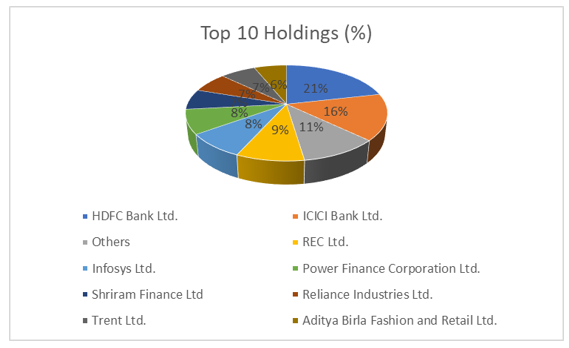

The Top 10 holdings of the LIC MF Large and Mid-Cap fund is as follows -

Why invest in LIC MF Large and Midcap Fund?

- The Indian economy is going through an up cycle which will come to fore as global macroeconomic challenges recede over next few quarters. Corporate and bank balance sheets are now in the best possible shape to drive capex and credit respectively. The earnings growth / valuation expectations context is turning more and more favorable.

- Large and mid-cap stocks are an integral part of the India growth story. Both the market cap segments will benefit from the Government’s structural reforms, infra spending which is likely to have a multiplier effect on private capex, digitization, shifting geo-politics and implications of global supply chain.

Who should invest in LIC MF Large and Midcap Fund?

LIC MF Large and Midcap Fund is suited for someone who is looking for a long-term growth-oriented style of equity investing with smooth experience, as the portfolio is relatively well balanced from a risk management point of view.

Investors should consult with their mutual fund distributor or financial advisors if LIC MF large and Midcap fund is suitable for their investment needs.

About LIC MF AMC -

LIC Mutual Fund is a Public Sector Undertaking (PSU) asset management company (AMC) with stakeholders LIC of India, LIC Housing Finance Ltd, GIC Housing Finance Ltd and Union Bank of India. The AMC was established in 1989; one of the first AMCs to be established when the Government wanted to bring in more players in the mutual fund industry after more than 2 decades of monopoly of Unit Trust of India. LIC MF offers a complete basket of products covering ETF, Debt, Equity, Hybrid, Passive schemes and Solution oriented themes. LIC has built a brand which is synonymous to trust. LIC Mutual Fund, under the aegis of LIC of India, strives to achieve a similar level in the Mutual Fund Industry.

In July 2023, some schemes of IDBI were merged with the schemes of LIC mutual fund. Following the acquisition of schemes of IDBI Asset Management Limited (IDBI AMC) by LIC Mutual Fund Asset Management Limited (LIC AMC), 10 of the 20 schemes of IDBI got added to the LIC MF product basket. The remaining 10 schemes of IDBI were added as it is to the LIC MF product offerings.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multi Cap Fund: Good choice for long term investors in current market

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Balanced Advantage Funds: Good risk return trade off with relatively lower volatility

- LIC MF Value Fund: Good fund in volatile market

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY