Market capture ratios in mutual fund selection can give better returns

Volatility is an intrinsic aspect of equity asset class. In the last 10 years, it seems that, business cycles are getting shorter and volatility is increasing in stock markets around the world. 2008 was a watershed year for markets in a number of respects; not only was it the worst bear market that most of us witnessed in our lifetimes till that point (and hopefully for the rest of our lifetime), but even 8 years later, we are still dealing with the after effects of the 2008 financial crisis. In fact, many of the major economic issues faced by capital markets are so challenging that, we can expect volatility to continue and even increase in the coming years.

Volatility has an impact

Volatility is not just worrying from a psychological perspective; it also has stressful financial implications for investors, especially when they are nearing their financial goals. If your equity investment loses a lot of value in market downturn, it will take that much longer to regain its value even after the market recovers. Therefore, while volatility is a necessary evil to get higher returns in the future, it is natural for investors to expect their equity investments to lose less value in downturns and appreciate more than the market in upturns. If your mutual fund scheme loses less value in downturn, it is better positioned, to capitalize on the higher base in subsequent rallies through the power of compounding.

Consistent performers out-perform in the longer term

While we are not saying that a mutual fund scheme which loses more than the market benchmark in downturns will always give lower long term returns than a scheme which loses less in downturns, we have observed that consistent (in both up and down markets) performers, generally deliver superior long term returns.

Our regular blog readers know that, Advisorkhoj is data driven in its approach to investing concepts and strategies. Let us provide you some data based evidence to support our assertion that, consistent performers generally deliver superior long term returns. We have developed a tool in our Mutual Fund Research section that can help investors identify the most consistent mutual fund schemes in any particular category of funds.

Please go to the link, Top Consistent Mutual Fund Performers on our website. Using this tool you can see the most consistent mutual fund schemes for any category (you can select the category from the drop down menu in the tool).

For the purpose of this discussion, let us focus on diversified equity funds. Make a mental note of the top 10 most consistent diversified equity funds (you can write the names down if you want). Next look up the top performing mutual funds (in the same category) over the last 5 years, by going to the link, Top Performing Mutual Funds - Equity Funds Diversified. Make a note of the top 10 diversified equity funds in this tool. Now compare the top 10 diversified equity mutual fund schemes in terms of 5 year returns with the list of Top Consistent Mutual Fund Performers. You will see that 8 out of the top 10 diversified equity schemes, in terms of 5 year returns, were also the most consistent performers.

This, we believe, is strong evidence that, consistent performers generally deliver superior long term returns. Please note that, our most consistent performers were identified on the basis of their annual performance (relative to peers), each year over the last 5 years. We had a variety of market conditions over the last 5 years, e.g. bull markets, bear markets and flat markets. The most consistent performers did well (on a relative basis, on average) in different market conditions, i.e. both bull markets and bear markets.

Separating milk from water

I will mention two famous quotes, one from investment guru, Warren Buffett and another from age old Indian tradition. First, the Warren Buffett quote, “You never know who is swimming naked until the tide goes out”; in other words, bull market performance / out-performance can simply be a result of taking more risks, which in turn will harm you in the bear market which invariably follows. Now to the age old Indian saying, “A swan (hamsa in Sanskrit) can separate milk and water”. What it really means is that, milk mixed with water, looks like milk and it is not possible for most of us to separate the two, but a swan (hamsa) can and hence it is considered to have special abilities (even divine) as per ancient Indian beliefs.

Our proverbial swan (hamsa) in the context of mutual funds is a concept that is increasingly gaining currency with mutual fund experts (especially in the US), Market Capture Ratios.

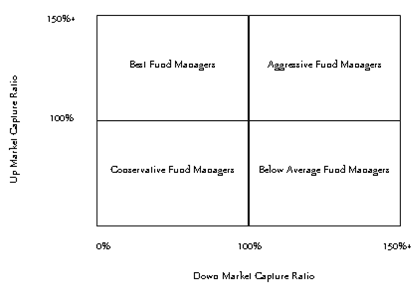

Market Capture Ratio is a conceptual and analytical framework, that helps mutual fund investors separate the up-market (market rising) and down-market (market falling) performances of mutual fund schemes, which trailing return, as a measure, is not able to distinguish. Market capture ratios reveal the fund manager’s attitude towards risk and also his / her abilities to deliver higher risk adjusted returns.

Market Capture Ratios

Up Market Capture Ratio measures the percentage of market gains captured by a fund manager when markets are up. If Up Market Capture Ratio of a mutual fund scheme is more than 100%, it means that the fund manager was able to beat the market benchmark in upturns. If Up Market Capture Ratio is less than 100%, it means that the fund manager was not able to beat the market benchmark in upturns.

For aggressive mutual fund investors, sufficiently high Up Market Capture Ratio should be an important consideration. You should know that, mutual funds investments involve a cost (expense ratio), which may not be apparent to you because it is priced in the Net Asset Value (NAV) of your mutual fund units; the cost is justified, only if the fund manager gives you better returns than the market benchmark; otherwise there are cheaper investment options (e.g. ETFs).

Even more important than Up Market Capture Ratio, in our opinion, is Down Market Capture Ratio. Down Market Capture Ratio measures the percentage of market losses suffered by your mutual fund scheme when markets are down. If Down Market Capture Ratio of a mutual fund scheme is less than 100%, it means that the fund manager was able to protect your investments from falling as much as the market benchmark in downturns. If Down Market Capture Ratio is less than 100%, it means that the fund fell less than the market benchmark in downturns. As discussed earlier, if your mutual fund scheme loses less value in downturn, it can capitalize on the higher base in subsequent rallies which will follow the downturn. This 2X2 Market Capture Ratio matrix reveals useful fund manager attributes.

You can find market capture ratios of equity mutual fund schemes on our website by using our research tool, Market Capture Ratio.

How to use Market Capture Ratio tool

First, you should shortlist mutual fund schemes based on your investment criteria and requirements. You should always evaluate multiple schemes to make the best investment decision. Once you have shortlisted the schemes, bucket them into categories, e.g. large cap, diversified, small/midcap, ELSS etc. Then go to our Market Capture Ratio tool. Select the category from the drop down menu and then enter scheme name in the appropriate box. We have built auto-type capability for scheme selection in our Mutual Fund Research section.

You need to type the first few letters of the scheme name and our program will display a list of potential schemes. If your scheme is not in the list, type a few more letters and our program will identify the scheme name for you. Once you enter all the scheme names that you want to evaluate, select the appropriate period by selecting from the drop down menu. A three year period is commonly used for mutual fund performance analysis, but in our opinion, for market capture ratio analysis you should use a longer period because, as discussed earlier, we think that, down market capture ratio is a more important metric and a 3 year period may not have enough down market periods and therefore not appropriate for market capture ratio analysis; as such, 5 years or longer periods is more suitable for this analysis.

However, if significant changes to the investment strategy of a fund (e.g. market cap strategy, change in fund manager, shift from value to growth investing or vice versa) within the investment period that you chose, then the analysis of the period is irrelevant and you should chose a period that more accurately reflects the changed circumstances of the mutual fund scheme. For example, if the fund manager of a scheme changed 3 or 4 years back, then you should select a three year period.

Our Market Capture Ratio tool gives investors three metrics, Up Market Capture Ratio (average percentage increase in scheme NAV relative to the market benchmark increase, when market is up), Down Market Capture Ratio (average percentage fall in scheme NAV relative to the market benchmark fall, when market is down) and Capture Ratio. When using our Market Capture Ratio tool, please note the following, when making equity mutual fund investment decisions.

- High (more than 100%) “Up Market Capture Ratio” is good, because it means the fund manager is able to generate higher than market returns when market is rising.

- Low “Down Market Capture Ratio” is good, because it means the fund manager is able to provide some downside risk protection when market is falling.

- Negative “Down Market Ratio” means that even in periods when the market fell, the fund on an average gave positive returns, which is always good for investors.

- Capture Ratio is the ratio of Up Market Capture Ratio and Down Market Capture Ratio. High Capture Ratio is good because it implies good risk adjusted returns. Negative Capture Ratio is also good, provided the negative is on account of negative “Down Market Capture Ratio”.

Why is Down Market Capture Ratio important?

While high Capture Ratio (ratio of Up Market Capture Ratio and Down Market Capture Ratio) is a great attribute for a fund, in our opinion Down Market Capture Ratio is more important ratio. As discussed earlier, an investment which falls less in market downturns has a higher base to compound off from, when participating in subsequent rallies. Statistical evidence also suggests that, funds with lower Down Market Capture Ratio are more likely to outperform compared to other funds.

We looked at market capture ratios of large cap, diversified and midcap funds in India over the last 5 years, and selected all funds whose Down Market Capture Ratio was less than 80%. 65% of these funds were in top 2 quartiles in terms of 5 year trailing returns, which we believe is fairly good statistical evidence of the effectiveness of Down Market Capture Ratio as a parameter for fund selection. Of course, Up Market Capture Ratio is also important. There are no magic rules for fund selection, but you can use down market capture ratio as the first filter (our proverbial swan which can separate milk from water) in your final scheme selection process and then use up market capture ratio or capture ratio to select the schemes that can give you best possible returns.

Conclusion

In advisorkhoj.com our objective is to arm investors and financial advisors with knowledge so that they can make the best investment decisions. Keeping pace with the global best-in-class practices of mutual fund research, we also endeavour to develop tools that can help investors put their knowledge to execution with minimal effort. In this post, we discussed the importance and effectiveness of using market capture ratios in making equity mutual fund investment decisions. Mutual fund investors and financial advisors in the US are increasingly using this to make investment decisions. We saw in this post that, market capture ratio is also extremely relevant in the Indian context as well.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY