Investing in Mutual Funds: Risks and Returns

Mutual Funds were first launched in India in 1964 in form of units by Unit Trust of India. The first scheme was US 1964. UTI enjoyed monopoly till 1987 after which marked the entry of non-UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LICI) and General Insurance Corporation of India (GIC). Private sector funds were launched from 1993 onwards and thus started a new era in the Indian mutual fund industry. This gave the Indian investors a wider choice of fund families and schemes across various sectors and companies. The Mutual Fund market has since seen stellar growth and currently around there are 46 players in the Mutual Fund market. A rising concern for the market stays that even though the companies providing Mutual Funds are increasing; India still remains an untapped market.

Theoretically, in a country that has a majority of financially backward population, middle class and above middle class workers, an idea like Mutual Funds should boom. Investors can invest a sum as small as र 500 in high return generating schemes. However, the reality is far from it. The public has a perceived notion of Mutual Funds being risky or they remain unaware about it. While the Mutual Fund market has come a long way the investors have failed to mirror the growth. With more than 46 MF players in the market, the population tapped is a little above maybe 5% or so.

It has been close to fifty years since Mutual Funds were first introduced to the financial markets. From then to now it has been a long journey with private players coming into the market and new products constantly being introduced to the market. However, penetration of this means of investment is yet to become a household phenomenon. Efforts are being made by SEBI and the Asset Management Companies concerned to spread investment awareness. It is also yielding results albeit slow. As the younger generation enter workplaces, they are becoming increasingly aware about their savings and investment. Hence, in the future it can be expected the penetration would increase and people would embrace this as go to form of investment.

If you are reading this and you have already been investing in Mutual Funds or contemplating such an investment, then you are doing yourself a favour. You are creating a second source of income on your investments. However, you have to understand one aspect: different investor's need different solutions. There are no quick fixes and short cuts; it always starts with yourself, your needs and your wants. You can start by asking yourself these questions:

Why Mutual Funds

It is natural for the seed of doubt to remain there because you are surrounded by traditional forms of investments which are now providing returns of around 8 – 10%. These are assured returns which are provided without posing any risk to the capital. Given such security, you may want to compromise on the extra returns that the MF claims to provide. However, there are certain parameters you need to familiarize yourself with. Savings accounts, fixed deposits and all other forms generate returns through simple interest. Mutual Funds generate returns with compound interest. Compound interest generates higher returns than simple interest because it creates a chain of interest by accounting the interest on interest. Hence, when you have the option to earn higher returns why do you wish to settle for less? Calculate the returns that you can expect from Mutual Funds here https://www.advisorkhoj.com/tools-and-calculators/systematic-investment-plan-calculator

The Returns to Expect

None of the Mutual Fund products promise guaranteed returns. If anyone has told you otherwise they are trying to miss sell you the product. While you cannot accurately predict the returns, you can make an estimation based on the past performance and the current market conditions.

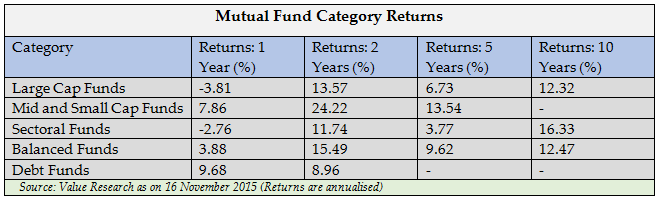

Returns of Various Categories: Different Mutual Fund products have the tendency to generate varying returns. The table below reflects the category return of a few of the categories. The returns in categories are always correlated to risk. Hence, higher the risk in a category, higher is the possibility of generation of returns over a longer period of time.

Investment Appetite and Return: The return that you expect to generate is also closely related to your investment appetite. If your investment appetite is bent towards a steady income generation then categories such as Large Cap Equity Funds or Balanced funds maybe good options to explore. If your investment appetite is bent towards aggressive investments then you may consider investments in Sectoral funds or Mid and Small Cap Funds. Hence, the higher the risk you are capable of taking, you increase your chances of earning returns.

You also expose your portfolio to volatility which may have adverse consequences. For example if you are concentrating your investments in Sectoral funds, they are known to be extremely volatile funds. So they cannot form an integral component of your portfolio. However, Diversified Equity Funds, which are also risky, are excellent investments for long term. In long term investments investors get high returns as the volatility reduces over a period of time. Hence, gauge your investment appetite and then you can estimate the returns your portfolio could generate.

What Determines Your Investment and Risk Appetite

Risk and investments appetite is not absolute; rather it changes with changes in circumstances closely related to the investor. Some investors are willing to change their investments and make new ones or some maybe stubborn and dismiss new ideas as too risky because of the following factors:

- Current Circumstances: The age of the investors, investible amount, the nature and amount of income determines the investment risk and appetite. A young investor may not have a lot to invest because of low starting salaries but they have high risk taking appetite because of their young age. An investor approaching retirement will have high investing appetite but low risk taking appetite.

- Past Experience: If you have had good experience with Mutual Funds in the past and have been able to generate substantial returns you will be open to further investments and taking higher risks. However, investors with no past experience will be wary of all new forms. Even investors who may not have generated satisfactory returns will tend to look for other form of investments.

- Personal Attitude: Your attitude towards investing matters quite a bit. Are you able to withstand notional losses for long term growth? These are aspects that determine what kind of an investor you are. If you are unable to withstand any form of losses or volatility then you might consider capital preservation or protection funds. However, if the volatility of equity does not irk you or bother you to the point of withdrawal you may stay invested for long term growth.

How Much to Invest

This is perhaps the most crucial question. How much is enough? How much of your net worth or salary should be engaged in investments? There is no fixed answer to this question. Rather it depends on quite a few factors:

Investment Objective: The objective determines how much you will invest. What is the purpose of your investments? A lot of investors seek capital appreciation and capital preservation. These investment objectives are usually exercised by investors who have retired or are close to their retirement period. In such period they cannot afford to face any losses and must preserve capital at all costs.

A lot of investors seek long term growth and a means of income generation. These are usually exercised by investors who have a considerable investment life ahead of them. They have financial goals to fulfil such as higher education, retirement planning payment of EMIs and are seeking long term growth. Generation of income is also one of the key aspects of investments as investments must be treated as a second source of income. Hence, depending on these aspects an investor has to figure out their investment objective and start investing accordingly.

Investors also invest to reduce tax liability. Equity linked Saving Schemes or ELSS is one such tax saving instrument where investors investing up to र 1,50,000 get tax rebates under Section 80C as per their income tax slab. Hence, you are investing in equities and saving taxes as well. ELSS falls under the 'Exempt-Exempt-Exempt' or EEE tax rebate where the investment, the accumulated amount and the withdrawal amount or the matured amount or dividends are all tax free.

Stock of Your Finances: The amount you can invest is determined by how much you earn and how much you spend. Hence, before you start investments or make fresh investments take a stock of your finances and figure out what are your overhead expenses. Once you have taken into account the earnings and expenditure, you can determine how much you are able to save and if it can be increased by cutting back expenses.

The Future Value of Investments: Once you have determined your present expenses you need to start taking the future into consideration. There is one factor that Mutual Fund takes into consideration that often traditional forms of investment ignore the inflation. Returns generated by Mutual Funds are always higher post the inflation adjustment. Your present investments have to suffice for the future; simply put the future value of your investment is going to be higher than its present value because of the rising inflation, check this https://www.advisorkhoj.com/tools-and-calculators/future-value-calculator. Based on these facts investor has to ensure that present investments are enough to meet the future needs. Mutual Funds are a way of ensuring that your savings stay protected from inflation.

Conclusion

Gold, real estate and fixed deposit have been the go to investment for every Indian household. The primary reason being these investments in gold and real estate are tangible and presence of it is a constant reminder of an investment gone right. However, if statistics are to be believed in the last ten to twenty years stock market has been the highest return generators. However, Indians are still unwilling to invest because they are risk aversive by nature. They perceive Mutual Funds to be risky and not aware of the fact that there are various kinds of funds that cater to varying investing needs. For the risk averse investors there are Capital Protection Funds, Debt Funds, Liquid Funds, Monthly Income Plans and so on. For the moderate risk takers there are Balanced and hybrid funds. For the young, aggressive and long term investors there are Diversified Equity Funds, Mid and Small Cap Funds and so on. Hence, it is the time to embrace Mutual Funds, a better return generator whether you like risk or you do not. It is also advisable to take help of a financial planner who can access your risk taking ability and recommend the schemes suitable for you.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY