Big difference in returns of top and poorly performing mutual fund schemes

About twelve years back, when I had been working in the US for a few years and had most of my savings invested in fixed income, I was looking to work with a financial advisor to help me increase my asset allocation in equities. A colleague at work recommended a financial advisor and this advisor worked with me to create a financial plan for me and my wife. One of the underlying assumptions in the financial plan was to get 8 - 10% returns from my equity investments (which, in the US, is considered to be the average long term equity returns). Since I was myself, working in the financial services, I kept track of my investments relative to the market. Three years after I started working with this advisor, I asked him whether we should have a re-look at our portfolio, since a number of the mutual funds were giving 4 – 5% higher returns than what I was getting from the schemes in my portfolio, which were, by the way, in line with the assumptions in my financial plan. My advisor told me, “Since you are already getting what you need as per your financial plan, why bother”? What he said may have been right from his perspective, but it was bit of a cultural surprise for me because I remembered from boyhood days in India, my mother going to 10 different shops in Sarojini Nagar market in New Delhi and bargaining endlessly just to get a र 100 cost saving; here, in my case, we were talking about a lot more money.

More recently, I have come across blogs where the moot point is if the financial advisor ensures that, the minimum investor expectations is met, the advisor has done a good enough job. It makes sense for investors to have reasonable expectations and good financial advisors would like their clients to have reasonable expectations. If an investor has reasonable expectations, he or she is more likely to be disciplined; if an investor has unreasonable expectations then he or she is likely to be undisciplined and take more risks than is warranted. When the going gets tough, which is bound to happen from time to time in equity markets, such investors redeem their investments and in the process, harm their long term financial objectives.

While I completely agree that investors should have reasonable expectations, let us ask ourselves this practical question. Are investors should be satisfied if just their minimum expectations are met? Consider this example. You expected 15% annualized return on your investment over 10 years, for which you started an SIP in a mutual fund scheme. After 10 years you got 15% returns on your investment, but your friend got 20% by investing in a different scheme and taking the same amount of risk. Will you be thrilled with your achievement?

For the sake of illustration, let us assume you invested र 5,000 monthly through SIP in a mutual fund scheme for a period of 10 years, and got 15% returns. Your friend also invested र 5,000 monthly through SIP in a mutual fund scheme in the same asset category, for the same period, but got 20% returns. Do you know how much difference in value terms would the 5% difference in returns be? Your investment value after 10 years would be र 13.8 lakhs, while your friend’s will be र 18.8 lakhs; a र 5 lakh difference in value!

If your financial advisor tells you that (hopefully he or she is not), getting more returns always means taking more risks, I will call that, lazy financial advisory. If higher returns always meant higher risks, then it means that all fund managers are the same and we would not have had terms like Alpha, Sharpe Ratio, Market Capture Ratios etc. Some mutual fund schemes outperform others, while taking the same amount of risk. This outperformance is not random from a statistical perspective, but is quite systematic if you look at the long term historical outperformance of some mutual schemes versus others. At the same time, you must remember that, historical performance is not an assurance of future performance. But, as an investor, you have the right to question why did not get, the highest possible returns on your investment, for the amount of risk that you have taken.

Mutual fund investors in India have a large number of options to choose from. There are hundreds of schemes from a large number of fund houses across a variety of categories, which makes it a difficult task for the investors to choose a fund. The first step of an investment process is to determine your investment objectives and risk tolerance level. Depending on your investment objectives, you should decide which category of funds will be suitable for your investment purpose and risk tolerance. Within a specific category, investors should choose a fund that gives the best returns on investment.

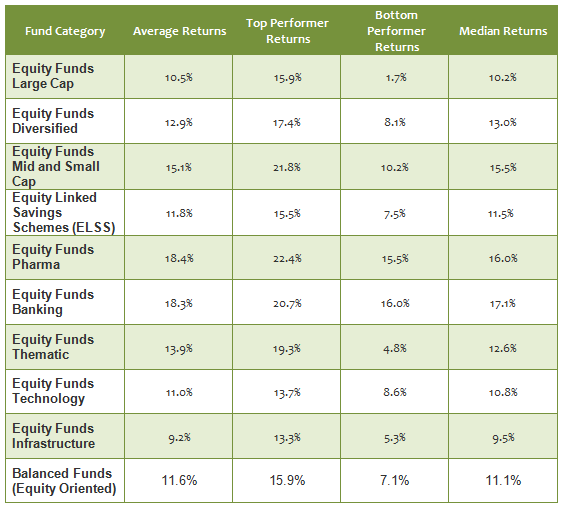

There is a big performance differential between top, average bottom performers, across various fund categories. In this post we will focus only on equity mutual funds, where the performance gap between top and bottom performers is usually the widest. You will hear some financial advisors saying that, over a long period of time there is not much difference in performance of different funds within a particular mutual fund category. Let us examine if this is true or not. The table below shows the category-wise average, top performer, bottom performer and median annualized trailing 10 year returns.

Source: Advisorkhoj Mutual Fund Category Returns

You can see that, there is a significant performance gap between the top and bottom performers even over a 10 year investment period. For a number of categories, the difference in annualized returns between top and bottom performer is as high as 8 – 10%. A difference of 8 – 10% in returns can make a huge difference in net worth over a 10 year period. Let us take diversified equity funds as example and assume that one investor invested र 1 lakh in the top performer 10 years back, while another investor invested the same amount in the bottom performer. Assuming both investors remained invested for 10 years, the value of र 1 lakh investment in the bottom performer today will be र 2.2 lakhs, while that of the top performer would be nearly र 5 lakhs. If you had invested in an average performer, the value of र 1 lakh investment made 10 years back will be र 3.4 lakhs, which is still considerably much lower than the returns you would have got from the top performer.

Let us now discuss, what median return means. Approximately 50% of all the mutual fund schemes in a category gave higher than median category returns, while around 50% of all the schemes in a category gave lower than median returns. Therefore, if a mutual fund scheme in your portfolio gave median returns over a specific time-scale, you should know that 50% of the schemes in that category gave better returns than your scheme. While most of us would be very disappointed if our portfolio schemes is in the bottom 50% over a sufficiently long time period, we will not also be satisfied if our scheme returns are near the median returns or thereabouts. When we invest our hard earned money, we expect the best results from our investments, do we not?

How to invest in the best performing funds?

In Advisorkhoj, we get a number of queries, asking us which are the best funds to invest over the next 5 years or 10 years. It is not possible to forecast accurately, what will happen in the future, especially over a long investment horizon. It is impossible to tell, which fund will give the highest return in the next 5 years or 10 years. Instead of trying to guess, which fund give the highest, you should aim to invest in funds top quartile funds.

Quartile rankings are a measure of how well a mutual fund has performed against all other funds in its category. The rankings range from "Top Quartile" to "Bottom Quartile" for all time periods covered in our drop down menu above. Mutual funds with the highest percent returns in the chosen time period are assigned to "Top Quartile", whereas those with the lowest returns are assigned to "Bottom Quartile". Quartile rankings are compiled by sorting the funds based on trailing returns over a period chosen by the user. Funds in the top 25% are assigned the ranking of "Top Quartile", the next 25% are assigned a ranking of "Upper Middle Quartile", the next 25% after that are assigned a ranking of "Lower Middle Quartile" and the lowest 25% are assigned the ranking of "Bottom Quartile". You can use our Quartile Ranking Tool to identify top quartile funds.

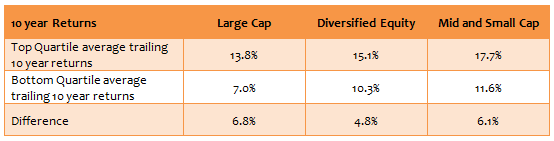

The table below shows the average trailing 10 year returns of top quartile funds versus bottom quartile funds of some equity fund categories.

You can see that, the difference in returns between Top Quartile Funds and Bottom Quartile Funds is quite substantial. You should endeavour to invest in top quartile funds and avoid bottom quartile funds.

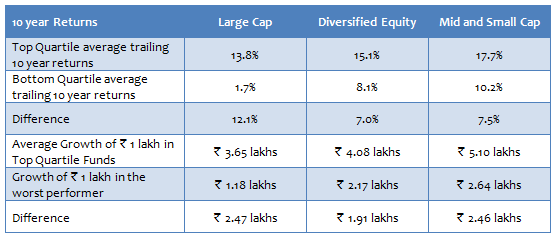

Let us now see the difference in returns of top quartile funds and the worst performers of respective categories. The difference in return is quite shocking.

It is easier to identify a top quartile fund than trying to guess which fund will give the highest return. However, you should know that, a top quartile fund can suffer a drop in ranking due to a variety of factors. If the drop is temporary, it is not an issue, but a drop in performance over considerable length of time will harm the interest of the investor. Therefore, before investing in top quartile fund, you should research whether, the quartile rank is a result of spurt in performance or has the fund showed consistency in performance.

We have developed an easy to understand tool that enables investors to see consistency of quartile rankings of mutual fund schemes over a period of time. Please see our Top Consistent Mutual Fund Performers tool in the Mutual Fund Research Centre of our website. To identify most consistent performers in a particular category, we have looked at annual quartile ranking of funds over the last 5 years and assigned consistency scores to funds based on the quartile ranks.

Funds which have consistently been in the top 2 quartiles have got the highest consistency scores, while funds which were in the lower quartiles in any year in the last 5 years got lower consistency scores. Performance consistency is a very important factor if you want to get the best returns from your investment.

In Advisorkhoj, we believe that, it is the fund manager, the research organization supporting him or her and the investment mandate of the fund that plays the most important roles in an equity fund’s performance. Performance measures like Rolling Returns, Alpha, Sharpe Ratio, Market Capture ratios etc reveal more about the fund manager’s performance than the historical trailing returns. You will find information on all these measures in the MF Research Centre on our website.

When should you replace underperforming funds in your portfolio?

A financial advisor once told me that, investors who forget that they even made an investment and remain invested for a very long period of time, get rewarded very handsomely. There is truth in what he said. I, myself, forgot about a few of my mutual fund investments and remained invested for more than 15 years; I got exceedingly good returns from those schemes.

Having said that, maybe I was lucky, because those schemes which I forgot, were really good schemes. But it was equally possible that, I could have invested my money in a scheme that underperformed for a long period of time, while I forgot about that investment. Many investors remain invested in underperforming schemes, either due to negligence or in the hope that the schemes will bounce back. When a scheme bounces back in performance terms, it becomes an attractive investment proposition for new investors, but such a scheme will take a long period of time to make up for the opportunity loss of investors, who remained invested in the scheme through its protracted period of underperformance. You should not wait forever, before making a decision to replace an underperforming fund because it can cost you a considerable amount in returns.

On the other hand, if a fund in your portfolio underperformed in the last one year, should you go ahead and replace it? No, you should give it some more time. There are a variety of factors that can cause a fund to outperform / underperform in the short term. Different sectors tend to perform differently depending on market conditions. The trailing returns of a mutual fund will depend on how the market conditions affected the stocks in the fund portfolio. Once conditions change and become favourable, an underperforming fund can outperform. As a general rule, you should observe a fund’s performance for about three years, before drawing any conclusion.

Conclusion

A very experienced and well renowned New Delhi based stock broker once told me that money must grow. I am sure you will agree with what he said, but for me the pace of growth is as important because it can make a big difference to wealth creation. It takes a little bit of self learning and practise to get the best results from the investment of your hard earned money. I keep telling people through our blog that, it is your money; why not put in the extra effort to get the best results. Identifying funds that will perform well in the future is not easy. A good financial adviser will be able help the investors to identify funds in the top quartile, so that they can maximize the return on their investments.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY