Asset Rebalancing will reduce your portfolio risk and improve returns

We have discussed the importance of asset allocation a number of times in our blog. Asset allocation ensures that you invest in the right asset class to meet your financial goals. It ensures that, you take the right amount of risk; too much or too little risk, can both harm your financial goals. One aspect of asset allocation often ignored by many retail investors in India is the importance of asset re-balancing.

What is asset re-balancing?

Some time back, I read an interesting analogy between asset allocation and gardening in a finance blog. Think of your investment portfolio as your garden. It takes meticulous planning and hard work to plant a garden. But what will happen, if you do not tend to your garden? Different plants and shrubs grow at different rates depending on the season. The different plants in your garden will start competing with each other for space, water and nutrients. Therefore, if you do not tend to your garden (weed, prune, water) on a regular basis, your garden will soon bear an untidy look. Also the faster growing plants may harm the growth of slower growing plants.

Similarly, in your investment portfolio, depending on the asset cycles, some asset classes will grow faster than other asset classes. Remember, different asset classes have different risk / return profiles. Therefore, over a period of time the risk profile of your investment portfolio can be very different from the risk profile that, you had envisaged.

Let us understand this, with the help of a simple example. Let us suppose, you invested र 10 lakhs in equity and debt assets. You desired asset allocation is 60% equity and 40% debt. Let us assume, the equity assets grow at 17% compounded annual growth rate (CAGR) over the next 4 years, while the debt assets grow at 7% CAGR. After 4 years your total investment value will र 17.7 lakhs. What will your asset allocation be after 4 years? It will be 70% equity and 30% debt; in other words, your investment portfolio has become more risky than you had intended it to be in the first place.

As an investor, you may be quite happy with the returns (र 7.7 lakhs profit on an investment of र 10 lakhs) but not concerned about the change in your asset allocation. However, you must remember that, bear markets are inevitable in asset cycles. Let us suppose in year 5, equity falls by 30%, while debt continues to give 7% returns. Your portfolio value after year 5 will be र 14.3 lakhs (र 3.3 lakhs year on year loss). With a 60% equity and 40% debt asset allocation, you would have expected a loss of 15% if equity fell by 30%, but in reality your loss was nearly 20%. It is surely going to hurt you, especially, if you needed the money at the end of year 5, but you should ask yourself, why did you make a bigger loss? Because over the last 4 years, your asset allocation and the risk profile of your investment changed considerably. This is why asset rebalancing is important.

Asset rebalancing is reviewing your investment portfolio on a regular basis and making suitable changes to your portfolio, to bring it back to your desired asset allocation. Asset rebalancing reduces the volatility of your portfolio returns (volatility is always stressful) and also gives you a higher return on your investment. In this post, we will discuss the importance of asset rebalancing and show how it not only reduces your portfolio risk, but also improves your overall portfolio returns.

Asset Rebalancing Techniques

There can be a variety of asset re-balancing techniques. The most basic asset re-balancing technique is reviewing your investment portfolio from time to time and switching from one asset class to another, to bring it back to your target asset allocation technique. Investors who have the requisite expertise can use more sophisticated techniques to switch between equity and debt depending on relative valuations and yields, e.g. investors can switch from equity to debt when equity valuations seem expensive (please see our post, Valuation Matters: How can you use valuations to make better investment decisions) and vice versa. Investors should also rebalance their asset allocation as they approach their specific investment goals, e.g. switch from more risky to less risky asset.

Asset Rebalancing Reduces Risk

We will discuss with an example, how asset re-balancing reduces your overall portfolio risk. Let us recap the basic concept first. Depending on where we are in the asset cycles, some asset classes grow faster than other asset classes. This causes an imbalance in portfolio asset allocation relative to your desired allocation. Going back to our gardening example, in different seasons, different plants in your garden grow faster than some other plants. If you want to maintain the desired look of your garden, you have to prune to faster growing plants and provide more water, nutrients etc to the slower growing plants.

Similarly, in your portfolio from time to time you should prune or trim faster growing assets, e.g. equity and add to slower growing assets, e.g. debt, to bring your portfolio back to the desired asset allocation. Please, remember we said trim and not cut, because cutting would defeat the purpose of asset allocation. Gardeners among our readers would know that, trimming has to be done with a lot of care. You should trim only the amount (or units of mutual funds) that is required to bring it back to the desired asset allocation. You should then add the trimmed surplus to the asset that is growing slowly.

Let us now discuss the example. For our analysis, we have looked at a 15 year period from the beginning of 2001 to 2016 (September 22). This period included several market cycles (bull markets and bear markets). We had a great bull run in India from 2004 to 2007. We also had the worst global financial crisis in the last 80 years in 2008. Post 2008, we had both bull and bear markets. Since, we are covering wide variety of market conditions in our analysis, it is not biased by any particular market condition(s) and therefore, the conclusions we can draw will be fairly robust.

Let us go back into the past and assume that, we are in the beginning of 2001 and we have र 10 Lakhs to invest. Our desired asset allocation is 60% equity and 40% debt. For our equity investment (र 60% of र 10 Lakhs = र 6 Lakhs), let us assume that, we invested in CNX Nifty (or an index fund that tracks the Nifty. We could have also invested in a diversified equity mutual fund and could have got higher returns than the Nifty, but for the sake of simplicity in this analysis, let us assume we invested the equity portion of our portfolio in Nifty. The chart below shows the Nifty price movement over the last 15 years.

Source: Advisorkhoj Research

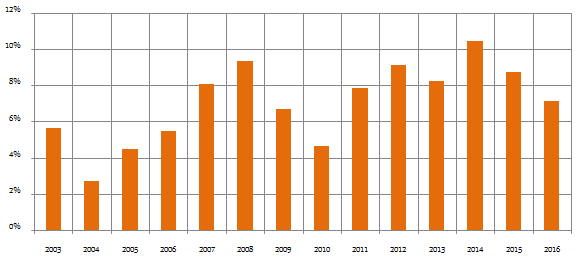

For the debt portion of our investment (र 40% of र 10 Lakhs = र 4 Lakhs), we chose a short term accrual debt fund. We will explain why we chose a short term accrual debt fund later. Let us assume that, the returns of short term debt fund are the same as the returns of CRISIL short term bond fund index. In reality, a short term debt mutual fund would have beaten the CRISIL short term bond fund index, but in this post, we are discussing a concept and therefore, we will not get into a discussion on which debt fund scheme gave the best returns. For the sake of simplicity, we are assuming that we got returns of the CRISIL short term bond fund index. The chart below shows the annual returns of CRISIL short term bond fund index from 2002 to 2016.

Source: Advisorkhoj Research

We used the most basic asset re-balancing technique, which is reviewing your investment portfolio from time to time and switching from one asset class to another, to bring it back to your target asset allocation technique. So we reviewed our asset allocation after each year, and if the allocation percentage of an asset was higher than the desired allocation (60% equity and 40% debt), we would reduce that asset class and add to the other asset class. Let us now explain why we chose short term accrual debt fund for our debt investment. Since we will rebalance our asset at the end of every year, we did not want to take interest rate risk in our debt investments. Short term accrual debt funds have very low interest rate risk. Please note further that, the base year of CRISIL short term bond fund index is April 2002. Since, our analysis begins at 2001, we have taken the prevailing bank 1 year fixed deposit rates as proxy for CRISIL short term bond index.

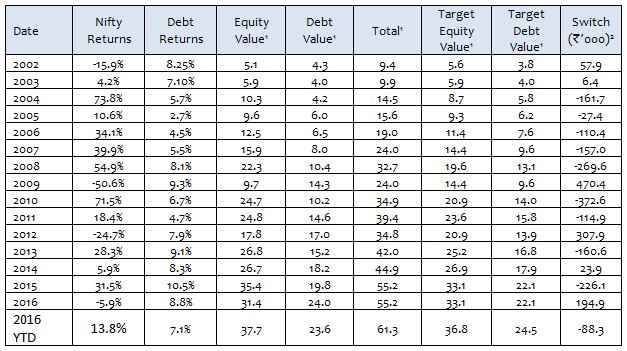

In 2001 Nifty fell by nearly 16%, whereas debt gave 8.25% return. The equity value of our portfolio was र 5.04 Lakhs and debt value of our portfolio was र 4.33 Lakhs (total र 9.37 Lakhs). Our asset allocation ratio at the end of 2001 was, therefore, 54% equity and 44% debt. Remember our target asset allocation was 60% equity and 40% debt. Therefore, we switched र 58,000 from debt to equity to bring it back to our target asset allocation (of 60% equity and 40% debt) in the beginning of 2002. After rebalancing our equity portion was र 5.62 Lakhs and debt value of our portfolio was र 3.75 Lakhs. In 2002 Nifty rose by 4.2%, whereas debt gave 7.1% return. The equity value of the portfolio at the end of 2002 was र 5.86 Lakhs and debt value of our portfolio was र 4.01 Lakhs (total र 9.87 Lakhs).

Our asset allocation ratio at the end of 2002 was 59% equity and 41% debt. The equity allocation was still less than the target allocation; the debt allocation being higher. Therefore, we switched र 6,400 from debt to equity to bring it back to our target asset allocation in the beginning of 2003. After rebalancing our equity portion was र 5.93 Lakhs and debt value of our portfolio was र 3.95 Lakhs. In 2003 Nifty rose by 74% (a bumper year for equity), whereas debt gave 5.7% return. The equity value of the portfolio at the end of 2003 was र 10.3 Lakhs and debt value of our portfolio was र 4.17 Lakhs (total र 14.5 Lakhs). We were now in a profit, but our asset allocation ratio at the end of 2003 was 71% equity and 29% debt. The equity allocation was more than the target allocation, while the debt allocation was less.

Since the equity allocation at the end of 2003 is more than the target allocation (debt allocation is less), therefore, even though we were tempted by equities, we switched र 1.62 Lakhs from equity to debt to bring it back to our target asset allocation (of 60% equity and 40% debt) in the beginning of 2004. After rebalancing our equity portion was र 8.69 Lakhs and debt value of our portfolio was र 5.79 Lakhs. The table below shows how asset re-balancing worked in all the years:-

Notes: 1) In र Lakhs 2) Positive signs implies switch from debt to equity and negative sign implies switch from equity to debt.

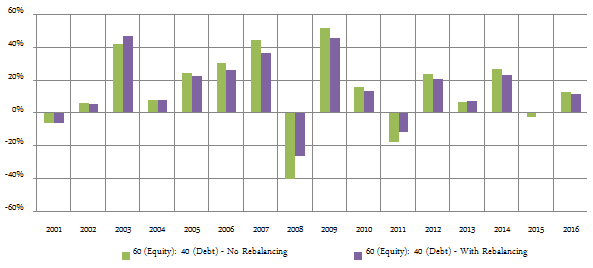

In our blog, we have always stressed the importance of discipline in investing, because we believe discipline is more important than intelligence in your final investment outcome. Discipline essentially is controlling your emotions and sticking to your strategy. Two human emotions influence our investing behaviour, greed and fear. Greed and fear, more often than not, lead to two outcomes in capital markets, real losses or opportunity losses. From an emotional standpoint, both greed and fear cause us to regret later. A disciplined investor is not driven by these emotions and simply sticks to his or her strategy. We will now see how this strategy paid off. The chart below shows the annual returns of two strategies; the green bars show the annual returns when you do not make any change to your portfolio (no asset re-balancing) and the purple bars shows the annual returns with asset re-balancing.

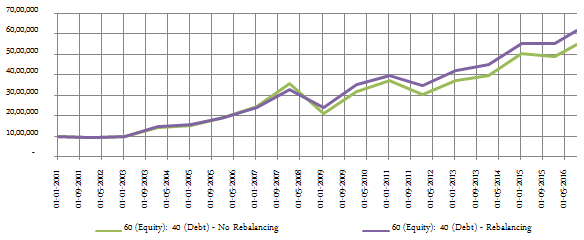

You can see that, with rebalancing (purple bars) your losses in bear markets / corrections are much smaller. The volatility of your portfolio is significantly lower with asset rebalancing. Lower volatility adds stability to your portfolio, should you need the money for your personal needs at a time when markets are in correction mode. While the volatility with asset rebalancing is lower (hence risk is lower), let us see which strategy would have given higher absolute returns over the last 15 years. The chart below shows the growth of र 10 Lakhs in a 60% equity and 40% debt portfolio in two scenarios; one with no asset rebalancing (green line) and another with asset rebalancing (purple line).

You can see that, asset rebalancing (purple line) gave us higher returns compared to no rebalancing (green line). र 10 Lakhs investment in 2001 would have grown to र 54 Lakhs by September 22, 2016 with no rebalancing. However with asset rebalancing, the same र 10 Lakhs investment in 2001 would have grown to र 61 Lakhs by September 22, 2016. The delta between the two strategies is र 7 Lakhs. The asset rebalancing strategy gave a CAGR of 12.9% on our investment, while no asset rebalancing would have given a CAGR of 12% only. Readers should note that, in our analysis, we ignored the impact of taxes but even we included taxes in our analysis, it would make only a marginal impact to our final outcome.

Conclusion

The asset rebalancing strategy that yielded almost 1% extra CAGR was not rocket science. The reason why asset rebalancing lowers risk and gives higher returns is also very intuitive. Asset rebalancing essentially means, we are buying low and selling high, the mantra of investing success. What it involved was a little bit of extra effort in monitoring your asset allocation, that too only once every year.

You do not have to worry about equity valuations and fixed income yields. All you have to do is to see the current equity to debt allocation percentages from time to time and rebalancing your portfolio to align it with the desired asset allocation. If you are working with a good financial advisor, you can outsource even that little bit of extra effort to your advisor. You and your financial advisor can also work together, to enrich the basic asset rebalancing strategy with valuation based investment decisions and further enhance your returns. Most professional / institutional investors incorporate asset or portfolio rebalancing in their investment strategy. Financial advisors should also integrate asset rebalancing as part of their portfolio management strategies for their clients, to help them navigate better through the vagaries of capital markets and meet their client’s financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY