Ghar Ghar Mutual Fund: Har Ghar SIP

Mutual funds have come a very long way in India as part of household financial assets. As on 30th April 2023, there were nearly 15 crore mutual fund folios (source: AMFI). Retail investors and high net worth individuals (HNIs) held nearly Rs 24 lakh crores of mutual funds as part of their financial assets. Systematic Investment Plans (SIPs) has become one of most popular way of saving and investing in mutual funds. As per AMFI data, there were 6.42 crores SIP accounts as of end of April 2023. Rs 12,000 – Rs 13,000 crores are invested every month in mutual funds through SIP.

Given the progress made by mutual funds over the last 25 years or so, Ghar Ghar Mutual Fund, Har Ghar SIP is a realizable aspiration. However, we have a long way to go, if we compare ourselves to developed economies. As per RBI’s report on household savings, mutual funds comprise only 7% of household financial assets (source: RBI, September 2022). In the United States, 23% of household assets are invested in mutual funds (source: Statista, 2021)

SIPs for family’s financial goals

Every family has financial goals. Stage of life financial goals like buying a house, taking a family vacation, children’s higher education, children’s marriage, supporting the needs of senior citizen parents, retirement planning and leaving an estate for loved ones are important priorities for all families. Your family can achieve these financial goals by investing in a disciplined and systematic way in mutual funds from their regular savings through SIPs. Commitment of every family member to the family goals will contribute to the success in achieving your goals. As a family, you need to be disciplined in your savings and investments - Family SIPs for your family goals.

Suggested reading - Women and Money

SIPs for individual financial goals

Apart from family financial goals, individual family members may have their own aspirations. Grandparents may want to go on a pilgrimage or vacation with their friends. Dad may want to upgrade his car or buy a watch. Mom may want to become an entrepreneur and needs to save funds required as capital to start her business. A child may want to take specialized course in an area of his / her interest e.g. computer programming, flying lessons etc. A child with aspirations in arts e.g. music, film making etc may need to funds to buy the equipment required to pursue his / her interests. You need to save and invest to achieve your individual aspirations. Every family member should start a SIP for their own goals – One Goal, One SIP.

Teach your children the importance of financial discipline

You should teach your children the importance of a financial discipline from a young age; this will go a long way in helping them achieve financial success in their lives. You should encourage them to start a SIP from their pocket money. Your children can start with a monthly SIP as low as just Rs 500 or even lower (e.g. Rs 100). If they start from the age of 9 to 10, they will accumulate a substantial sum by the time they are 19 – 20 years old. They will not have to ask for money from their elders to make a purchase they want; they can use their own investments. Most importantly, you will help them inculcate a habit of savings and prevent developing the bad habit of relying on debt to fund expenses.

Why invest through SIPs?

- With SIPs, you can start investing in mutual funds from a young age to get compounding benefits over long investment tenures.

- SIPs can help you remain disciplined in your investments. Investment discipline means that you invest according to your financial plan and not make impulsive decisions based on market movements.

- SIP can help you benefit from market volatility through Rupee Cost Averaging. By investing through SIP in market corrections / bear markets, you will be accumulating units at a lower cost. This can give your higher capital appreciation in the long term.

Financial freedom for the family

Today work related stress and rising cost of lifestyle is taking a toll on our mental and physical health. As per a recent ICMR study (9th June 2023, Economic Times), cases of hypertension (high blood pressure) and diabetes is rising rapidly in India. Stress related to financial security affects not just the earning members of the family, it affects all family members. How to reduce or eliminate this stress? This answer is financial freedom.

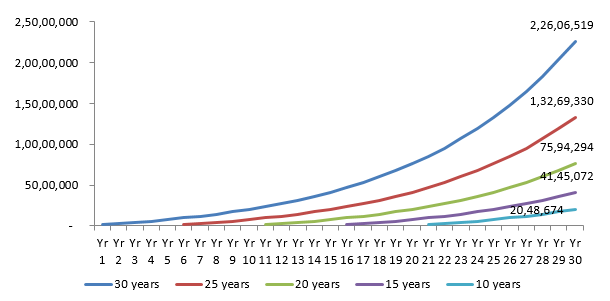

Financial freedom essentially means that income or capital appreciation from your investments will be sufficient to meet your living expenses. Financial freedom does not necessarily mean retirement; it simply means that you will be stress free as far as meeting your expenses or sustaining your lifestyle is concerned. The chart below shows the wealth creation by Rs 10,000 monthly SIP over different investment tenures (e.g. 30 years, 25 years, 20 years etc) assuming 10% CAGR return on investment. You can see that the power of compounding is higher over long investment tenures.

Disclaimer: The above chart is purely illustrative for investor education purposes and is not an indicator of actual returns on your investments. Mutual funds are subject to market risks. Consult with your financial advisor before investing. The Financial Solution(s) stated above is ONLY for highlighting the many advantages perceived from investments in Mutual Funds but does not in any manner, indicate or imply, either the quality of any particular scheme or guarantee any specific performance/returns. 'Past performance may or may not be sustained in future'.

'Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund is not guaranteeing / offering / communicating any indicative yield/returns on investments'.

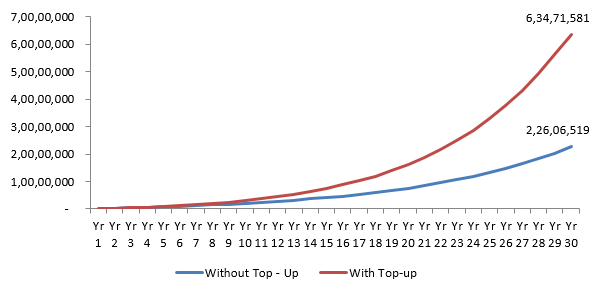

SIP Top-up is a mutual fund facility using which you can increase your SIP instalments at regular intervals e.g. half yearly, annual etc. You should use SIP top-up facility to increase your investments as your disposable increases over time. The chart below shows the wealth creation by Rs 10,000 regular monthly SIP and monthly SIP with 10% annual top-up over 30 year investment tenure (assuming CAGR return of 10%). You can see that SIP Top-up can help you achieve financial independence faster and also create more wealth for you.

Disclaimer: The above chart is purely illustrative for investor education purposes and is not an indicator of actual returns on your investments. Mutual funds are subject to market risks. Consult with your financial advisor before investing. The Financial Solution(s) stated above is ONLY for highlighting the many advantages perceived from investments in Mutual Funds but does not in any manner, indicate or imply, either the quality of any particular scheme or guarantee any specific performance/returns. 'Past performance may or may not be sustained in future'.

'Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund is not guaranteeing / offering / communicating any indicative yield/returns on investments'.

Through SIP / SIP Top-up your family can achieve financial freedom. Free from stress, you can focus on health, your family, your dreams and desires.

Make SIPs a part of your family’s financial habits

You have to pay rent / home loan EMI every month, your children’s school fees, utility bills, credit card bills etc. It has become part of your habit. Similarly, your child may be attending coaching / tuition classes, cricket / tennis / any other sport coaching, music lessons etc. It becomes a part of their habit. If your family likes eating out once every week / month or take a vacation once / twice a year or etc these are also likely to become your family’s habits. Similarly, you can make SIPs part of your financial habits. Once you develop a good habit, you are bound to get good results in the long term.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY