Financial Independence: Mutual Fund Sahi Hain

On 15th August 2023, we celebrated the 76th anniversary of our Independence. Independence Day is a day of great pride for all Indians. In the last 76 years, India as a nation has made great progress. India’s share of global GDP (in PPP terms) was just 3.8% just after Independence. Today India is the 5th largest economy in the world, overtaking her colonial master and her share of global GDP is estimated to be 7.2% (source: Statista, 2022). On the occasion of the 76th anniversary of our independence, you should understand the importance of financial independence for you and your loved ones.

What is financial independence?

Freedom may mean different things to different people. In finance and investment parlance, financial independence means that you have enough economic resources to meet your day to day needs without depending on a job. There may be different motivations for being in a job e.g. you may like the work, company’s culture, your colleagues etc, but the primary purpose of being in a job for most people is to earn income to pay for your living expenses, e.g. food, rent, EMIs, utility bills, children’s school fees etc. If you are financially independent, you can take care of your expenses without having to be in a job. The returns from your assets should generate sufficient cash-flows to meet all your expenses.

Is financial independence relevant for all?

Financial independence is relevant to everyone. Circumstances, beyond your control can force you leave your job and be without income. You will still have to pay the bills. Even if you are in a secure job, a day will come when you will have to retire. When you do not have income from a job, you will have to depend on your savings and investments to meet all your expenses. Retired lives can be very long e.g. 20 to 30 years. If your income is not sufficient to meet your expenses, then you will have to be dependent on others e.g. children, relatives etc.

Every family has aspirations e.g. like buying a house, taking a family vacation, children’s higher education, children’s marriage, supporting the needs of retired parents, own retirement planning etc. Individual family members may have their own aspirations. Grandparents may want to go on a pilgrimage or vacation with their friends, dad may want to upgrade his car, mom may want to become an entrepreneur, and children may want to buy the latest computer or bike etc. If you / your family members do not want to be dependent on anyone, then everyone should strive to be financially independent from a young age.

How to be financially independent?

You will be financially independent if you accumulate a corpus which can generate sufficient returns to meet all your expenses the rest of your life. The returns can be either as regular income or capital appreciation. You should always factor in inflation in your financial planning. Your expenses will keep growing over time due to inflation; accordingly your returns should also grow over time.

How to plan for financial independence

- Start saving: You need to save to invest in assets which can generate returns for you. The famous investor, Warren Buffet said, “Do not save what is left after spending, but spend what is left after saving.” You have to prioritize savings if you want to achieve financial independence.

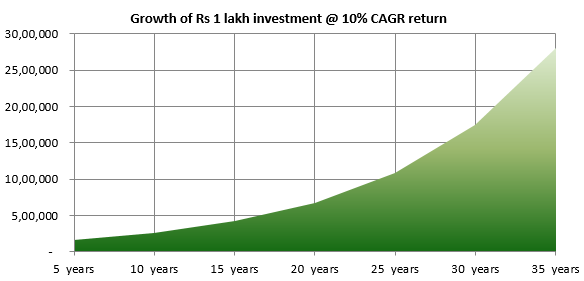

- Start early: It is very important to start saving from an early age. One of most important factors in wealth creation is time. Investments generate returns over time and returns invested generate more returns. This is known as the power of compounding (see the chart below).

Disclaimer: Figures above are purely illustrative for investor education purposes. There is no guarantee that you will be able to accumulate these corpuses over the said investment tenures. Mutual funds are subject to market risks. Consult with your financial advisor before investing.

- Investing your savings wisely: You need to invest your savings in assets which can generate returns. Different asset classes have different risk / return characteristics. You need to invest in the right asset class according to your age and risk appetite. For younger investors, equity is the most suitable asset class for wealth creation over long investment horizons. You should consult with your financial advisor if you want to understand your risk appetite and suitable asset allocation.

Source: National Stock Exchange, Yahoo Finance, MCX, as on 31st July 2023. Equity is represented by Nifty 50 TRI, debt by Nifty 10 year Benchmark G-Sec Index, gold by MCX Gold futures and international by S&P 500 in INR. Disclaimer: Past performance may or may not be sustained in the future.

- Remain disciplined: Investment discipline means that you invest according to a plan (financial plan) designed to meet your financial goals and balance risk and returns (asset allocation). You should stick to your plan and not make impulsive decisions based on market movements.

How can mutual funds help in achieving financial independence?

- Mutual funds are ideally suited for long term wealth creation for retail investors because it offers risk diversification and professional investment management.

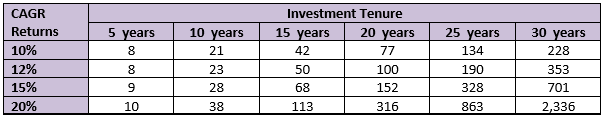

- You can start investing in mutual funds from your regular savings through Systematic Investment Plans (SIP). You can start investing in mutual funds from a young age through SIP and to get compounding benefits over long investment tenures. The table below shows a scenarios of the corpus (in Rs lakhs) built over various investment tenures at different CAGR returns, with monthly SIP of Rs. 10000/-. You can see that over long investment tenures you have the potential of accumulating substantial wealth and achieving financial independence with disciplined investing.

Disclaimer: Figures above are purely illustrative for investor education purposes. There is no guarantee that you will be able to accumulate these corpuses over the said investment tenures. Mutual funds are subject to market risks. Consult with your financial advisor before investing.

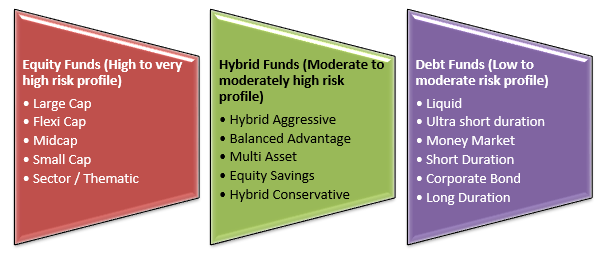

- Mutual funds offer a variety of products for different risk appetites and investment needs. You should invest in the product that is suitable for your risk appetite and investment needs. You should consult with your financial advisor if required.

- Mutual funds are one of the most tax efficient investments for long investment tenures. Long term capital gains in equity funds of up to Rs 1 lakh is tax exempt and taxed at 10% thereafter. Capital gains in debt funds are taxed as per the income tax slab of the investor. However, unlike bank FD interest, there is no TDS or taxation on accrued interest or unrealized gains. Only realized gains are taxed.

- After you have accumulated the desired corpus for your goal, you can use Systematic Withdrawal Plan facility to meet your regular cash-flow needs in a tax efficient way.

You may also want to read: Har Ghar SIP

Azadi Ka Amrit Mahotsav

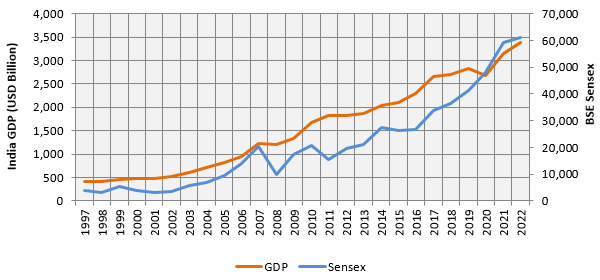

On the occasion of our 75th anniversary of Independence in 2022, the Government laid out its vision that India will become a developed economy in the next 25 years, i.e. by 2047 when the country will celebrate the 100th anniversary of Independence. In the last 25 years, our GDP grew from US $416 billion to US $3.4 trillion i.e. 8 times growth (source: World Bank, CY 1997 - 2022). If we extrapolate the CAGR growth over the next the 25 years then by 2047 our GDP will grow to nearly US $28 trillion putting India in the top 3 economies of the world. Extrapolating historical GDP growth rates India will overtake both Germany and Japan by 2030. In the last 25 years, while our GDP grew 8 times, the BSE Sensex grew from around 3,700 levels to 65,000+ levels (as on 31st July 2023) i.e. nearly 17 times at CAGR of 11.9% (see the chart below). You can imagine how much wealth you can create through disciplined investing over long investment tenures.

Source: World Bank, Bombay Stock Exchange, Advisorkhoj Research, as on 31st December 2022. Disclaimer: Past performance may or may not be sustained in the future.

Investors should consult with their financial advisors or mutual fund distributors how financial planning with mutual funds can help them achieve financial independence.

You may also want to read: Equity and debt passive funds: What you need to know about investing in passive funds?

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY