Why your Investments should have a Long Term Horizon

What is the definition of long term? How is it different from short term? Though long term and short term are quite subjective periods; technically from the income tax prospective any investment instrument held for over a year is termed as long term. However various analyst and experts in equity investing or mutual funds argue that long term in equity investing is about 3 to 5 years. Whatever be the investment horizon for investments their basic objective is to earn profits. Then, why do experts insist that investments should have a long term horizon.

Stated below are the advantages of long term investment.

Mitigation of Volatility

Markets in the short term are volatile; in the long term though markets are predictable, based on past performance. Though past performance does not necessarily reflect future performance or guarantee the future returns, in the long term investors exhibit a stable behavior.

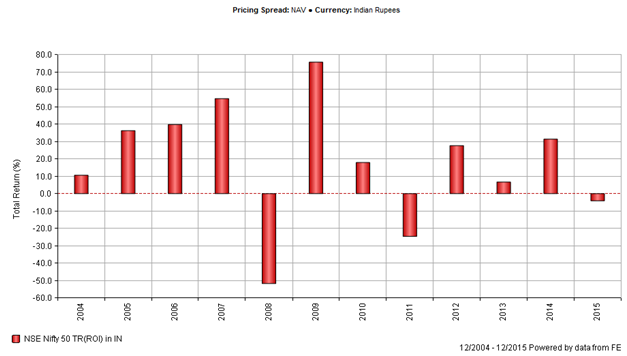

For the sake of simplicity let us understand this with the help of an example. Let us take annualized return of the market for the past 10 years i.e. from Jan 2006 to Dec 2015 and compare that with the performance in each calendar year. We see that in certain years the market has reflected negative returns while in some there are high positive returns; however over the 10 year horizon the Nifty has grown from 2,800 levels to 7,900 levels delivering an annualized return of around 11% p.a., even though the annual returns were in negative in the year 2008, 2011 and 2015! Please see the chart below to understand it clearly.

Source: Valuexpress analytics (NIFTY 50 annual Returns)

Enjoying the benefits of law of averaging

Short term investments are lump-sum and are based on market volatility; therefore they have an equal upside and downside risk. On the other hand long term investments can be averaged off if there is a wrong call taken by you. In case of mutual funds if you have invested a lumpsum amount at a higher level of the markets, you can average out the cost to a lower level by investing systematically over a long period of time. You might like to read disciplined investment makes a big difference in the long run

Garner the advantages of power of compounding

Compound interest is the concept of adding earned or accumulated interest back to the principal amount, so that interest is earned on top of interest from that period onwards. The act of adding declared interest to be principal is called compounding. The longer the period the better or profound will be the effect of compounding.

We shall understand the power of compounding better with the help of an example.

As you can see from the above example, Ramesh saves only र 60,000 (र 1,000 per month for 5 years) more than what Suresh is saving. But by saving र 60,000 extra in 5 years he has been able to build a corpus which is almost 90% bigger than the corpus of Suresh!

The above results have been found from here

If our focus is on starting an investment plan as soon as we can and investing regularly, the strategy will then allow you to achieve your goals by compounding through the growth of reinvested earnings and a regular savings plan. Would you like to know how compounding works ?

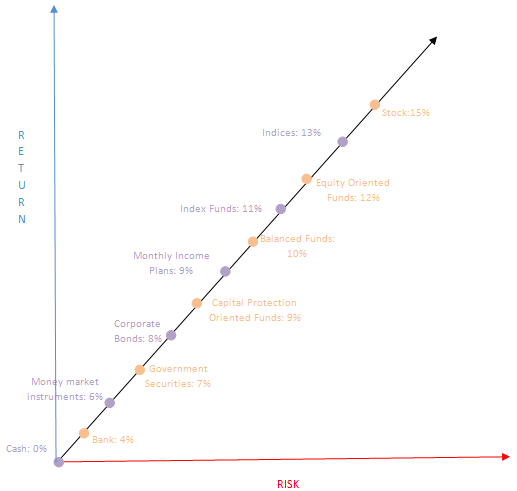

Benefits of High risk and High return

Different assets classes have different level of risk associated with it. High risk is coupled with high reward. Assets with higher short-term volatility or risk, such as stocks, tend to have higher returns over the long term than less volatile assets such as money market instruments. As seen in the risk return matrix below the assets lying higher up in the matrix are high risk assets; however if held for a longer term the return on these assets are the highest.

Let us take example of conservative short term investment v/s aggressive long term investment. Let us assume, your are 30 year old parent of two children, you have a corpus of र 25 Lacs which have to be allocated in such a way that you can meet your emergency requirement, short term goals like vacation, purchase of a car and long term goals like children education and marriage, retirement. You could allocate your funds in following manner -

As seen in the example to meet long term goals we have allocated risky assets such as equity oriented mutual funds or stocks and to meet short term goals we have allocated funds to conservative asset class such as liquid and debt fund or bank deposits. This is simply because in the short term returns are either fixed thus stable or more predictable whereas in the long term though returns of risky asset classes are volatile, it gives higher returns due to equity investing and period of compounding.

Reap the benefits of tax concessions given to long term investors

To curtail speculative trade in equity, long term investors are given tax sops by Government of various countries across the world. The Indian government encourages long term equity or equity mutual fund investments by not taxing any returns derived from these instruments over the long term i.e. above one year. The long term capital gains tax is totally tax free in case of equities and equity oriented mutual funds. Dividend received from equity oriented mutual funds are also tax free without any limit whereas dividends received from equities is tax free upto Rs. 10 lakhs p.a. in the hands of the shareholder.

In the same say to encourage investors to put their money in debt funds the Indian government has provided tax benefits for long term debt fund investors also. Investors who held their debt investments for over 3 years can reap the benefits of long term capital gains tax post indexation on debt funds.

However Interest received on any bonds, debentures, fixed deposits, banks savings account, whether cumulative or non cumulative or whether held for one day, one month, one year or 10 years are taxable in the hands of the investor over and above Rs. 10,000 p.a.

You might like to read what type of debt mutual funds can I use as an alternative for fixed deposits

Long term goals are achievable though long term investment

Whether you invest in debt or equity, as an investor if you wish to plan for retirement, children’s higher education and marriage or creation of wealth, you have to invest in the assets from a long term prospective. Whether an investor is a salaried individual or a businessman or a professional if they wish to achieve the long term goals especially for retirement and wealth creation they have to keep a long term horizon. One cannot be accumulating wealth for retirement keeping six months or a year as an investment horizon. An investor cannot be building corpus for retirement or children’s education and marriage by trading in stocks, bonds, currency or commodity.

It is a convenient choice

Long term investment is proactive while short term is reactive. It’s not rocket science to build and manage your long term investment portfolio. On top of it long term investment gives you time off and help you to have a relaxed time. Short term investing or trading requires a detailed study of demand and supply of the product that you are trading in also called technical analysis. It also requires the trader to be abreast with all the news and views of the market and to be a disciplined person not allowing your emotions to take control of your decisions. Basically as investing is simpler than trading it allows an investor to have a good night’s sleep in contrast to a trader.

Whether it’s investing or trading, the idea behind it is to earn profits. Trading is said to be a zero sum game as on some days you might earn descent profits and on some ugly day when your decision is wrong, all your profits gets wiped off. The longer you stay invested the lower is the chance of incurring any loss.

Conclusion

On the short term versus long term debate, in our opinion, the key is to have an apt mix between long term and short term investments. All the short term goals are invested for a shorter horizon and should be invested in conservative asset class such as bank depsoits, liquid funds and short term debt funds etc. while for the long term goals where the time horizon is long the investor should go for equity oriented investments even though it is risky. You may like to read investing in mutual funds: risk and returns

A typical learning curve for a young investor begins he receives a tip from friends to make quick money. They say that first you have to dirty your hands in the muck if you wish to taste the scent of trading in risky asset classes such equity, commodity or currency. If you’re young, you could follow a dual strategy towards investment. Such an investor could allocate maximum 5% to 10% of the total portfolio value for such purpose but not more. The remaining 90-95% of the portfolio needs to be seriously invested following your risk appetite and asset allocation aligned with your long term financial goals. Else sustained wealth creation in the long term will not be attained.

Mutual funds offer many investment choices based on various factors

So, what is your success and how much of investment you would like to do and build wealth in the long-term is totally your call! We can only suggest but the action is upto you and your will power to remain invested despite the various temptations. We suggest you to read this 7 common investing myths and mistakes

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY