Systematic Investing Planning Mistakes to Avoid

Systematic Investment Planning is that tool that can turn small amounts into a big one. It does not matter what your current financial standing might be. Investing regularly is the one of the most effective means of creating an alternative stream of income. SIPs have emerged as the most effective tool of investment which allows most investors irrespective of their financial standing to create wealth. This means of investment has overshadowed the previous saying that you need a lot of wealth to create wealth. An individual who can save even र 500 a month has an equal chance of creating wealth over a long period of time as much as an individual who can spare a few thousands or lacs for investment. That is the power of compounding where every interest on interest is added to provide maximum returns. While a lot of us are aware of the power of Systematic Investment Plans or SIPs, we also tend to make a few fundamental errors when it comes to the actual investments and maintaining it. We are going to point out a few so that nothing comes between you and the process of creating wealth.

High Amounts for Investing

The very fundamental trait that distinguishes SIPs from other means of investment is the small amounts that you can invest. Hence, if you commit a huge amount that you want to invest every month and then fail to continue it for few months because of lack of savings, high expenditure or some financial problem then you have lost the avenue for investment for those months. You can still invest the instalments missed for those months later on. However, out of 12 months if you manage to invest only for 11 or 10 months, would your investment generate the same return? My answer is No.

Hence, instead of being overly ambitious or optimistic regarding the monthly systematic investing, decide a amount every month that is manageable. You must be comfortable with your finances after the investment. Your investments should not become a burden. If you cannot invest a stipulated sum on a monthly but on a quarterly basis you can opt for that option as well. Picking an amount that is too high or too low can cause or can put an unnecessary pressure and affect the performance of your investments.

You may try this calculator to know your future SIP Value

Only for Small Investors

There is a common myth associated with Systematic Investment Plans that investors who cannot invest through lump sum invest through SIPs. Hence, it is for the investors who have small amounts. This could not have been further from the truth. Instead of र 5000 a month, if you can spare र 50,000 a month; you can still invest in SIPs. The fundamental of Systematic Investment Plans or SIPs, which are time value of money, rupee cost averaging and compounding do not change irrespective of the amount invested. So if you can manage to invest large sums in lump sum or regularly per month, you can still invest in SIPs and get the same benefits.

You may like to read The Right Systematic Investment Plan Amount

Investing for a Short Period

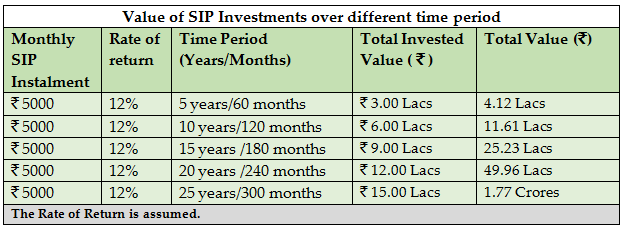

This is one of the most common mistakes investors make. The value of investments is not created through the amount that you invest. Rather, the value is created by the time period of that investment. The longer you stay invested, higher will be the value of your investment.

Source: https://www.advisorkhoj.com/tools-and-calculators/systematic-investment-plan-calculator

In the above example the possible amounts, if you continue the investments for a number of years, has been shown. In the first five years the corpus of र 3 lacs grows only to र 4.12 lacs. But if you continue investing the same amount month after month and stay invested for 20 – 25 years the corpus grows to a phenomenal र 49.96 Lacs and र 1.77 Crores in 20 and 25 years respectively. You can see the difference between investment for 5 years and investment for 20 - 25 years. The investment value is created by the time period of investment and thus benefits from the power of compounding. Hence, if you have been contemplating redeeming after a short period of time not only are you losing on potential wealth creation, you may make a loss as well.

Discontinuing in Bearish Markets

This is a classic trend where investors try to time the markets and invest in rising markets and redeem in falling markets. While this is the trend, this does not necessarily benefit the investors. In fact it should be the opposite, where the investors should redeem or stay invested in rising markets and invest in falling markets. Investors investing through SIP redeem SIPs when markets fall and this is a big mistake. They should look at this as an opportunity to invest more because if they invest in a lower market they get higher number of units as the NAV is low and benefit in terms of rupee cost averaging. Investors also do not have the expertise to sieve noise from information. Short term market fluctuations are created by noise in the market and they have no significant impact on investments. Hence, if you are hurriedly redeeming your investments without analysing the situation you may be losing out on potential wealth creation.

Investors mistakenly think that short term fluctuations can erode their investments. That cannot happen. In fact, if you have planned to stay invested for a long period of time, these fluctuations should hold no value at all. The longer you stay invested, the lesser will be the impact of short term fluctuations.

Choosing Dividend Option over Growth Option

Before we delve into this topic, it is essential to understand how compounding works. Compounding, often called the eighth wonder of the world, works by creating a chain of interest on the interest calculated to the last divisible penny. Hence, the returns through compound interest are way higher than the return that is calculated through simple interest. As an investor when you are choosing the fund to invest, you always have two options: Dividend or Growth option. Dividend is basically a withdrawal from your corpus and thus if you are opting for that, the compounding effect is reduced and it hinders the growth of your targeted corpus. In growth option, no dividends are paid or declared and thus the corpus continues to grow and benefit from compounding. In case you have already opted for the dividend option, you can change it to growth option or go for dividend reinvestment option, which will give you the same benefits as the growth option. Avoid this mistake in order to grow your corpus and reach the targeted amount.

Deciding Not to Boost Your SIPs

A lot of us go through financially lean periods and financial highs. During the period of financial high, you may have accumulated a moderate lump sum. However, if you do not have any urgent financial requirement or anything particular to do with that sum, the chances are you are going to spend it. Instead of allowing this to happen, you can simply add this to your existing SIP fund. A lot of investors are not aware, that you can add lump sums to the same fund in the same folio or account even if you are investing a lump sum amount. Adding a lump sum once in a while boosts your investments. After all, the SIP amount and a lump sum are bound to generate more returns than just your monthly investment. If you have lump sum, do not hesitate to add it to your ongoing investments.

Redeeming at Present to Add Later

Investors make a common mistake in thinking, large amount leads to higher returns. The reasoning to a certain degree is correct, the individual investing र 50, 000 a month will numerically generate a higher return than an individual who is investing र 500 a month. However, Investors also tend to redeem parts of their SIP investments whenever they need some amount during some urgent need etc. And later on decide to either adding back the amount or not adding it at all. While adding later puts back the corpus to where it was supposed, returns do not necessarily work that way. If you have redeemed a part of the corpus only to add it back six months later, you have lost the return that the part redeemed corpus could have generated in those six months. It is not the corpus or the amount that determines the returns; it is the duration of investment and the discipline that makes the difference. More importantly, the momentum of generating the targeted corpus for the long term gets disturbed. You should never redeem your SIP investments partly or fully during the SIP period. Systematic Investment Plan is a long term investment idea for wealth creation and therefore should not be used like a bank account. For any emergency or unforeseen events you should have sufficient balance in your savings bank account or liquid funds.

Conclusion

It is often said, learn from your mistakes. We can twist that saying a little; learn from your mistakes and others. You do not have to make the above mistakes to learn from them. You already know what the common mistakes are, you just have to make sure you avoid as many of them as you can. Once you have ensured that, there is nothing that stands in way of you and your wealth creation.

RECOMMENDED READS

LATEST ARTICLES

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

- How can Multi Asset Allocation Funds provide stability in your portfolio

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY