Disciplined investment makes a big difference in the long run

The Oxford Dictionary defines ‘disciplined’ as ‘showing a controlled form of behavior of a way of working’ while ‘investment’ is defined as ‘the action or process of investing money for profit’. When combined, the two words describe a controlled behavior of investing money for making profit.

Profits always lure us and every investment we make is done with a view to earn the maximum profit. No matter where we invest our money, we always complain that our investments are not generating the profits which are desired from them and this causes us to switch our investments frequently. But, have we ever delved into our actions to find out the reason why?

We have been taught about the importance of discipline in school and the fear of punishment always made us to maintain discipline and stick to a specified code of conduct. However, this discipline is somewhat lost in our lives and our investment patterns speak for themselves when it comes to discipline. How many of us actually adopt a disciplined investment approach?

‘Investing should be like watching paint dry or watching grass grow. If you want excitement…go to Las Vegas’, commented Paul Samuelson, a Nobel Prize winning American Economist. He couldn’t be more right. A disciplined investment which is done for a longer tenure is the best option if you want your investments to grow.

Why do you need a disciplined investment? Let’s find out, shall we?Here are the benefits of a disciplined investment.

Better returns

- following a disciplined investment ensures good returns over the time and this is no rocket science. The power of compounding works in your favor to build your meagre savings, consistently over a long period of time which is possible only if you are disciplined in your approach towards saving.Meeting your financial goals

- setting a financial goal and actually meeting it are two different things. We always set our financial goals but we hardly manage to meet it. The reason is simple – lack of a disciplined effort on our part to meet the goals. Whether you plan for the future of your child or desire to build up a retirement corpus, a disciplined investment is required where you continue contributing towards your financial goals. Stopping your contributions mid-way or withdrawing from the funds meant for your financial goals would definitely spell disaster.

If numbers are your thing, let us consider the example of a SIP from one of the best performing mutual fund scheme which provided a 17.88% annualized return over a 3 year period and a 20.52% over a 15 year period. If you would have invested Rs.5000 every month in this scheme, in 3 years you would have got Rs.235, 936. However, if you have continued the same SIP for a longer tenure of 15 years through a disciplined investment approach, your corpus would have accumulated to Rs.58,93,912 which is substantially higher compared to the amount that you would have got after three year.

This is the sheer benefit of being disciplined in your investments and continuing the same over the long term.(You can check the example at the bottom for an illustration of the same as well.)

How to do Disciplined Investments?

These points more form a gist of the innumerable benefits of a disciplined investment. The next question on your mind now would be how to invest following a disciplined approach. Well, the answer is simple – a Systematic Investment Plans (SIP) of EquityMutual Funds.Yes, investing in a SIP over a long tenure is the best answer to adopt a disciplined investment practice.

The benefits of investing in a SIP, besides the obvious returns, are many and I have made a list to state them. So, here we go -

Smaller and affordable investments

– a SIP scores on the front of small affordable monthly investments. As such, it becomes possible for a common man to afford investing in equity mutual funds with as little savings as they can manage. So, whether you can take out Rs.500 per month or Rs.5000, it is your call. Even your little savings would accumulate in a considerable corpus in the long run.Flexible

– SIPs are very flexible in the sense that you can invest as much and as little in the plan as per your savings. There is no cap on the maximum saving that can be made in these plans. Rs.5000, Rs.10, 000 or Rs.50, 000 per month, take your call! You may choose to increase, decrease or even stop your SIP at your own free will without any charges, delay, etc.Easy redemption

– Open ended mutual funds are easily redeemable. You can redeem your entire investment as soon as you invest the same. However, to avoid an exit load, you would simply have to hold your investments for a minimum period of 12-24 months or so (based on the terms of the schemes you have invested in) and then redeem all units. Redemption proceeds are credited in your bank account normally on 4th working day (transaction day + 3 working days). The other benefit of investing in equity mutual funds is that the long term capital gains are totally tax free.Emergency Solution

- A mutual fund comes in handy when you face an emergency. You should invest your surplus cash in liquid mutual funds either through SIP or lump sum mode and redeem them whenever you are urgently in need of emergency money. Liquid funds returns are superiorthan savings bank account and the most ideal option to build your emergency corpus.Freedom from timing the market

– When we invest in equity, the primary concern we have is timing the market, buying when the market falls and selling when it rises to reap maximum profits. Though profitable, timing the market becomes difficult if you are not a professional or experienced, following this practice is tiresome and stressing. A SIP which makes investments every months irrespective of the market movements can overcome this problem and is also simpler.Rupee-cost averaging

– the above-mentioned freedom of timing the market is possible because of the principle of rupee-cost averaging which is prevalent in a SIP investment. The market volatility is smoothed out through smaller investments of a SIP. Let us understand it with a simple calculation:

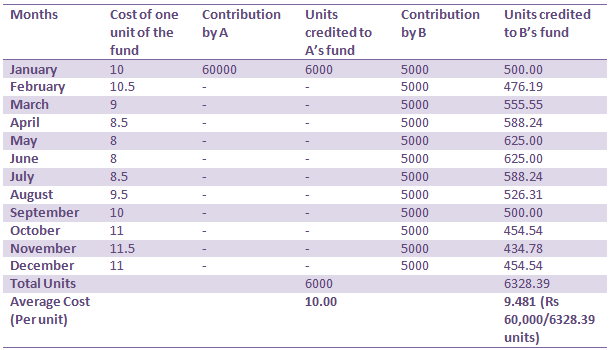

Suppose, A invests Rs.60, 000 at one go in a fund at the starting of the year while B makes a monthly contribution of Rs.5000 every month from the starting of the year for a year.

Let us compare their returns over a 12 month period assuming a rise and fall in the value of the fund:

Considering the year end per unit value of Rs.11, A’s fund value stands at Rs.66, 000 while B’s value stands at Rs.69, 602 though both invested the same amount and the average NAV for A stays at Rs 10 while that of B comes down to Rs 9.481.

Disciplined Investment is very important if you want to reap the maximum benefits from SIPs. In the words of Warren Buffet, ‘Successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.’ Buffet couldn’t have been more correct. To enjoy higher returns, disciplined investment is what it takes.

Now, the last and the obvious question is how to follow a disciplined investment? Just a few important steps and you would be on your way to a disciplined investment. The steps are:

Financial planning

– the first and the most important step is the plan. What are your savings, what are your financial goals and how long would you stay invested. This is the basic point of a disciplined investment and also its stepping stoneHave realistic goals

– your financial goals should be realistic. Having an income of Rs.10 lakhs a year and thinking of having a lifestyle of Sachin Tendulkar is like wishing fishes to fly. Plan your goals realistically putting aside your whims.Asset allocation

– having a well-balanced and a diverse portfolio is important so that you can enjoy the benefits of diversification. A lopsided portfolio is a disaster and though investing in SIP is beneficial, you should also ensure having debt allocation in your portfolio for hedging against volatility.Contingency funding

– build a contingency fund so that you don’t have to break your discipline when an emergency strikes. A contingency fund is very important and the solution is insurance plans – both life and health.Resist withdrawals

– the last word in disciplined investing and the only prohibitive clause is resisting withdrawals. A volatile trend in the market, meeting any financial needs, lower short-term returns might tempt you to break your investing habit. Don’t do that. You already know that over the long run, these factors phase out and the corpus you accumulate is sizeable (thanks to the power of compounding!). However, there is no harm in reviewing your portfolio (even if it is for long term) once every year and ensure that the performance of each scheme is aligned to your long term goals.

All in all, disciplined investing is only the right way to go if you need long-term benefits and want financial stability and there’s no short-cut to it.

RECOMMENDED READS

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY