SBI Nifty 50 Equal Weight Index Fund: A good index fund for long term investments

2024 has begun on a very bullish note for the equity market with the Nifty 50 climbing over the 22,000 level. With China underperforming and India outperforming, India is expected to higher share of FII’s emerging market allocations, of which a large percentage is likely to go into the Nifty 50 stocks. SBI MF has launched SBI Nifty 50 Equal Weight Index Fund New Fund Offer (NFO), a passive fund which will track the Nifty 50 Equal Weight Index. The NFO opened for subscription on 16th January 2024 and close on 29th January 2024.

About the Nifty 50 Index

ETFs and index funds tracking the Nifty 50 index are among the most popular passive funds, for the simple reason that Nifty 50 is the leading broad market index in India. The companies comprising the Nifty 50 index are the largest companies in the country and leaders in their respective industry sectors. Nifty 50 stocks have high institutional ownership (both institutional and domestic) relative to the broader market stocks. Nifty 50 stocks are also the most actively traded stocks and therefore have very high liquidity.

What is Nifty 50 Equal Weight Index?

As in the name, the index comprises of all NIFTY 50 stocks but has equal weightage (2% of the index value) in each stock. The index is re-balanced quarterly to readjust the proportion of each index constituent (stock) back to 2% of the index value.

What is difference between Nifty 50 Index and Nifty 50 Equal Weight Index?

Both the indices invest in the same stocks. Nifty 50 Index is a market cap weighted index i.e. stocks with larger market capitalization are given higher weighs in the Nifty 50 index. Nifty 50 Equal Weight Index on the other assigns same weights to all the 50 stocks in the index.

Why invest in Nifty 50 Equal Weight Index?

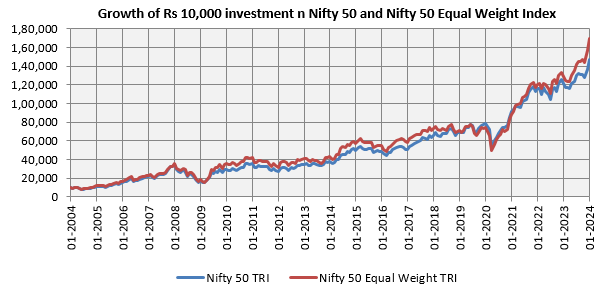

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

Nifty 50 Equal Weight TRI has outperformed Nifty 50 TRI over long investment tenures. The chart above shows the growth of Rs 10,000 investment in Nifty and Nifty 50 Equal Weight TRI over the past 20 years (as on 31st December 2023).

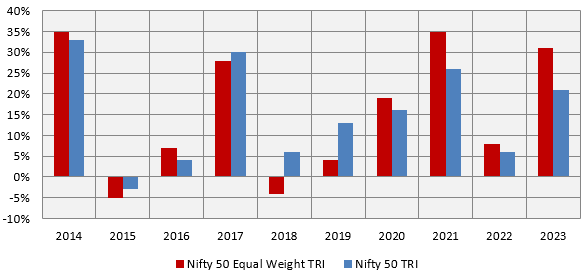

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

While the first chart shows the long term outperformance of Nifty 50 Equal Weight TRI, the index outperformed Nifty 50 TRI even in the short term (see the chart above); you can see that Nifty 50 Equal Weight outperformed Nifty 50 for the last 3 consecutive years.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

Nifty 50 Equal Weight TRI outperformed Nifty 50 TRI in broad-based market rallies. The chart below shows the annual (calendar year) returns of the 2 indices. Since Nifty 50 is a market cap weighted index, its performance is relatively more influenced by the performance of the heavy weight stocks (e.g. Reliance, TCS, HDFC Bank etc). On the other hand, all the 50 stocks in the Nifty 50 Equal Weight index contribute in equal measure to the index performance

In a narrow / polarized markets only few sectors perform e.g. in economic downturns, defensive sectors like FMCG, IT, Pharma etc outperform. In phases of economic recovery, cyclical sectors outperform. Nifty 50 has higher allocations to a relatively few sectors, whereas Nifty 50 Equal Weight Index has higher allocations to more sectors and is more diversified from a sector standpoint. In the current market and economic scenario a broad range of sectors will participate / benefit from economic recovery and India’s long term economic growth. As such, we expect Nifty 50 Equal Weight Index to create wealth for investors over long investment horizon.

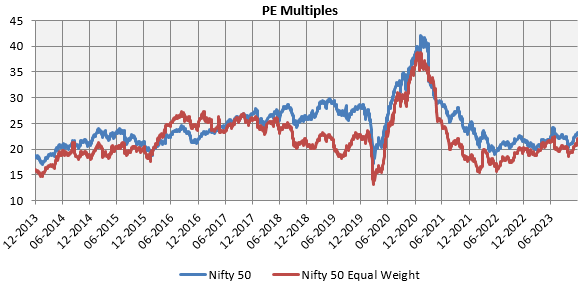

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

With market at record highs, valuations can be a concern for investors. Both Nifty 50 and Nifty 50 Equal Weight Index are trading below their 10 year historical average valuations. However, if you compare the valuations (PE multiples) of Nifty 50 and Nifty 50 Equal Weight index, then the latter is available at lower / cheaper valuations.

Why invest in index funds?

- Total expense ratios (TER) of index are much lower than actively managed funds. The fund manager of an active fund will have to generate significant alphas on a consistent basis to match the performance of an index fund tracking the same benchmark index. Suppose the TER of an active fund is 2%, while that of an index fund tracking the same index is 1%. This difference in costs implies that the active fund will have to consistently beat the benchmark by at least 1% to match the performance of the index fund. Over long investment horizons, lower costs may result in considerably higher returns due to the compounding effect.

- In order to beat the index, the fund manager of an active fund will have to be overweight or underweight on certain stocks in the index. This will result in unsystematic risk i.e. stock or sector specific risks. While unsystematic risk can lead to outperformance, it can also result in underperformance. Unsystematic risk is an additional risk in investment over and above market risks. There is no unsystematic risk in index fund.

- Fund managers are humans and like any other human can make errors in judgement, which can the impact the performance of the schemes managed by them. Furthermore, change in fund manager can have an impact on the performance of an active scheme. There is no human or fund manager bias in index funds – they simply track the index.

- Unlike ETFs, you do not need demat accounts to invest in index funds.

- Unlike ETFs, you do have to worry about liquidity. You can redeem your index funds with the AMC subject to exit load structure of the scheme (refer to the scheme information document for more details).

- Unlike ETFs, you can invest in the index fund from your regular savings through Systematic Investment Plan (SIP).

Summing up – Why invest in SBI Nifty 50 Equal Weight IndexFund

- Equal exposure to Top 50 large cap companies listed on NSE (~2% in each stock)

- Equal exposureresults in lowersector & stockconcentration risk

- Aims to benefit from growth potential of all the stocks/sectors rather than depending on a few stocks/sectors with higher allocation

- Quarterlyrebalancing of portfolio weights (March, June, September and December)

Investors should consult with their financial advisors or mutual fund distributors if SBI Nifty 50 Equal Weight Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY