SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

The popularity of Mutual funds among domestic investors has grown manifold in the past 10 years. Assets under management (AUM) of mutual funds in India jumped more than 6X in the last 10 years from around Rs 10 lakh crores to Rs 66 lakh crores (source: AMFI, as on 31st August 2024). Total SIP accounts stood at around 10 crores as on 31st August 2024 (source: AMFI).

However, despite the impressive growth in mutual fund assets under management, the percentage of household savings invested in mutual funds is still relatively low compared to developed economies. As per Reserve Bank of India’s report on Household Financial Savings, the percentage of household savings invested in mutual funds is around 8%. On the other hand, the percentage of household savings invested in Bank Fixed Deposits is 45% (source: RBI, as on 31st March 2023). If we include Government Small Savings schemes, more than 50% of household savings are invested in Bank FDs and Government small savings schemes.

Current interest rate scenario

Current Fixed Deposit interest rates for 2 – 3 year term deposits are 6.75 – 7% (source: SBI). The target CPI inflation rate is 4.5%. On a post-tax basis, the returns from investments in FD can just barely keep up with inflation (for investors in the higher tax brackets). This has been a concern for many retail investors. Interest rates are expected to come down in the future as we approach the end of the interest rate cycle and RBI starts cutting interest rates.

How can investors can higher returns without taking high risks?

It is understandable that investors who prefer to keep their savings in Fixed Deposits are risk averse. Through asset allocation investors can balance risk and returns, according to their risk appetites and their investment needs / objectives. Mutual funds provide investment solutions for investors to earn higher returns by taking some risks. First time investors in MF can start in conservative hybrid funds due to its mix of debt and a little bit of equity for the kicker in a growing market like India.

What are conservative hybrid funds?

Conservative hybrid funds are hybrid mutual fund schemes which invest primarily in debt and money market instruments and also in equity and equity related securities. As per SEBI’s mandate, conservative hybrid funds must invest 75 – 90% of their assets in debt and money market instruments. They also invest 10 – 25% of their assets in equity and equity related securities. The funds are suitable for conservative investors, hence the name conservative hybrid funds. These funds can also be suitable for new investors who do not have the experience of equity markets.

Why conservative hybrid funds are suitable for first time or risk averse investors?

Simple asset allocation maths will demonstrate why conservative hybrid funds are suitable for first time investors. Let us assume that a conservative hybrid fund has 80% allocation to debt and 20% allocation to equity. Let us assume the debt as an asset class gives 7% annualized return. So in a year, the debt portion of the fund will contribute 5.6% to the fund’s returns. If the equity return is 15% in a year, then the equity portion will contribute 3% to the fund’s returns. So the overall return will be 8.6%. Let us now assume that in the next year, equity market fell by 20%. In that year, the return of the equity portion of the fund will be -4%, but the return of the debt portion will be 5.6%. So the return of the hypothetical conservative hybrid fund will be 1.6% (5.6% - 4%) i.e. the return is still positive despite the large correction in equities. You can see that conservative hybrid funds can limit downside risk of investors in bear markets. Stability is a very important factor in investor experience because behavioural biases in the extreme volatility can lead the investor to make decisions, which harm their long term financial interests. Over sufficiently long investment tenures, conservative hybrid funds have the potential of generating inflation beating returns. One such example is SBI Conservative Hybrid Fund.

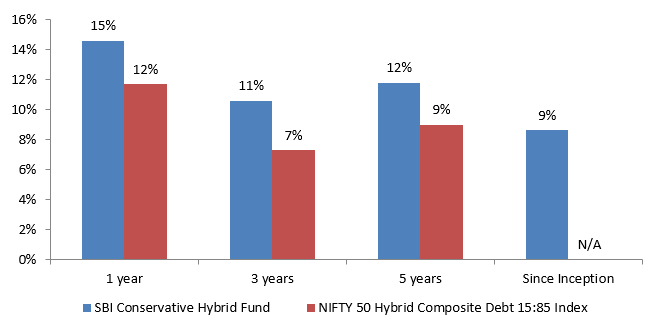

SBI Conservative Hybrid Fund – Outperformed the benchmark

SBI Conservative Hybrid Fund has a track record of more than 23 years with an AUM base of more than Rs 10,000 crores as on 31st August 2024 (source: SBIMF Fund Factsheet). The fund has outperformed its benchmark index (Nifty 50 Hybrid Composite Debt 15:85 Index) over different investment periods.

Source: Advisorkhoj Research, SBI MF fund factsheet, as on 31st August 2024

SBI Conservative Hybrid Funds – Outperformed the peers

The chart below shows the 1 year rolling returns over the last 10 years of SBI Conservative Hybrid Fund versus the hybrid conservative category average. You can see that SBI Conservative Hybrid Fund was able to outperform the peers consistently across different market conditions. You can see that the fund was able to give 8%+ returns in more than two thirds of the instances across different market conditions.

Source: Advisorkhoj Research, SBI MF Fund Factsheet, as on 31st August. * Nifty 50 Hybrid Composite Debt 15:85 Index

Consistently ranking in the Top 2 quartiles

SBI Conservative Hybrid Fund has been fairly consistent in ranking in the Top 2 quartiles for the last 10 years – 8 out of 10 years in the top 2 quartiles and 6 years in the topmost quartile.

Source: Advisorkhoj Research, SBI MF Fund Factsheet, as on 31st August.

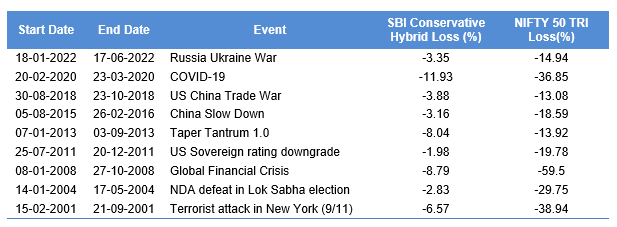

Limited Downside Risks

The table below shows the major drawdowns since the inception of the fund versus the Nifty 50. You can see that the fund was the able to limit the downside risk for the investors.

Source: Advisorkhoj Research

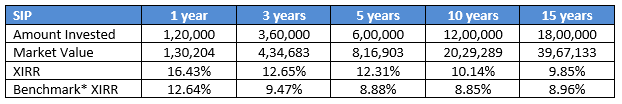

Suitable for SIP

The table below shows the SIP returns of SBI Conservative Hybrid Fund over different investment tenures versus the benchmark. You can see that the fund gave double digit / close to double digit returns even over long investment tenures and was also able to the beat the benchmark XIRR.

Source: Advisorkhoj Research, SBI MF Fund Factsheet, as on 31st August. * Nifty 50 Hybrid Composite Debt 15:85 Index

Suitable for SWP for long periods

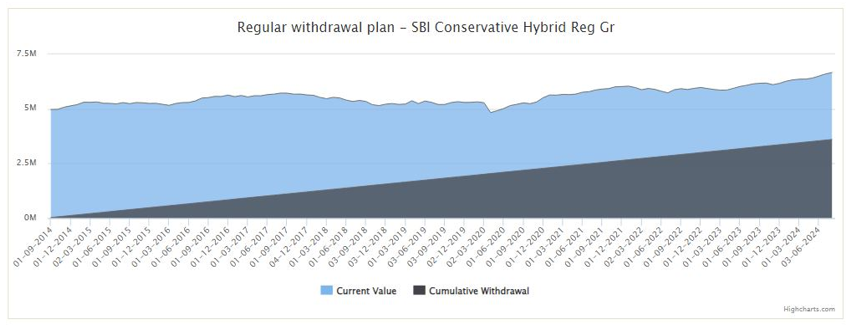

The chart below shows the results of Rs 30,000 monthly Systematic Withdrawal Plan (SWP) from a lump sum investment of Rs 50 lakhs in SBI Conservative Hybrid Fund, over the last 10 years. You can see that despite withdrawing Rs 36 lakhs on a cumulative basis over the last 10 years, the market value of the balance units of SBI Conservative Hybrid Fund has grown from Rs 50 lakhs to Rs 66 lakhs i.e. capital appreciation despite monthly withdrawals.

Source: Advisorkhoj Research, as on 31st August.

Taxation considerations

Conservative hybrid funds are taxed as per the income tax rate of the investor, irrespective of the holding periods. Bank FD interest is taxed on an accrued basis. On the other hand, the mutual funds are taxed only when they are redeemed, not during the investment tenure. In other words, mutual funds enjoy deferred tax treatment unlike in FD’s. Also, with the taxation bracket now at Rs 7.5 lakhs (in the new tax regime), many younger investors can start SIPs in this fund.

Who should invest in SBI Conservative Hybrid Fund?

- Investors who want to get higher returns than traditional fixed income investments without taking high risks.

- Investors with moderate to moderately high risk appetites.

- First time investors can invest in this fund with long investment horizon.

- Investors who have at least 3 – 5 years investment horizon.

- Investors should consult with their financial advisors or mutual fund distributors before investing in SBI Conservative Hybrid Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Contra Fund: Great wealth creation track record

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY