SBI Balanced Advantage Fund: Benefits of growth and stability

The growing popularity of mutual funds in India shows that investors are looking for higher returns than traditional fixed income investments. Historical data shows that over long investment horizon, equity as an asset class has the potential of giving better risk-adjusted returns compared to other asset classes. However, equity is also a volatile asset class. Behavioural factors e.g. greed and fear, herd mentality etc in volatile equity markets, can lead to wrong decisions and sub-optimal returns.

Timing the market i.e. predicting when to invest and exit is very difficult because prices are driven by sentiments, rather than fundamentals. SBI Balanced Advantage Fund uses parameters such as sentiment indicator, valuations and earnings drivers to decide on asset allocation. This is taken basis various macro inputs like Fiscal / Monetary positions, real rates, monetary policy framework, variables of offshore markets etc. The fund aims to capture the potential upside and limit the downside of equity markets. In this article, we will review SBI Balanced Advantage Fund.

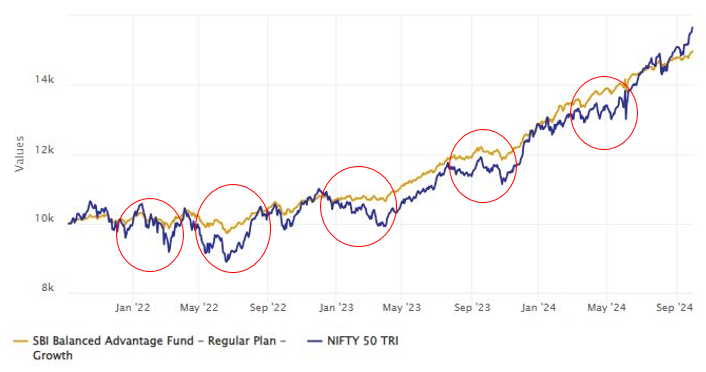

How has SBI Balanced Advantage Fund performed in volatile markets?

SBI Balanced Advantage Fund has completed 3 years. However, we have experienced different market conditions since the launch of the fund including periods of high volatility (see parts of the chart below circled in red). Though the fund has given commensurate returns compared to Nifty 50, it was much less volatile compared to Nifty in market correction phases. In other words, SBI Balanced Advantage Fund was able to provide stability and generate superior risk adjusted returns.

Source: Advisorkhoj Research, as on 27.09.2024

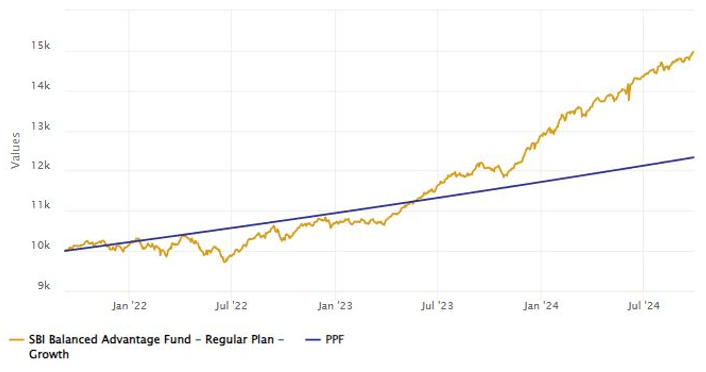

How SBI Balanced Advantage Fund performed versus traditional fixed income?

You can see that the SBI Balanced Advantage fund was able to provide better risk adjusted returns compared to traditional fixed income savings like Government Small Savings Schemes. That is why this fund is suitable for investors who want to enjoy the potential growth opportunities offered by equity markets while aiming to limit the downside.

Source: Advisorkhoj Research, as on 27.09.2024

About Balanced Advantage Funds

Balanced advantage funds, also known as dynamic asset allocation funds, are a type of hybrid mutual funds. Hybrid funds invest across multiple asset classes e.g. equity, debt etc. These funds provide asset allocation or risk diversification benefits to your portfolio. Different asset classes have different risk / return characteristics. Asset allocation aims to balance risk and returns to achieve financial goals. Balanced advantage funds use dynamic asset allocation strategy. In this asset allocation strategy, the asset allocation changes depending on market conditions. For example, a balanced advantage fund may reduce its equity allocations and increase its debt allocations as equity valuations increase. When equity valuation decreases, the fund may increase its equity allocation and reduce its fixed income allocation. SEBI has not mandated upper or lower asset allocation limits for dynamic asset allocation funds and fund managers have the complete flexibility to manoeuvre asset allocation in the range of 0 – 100% to arrive at an optimal allocation based on pre-set conditions or in-house models.

Asset allocation of the SBI Balanced Advantage Fund

- Net long Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by the fund managers, using parameters such as Sentiment Indicator, Valuations & Earnings Drivers. The net long equity allocation of the scheme is aimed at providing long term capital appreciation (wealth creation) for investors and involves high conviction ideas of the fund manager and analyst team.

- Debt: Debt allocation is based on high credit / sovereign portfolio to maintain liquidity and provide stability in volatile markets.

- Arbitrage: This is the fully hedged equity component but generates arbitrage returns based on price differences in cash and futures market or corporate actions. The arbitrage component reduces the net long equity exposure and at the same time, helps to keep the gross equity exposure above 65%, and provide equity taxation benefits to investors.

Portfolio construction strategy

The scheme has a quantitative framework, the top-down investment strategy in terms of the market cap allocation, investment style (growth / value / quality), sector preference etc. Stock selection is based on fund manager’s conviction. The fund manager uses portfolios based on the highest conviction ideas of the SBI MF analyst team. The debt portion of the scheme portfolio is of high credit quality / sovereign securities to maintain liquidity. The fund manager actively manages duration to generate alpha across the yield curve.

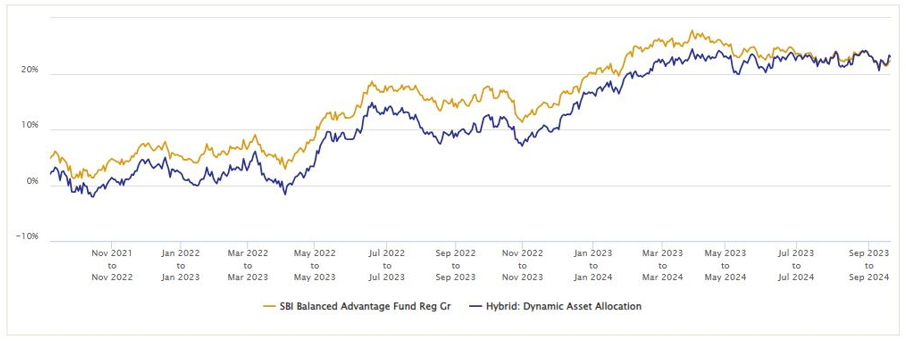

How has SBI Balanced Advantage Fund performed versus peers?

The chart below shows the 1 year rolling returns of SBI Balanced Advantage Fund versus the category average since inception. You can see that the scheme has outperformed the category average across different market conditions over 1 year investment tenures since inception.

Source: Advisorkhoj Rolling Returns, as on 27.09.2024

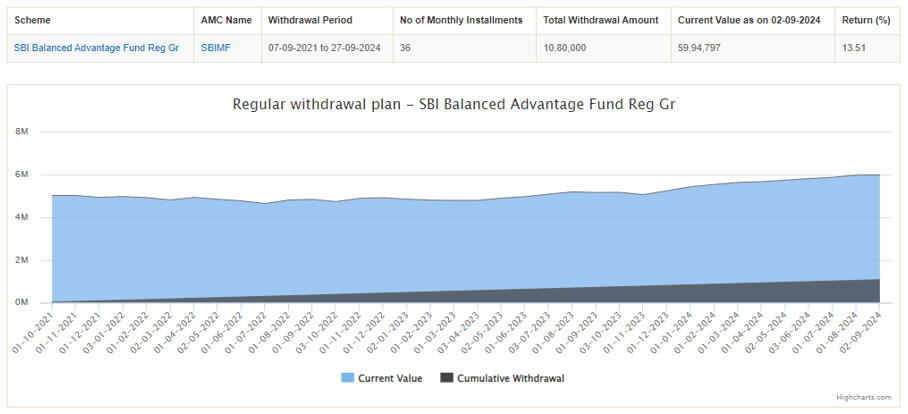

Regular cash-flows through SWP

Since Balanced Advantage Funds are more stable than pure equity funds or aggressive hybrid funds, they are more suited for generating cash-flows through SWP over long investment tenures. The chart below shows the result of Rs 30,000 monthly SWP from Rs 50 lakhs lump sum investment in the SBI Balanced Advantage Fund since the inception of the scheme i.e. more than 7% withdrawal every year. You can see that, despite drawing cash-flows of nearly Rs 11 lakhs over the last 3 years through SWP, the value of your balance units in the scheme would have grown from Rs 50 lakhs to Rs 60 lakhs. The capital appreciation implies that in future, you can increase your withdrawals by a moderate amount to meet inflationary needs / expenses, without significantly impacting the principal amount invested. If the value of your balance units after SWP is more than your initial investment, then you can sustain your SWP for long periods of time. This example shows that SBI Balanced Advantage Fund is well suited for SWP for retired investors or investors who are planning for retirement in the near to medium term.

Source: Advisorkhoj SWP Calculator, as on 27.09.2024

Why invest in SBI Balanced Advantage Fund?

- For investors who would like to move between asset classes seamlessly and the decision is taken by an expert fund manager

- The fund is suited for Investors wanting to invest in equities but would like to protect their investments from potential downside.

- Investors can invest in this fund as an asset allocation strategy i.e. to balance risks and returns.

- Investors who have already retired and can do an SWP from this fund for tax efficient regular income.

Who should invest in SBI Balanced Advantage Fund?

- Investors looking for long term risk adjusted returns.

- Investors looking for a dynamic solution for the optimal mix of debt and equity.

- Investors who have minimum 3 – 5 years of investment horizon.

Investors should consult with their financial advisors or mutual fund distributors if SBI Balanced Advantage Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY