SBI Multi-Asset Allocation Fund: Power of multi asset allocation in volatile market

Market and economic context

The market has been very volatile since the end of September or early October 2024. Nifty is down almost 2,000 points from its all time high. Nifty had even breached the key support level of 24,000 but the market has bounced back from bottom. US market has rallied after the US Presidential elections. Positive global cues may support Indian equities. However, there are concerns about earnings outlook.

SBI Multi Asset Fund provided stability in volatile market

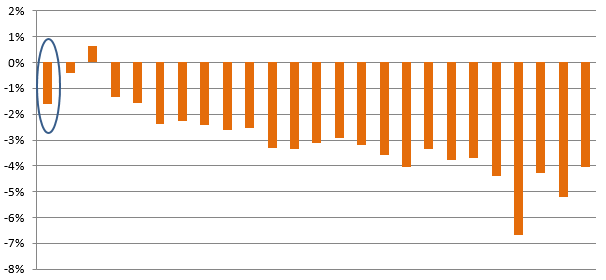

The chart below shows the drawdown of multi asset funds from the market peak (period 26th September to 31st October 2024). SBI Multi Asset Allocation Fund (circled in blue) experienced smaller drawdown relative to its peers.

Source: Advisorkhoj Research, 26th September to 31st October 2024

What are Multi Asset Allocation Funds?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, debt and equity, these schemes invest in asset classes like gold, silver, real estate investment trusts (REIT), infrastructure investment trusts (InvITs) etc.

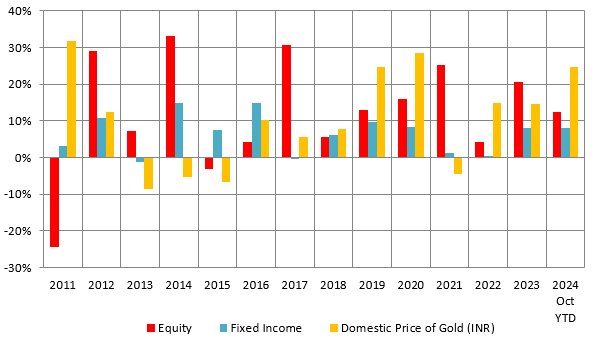

Multi-asset allocation provides better diversification

The chart below shows the annual returns of different asset classes. You can see that different asset classes outperform / underperform each other in different market / economic conditions. You can see that debt is much more stable than equity. While equity and debt can have some positive correlation (usually with a lag) depending on fiscal and monetary policies, gold and equity are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa. As such, a combination of 3 or more asset classes can balance risk and return more effectively than a combination of just equity and debt.

Source: National Stock Exchange, MCX, Advisorkhoj Research, as on 31st October 2024. Nifty 50 TRI is used as a proxy for equity as an asset class, Nifty 10 year benchmark G-Sec Index is used as proxy for debt as an asset class and spot price of Gold (in MCX) is used as proxy for Gold as an asset class. Disclaimer: Past performance may or may not be sustained in the future.

About SBI Multi Asset allocation Fund

The scheme was launched in 2005 and has Rs 6,590 crores of assets under management (AUM). Previously known as SBI Magnum Monthly Income Plan – Floater, this scheme in its multi asset allocation fund avatar came into being in May 2018 after AMCs rationalized and re-classified their older schemes to comply with SEBI’s mutual fund rationalization and re-classification directive. The expense ratio of the scheme is 1.62%. Dinesh Balachandran, Mansi Sajeja, Vandna Soni and Pradeep Kesavan (dedicated fund manager for overseas securities) are the fund managers of this scheme.

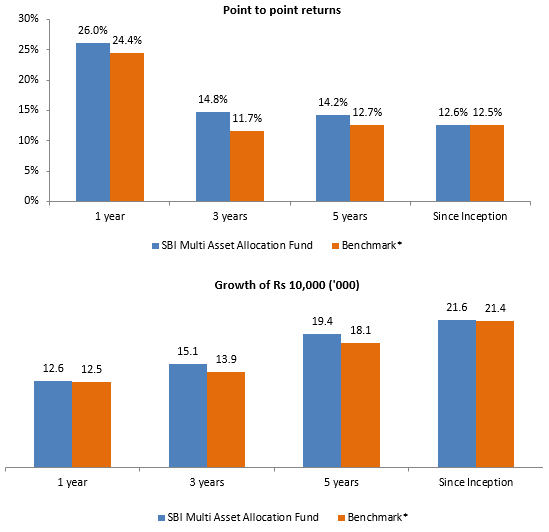

Fund performance

The scheme has outperformed its benchmark over different investment periods.

Source: SBI MF Factsheet, as on 31st October 2024. Returns over periods exceeding 1 year are in CAGR. *First Tier Scheme Benchmark: - 45% BSE 500 TRI + 40% Crisil Composite Bond Fund Index + 10% Domestic prices of Gold +5% Domestic prices of silver.

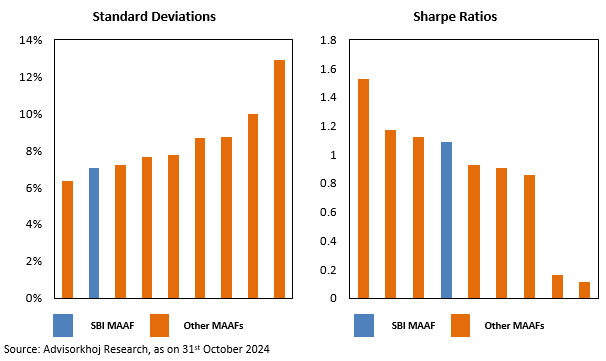

Lower volatility and superior risk adjusted returns compared to peers

Standard deviation is a measure of volatility, while Sharpe Ratio is a measure of risk adjusted returns. We looked at the standard deviations and Sharpe Ratios of all multi asset allocation funds, which have completed 3 years (as on 31st October 2024). You can see that SBI Multi Asset Allocation Fund has lower standard deviations and higher Sharpe Ratios compared to most of its peer funds.

Source: Advisorkhoj Research, as on 31st October 2024

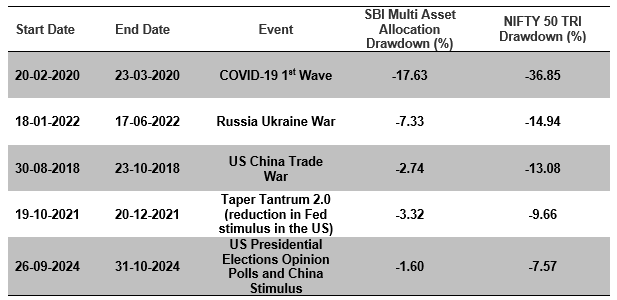

Smaller drawdowns

The multi asset allocation strategy of the scheme provides some downside protection and limits downside risks in highly volatile markets. The table below shows the 5 biggest drawdowns in the equity market over the last 5 years and its impact on SBI Multi Asset Allocation Fund. You can see that in the major periods of high volatility in the equity markets, SBI Multi Asset Allocation Fund saw much smaller drawdowns compared to pure equity as an asset class. This scheme can provide stability to your investment portfolio.

Source: Advisorkhoj Research, as on 31st October 2024

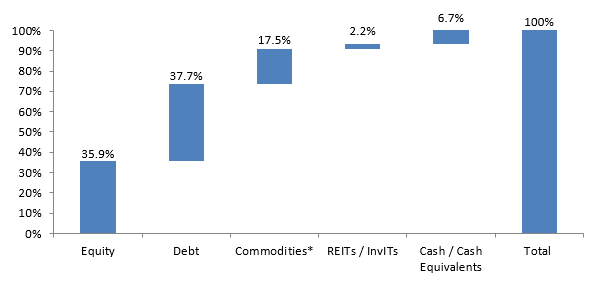

Current Asset Allocation

The waterfall chart below shows the current asset allocation of SBI Multi Asset Allocation Fund. The fund managers are very prudent about risks. The commodities / precious metals allocations of the fund not cushioned the portfolio against equity market downside, it also provided diversification and stability as gold and silver outperformed equities.

Source: SBI MF monthly fund factsheet (as on 31st October 2024) *Comprises of Gold and Silver ETFs.

Why invest in SBI Multi Asset Allocation Fund?

- All-weather fund: SBI Multi Asset Allocation Fundis an all-weather funds which not only provide diversification to your portfolio but also enable you to protect against potential downsides / drawdowns from a particular asset class like equity.

- Convenience: The fund invests in multiple asset classes depending on the opportunities that exist in each asset class. This saves you the hassle of investing in an equity, debt and gold / silver fund on your own. Also, you incur the cost of investing in one fund vis-à-vis if you invested separately in each asset class-based fund.

- Diversification: As the fund invests in multiple asset classes, having low correlation with each other, the opportunity for stable long-term capital growth is better. The good performance of any one asset class in a year helps cushion against the poor performance of others thus stabilising the returns.

- Actively Managed Portfolio in one Fund: The fund is actively managed which means it makes the reallocation decision across asset classes for you according to the current market scenario. This eliminates the hassle of the investors timing the market and rebalancing the portfolio consisting of multiple asset classes.

- Tax efficiency over long investment tenure: Long term capital gains (holding period of 2 years or longer) are taxed at 12.5% making this fund more tax efficient than traditional fixed income investments, especially for investors in the higher tax brackets.

Who should invest in SBI Multi Asset Allocation Fund?

- Investors looking for a long-term strategic allocation to different asset classes.

- Investors looking for relatively stable returns with low downside risks.

- Investors with high to very high-risk appetites.

- Investors with long investment tenures. We recommend minimum 3 years investment tenures for this scheme.

- Investors should consult with their financial advisors or mutual fund distributors if SBI Multi Asset Allocation Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY