SBI Contra Fund: Great wealth creation track record

SBI Contra Fund has an enviable long term track record of wealth creation. If you started a Rs 10,000 monthly SIP in SBI Contra Fund, 10 years back, you could have accumulated Rs 39.4 lakhs, with a cumulative investment of just Rs 12 lakhs (as on 31st July 2024); XIRR of 21.82%. The fund has given strong risk adjusted returns. In this article, we will review SBI Contra Fund.

Current market context

Equity market is at record highs, continuing its strong run from 2023. The rally in equities has been broad based with small and midcaps outperforming large cap stocks. Global markets, especially the US market, have supported the momentum in Indian equities. Though the valuations (trailing twelve months PE multiple) at the broad market levels are around the long-term average valuations, valuations may be stretched in certain pockets of the market. The market has been range bound after making all time high. We are seeing profit booking at higher levels and support coming in at lower level of the range. In terms of global risk factors, there are concerns about possible recession in the United States. This may cause volatility in the market from time to time.

What is a Contra Fund?

Contra funds are equity mutual fund schemes following the contrarian investment style, where you invest in stocks that are currently out of favour in the market. Contrarian fund managers invest in stocks or sectors in which they expect price recovery in the future. Since contrarian investors usually buy stocks at deep discounts relative to their intrinsic value, they can get good returns in the long term.

Why contra is a good strategy in volatile markets?

For investors, who want to invest for the long term and do not want high volatility, contra funds may be good investment opportunities. Contrarian investment involves doing the opposite of what the majority of investors are doing and try to buy stocks which have been neglected by the market. In volatile markets, contra funds can buy stocks with strong earnings growth potential at very low prices. Since these are usually stocks, which the market is ignoring and trading at low prices, they are relatively less affected by volatility. Once the stock can unlock its growth potential, it can create high alphas for investors.

About SBI Contra Fund

SBI Contra Fund is the best performing contra funds over the last 10 years. The scheme was launched in July 1999 and has Rs 37,883 crores of assets under management (as on 31st July 2024). The expense ratio of the scheme is 1.54% (as on 31st July 2024).Veteran fund manager, Dinesh Balachandran and Pradeep Kesavan (dedicated fund manager for overseas investments are managing of this scheme.

Performance of SBI Contra Fund

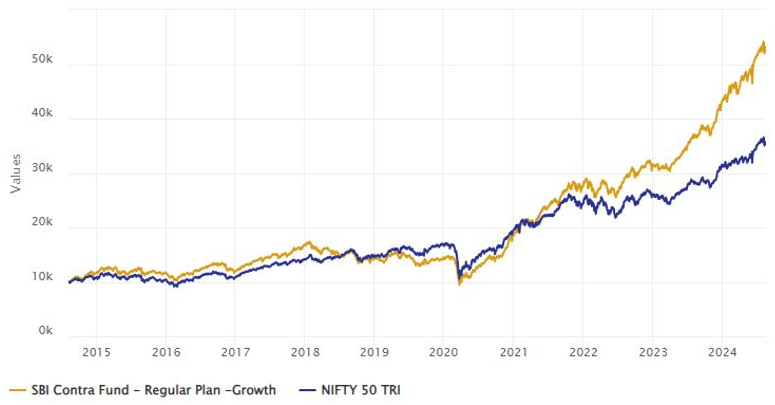

The chart below shows the growth of Rs 10,000 lump sum investment in the fund over the last 10 years ending 31st July 2024 versus the broad market index Nifty 50 TRI. You can see that the fund has generated large alphas relative to Nifty over long investment horizon.

Source: Advisorkhoj Research, as on 31st July 2024

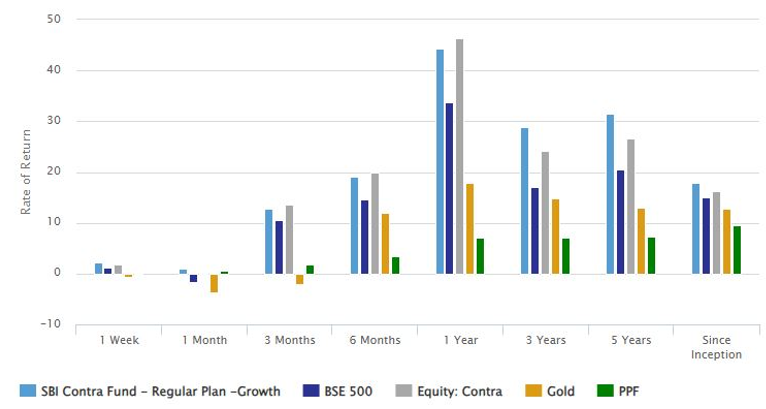

The chart below shows the returns of SBI Contra Fund over different investment periods versus the benchmark index, category average and other asset classes. You can see that scheme has outperformed the benchmark, category average and other asset classes over different investment periods.

Source: Advisorkhoj Research, as on 31st July 2024. Returns for periods exceeding 1 year are annualized (CAGR)

SBI Contra Fund – Investment Strategy

The scheme focuses on companies and sectors that are currently not in favour of the markets and attempts to find companies that have the potential to revert back and grow in the long-term.

- Sector level

- Identifying sectors which have long term potential but are currently out of favour.

- Stock level:

- Identifying companies wherein the stock is trading at lower than its intrinsic value. The focus is on identifying neglected stocks that are undervalued today (trading at lower P/E multiple or P/BV) but have a potential of growing in the long-term.

- Companies which have strong fundamentals but are available at discounted values owing to short term performance issues.

Wealth creation by SBI Contra Fund

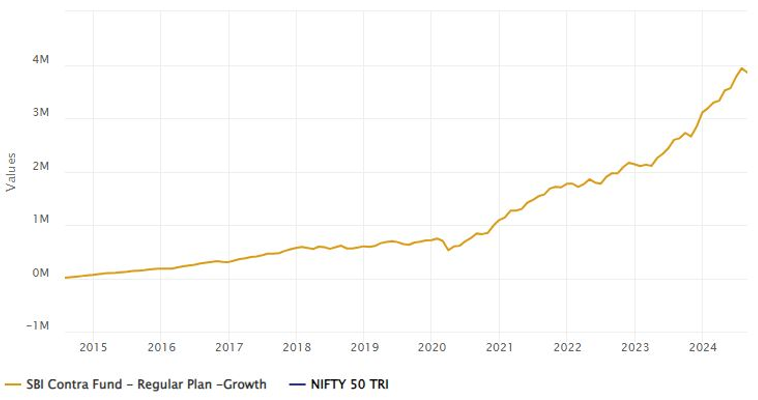

The chart below shows the growth of Rs 10,000 monthly SIP in SBI Contra Fund over the last 10 years (ending 31st July 2024). You can see that with a cumulative investment of Rs 12 lakhs you could have accumulated a corpus of nearly Rs 40 lakhs over the past 10 years. The annualized SIP return of the scheme was 21.82%.

Source: Advisorkhoj Research, as on 31st July 2024

Superb risk adjusted returns

Up Market Capture Ratio and Down-Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of SBI Contra Fund over the last 3 years. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of SBI Contra Fund over last 3 years was 105% which implies that if the benchmark index went up by 1% in a month, then the fund’s Net Asset Value (NAV) went up by 1.05%. The Down-Market Capture Ratio of the fund was only 46% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.46%; in other words, the fund was able to limit the downside risk of investors in falling markets. An up-market capture ratio which is higher than the down-market capture ratio, is a strong indication of the potential of the fund to give superior risk adjusted returns of the fund.

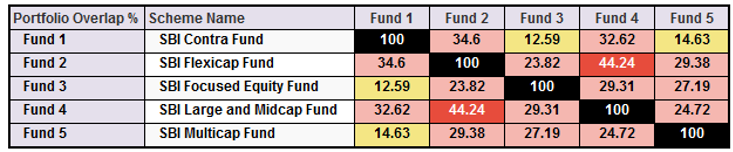

Low Overlap with other SBI MF equity diversified equity funds

SBI Contra Fund has low portfolio overlap (common stocks) with other diversified equity funds of SBI MF. You can build your portfolio with SBI Contra Fund and other SBI MF diversified equity funds (according to your risk appetite and investment needs) to add richer diversification to your investment portfolio.

Source: SBI MF fund factsheets (as on 31st July 2024)

Why invest in SBI Contra Fund?

- With uncertainty about timing of interest rate cuts, possibility of recession in developed markets, unwinding of Yen carry trade, developing geo-political situation in the middle east and market near all time, equity markets may continue to remain volatile in the near term.

- Contra funds may be good investment option in such conditions, as it may have lesser downside risks and offer superior risk return trade off in the long term.

- You may be able to invest in quality stocks at low prices through contra funds.

- SBI Contra Fund has strong long term performance track record. It has been a proven wealth creator for investors.

- Industry veteran, Dinesh Balachandran has been managing this scheme for 6 years. The long continuity of the fund manager has ensured consistency in investment approach, strategy and performance.

- Longevity has helped it generate superior risk adjusted returns and wealth creation for investors due to the philosophy of being contrarian for long periods of time.

Who should invest in SBI Contra Fund?

- Investors looking for long capital appreciation using contrarian investment strategy.

- Investors with long investment horizons e.g., minimum 5 years.

- Investors may invest in the scheme through SIP and lumpsum.

Investors should consult with their financial advisor or mutual fund distributor if SBI Contra Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY