SBI Innovative Opportunities Fund NFO: An increasingly attractive theme for long term investors

SBI Mutual Fund has launched a New Fund Offer, SBI Innovative Opportunities Fund, an open-ended equity scheme following the innovation theme. The fund will seek to identify investment opportunities in companies which are innovators (demonstrated through innovation in product/process or through innovative business models) or are significantly investing into research and development for creation of innovative products/processes upcoming trends and disruptive business ideas. The NFO opened for subscription on 29th July 2024 and will close on 12th August 2024. In this article, we will review SBI Innovative Opportunities Fund NFO.

Innovation gives businesses a competitive edge

Innovation has shaped the progress of human civilization since the earliest days. The journey from the invention of printing press to smartphone is essentially long series of innovations. Williams tube to cloud storage, music boxes and phonographs to digital streaming etc are examples of innovations that have been the bedrock of technological advancement. Businesses that make innovation an integral part of their business processes, can improve their market share, increase their productivity, revenues and profits.

In the year 2000, median age of S&P Top 10 companies was 85 years. By 2018, the median age of S&P Top 10 companies had reduced to 33 years. As per a McKinsey report, average age of S&P 500 companies will be just 12 years by 2027. The average age of a unicorn start up is just 6 years. The increasing pace of innovation is disrupting business models. “Innovate or perish” has become the watchword.

Innovation and wealth creation

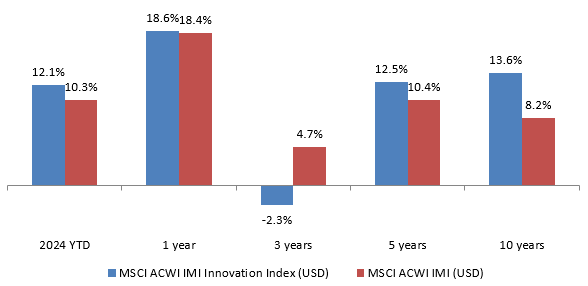

Historical returns data provides sufficient evidence that innovative companies gave significantly higher than average returns compared to the broad market. The chart below shows the returns of the MSCI All Country World (ACWI) Investment Market (IMI) Innovation Index versus the MSCI All Country World (ACWI) Investment Market Index (IMI). The MSCI ACWI IMI includes large, mid and small-cap securities across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. The innovation index is focused on the following themes: Autonomous Technology (AI) & Industrial Innovation (Robotics), Genomic Innovation, Fintech Innovation, and Next Generation Internet Innovation (e.g. blockchains).

Source: MSCI, as on 28th June 2024.

India is currently at the cusp of an innovation cycle

India’s position in the Global Innovation Index has improved to 40th rank in 2023 from 81 in 2015. The factors influencing India Innovation Story are as follows:-

- Booming Startup Ecosystem: India has the 3 largest start-up ecosystems in the world with 115 startups in the Unicorn club. The number of Unicorns in India is expected to more than double by 2030 led by e-commerce & Fintech.

- Inherent Talent Pool: 2.5 million STEM graduates every year (out of which around 60% are from Tier 2 and 3 cities). AI skill penetration rate in India is 3X of G-20 average.

- Strong Digital Infrastructure: High broadband and mobile (smartphone) penetration through 138 Data Centres with 737+MW Capacity, 646.7k Km Optical Fibre, 5G roll-out, ubiquitous digital payment network.

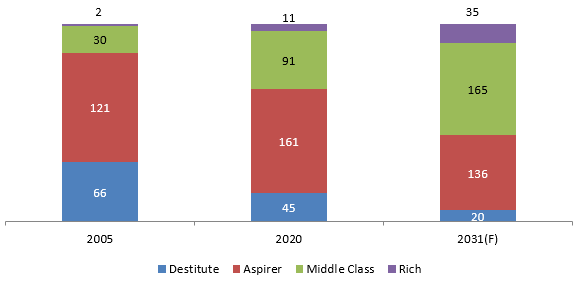

- Growing Consumer Market: With economic growth and rising per capita income the growing middle class will form a large consumer market of massive scale.

Source: SBI MF.

- Government Initiatives: Startup India initiatives, Atal Innovation Mission, National Innovation Foundation of India, Credit Guarantee Scheme for startups, PLI scheme etc.

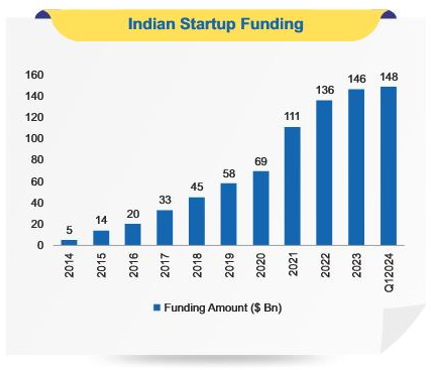

- Strong Funding Ecosystem: From $5 B in 2014, Indian startups have raised $148 B up to Q1 of 2024. There is potential to raise more funds through IPO.

Source: SBI MF

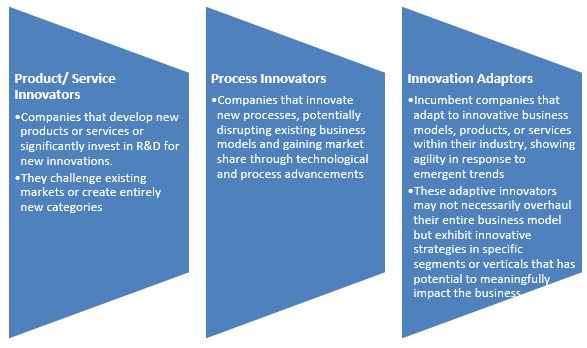

How will SBI Innovative Opportunities Fund identify innovative companies?

- Target businesses adopting automation, AI, or sustainable practices in their processes that lead to cost reduction & improved efficiency & value enhancement.

- Identify incumbent companies that demonstrate agility in adapting to new technologies or business models.

- Focus on those making strategic investments in emerging market segments or verticals in addition to its core business.

- Focus on companies with a significant portion of their revenue allocated to R&D and strategic partnerships.

- Focus on firms that not only innovate but also create sustainable competitive advantages through their innovations.

Investment strategy

Who should invest in SBI Innovative Opportunities Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio.

- Investors seeking capital appreciation through investments in forward-looking business ideas and a growth-oriented long-term portfolio.

- Investors looking for a fund that consistently seeks out investment opportunities in upcoming trends and disruptive business ideas will find this fund true to label.

- Investors with investment horizons of at least 5 years or longer

- Investors with a very high-risk appetite.

- You can invest in lumpsum or SIP depending on your financial situation and investment needs.

- Investors should consult with their financial advisors or mutual fund distributors if SBI Innovative Opportunities Fund can be part of their portfolio in line with their goals and risk-appetite.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY