SBI Energy Opportunities Fund: Off to a terrific start

SBI Mutual Fund had launched SBI Energy Opportunities Fund in February 2024. This is a thematic fund which will invest in companies engaging in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to sectors such as oil & gas, utilities and power. The fund has given 12.1% return since its inception (as on 30th June 2024, source: Advisorkhoj Research). The assets under management (AUM) of the fund has recently crossed Rs 10,000 crores a major milestone, within a very short period of just 4 – 5 months.

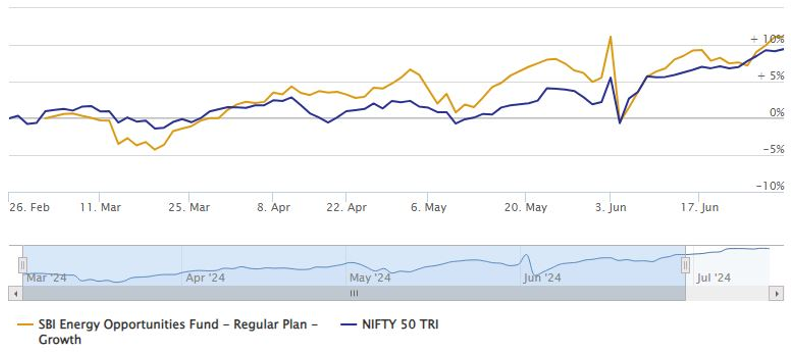

NAV growth

The chart below shows the NAV growth of the fund versus Nifty since the inception of the fund (as on 30th June 2024). You can see that the fund has beaten the broad market index.

Source: Advisorkhoj Research, as on 30th June 2024.

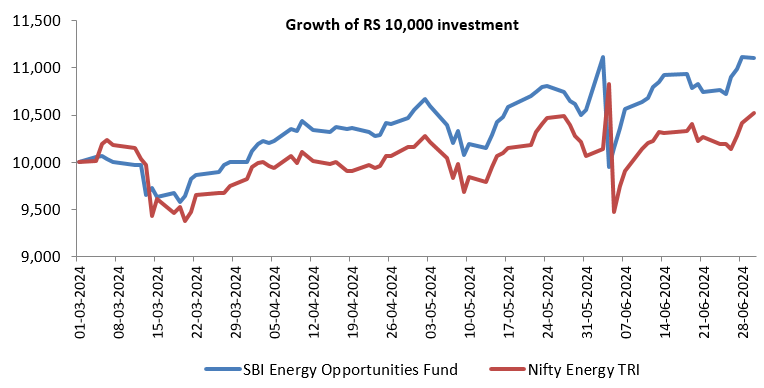

Outperformed the benchmark index - ALPHA

The chart below shows the growth of Rs 10,000 investment in SBI Energy Opportunities Fund versus its benchmark, Nifty Energy Index. You can see that the fund has beaten the benchmark index and created alphas for investors.

Source: Advisorkhoj Research, as on 30th June 2024.

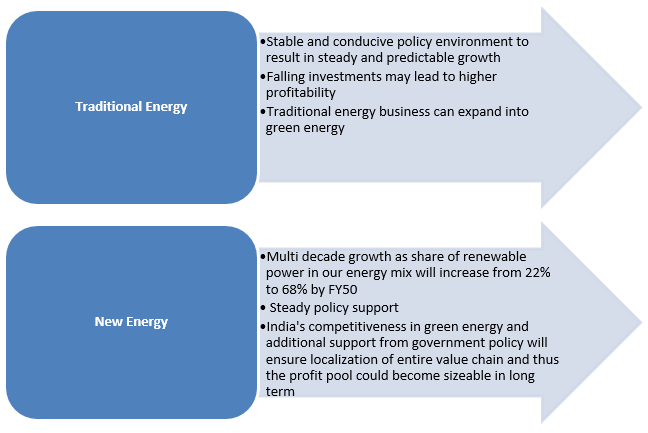

Why is energy an attractive investment theme in the long term?

- India is among the largest and fastest growing energy markets. By 2050, India is expected to be the second largest energy market. India’s energy consumption ex of coal & oil to grow at 6.4% CAGR through 2050.

- Government policies in sectors like coal, oil and gas will result in higher cash-flows, operating margins and earnings (PAT).

- India’s has a natural advantage in green energy which can lead to energy self-sufficiency. Redeployment of cash flow from traditional energy business into green energy could enhance value.

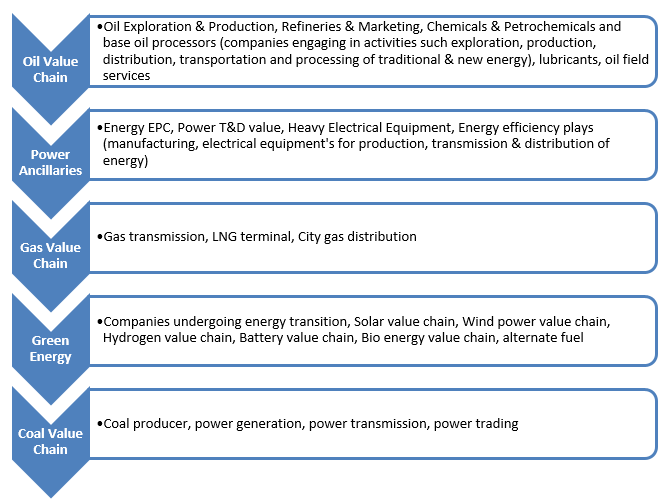

About SBI Energy Opportunities Fund – Investment Universe

SBI Energy Opportunities Fund – Barbell Investment Strategy

The fund will invest in an optimal mix of traditional & new energy and power utility companies, reducing return volatility and offer better risk adjusted returns.

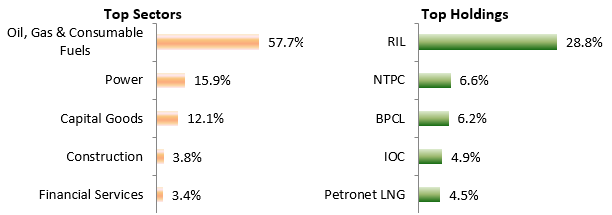

Current Portfolio Positioning

Source: SBI MF Factsheet, as on 30th June 2024

Why invest in SBI Energy Opportunities Fund?

- India is expected to be the fastest growing energy market in the world.

- Economic growth is expected to lead to a rise in per capita energy consumption in India.

- Natural advantage in green energy to help India move from energy deficiency to energy self-sufficiency.

- Policy framework for traditional and new energy companies is conducive for growth impetus and stability in earnings.

- The energy segment is underrepresented in the broader market index.

- Valuations are reasonable relative to broad market. TTM PE ratio of Nifty Energy TRI is 14.12 versus Nifty 50 PE ratio of 22.85 (source: NSE, as on 28th June 2024).

- The fund has made a good start and outperformed the benchmark index since inception.

Who should invest in SBI Energy Opportunities Fund?

- Investors willing to have tactical allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from energy theme.

- Investors with very high-risk appetites.

- Investors with minimum 3-to-5-year investment tenures.

- You can invest either in lumpsum and / or SIP, depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if SBI Energy Opportunities Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY