SBI Infrastructure Fund: A suitable fund for investment in infrastructure theme

The SBI Infrastructure Fund is an equity scheme that aims to provide investors with opportunities for long term capital growth through an active management of a diversified basket of equity stocks of infrastructure and allied companies and in debt and money market instruments.

Why invest in an Infrastructure fund?

Infrastructure plays a crucial role in the progress of a country. Given India’s aspiration to become a developed economy by 2047, infrastructure development is crucial in achieving that vision. The Government recognizes the infrastructural needs and has developed various policies in this regard. The National Infrastructure Pipeline (NIP), introduced in 2019 emphasizes social and infrastructure projects including energy, roads, railways, and urban development projects worth Rs 102 lakh crores (source: National Investment Promotion and Facilitation Agency, Government of India). Some of the major policies and schemes announced by the Government to boost infrastructure are setting up a Rs 20,000 crores National Investment and Infrastructure Fund (NIIF), the National Infrastructure Pipeline, PM Gati Shakti Master Plan, National Logistics Policy, RCS-UDAN, Sagarmala, Bharatmala, Digital India scheme, Telecom Technology Development Fund, and PLI.

Private Sector Capex spending is required to drive infrastructure growth

The Government emphasized the need for increased spending in the infrastructure sector in the Union Budget of 2023-24, and nearly tripled its infrastructure spending to 3.3% of GDP compared to its spending in 2019-20. However, Government spending needs to be supplemented by private sector capex spending. With improving balance sheets (lower debt to equity ratios) and lower interest rates in the near to medium term, the time is ripe for private sector capex spending. With impetus of Government spending and potential private sector, infrastructure sector companies are likely to play a key role in the India Growth Story.

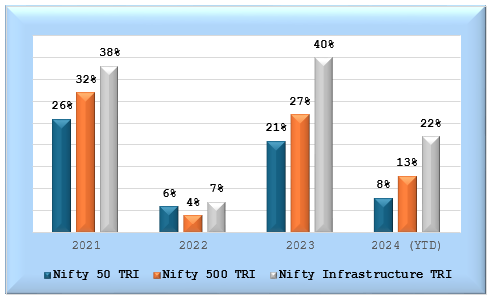

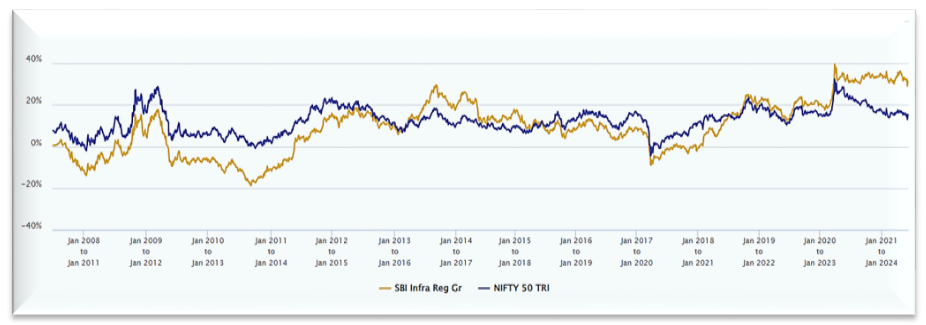

Infrastructure Sector has outperformed the broad market

The chart below shows that the infrastructure sector has outperformed the broad market indices since the economy opened up after the COVID 19 pandemic in 2020-21. Since the Union Budget 2021, the Government spending on infrastructure sector has benefited the stocks in the sector leading to their outperforming the market.

Source: Advisorkhoj Research (as on 31st May 2024)

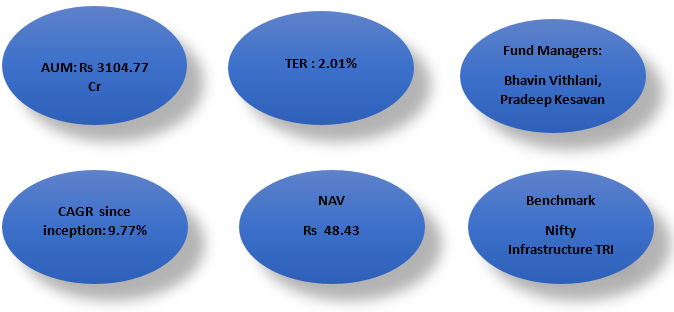

SBI Infrastructure Fund Regular Growth

If you had invested Rs 1 lakh as lumpsum into the SBI Infrastructure Fund (Regular Growth) at its inception in July 2007, the value of your investment would have appreciated to Rs 4.84 Lakhs as on 31st May 2024 giving CAGR of 9.77%. See the figure below for other fund details.

Source: Fund factsheet (as on 31st May 2024)

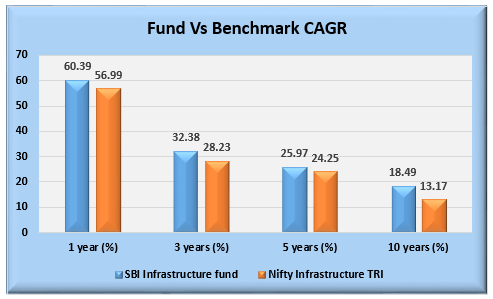

The chart below shows the 1, 3, 5, and 10 years CAGR returns of the fund versus the benchmark Nifty Infrastructure Index. You can see that the fund has generated alphas for investors relative to the benchmark index.

Source: Advisorkhoj Research (as on 31st May 2024)

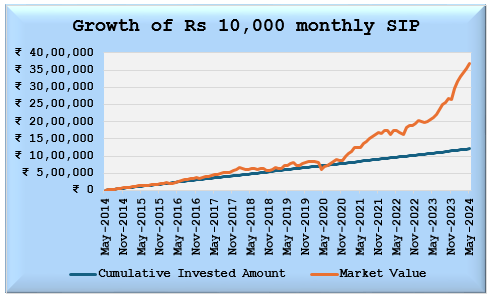

Wealth Creation through SIP

It is common amongst investors to try and time the investment into sectoral and thematic funds. We believe that investment into infrastructure funds should be looked at as a long-term investment plan as it is integral to the India Growth story and the country’s journey to becoming a developed economy. The chart below shows how a monthly SIP of Rs 10,000/- would have grown to Rs 37.36 lakhs (as on 31st May 2024), giving an XIRR of 21.99 %, against a cumulative invested amount of Rs 12.10 lakhs in the last 10 years, since 1st April 2014.

Source: Advisorkhoj Research (as on 31st May 2024)

Rolling Returns

The 3-year rolling returns of the fund since inception (as on 14th May 2024) shows that the fund has given returns above 15% for 30.72% times.

Source: Advisorkhoj Research (as on 31st May 2024)

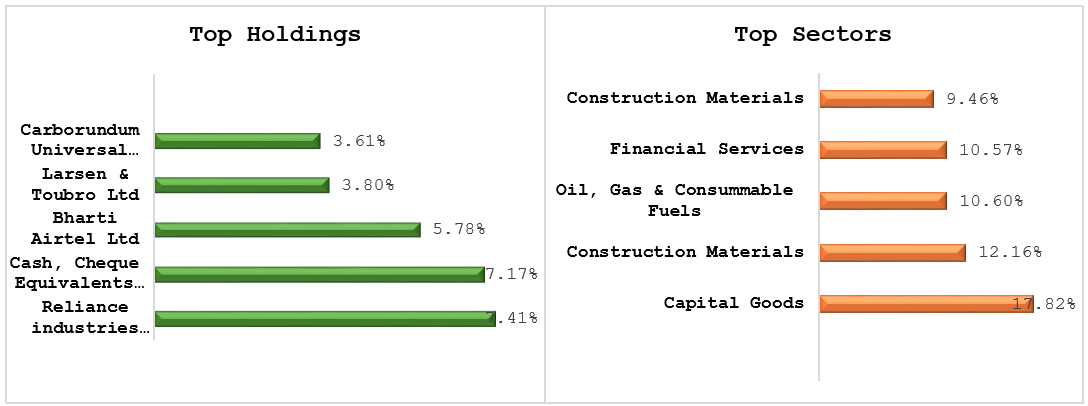

Portfolio Allocation

Source: Fund factsheet (as on 31st May 2024)

Why invest in SBI Infrastructure Fund?

- SBI Infrastructure Fund is a dedicated Infrastructure fund, that invests in ‘Market leaders’ or businesses with ‘unique business proposition’.

- The fund aims to tap businesses that are expected to gain multi-fold with the implementation of Government policies and reforms.

- Infrastructure and manufacturing will play a key role in Government's vision of making India a developed country - Viksit Bharat.

- India's potential to be a global manufacturing hub is integral to the India Growth Story. India stands to gain from the global supply chain realignments e.g. China + 1 strategy, especially in industries like electronics, pharma, automobiles etc.

- Industrial growth of an economy is heavily dependent on infrastructure development. Therefore, the infra sector will play a key role in the India Growth Story.

- The SBI Infrastructure Fund gives you an opportunity to participate in the India Growth Story.

- SBI Infrastructure fund is more diversified than other Sectoral funds as Infrastructure invests in a variety of industry sectors linked with the infrastructure theme.

Who Should invest in the SBI Infrastructure fund?

- Investors looking for long term capital appreciation through Infrastructure theme.

- Investors with a very high-risk appetite.

- Investors with an investment horizon of minimum 3 years.

- Investors looking for tactical Allocation to overall equity portfolio.

Consult with your financial planner or mutual fund distributor to understand if the SBI Infrastructure Fund is suited to your investor profile.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY