SBI Automotive Opportunities Fund NFO: Invest in one of the fastest growing sectors in India

SBI Mutual Fund is launching a new fund offer, SBI Automotive Opportunities Fund, an open-ended equity scheme following automotive & allied businesses activities theme.

The NFO will open for subscription on 17th May 2024 and close on 31st May 2024.

In this article we will review this NFO.

Role of thematic funds in your portfolio -

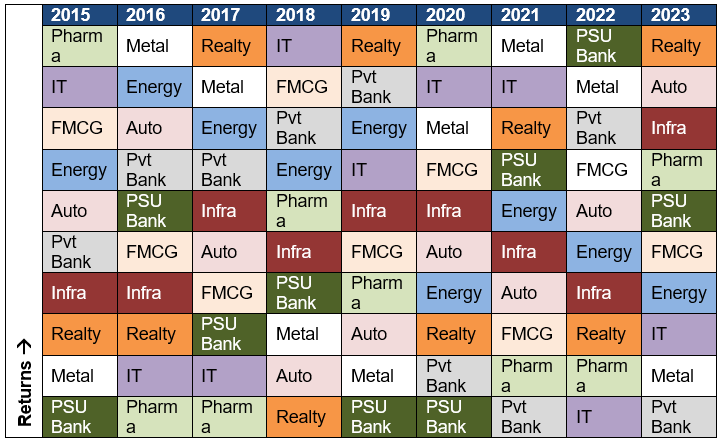

Financial advisors suggest that your core equity portfolio should comprise of diversified equity funds. Experienced investors or investors with higher risk appetites can have satellite allocations to thematic or sectoral funds which have the potential to boost your portfolio returns over sufficiently long investment horizons. Historical data shows that different sectors outperform / underperform in different market phases – sector rotation is an ongoing phenomenon in equity markets (see the chart below). Allocating a portion of your investments to sectors that are likely to outperform the broad market in certain market phases can create alphas for your investment portfolio. You should bear in mind that the risk profile of thematic funds is higher than diversified funds; invest according to your risk appetite.

Source: National Stock Exchange sector indices, as on 31st Dec 2023. Disclaimer: Past performance may or may be sustained in the future.

Automotive sector on a strong rebound -

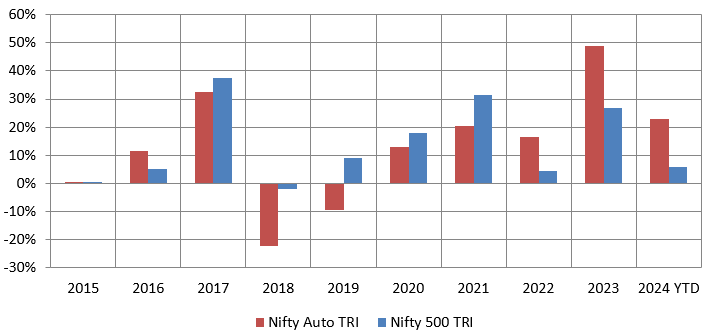

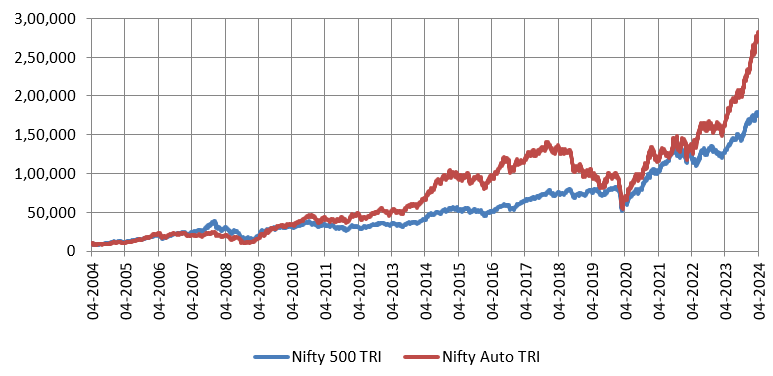

The automotive sector in India underperformed for 5 years, from 2017 to 2021 for several reasons viz. demand and capex slowdown, high costs due to BS – 6 norms, credit crunch due NPAs in banks / NBFCs, rise in ride-share services (e.g. Uber) and COVID-19. The auto sector rebounded in 2022 and has outperformed the broad market index, Nifty 500 for three consecutive years including 2024 YTD (see the chart below). In the last 3 years, Nifty Auto TRI gave 33% CAGR return, while Nifty 500 TRI and Nifty 50 TRI gave 18.59% and 15.23% CAGR returns respectively (as on 10th May 2024).

Source: National Stock Exchange, as on 10th May 2024. Disclaimer: Past performance may or may be sustained in the future.

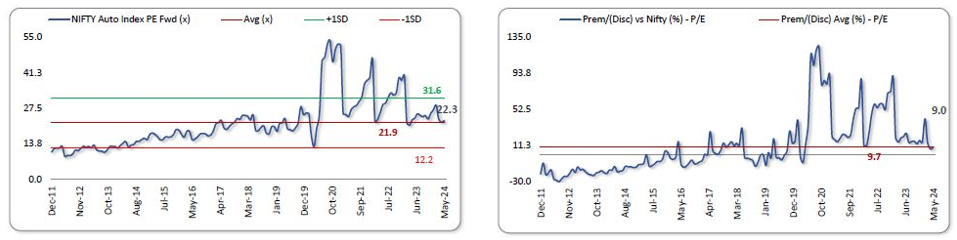

Valuations are reasonable -

Nifty Auto Index is trading at reasonable valuations relative to its historical valuations. If we compare Nifty Auto valuations relative Nifty 50 (premium versus Nifty 50) compared to historical premiums versus Nifty, the Auto is not overpriced compared to the broad market.

Source: National Stock Exchange sector indices, as on 10th May 2024. Disclaimer: Past performance may or may be sustained in the future.

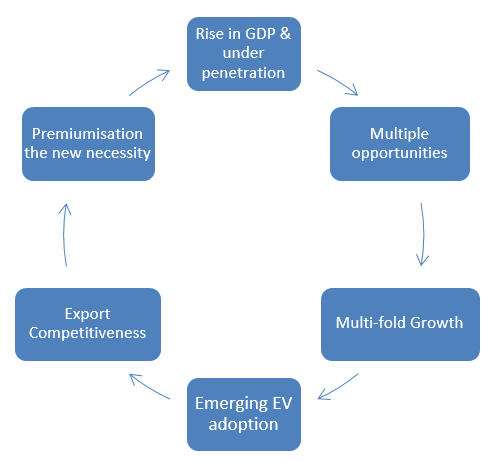

Automobile sector prospects -

- 4-wheeler and 2-wheeler penetration in India is higher compared to emerging markets.

- Rise in per capita income leading to better affordability since average vehicle price growth is lower than rise in per capita income.

- Governments reforms supportive for growth in manufacturing and in-turn for automotive segment

- India today is where China and Korea were in early hyper-growth phase.

Automotive Theme – A structural opportunity

Wealth creation by Auto Index -

The chart below shows the growth of Rs 10,000 in Nifty Auto TRI versus Nifty 500 TRI over the last 20 years (as on 30th April 2024). You can see that Nifty Auto TRI was able to outperform the broad market index Nifty 500 TRI. Nifty Auto TRI gave 18% CAGR return in the last 20 years while Nifty 500 TRI gave 16% CAGR return.

Source: National Stock Exchange, as on 30th April 2024. Disclaimer: Past performance may or may be sustained in the future.

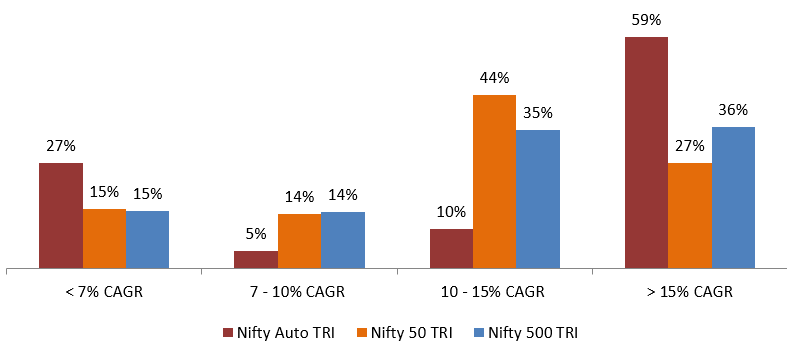

5 year rolling returns distribution of Auto Index versus broad market indices -

Source: National Stock Exchange, SBI MF, as on 30th April 2024. Disclaimer: Past performance may or may be sustained in the future.

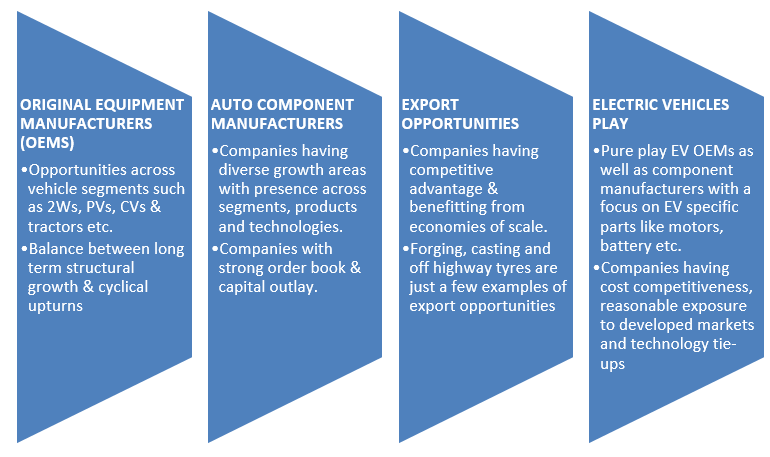

About SBI Automotive Opportunities Fund

Stock selection strategy -

- Economic growth trend and penetration levels.

- Companies' growth potential.

- Brand building capabilities.

- Ability to adopt to evolving auto landscape.

- Companies earning quality and cash flows.

- Capital allocation strategy and return profile.

- The classification of companies following the automotive & allied business activities theme will be largely guided by AMFI industry classification.

Who should invest in SBI Automotive Opportunities Fund?

- Investors willing to have Tactical Allocation to their overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from automotive & allied businesses theme.

- Investors with a very high-risk appetite.

- Investors with a minimum 5-year investment tenure.

- You can invest either in lumpsum and SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if SBI Automotive Opportunities Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY